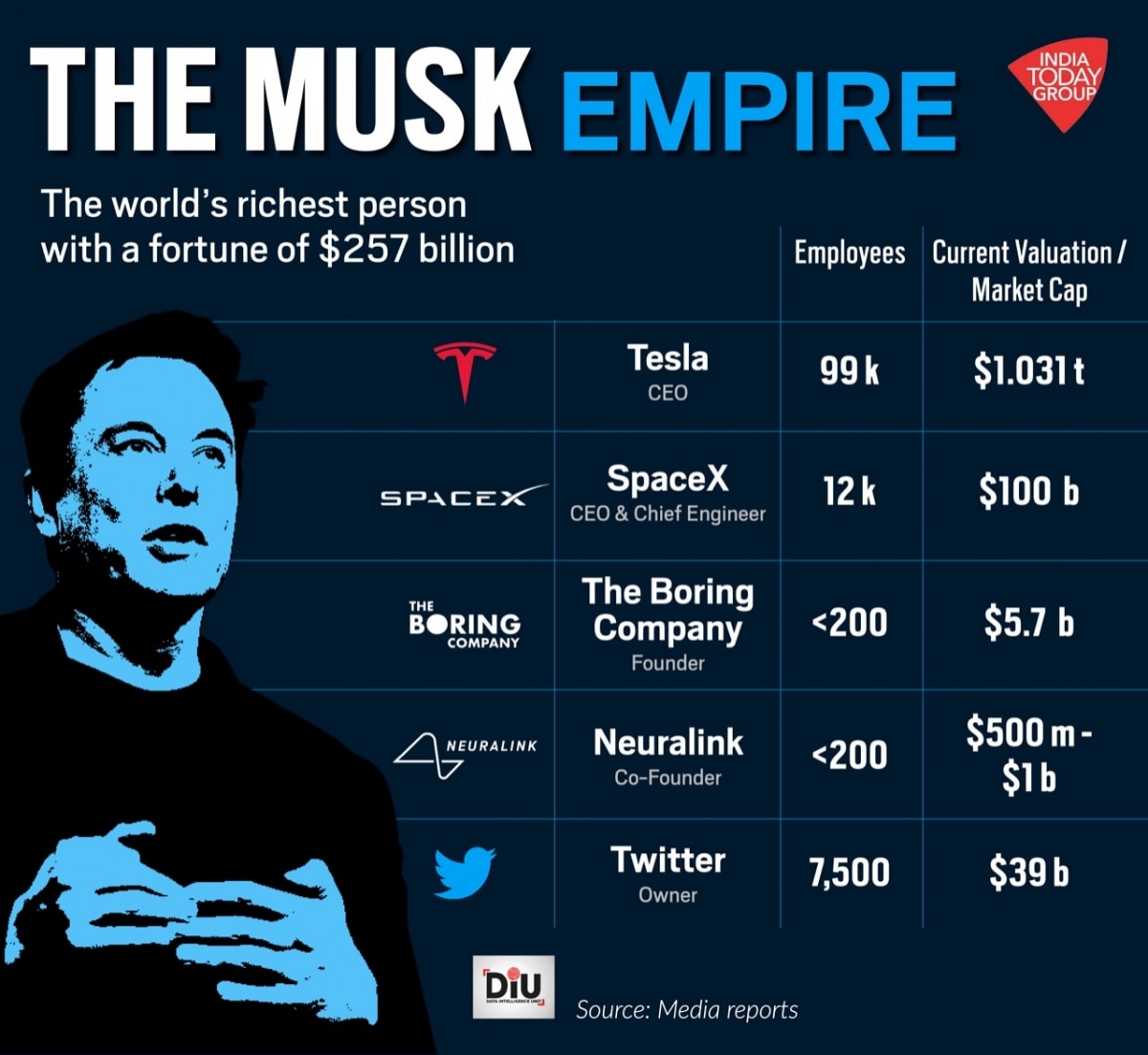

US Economic Shifts And Elon Musk's Net Worth: A Tesla Case Study

Table of Contents

Macroeconomic Factors Influencing Tesla's Stock Price and Musk's Wealth

Several key macroeconomic factors significantly impact Tesla's stock price and, consequently, Elon Musk's net worth. These factors underscore the intricate connection between US economic shifts and Elon Musk's net worth.

Interest Rate Hikes and Inflation's Impact

Rising interest rates directly affect investor sentiment towards growth stocks like Tesla. Higher rates increase borrowing costs for companies, potentially slowing down growth and reducing future earnings projections. This often leads to a decrease in demand for growth stocks, impacting their valuations. Simultaneously, inflation erodes consumer purchasing power, potentially reducing demand for luxury goods like electric vehicles (EVs).

- Example 1: The Federal Reserve's interest rate hikes in 2022 correlated with a period of decline in Tesla's stock price.

- Example 2: High inflation rates in 2022 and 2023 impacted consumer spending, potentially affecting Tesla's EV sales figures, although the impact was mitigated by strong demand and a robust waiting list.

Supply Chain Disruptions and Their Ripple Effect

Global supply chain disruptions have significantly impacted Tesla's production and profitability. Shortages of crucial components, especially battery materials, hampered production capacity and led to delays in deliveries, affecting both revenue and investor confidence. This demonstrates a direct link between global economic instability and the volatility of US economic shifts and Elon Musk's net worth.

- Example 1: The semiconductor chip shortage in 2021 and 2022 constrained Tesla's production output, leading to temporary setbacks in its growth trajectory.

- Example 2: Disruptions to the supply of lithium and other battery materials directly impacted Tesla's ability to meet the high demand for its EVs, creating additional price pressure.

Government Regulations and Incentives for EVs

Government policies, including tax credits, subsidies, and regulations, play a crucial role in shaping the EV market and Tesla's success. Favorable government incentives boost EV adoption, benefiting Tesla's market share. Conversely, stringent regulations can increase production costs and pose challenges to Tesla's future expansion. These factors further highlight the interplay between US economic shifts and Elon Musk's net worth.

- Example 1: The US government's tax credits for EV purchases have significantly boosted demand for Tesla's vehicles.

- Example 2: Potential future regulations on autonomous driving technology could impact Tesla's development and deployment timelines, influencing investor sentiment and consequently, Musk's wealth.

Tesla's Business Performance and its Correlation with Musk's Net Worth

Tesla's business performance directly correlates with Elon Musk's net worth. His wealth is largely tied to his significant ownership stake in the company.

Tesla's Revenue Growth and Profitability

Tesla's financial performance over the past few years reveals periods of strong revenue growth and increased profitability, underpinning the growth of Musk's net worth. However, economic downturns can impact sales and profitability, directly affecting his wealth.

- Example 1: Tesla's consistently strong revenue growth over several quarters directly translates to an increase in its market capitalization and, consequently, Musk's net worth.

- Example 2: Any slowdown in Tesla's sales figures, due to economic downturns or market competition, can directly impact the company's valuation and Musk's wealth.

Innovation and Technological Advancements at Tesla

Tesla's relentless innovation in battery technology, autonomous driving, and other areas significantly contributes to its stock price and market valuation. Investor confidence in Tesla's technological leadership fuels Musk's net worth.

- Example 1: Breakthroughs in battery technology, resulting in longer ranges and faster charging times, have been key drivers of Tesla's success and Musk's wealth.

- Example 2: Advancements in autonomous driving capabilities, despite challenges and setbacks, continue to shape investor perception and influence Tesla's stock price and Musk's net worth.

Market Sentiment and Investor Confidence in Tesla

Shifts in investor sentiment towards Tesla, influenced by positive news, negative press, or Musk's public statements, directly impact its stock price and Musk's net worth. The role of social media and Musk's pronouncements cannot be underestimated in this context.

- Example 1: Positive news about Tesla's production ramp-up or new product launches often leads to a surge in its stock price and a corresponding increase in Musk's wealth.

- Example 2: Conversely, negative news, controversies, or critical media reports can negatively impact Tesla's stock and consequently, Musk's net worth.

Conclusion

In conclusion, the relationship between US economic shifts and Elon Musk's net worth is undeniable. Tesla's performance, driven by macroeconomic factors, technological innovation, and market sentiment, directly impacts Musk's wealth. Understanding these intricate interconnections is vital for comprehending the volatility of both Tesla's stock price and Musk's substantial fortune. To further explore this dynamic relationship, we encourage readers to delve deeper into macroeconomic indicators, Tesla's financial reports, and the broader context of the EV market. Continue your research into the interplay between US economic shifts and Elon Musk's net worth for a more complete understanding of this fascinating case study.

Featured Posts

-

Dijon Concertation Achevee Pour La Troisieme Ligne De Tramway

May 09, 2025

Dijon Concertation Achevee Pour La Troisieme Ligne De Tramway

May 09, 2025 -

Asylum Policy Shift Uk Targets Migrants From Specific Countries

May 09, 2025

Asylum Policy Shift Uk Targets Migrants From Specific Countries

May 09, 2025 -

The Great Decoupling And Its Effects On Technological Advancement

May 09, 2025

The Great Decoupling And Its Effects On Technological Advancement

May 09, 2025 -

Choosing Childcare Daycare Vs Other Options For Working Parents

May 09, 2025

Choosing Childcare Daycare Vs Other Options For Working Parents

May 09, 2025 -

Is A Trillion Dollar Palantir Stock Realistic By 2030

May 09, 2025

Is A Trillion Dollar Palantir Stock Realistic By 2030

May 09, 2025