US Debt Ceiling: August Deadline Looms, Warns Treasury Official

Table of Contents

Understanding the US Debt Ceiling

The US debt ceiling is the legal limit on the total amount of money the US government can borrow to meet its existing legal obligations. It's a crucial aspect of US fiscal policy, often misunderstood by the public.

- Defines the legal limit: This limit isn't about how much the government can spend; it's about how much it can borrow to cover previously authorized spending. Think of it as a credit limit on a national credit card.

- Separate from the budget: The debt ceiling and the federal budget are distinct. Congress sets the budget, determining spending levels. The debt ceiling simply dictates how much the government can borrow to finance that spending if revenue is insufficient.

- Recurring need for Congressional action: Because the government frequently spends more than it receives in revenue, Congress must regularly raise or suspend the debt ceiling. This has become a recurring political battleground.

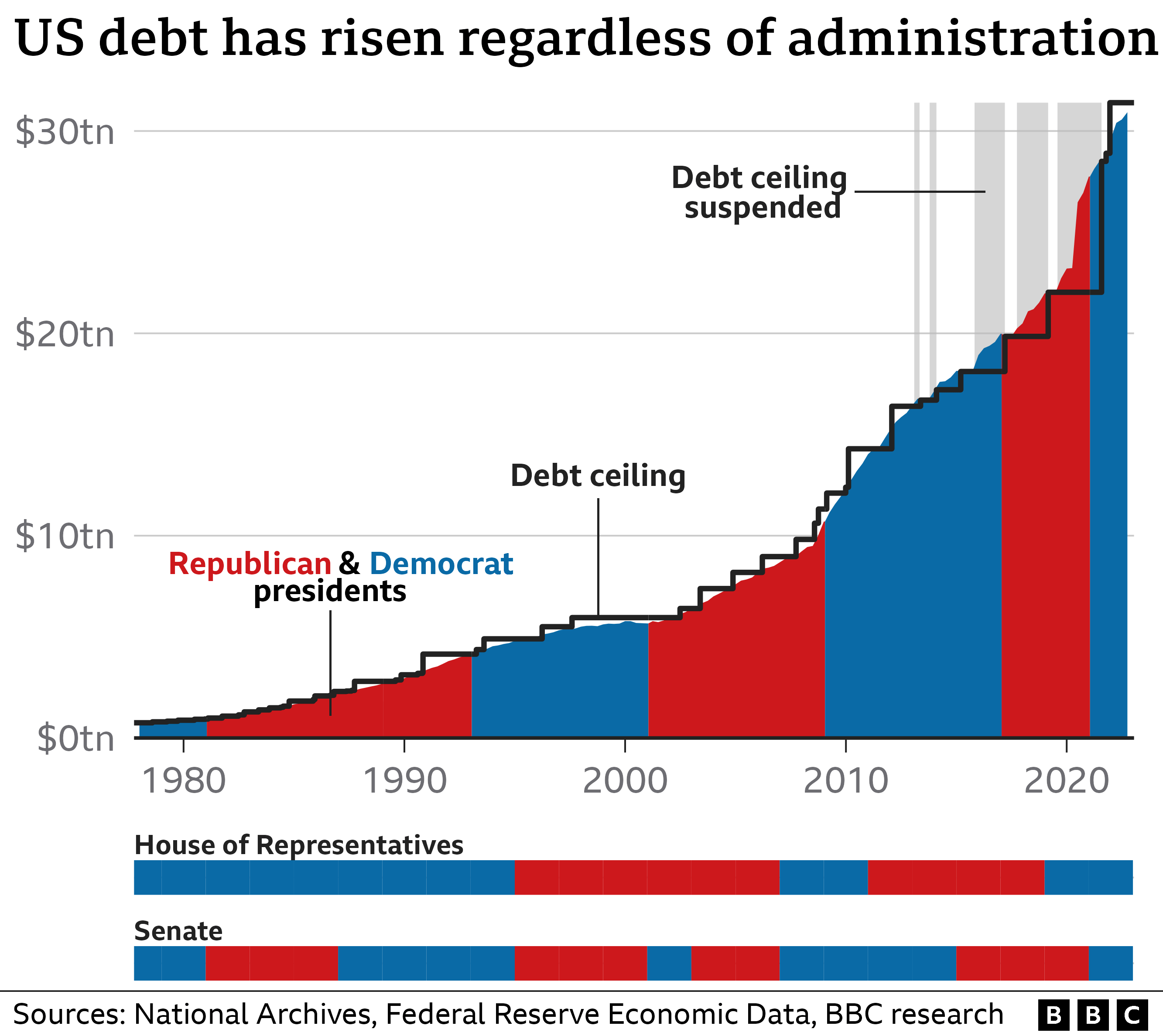

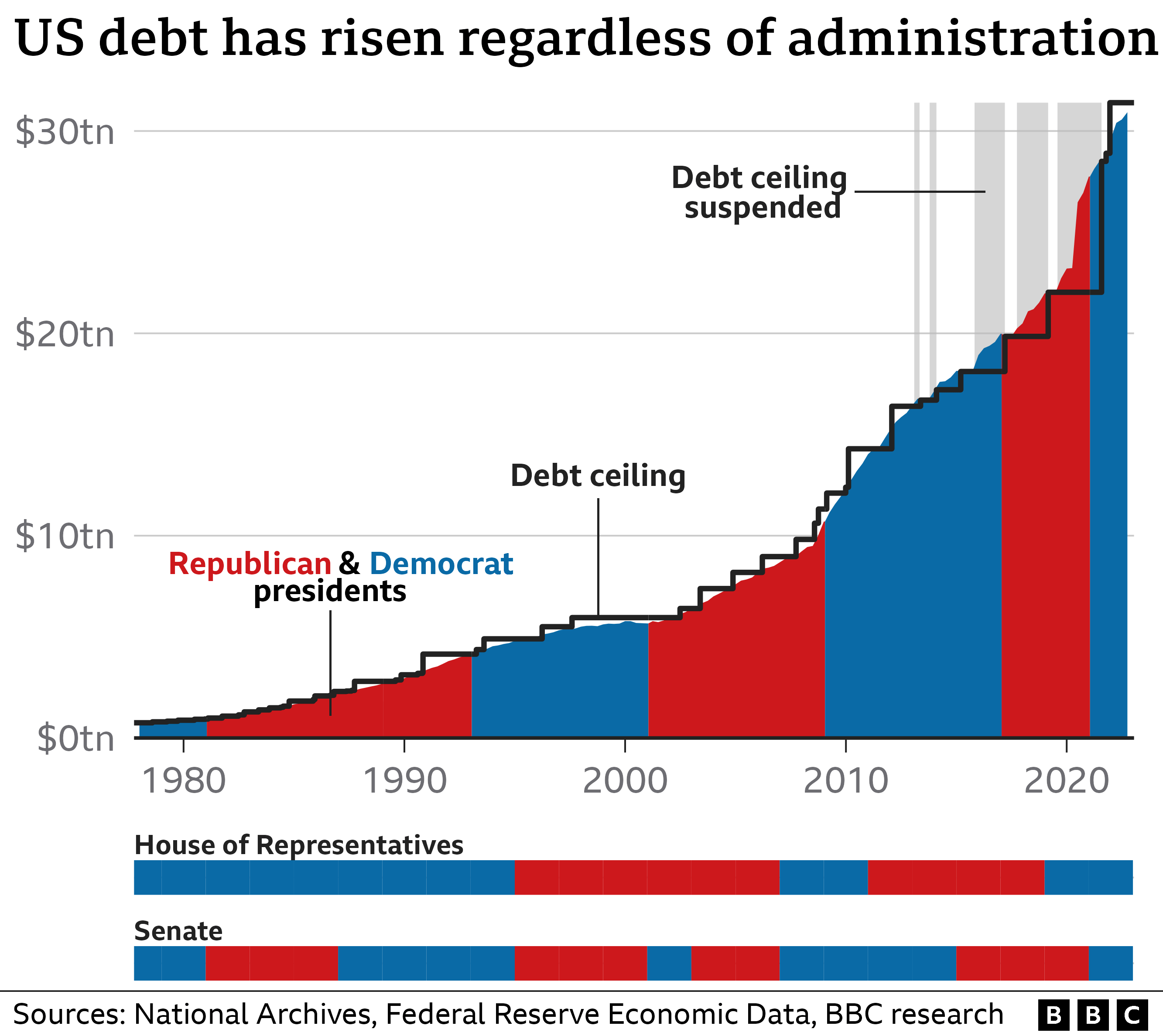

- Historical context: The debt ceiling has been raised or suspended numerous times throughout history, reflecting the nation's evolving fiscal landscape. However, the frequency and intensity of these debates have increased in recent years, leading to increased uncertainty and market volatility.

The August Deadline and its Implications

Treasury Secretary Janet Yellen has warned that the US could default on its debt obligations as early as August if Congress fails to raise the debt ceiling. The consequences of inaction are severe:

- Potential government shutdown: Without the ability to borrow, the government might be forced to cease non-essential operations, leading to widespread disruption.

- Risk of default on US debt obligations: A US debt default would be unprecedented and could trigger a global financial crisis. This would harm the reputation of the US dollar, the world’s reserve currency.

- Negative impact on the US economy: Credit rating downgrades are likely, increasing borrowing costs for the government and businesses. Higher interest rates would impact consumers and businesses, slowing economic growth. The potential economic fallout could include job losses, decreased investment, and a potential recession. Economic models predict significant GDP contraction.

Political Implications and Potential Solutions

Raising the debt ceiling is often fraught with political challenges.

- Republican and Democratic stances: Republicans often seek to tie debt ceiling increases to spending cuts, while Democrats generally favor a clean increase without conditions. This leads to prolonged negotiations and political gridlock.

- Potential compromises and bipartisan solutions: Finding common ground requires bipartisan cooperation, but past attempts have often resulted in last-minute deals.

- The role of the White House and Congress: The White House plays a crucial role in negotiations, but ultimately, Congress must pass legislation to raise the debt ceiling. The ability to forge a bipartisan consensus will be crucial in averting a crisis.

Short-Term vs. Long-Term Solutions

Addressing the US debt ceiling requires considering both short-term and long-term solutions.

- Temporary fixes: Raising the ceiling for a short period provides immediate relief but avoids addressing the underlying issues of long-term federal spending.

- Addressing underlying issues: Meaningful long-term solutions require tackling the challenges of unsustainable spending and revenue shortfalls through comprehensive budget reforms. This requires difficult political decisions.

The Impact on the Average American

A debt ceiling crisis would significantly impact ordinary citizens:

- Potential job losses: An economic downturn triggered by a debt ceiling breach would likely lead to job losses across various sectors.

- Increased interest rates on loans: Higher interest rates would make it more expensive to borrow money for homes, cars, and other purchases.

- Reduced government services: A government shutdown could lead to disruptions in essential services, impacting healthcare, education, and other vital areas. This includes delays in social security payments and veterans benefits.

Conclusion:

The looming August deadline for the US debt ceiling presents a serious threat to the US economy and global financial stability. Failure to raise the debt ceiling could trigger a cascade of negative consequences, impacting everything from employment to interest rates. Understanding the complexities of the US debt ceiling is critical for informed citizenship and engaging in constructive dialogue about fiscal responsibility. Stay informed about developments regarding the US debt ceiling and advocate for responsible solutions to prevent a national crisis. Contact your elected officials and urge them to prioritize a swift and decisive resolution to the impending US debt ceiling crisis.

Featured Posts

-

Yankees Vs Rays Series Injury Report May 2 4

May 11, 2025

Yankees Vs Rays Series Injury Report May 2 4

May 11, 2025 -

Celtics Guard Payton Pritchards Sixth Man Of The Year Case

May 11, 2025

Celtics Guard Payton Pritchards Sixth Man Of The Year Case

May 11, 2025 -

The Next Papal Election Exploring Potential Candidates And Their Platforms

May 11, 2025

The Next Papal Election Exploring Potential Candidates And Their Platforms

May 11, 2025 -

Putin Predupredil Dzhonsona O Rossiyskom Yadernom Potentsiale

May 11, 2025

Putin Predupredil Dzhonsona O Rossiyskom Yadernom Potentsiale

May 11, 2025 -

Proposed Changes To Asylum Policy In The Netherlands Detention And Area Bans

May 11, 2025

Proposed Changes To Asylum Policy In The Netherlands Detention And Area Bans

May 11, 2025