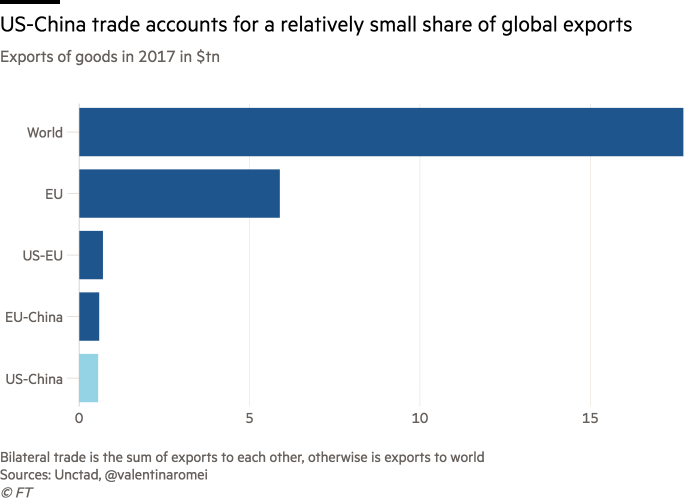

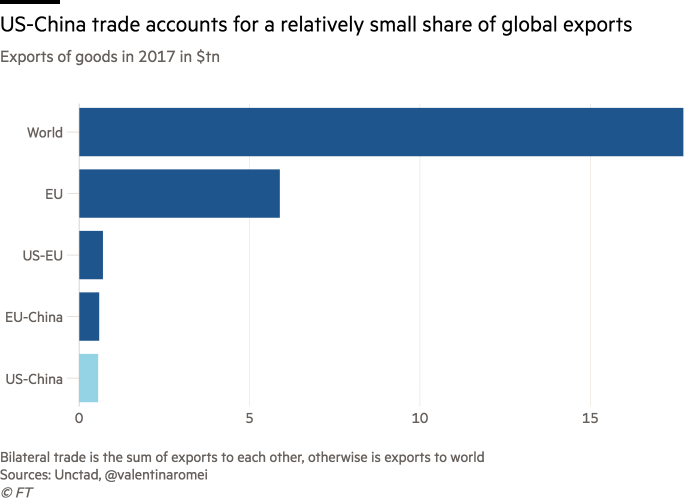

US-China Trade War Impact: Today's Stock Market Analysis

Table of Contents

Impact on Specific Sectors

The US-China trade war hasn't impacted all sectors equally. Certain industries have felt the brunt of tariffs and trade restrictions more acutely than others. This uneven impact highlights the complexities of global trade and the interconnectedness of the world economy. The consequences of the US-China trade war extend beyond simple tariff increases, affecting supply chains, consumer prices, and investor confidence.

-

Technology Sector Volatility: The technology sector has experienced significant volatility due to restrictions imposed on Chinese tech companies. Companies reliant on Chinese manufacturing or the Chinese market have seen their stock prices fluctuate dramatically in response to trade policy changes. This includes restrictions on the sale of advanced technologies and data sharing concerns. Examples include the impact on companies like Qualcomm and Apple, who have seen both opportunities and challenges arise from the trade war's impact on their supply chains and market access in China.

-

Agricultural Sector Struggles: The agricultural sector, particularly in the US, has been severely affected by tariffs imposed on soybean and pork exports to China. Farmers have faced reduced demand and lower prices, leading to significant financial hardship for many. The ripple effect extends throughout the agricultural supply chain, impacting related industries and rural economies. Deere & Company, a major agricultural machinery producer, provides a prime example of a company whose performance has been closely tied to the fluctuations in soybean and pork exports.

-

Manufacturing Sector Challenges: The manufacturing sector faces increased input costs due to tariffs on imported materials and reduced export markets. Companies reliant on global supply chains have had to adapt, sometimes at considerable expense, leading to decreased profitability and job losses in some areas. The increased uncertainty created by the trade war makes long-term planning difficult, further hampering investment and growth in this crucial sector. This also leads to increased prices for consumers.

Global Market Volatility and Uncertainty

The US-China trade war's effects extend far beyond the borders of the two countries. The ripple effect has created significant global market volatility and uncertainty. This uncertainty impacts investor decisions, making it challenging to predict future market trends accurately.

-

Increased Market Uncertainty and Investor Anxiety: The ongoing trade dispute has fueled market uncertainty and investor anxiety, leading to increased volatility in global stock markets. Investors are constantly assessing the potential consequences of escalating trade tensions and adapting their portfolios accordingly.

-

Fluctuations in Currency Exchange Rates: Currency exchange rates have been significantly impacted, reflecting the shifting economic landscape and investor sentiment. The uncertainty surrounding the trade war contributes to fluctuations in currency values, affecting international trade and investment flows.

-

Impact on Global Supply Chains and Production Costs: Disruptions to global supply chains have led to increased production costs for many businesses. Companies are forced to re-evaluate their sourcing strategies and explore alternative suppliers, leading to increased expenses and potential delays in production.

-

Increased Risk Aversion Among Investors: The overall uncertainty has increased risk aversion among investors, leading many to adopt more conservative investment strategies and seek safe haven assets. This can impact market liquidity and potentially slow down economic growth.

-

Global Market Indices Reactions: Major global market indices, such as the Dow Jones Industrial Average, the S&P 500, and the Shanghai Composite, have all exhibited significant reactions to news and developments related to the US-China trade war. These reactions often reflect investor sentiment and the perceived impact of the trade dispute on economic growth.

Government Policies and Their Influence

Government policies, both in the US and China, have played a significant role in shaping the impact of the trade war. These policies, and the potential for future policy changes, are crucial factors to consider when assessing the ongoing situation.

-

US Tariff Policies and Their Impact: The US imposition of tariffs has aimed to protect domestic industries and encourage fairer trade practices. However, these tariffs have also led to increased costs for consumers and businesses, and sparked retaliatory measures from China.

-

Chinese Retaliatory Tariffs and Their Consequences: China's retaliatory tariffs have had a significant impact on US exports, particularly in the agricultural sector. These measures have created further economic uncertainty and exacerbated the trade tensions.

-

Potential Future Policy Changes and Their Predicted Impact: Any future changes in trade policy, whether in the form of further tariffs, de-escalation efforts, or new trade agreements, will likely have a significant impact on global markets. Monitoring these policy shifts is crucial for investors.

-

The Role of International Organizations: International organizations like the World Trade Organization (WTO) have attempted to mediate the conflict and promote a resolution through diplomatic channels. The success of these efforts will significantly influence the future trajectory of the trade war and its effects on the global economy.

Investment Strategies in a Trade War Environment

Navigating the current market conditions requires a thoughtful and adaptable investment strategy. Investors need to consider the potential risks and opportunities presented by the ongoing trade war.

-

Diversification Strategies to Minimize Risk: Diversification across different asset classes and geographic regions is crucial to minimize exposure to the risks associated with the trade war. This strategy reduces the impact of any single sector or market's downturn on an investor's overall portfolio.

-

Focus on Companies Less Exposed to the Trade War: Identifying companies with lower exposure to the trade war is a key strategy. This could involve focusing on companies with strong domestic markets or those operating in sectors less affected by trade tensions.

-

Analyzing Companies with Strong Domestic Markets: Companies with a strong focus on the domestic market are often less vulnerable to the disruptions caused by the trade war. These companies may provide a more stable investment option during periods of heightened uncertainty.

-

Importance of Long-Term Investment Strategies over Short-Term Reactions: A long-term investment horizon is crucial in navigating market volatility. Short-term reactions to trade war news can lead to poor investment decisions. A patient, long-term approach is often the most effective way to weather the storm.

-

Consideration of Hedging Strategies to Mitigate Risk: Hedging strategies, such as investing in inverse ETFs or utilizing options contracts, can help mitigate risk during periods of market uncertainty. However, it is essential to carefully consider the risks and costs associated with these strategies.

Conclusion

The US-China trade war's impact on today's stock market is multifaceted and complex, affecting various sectors and creating significant global market volatility. Understanding these impacts and adapting investment strategies accordingly is crucial for investors.

Call to Action: Stay informed about the evolving US-China trade war situation and its impact on the stock market. Regularly analyze the effects of the US-China trade war impact on your portfolio to make informed decisions and navigate this dynamic environment effectively. Continue researching and monitoring the US-China trade war impact for a comprehensive understanding of market trends.

Featured Posts

-

Cinema Con 2024 First Look At The Mission Impossible Dead Reckoning Part Two Standee

Apr 26, 2025

Cinema Con 2024 First Look At The Mission Impossible Dead Reckoning Part Two Standee

Apr 26, 2025 -

New York Knicks Roommates Show 12 Dream Guests

Apr 26, 2025

New York Knicks Roommates Show 12 Dream Guests

Apr 26, 2025 -

Unlock Todays Nyt Spelling Bee February 3rd 337 Hints And Solutions

Apr 26, 2025

Unlock Todays Nyt Spelling Bee February 3rd 337 Hints And Solutions

Apr 26, 2025 -

Mission Impossible 7 Tom Cruises Perilous Stunt Takes Center Stage

Apr 26, 2025

Mission Impossible 7 Tom Cruises Perilous Stunt Takes Center Stage

Apr 26, 2025 -

New York Giants Shedeur Sanders As The Quarterback Of The Future

Apr 26, 2025

New York Giants Shedeur Sanders As The Quarterback Of The Future

Apr 26, 2025

Latest Posts

-

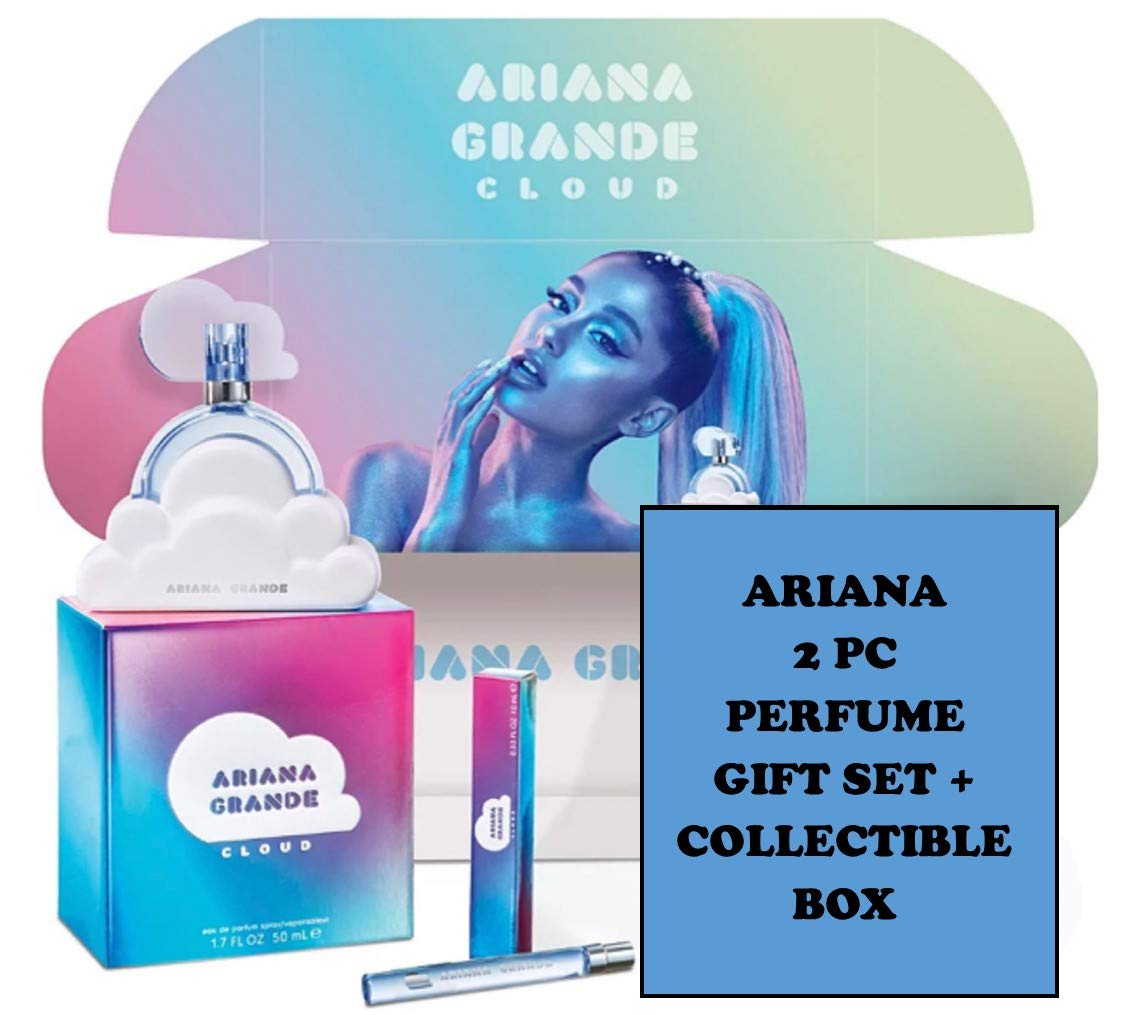

Buy Ariana Grande Lovenote Fragrance Set Online A Complete Guide To Pricing And Retailers

Apr 27, 2025

Buy Ariana Grande Lovenote Fragrance Set Online A Complete Guide To Pricing And Retailers

Apr 27, 2025 -

Ariana Grande Lovenote Fragrance Set Online Shopping Guide And Price Check

Apr 27, 2025

Ariana Grande Lovenote Fragrance Set Online Shopping Guide And Price Check

Apr 27, 2025 -

Find The Best Price For Ariana Grande Lovenote Fragrance Set Online

Apr 27, 2025

Find The Best Price For Ariana Grande Lovenote Fragrance Set Online

Apr 27, 2025 -

Mafs Star Sam Carraro Joins Love Triangle But For How Long

Apr 27, 2025

Mafs Star Sam Carraro Joins Love Triangle But For How Long

Apr 27, 2025 -

Sam Carraros Love Triangle Stint A Five Minute Wonder Or Not

Apr 27, 2025

Sam Carraros Love Triangle Stint A Five Minute Wonder Or Not

Apr 27, 2025