US-China Trade War Escalates: Stock Market Live Updates

Table of Contents

Latest Developments and Tariff Actions

The US-China trade war is characterized by a cycle of escalating tariffs and retaliatory measures. Staying abreast of these developments is vital for informed investment decisions.

New Tariff Announcements and Implementation

Recent announcements have seen both the US and China impose new tariffs on a range of goods. These actions significantly impact various sectors and contribute to market volatility. For example, the latest round of tariffs targeted agricultural products from both countries, impacting farmers and food producers. Technology companies are also heavily affected by the ongoing trade restrictions.

- Specific products affected: Agricultural goods (soybeans, pork), technology products (semiconductors, smartphones), textiles, and various manufactured goods.

- Dates of implementation: Specific dates vary depending on the targeted goods and announcements, so always check official government websites for the most current information.

- Estimated economic impact: The economic impact is substantial, impacting global supply chains, consumer prices, and overall economic growth. Independent economic forecasts vary, but the consensus points toward negative impacts.

- Companies impacted: Companies like Apple (AAPL), Intel (INTC), and Deere & Company (DE) have publicly discussed the negative impacts of tariffs on their profits and operations. Numerous smaller companies, especially those heavily reliant on trade with China or the US, are also experiencing difficulties. It's crucial to monitor the financial reports of specific companies to gauge their vulnerability to the US-China trade war.

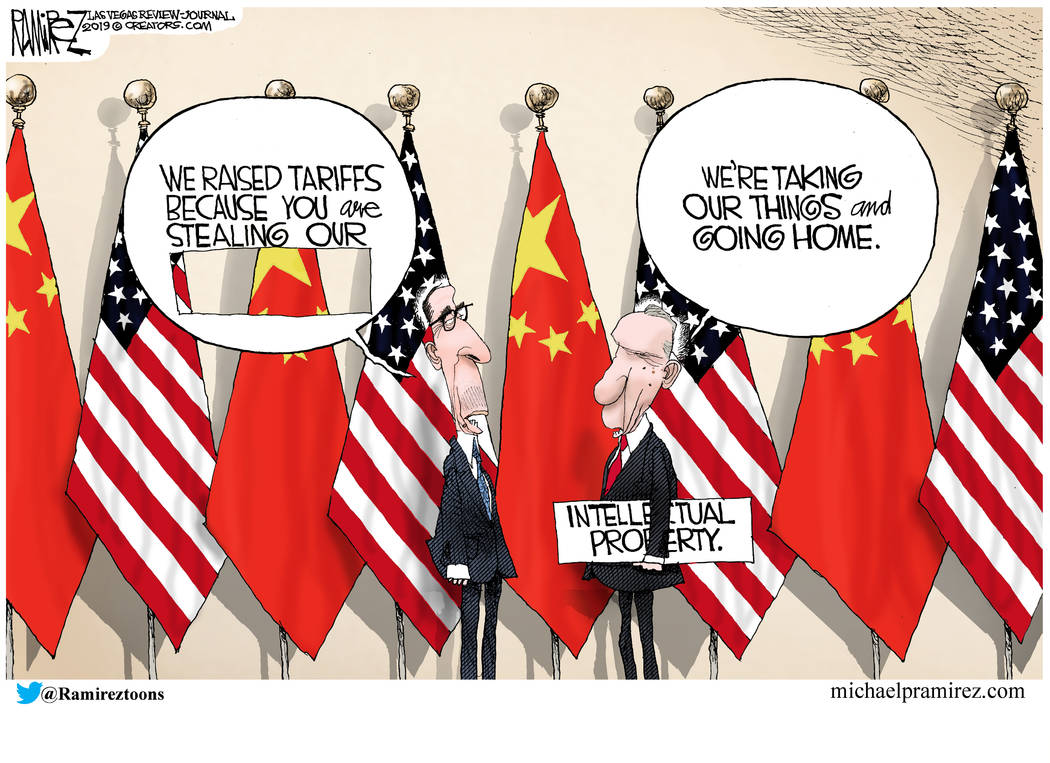

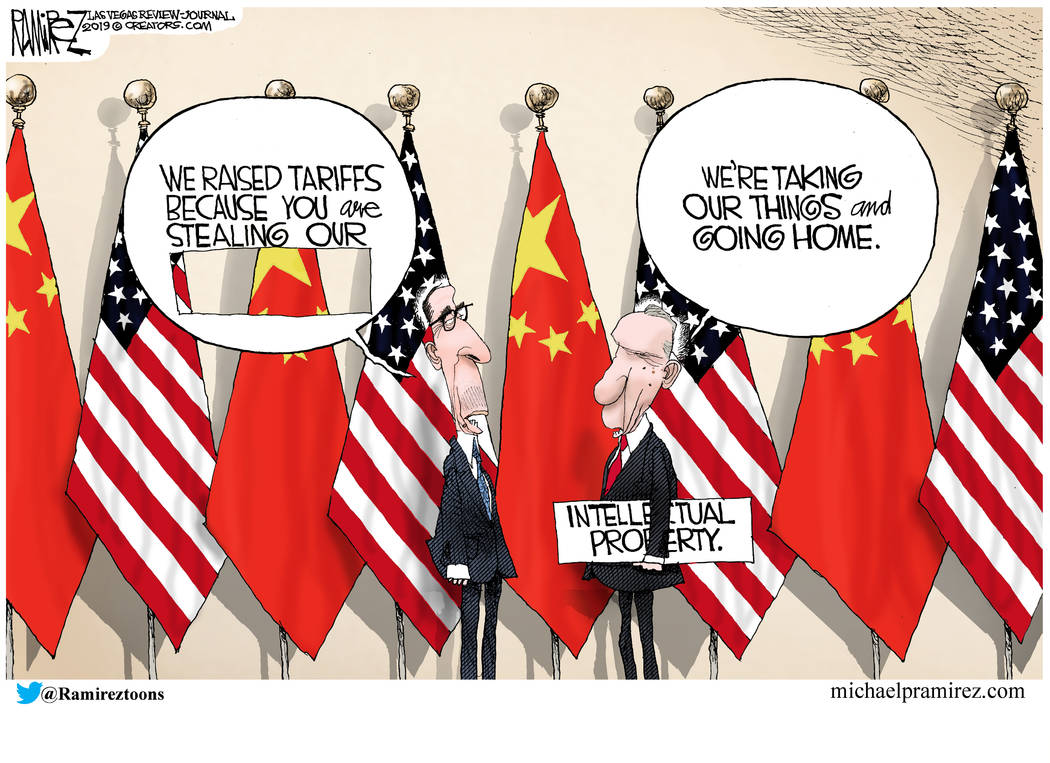

Retaliatory Measures and Trade Negotiations

Both countries have implemented retaliatory measures in response to each other’s tariffs. These actions have created a cycle of escalating tensions, further destabilizing global markets. The status of ongoing trade negotiations is constantly evolving, with periods of apparent progress followed by setbacks.

- Summaries of negotiation rounds: While there have been several rounds of negotiations, substantial breakthroughs have been few and far between. Key sticking points include intellectual property rights, technology transfer, and market access.

- Key sticking points: Disagreements persist on issues like forced technology transfer, intellectual property theft, and the trade deficit between the two nations. These are major obstacles to reaching a comprehensive trade agreement.

- Potential compromises: While potential compromises are constantly speculated upon, no significant breakthroughs have been publicly announced. The situation remains fluid, and updates should be followed closely. Links to official government statements and news releases from credible sources are essential for keeping up-to-date on these developments.

Impact on Global Stock Markets

The US-China trade war has significantly impacted global stock markets, creating uncertainty and volatility.

Market Volatility and Investor Sentiment

The ongoing trade tensions have led to increased market volatility. Major stock market indices such as the Dow Jones Industrial Average, S&P 500, Nasdaq Composite, and Shanghai Composite have experienced significant fluctuations in response to trade-related news.

- Specific market movements: Market movements are highly dynamic, reflecting the latest news and developments in the trade war. Closely monitor these indices using reputable financial news sources for real-time data.

- Investor sentiment: Investor sentiment has shifted from cautious optimism to considerable concern, as demonstrated by various market indicators, including the VIX (fear gauge), which measures market volatility. This heightened uncertainty influences investment decisions.

- Analysis of market trends: The impact is sector-specific, but overall, prolonged trade tensions tend to lead to a decrease in investor confidence and a negative impact on market performance.

Sector-Specific Impacts

The impact of the trade war is not uniform across all sectors. Certain industries are more exposed than others due to their reliance on trade with China or the US.

- Specific examples of companies experiencing significant gains or losses: The technology sector, particularly companies involved in semiconductor manufacturing or smartphone production, has been greatly affected. Companies heavily reliant on exports to China have also suffered. Conversely, some companies may benefit from the shift in supply chains.

- Analysis of industry performance: Industries closely tied to global trade, such as manufacturing and agriculture, have been particularly hard hit. The effects ripple across related industries, impacting the wider economy.

Strategies for Navigating Market Uncertainty

Navigating the uncertainty caused by the US-China trade war requires a strategic approach to investing.

Diversification and Risk Management

Diversification is key to mitigating the risks associated with the trade war’s impact on specific sectors or companies.

- Strategies for risk management: Diversify your investment portfolio across different asset classes (stocks, bonds, real estate) and geographical regions. Consider hedging strategies to protect against potential losses. Reduce your exposure to companies heavily reliant on trade between the US and China.

- Asset allocation advice: Adjust your asset allocation based on your risk tolerance and investment goals. Consult with a financial advisor for personalized advice.

- Hedging techniques: Explore hedging strategies, such as using options or futures contracts, to reduce potential losses from market volatility.

Long-Term Investment Strategies

Maintaining a long-term investment perspective is crucial, even during periods of short-term market volatility.

- Advice on long-term investing: Avoid making rash decisions based on short-term market fluctuations. Focus on your long-term financial goals and stick to your investment plan.

- Avoiding panic selling: Resist the urge to panic sell your investments during periods of market downturn. This can lock in losses and prevent you from benefiting from potential future growth.

- Considering alternative investment options: Explore alternative investment options, such as precious metals or other asset classes, to diversify your portfolio and mitigate risks.

Conclusion

The escalating US-China trade war presents significant challenges for global stock markets, creating considerable uncertainty and volatility. The ongoing tariff battles, retaliatory measures, and fluctuating investor sentiment underscore the need for informed and adaptable investment strategies. Understanding the sector-specific impacts and employing effective risk management techniques, such as diversification and hedging, are crucial for navigating this turbulent period. Maintaining a long-term perspective and avoiding knee-jerk reactions are also essential.

Call to Action: Stay informed about the latest developments in the US-China trade war by regularly checking our website for live updates and analysis. Understanding the complexities of the US-China trade war and its effect on the stock market is crucial for making informed investment decisions. For up-to-date insights and strategies for navigating this evolving situation, continue to follow our US-China trade war stock market updates.

Featured Posts

-

Eurovision 2025 Sissal Repraesenterer Danmark

May 11, 2025

Eurovision 2025 Sissal Repraesenterer Danmark

May 11, 2025 -

Senior Activities Calendar Trips Events And Outings

May 11, 2025

Senior Activities Calendar Trips Events And Outings

May 11, 2025 -

Farrah Abrahams Post Teen Mom Life Success Or Struggle

May 11, 2025

Farrah Abrahams Post Teen Mom Life Success Or Struggle

May 11, 2025 -

New Calvin Klein Campaign Featuring Lily Collins Image 5133596

May 11, 2025

New Calvin Klein Campaign Featuring Lily Collins Image 5133596

May 11, 2025 -

New Calvin Klein Campaign Featuring Lily Collins Image 5133598

May 11, 2025

New Calvin Klein Campaign Featuring Lily Collins Image 5133598

May 11, 2025