US-China Trade War Eases: S&P 500 Reacts With 3%+ Surge

Table of Contents

The De-escalation of US-China Trade Tensions

The recent easing of US-China trade tensions marks a pivotal moment in the protracted trade war. This development follows months of negotiations and escalating tariffs that significantly impacted global market sentiment and investor confidence. Several key agreements and concessions paved the way for this de-escalation.

Key Agreements and Concessions

The agreement between the US and China involved a multifaceted approach to resolving key trade disagreements. Specific details released include:

- Tariff Reductions and Suspensions: Both countries agreed to reduce existing tariffs on a significant number of goods, providing immediate relief to businesses and consumers. The specific percentage reductions and the categories of goods affected have been detailed in official statements.

- Intellectual Property Protection: China committed to stronger enforcement of intellectual property rights, a long-standing point of contention in the trade dispute. This includes provisions for increased penalties for infringement and improved protection for US companies operating in China.

- Increased Purchases of US Goods: China pledged to significantly increase its purchases of US agricultural products, manufactured goods, and energy resources over the next several years. This commitment aims to address the US trade deficit with China.

- Other Concessions: Other significant concessions included agreements on currency manipulation, market access for US companies, and dispute resolution mechanisms.

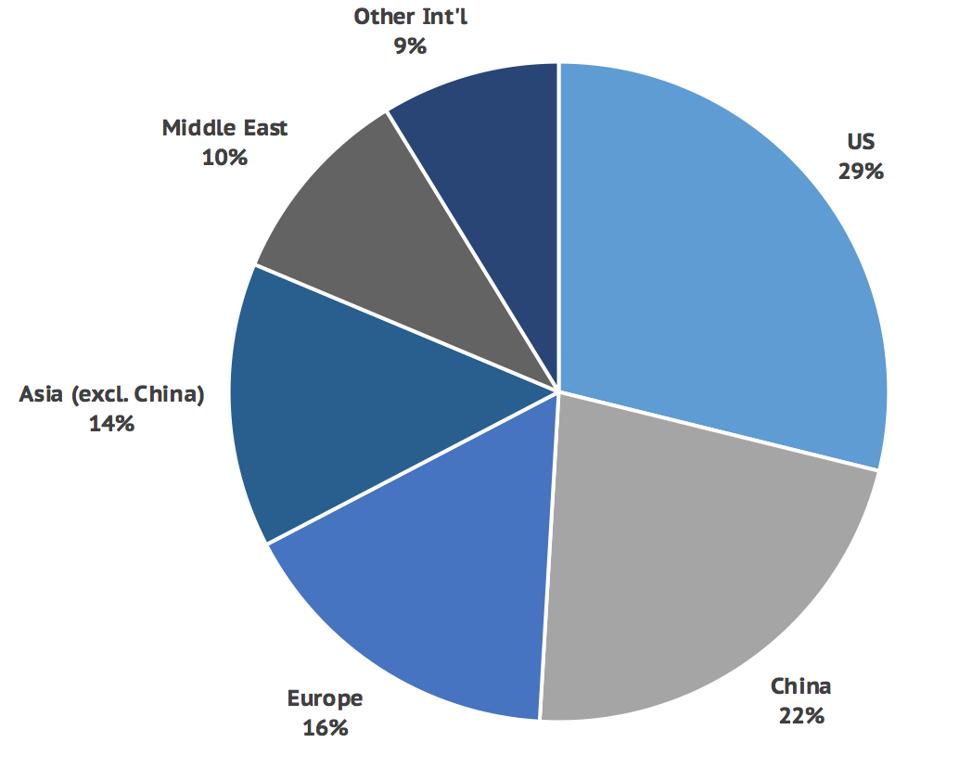

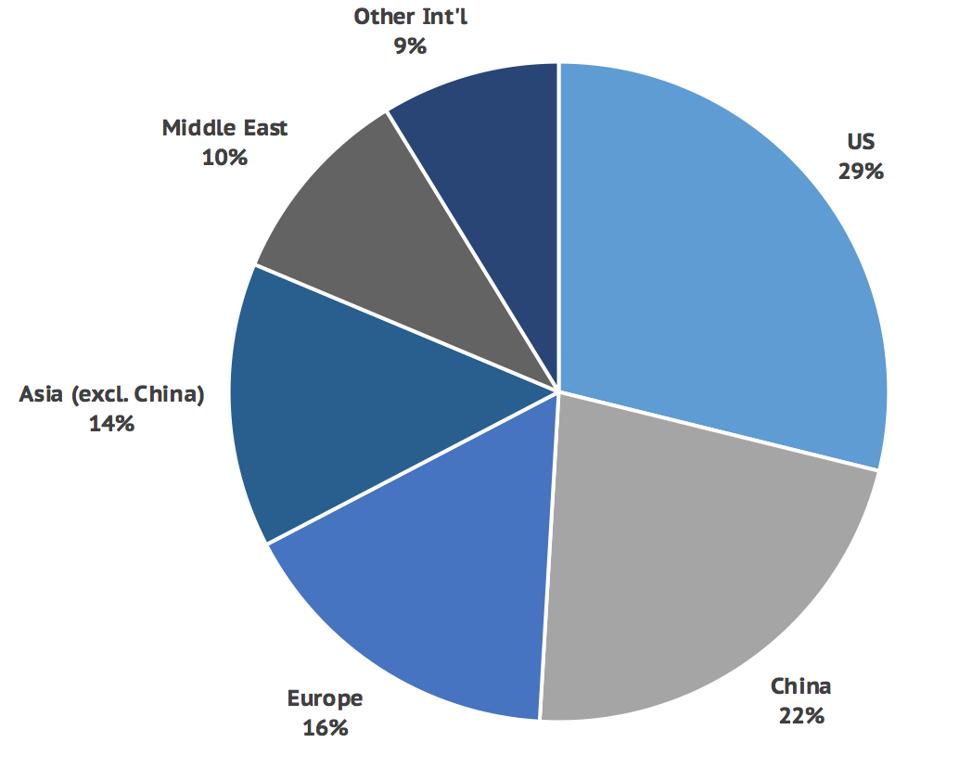

Impact on Global Market Sentiment

The news of the trade war easing immediately boosted investor confidence and significantly reduced market volatility. The reduced uncertainty surrounding future trade policies created a more favorable environment for investment.

- Increased Investor Optimism and Risk-Taking: Investors reacted positively, leading to increased risk appetite and a surge in stock prices across various sectors.

- Reduced Uncertainty for Businesses and Investors: The clarity provided by the agreement allowed businesses to better plan for the future, reducing uncertainty and fostering investment.

- Positive Impact on Global Supply Chains: Easing trade tensions improved the predictability of global supply chains, leading to more efficient operations and reduced costs for businesses.

S&P 500's Sharp Rise: A Detailed Analysis

The S&P 500 experienced a dramatic surge, rising by over 3% in a single day—a historically significant jump, especially considering the recent market uncertainties. This reflects the market's overwhelmingly positive response to the de-escalation of US-China trade tensions.

Magnitude of the Surge

The 3%+ increase in the S&P 500 represents one of the largest single-day gains in recent years. The magnitude of the increase highlights the significant weight of the US-China trade war on investor sentiment and market performance. This surge reversed some of the losses incurred during the peak of the trade conflict.

Sector-Specific Performances

While the entire market experienced significant gains, certain sectors benefited disproportionately from the positive news.

- Technology Stocks: Technology companies, particularly those heavily reliant on international trade, saw substantial increases in their stock prices.

- Consumer Discretionary Stocks: Companies in the consumer discretionary sector also experienced strong gains, reflecting increased consumer confidence.

- Industrial Stocks: Industrial companies, heavily impacted by trade tariffs, saw a significant rebound in their stock prices.

- Less Significant Gains/Declines: Some sectors, such as utilities, demonstrated less significant gains, reflecting their relatively lower sensitivity to trade policy changes.

Analyst Reactions and Predictions

Financial analysts largely viewed the de-escalation of the US-China trade war as a positive development, although many remain cautious about the long-term implications. Many analysts have voiced optimism about the market outlook and predicted continued economic growth. However, they also cautioned that lingering uncertainties and potential future trade disputes could affect the long-term growth trajectory. The consensus seems to be cautiously optimistic, with the market expected to continue its upward trend in the near term, though significant volatility remains a possibility.

Potential Long-Term Impacts and Remaining Uncertainties

While the recent de-escalation is positive news, several unresolved issues and potential future tensions remain. Navigating these uncertainties will be crucial for both businesses and investors in the coming years.

Lingering Trade Disputes

Despite the agreement, several areas of disagreement persist between the US and China. These could potentially reignite trade tensions in the future.

- Areas where disagreements persist: Some areas where disagreements may persist include technology transfer, subsidies for state-owned enterprises, and access to the Chinese market.

- Potential for future trade disputes: The potential for future disputes remains, particularly if either side fails to fully comply with the agreement's terms.

- Impact of geopolitical factors: Geopolitical factors and evolving global dynamics could also impact the bilateral relations between the US and China, potentially influencing future trade negotiations.

Economic Implications Beyond the S&P 500

The easing of trade tensions will have broader economic consequences beyond the immediate impact on the stock market.

- Impact on global trade: Reduced tariffs will facilitate global trade, boosting economic activity worldwide.

- Effects on inflation: Changes in import prices could influence inflation rates in both countries and globally.

- Potential changes in supply chains: Companies might readjust their supply chains in response to the changed trade environment.

Conclusion: Navigating the Aftermath of the Easing US-China Trade War

The easing of US-China trade tensions has had a profound and immediate impact on global markets, with the S&P 500 experiencing a significant surge. Key agreements on tariff reductions, intellectual property protection, and increased purchases of US goods have contributed to this positive shift. While the market has responded favorably, lingering uncertainties and the potential for future trade disputes remain. Understanding these dynamics is crucial for navigating this evolving situation effectively. Stay informed about further developments in the US-China trade war and its impact on your investments. Monitor the S&P 500 and other key market indicators to navigate this evolving situation effectively. For up-to-date information, refer to reputable financial news sources like the Wall Street Journal, Bloomberg, and the Financial Times.

Featured Posts

-

Adrien Brody Post Oscar Win Why Hes Ideal For Mcus Magneto

May 13, 2025

Adrien Brody Post Oscar Win Why Hes Ideal For Mcus Magneto

May 13, 2025 -

Leonardo Di Caprio Hiding After Brutal Mocking

May 13, 2025

Leonardo Di Caprio Hiding After Brutal Mocking

May 13, 2025 -

Kim Kardashians Swimwear Campaign Faces Backlash Tory Lanez Music Sparks Debate

May 13, 2025

Kim Kardashians Swimwear Campaign Faces Backlash Tory Lanez Music Sparks Debate

May 13, 2025 -

Senior Travel Calendar Planned Trips Activities And Events

May 13, 2025

Senior Travel Calendar Planned Trips Activities And Events

May 13, 2025 -

Economic Disaster Looms For Spanish Towns Following Brexit Deal

May 13, 2025

Economic Disaster Looms For Spanish Towns Following Brexit Deal

May 13, 2025