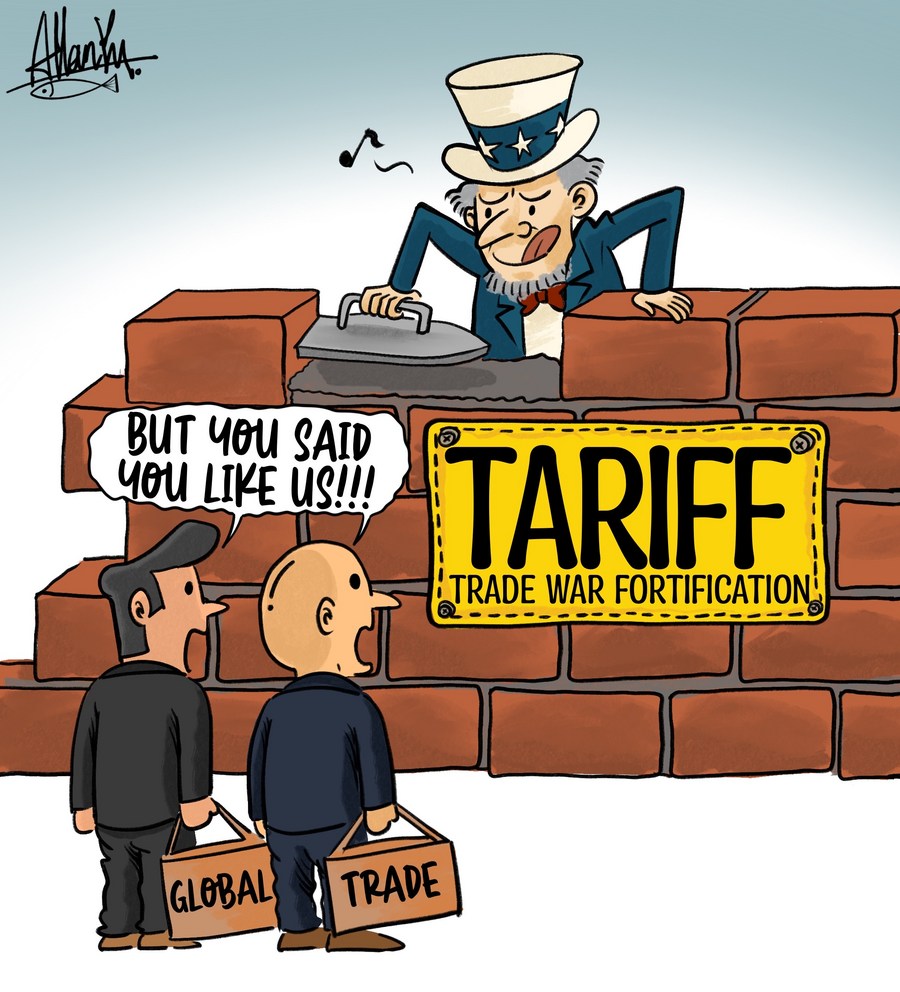

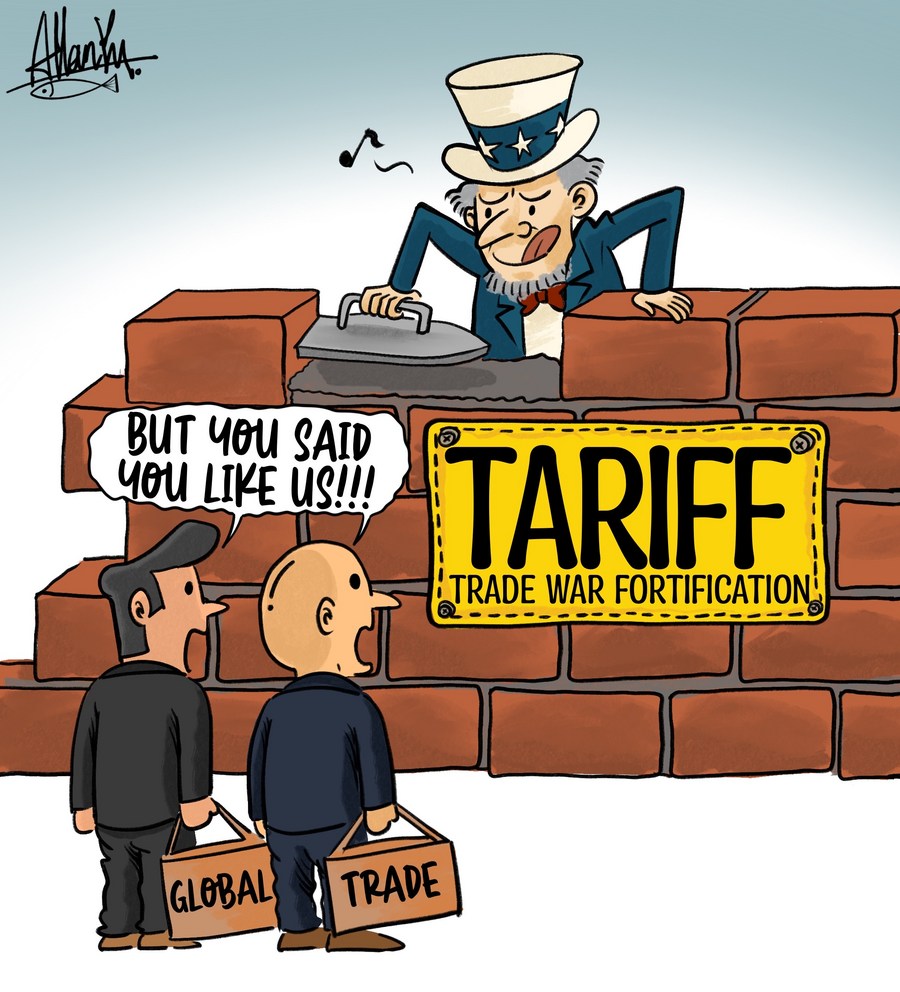

US-China Trade War: 80% Tariff Impact On Stock Market Today

Table of Contents

Direct Impact of Tariffs on Specific Sectors

The US-China trade war hasn't impacted all sectors equally. Some have borne the brunt of the 80% tariffs more directly than others. Let's examine the key areas:

Technology Sector Volatility

The technology sector, a central player in the global economy, has felt the US-China trade war acutely. Tariffs on semiconductors, computer components, and other crucial tech products have created significant volatility.

- Increased costs: Tariffs have increased the cost of production for technology companies, forcing them to either absorb these costs, impacting profitability, or pass them on to consumers through higher prices.

- Supply chain disruptions: The imposition of tariffs has disrupted established supply chains, creating uncertainty and logistical challenges for businesses reliant on global sourcing.

- Investment hesitation: The uncertainty surrounding future tariff policies and trade negotiations has made many investors hesitant to commit to long-term investments in the tech sector.

- Examples: Companies like Apple, Qualcomm, and Intel have all publicly acknowledged the negative impacts of the US-China trade war on their operations and financial performance.

Impact on Manufacturing and Retail

The manufacturing and retail sectors have also been severely impacted by the US-China trade war. Higher import costs and reduced consumer spending have become defining features of this period.

- Higher import costs: Tariffs on imported raw materials and finished goods have increased production costs for manufacturers and retailers, squeezing profit margins.

- Reduced consumer spending: Increased prices for consumer goods, directly resulting from tariffs, have led to reduced consumer demand and slower economic growth.

- Impact on small businesses: Smaller businesses, with less financial flexibility, have been disproportionately affected by the increased costs and reduced demand.

- Examples: Industries like apparel, furniture, and electronics have experienced notable challenges due to increased import costs.

Agricultural Sector Challenges

The agricultural sector has been a significant target in the trade war, facing retaliatory tariffs from China that have severely impacted exports and farm incomes.

- Decreased exports: Chinese tariffs on US agricultural products, such as soybeans and pork, have drastically reduced export volumes, leading to surplus production and lower prices for farmers.

- Lower farm incomes: Reduced export opportunities have significantly impacted farm incomes, leading to financial hardship and potential bankruptcies for many agricultural businesses.

- Government support programs: The US government has implemented various support programs to mitigate the losses faced by farmers, but these have often proven insufficient.

- Long-term effects: The long-term effects of the trade war on the agricultural sector are still unfolding and will likely have significant implications for food security and rural economies.

Indirect Impact on Investor Sentiment and Market Confidence

Beyond the direct impact on specific sectors, the US-China trade war has had a significant indirect impact on investor sentiment and market confidence, creating a ripple effect across the global economy.

Uncertainty and Volatility

The ongoing trade war has created considerable uncertainty in the market, leading to increased volatility and reduced investor confidence.

- Hesitant investors: The unpredictable nature of the trade war makes it difficult for investors to make long-term investment decisions, preferring to adopt a wait-and-see approach.

- Increased market fluctuations: News and developments related to the trade war trigger significant market fluctuations, leading to increased risk and uncertainty.

- Impact on global growth: The trade war has negatively impacted global economic growth projections, further dampening investor sentiment.

Flight to Safety

Faced with uncertainty, investors have sought refuge in "safe haven" assets, reducing investment in riskier assets.

- Increased gold demand: The demand for gold, a traditional safe haven asset, has increased significantly as investors seek to preserve capital during times of economic uncertainty.

- Lower risk investment returns: The shift towards safer investments has resulted in lower returns on riskier assets such as stocks and emerging market bonds.

- Conservative investment strategies: Investors have adopted more conservative investment strategies to minimize risk and protect their portfolios.

Impact on the US Dollar

The US-China trade war has also influenced the strength of the US dollar relative to other currencies.

- International trade balances: The trade war has impacted international trade balances, leading to fluctuations in currency exchange rates.

- Multinational corporation profits: Fluctuations in currency values can impact the profits of multinational corporations operating in both the US and China.

- Currency manipulation accusations: The trade war has also led to accusations of currency manipulation between the US and China, further adding to market uncertainty.

Government Response and Mitigation Strategies

Both the US and Chinese governments have implemented various strategies to mitigate the negative impacts of the trade war, though their effectiveness remains a subject of debate.

Tariffs and Trade Agreements

The US government's primary response has been through the imposition of tariffs and the negotiation (or renegotiation) of trade agreements.

- Tariff effectiveness: The effectiveness of different tariff strategies is still being debated, with some arguing that they have been counterproductive, while others maintain they are a necessary tool in trade negotiations.

- Future trade agreements: The outcome of ongoing trade negotiations will significantly influence the future trajectory of the US-China trade relationship and its impact on the stock market.

- Government subsidies: Governments have also provided subsidies to industries severely affected by tariffs to help them offset the increased costs and maintain competitiveness.

Economic Stimulus Measures

Governments have also implemented economic stimulus measures to counteract the negative economic consequences of the trade war.

- Fiscal and monetary policies: Both fiscal (government spending) and monetary (interest rate adjustments) policies have been used to try and stimulate economic activity and mitigate the impact of the trade war.

- Stimulus effectiveness: The effectiveness of these stimulus measures is subject to ongoing debate, with some economists questioning their long-term sustainability.

- National debt: Increased government spending to fund stimulus measures can lead to an increase in national debt, potentially creating long-term economic challenges.

Conclusion

The US-China trade war, with its 80% tariffs on some goods, has had a profound and multifaceted impact on the stock market today. From direct effects on specific sectors to indirect impacts on investor sentiment and market confidence, the implications are far-reaching. Understanding these impacts is crucial for navigating the current market conditions. By staying informed about developments in the US-China trade war and its effects on various sectors, investors can make more informed decisions and potentially mitigate risks. Stay updated on the latest news regarding the US-China trade war and its effects to better understand its ongoing impact on the stock market. Continue your research on the US-China trade war to make well-informed investment choices.

Featured Posts

-

The Quiet Hand Of Jared Kushner In Trumps Middle East Strategy

May 11, 2025

The Quiet Hand Of Jared Kushner In Trumps Middle East Strategy

May 11, 2025 -

Is Black Gold Within Reach Assessing Uruguays Offshore Potential

May 11, 2025

Is Black Gold Within Reach Assessing Uruguays Offshore Potential

May 11, 2025 -

Cissokho Vs Kavaliauskas Wbc Final Eliminator Showdown

May 11, 2025

Cissokho Vs Kavaliauskas Wbc Final Eliminator Showdown

May 11, 2025 -

Knicks Vs Pistons Magic Johnsons Bold Prediction

May 11, 2025

Knicks Vs Pistons Magic Johnsons Bold Prediction

May 11, 2025 -

Experience Grand Slam Tennis Through The Jamaica Observer

May 11, 2025

Experience Grand Slam Tennis Through The Jamaica Observer

May 11, 2025