US-China Trade: Trump Administration Demands Tariff Cuts And Rare Earth Solutions

Table of Contents

The Trump Administration's Tariff Strategy and its Impact on US-China Trade

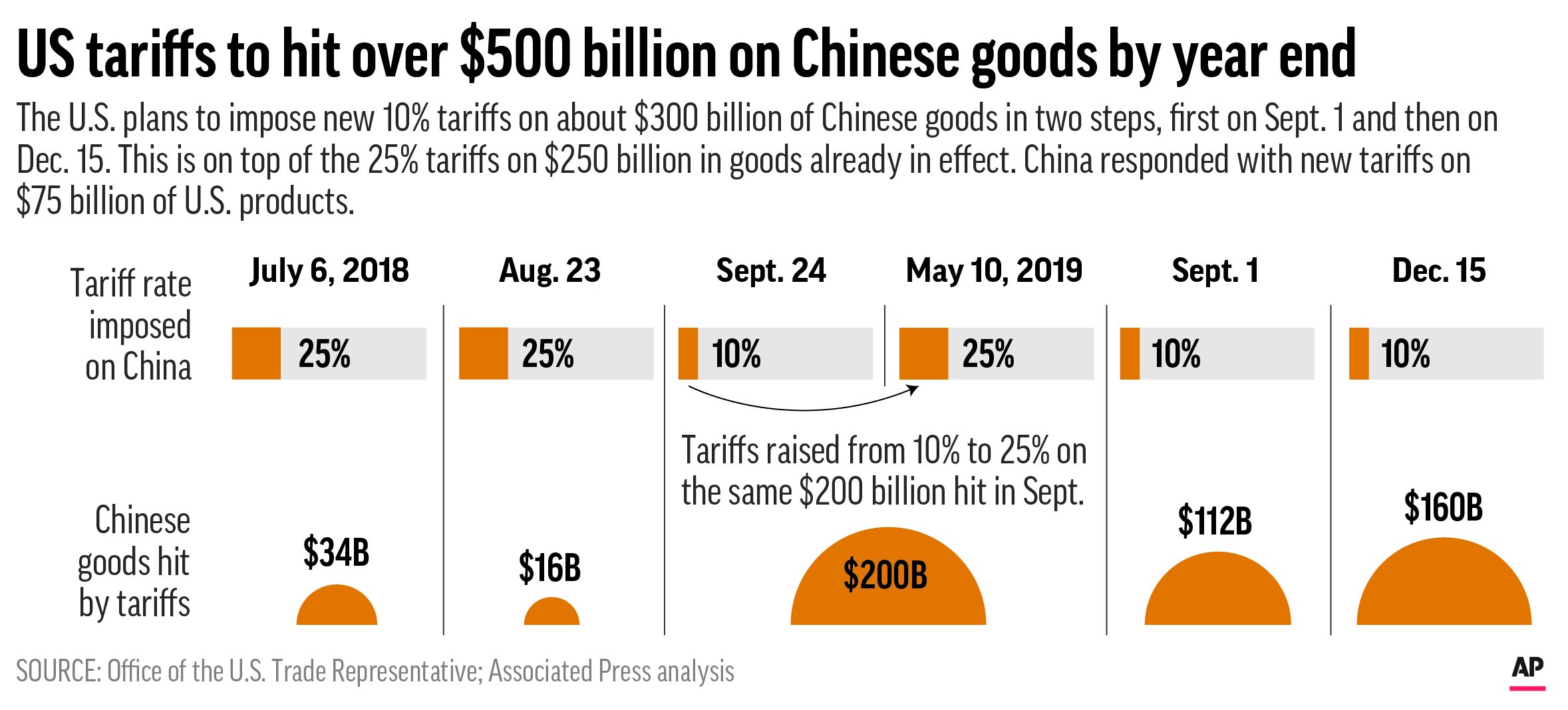

The Trump administration's imposition of tariffs on Chinese goods was justified as a means to address what it perceived as unfair trade practices, including intellectual property theft and forced technology transfer. The administration aimed to level the playing field and reduce the significant US trade deficit with China. However, this strategy triggered a tit-for-tat escalation, initiating a full-blown trade war.

- Rationale: The tariffs were intended to pressure China into negotiating more favorable trade deals, addressing issues such as market access for US companies and intellectual property protection.

- Economic Impact: The tariffs resulted in:

- Increased prices for consumers: Tariffs increased the cost of imported Chinese goods, leading to higher prices for consumers in the US.

- Disruptions to supply chains: Businesses faced significant disruptions as supply chains were redirected, leading to delays and increased costs.

- Retaliatory tariffs from China: China responded by imposing its own tariffs on US goods, impacting various sectors of the US economy.

- Effectiveness: The effectiveness of tariffs as a negotiating tool remains a subject of debate. While they undoubtedly put pressure on China, they also inflicted harm on the US economy. The outcome highlights the complexities of using economic sanctions as a lever in international trade negotiations. Keywords: US-China trade war, tariffs, trade negotiations, trade deficit, economic sanctions.

The Strategic Importance of Rare Earths in US-China Relations

Rare earth elements (REEs) are a group of 17 chemically similar metallic elements critical for various high-tech applications, including smartphones, electric vehicles, military equipment, and renewable energy technologies. China holds a dominant position in the global REE market, controlling a significant share of mining and processing.

- China's Dominance: China's near-monopoly on REE processing created significant vulnerabilities for the US, raising concerns about supply chain security and national security.

- Security Implications: The US reliance on China for REEs posed a significant risk, as disruptions to supply could cripple various industries and impact national defense capabilities.

- Diversification Efforts: The Trump administration sought to diversify REE sourcing through:

- Investment in domestic mining and processing: Efforts were made to stimulate domestic REE production to reduce reliance on China.

- Strengthening alliances with other rare earth producing nations: The US sought to develop stronger partnerships with countries like Australia and other nations to create more robust and diversified supply chains. Keywords: rare earth elements, rare earth minerals, supply chain security, national security, strategic minerals, resource diversification.

Negotiating Tariff Reductions and Rare Earth Solutions: Challenges and Opportunities

Negotiating with China on both tariff reductions and rare earth access proved exceptionally challenging. The issues are deeply intertwined, with each impacting the other.

- Negotiation Complexities: The negotiations involved intricate details, requiring compromises on both sides. The differing economic and political systems made finding common ground difficult.

- Potential for Compromise: While significant differences persisted, there was potential for agreement on certain areas, such as intellectual property protection and market access.

- Role of International Organizations: The World Trade Organization (WTO) played a role, though its influence was limited by the bilateral nature of the dispute and the challenges of enforcing rulings.

- Alternative Strategies: Strategies beyond tariffs included:

- Strengthening intellectual property rights protection: Addressing intellectual property theft was crucial to creating a fairer trade environment.

- Promoting fair competition: Ensuring a level playing field for US companies operating in China was essential.

- Enhancing bilateral investment agreements: Strengthening investment agreements could provide more legal recourse and protection for US companies. Keywords: trade negotiations, bilateral agreements, WTO, intellectual property, fair trade, economic diplomacy.

The Future of US-China Trade: Addressing Tariff Barriers and Securing Rare Earth Supplies

The Trump administration's approach to US-China trade relations, characterized by aggressive tariff strategies and efforts to diversify rare earth sourcing, left a lasting impact. While the tariffs ultimately had mixed results and the REE situation requires sustained commitment to domestic production and international collaboration, the experience highlighted the critical need for a more balanced and secure trade relationship. Addressing both tariff barriers and securing rare earth supplies remain crucial for future stability. Understanding the intricacies of US-China trade relations, particularly concerning tariff negotiations and rare earth sourcing, is crucial for informed decision-making. Further research into the complexities of US-China trade, encompassing tariff strategies and rare earth solutions, is essential for building a sustainable and secure future.

Featured Posts

-

No Confidence Vote Fails Faber Remains Asylum Minister

May 11, 2025

No Confidence Vote Fails Faber Remains Asylum Minister

May 11, 2025 -

Beatrices Account Of Prince Andrew And Fergies Divorce

May 11, 2025

Beatrices Account Of Prince Andrew And Fergies Divorce

May 11, 2025 -

Possible Next Pope Examining Nine Leading Contenders

May 11, 2025

Possible Next Pope Examining Nine Leading Contenders

May 11, 2025 -

Boston Celtics Clinch Division Title In Blowout Fashion

May 11, 2025

Boston Celtics Clinch Division Title In Blowout Fashion

May 11, 2025 -

O Keefes Undercover Sting Further Fallout For Prince Andrew

May 11, 2025

O Keefes Undercover Sting Further Fallout For Prince Andrew

May 11, 2025