US$9 Billion Parkland Acquisition: Shareholders To Vote In June

Table of Contents

Details of the US$9 Billion Parkland Acquisition

The acquiring company, let's call them "MegaHealth Corp," a leading player in the national healthcare industry with a strong reputation for innovative technologies and efficient operations, is seeking to acquire Parkland Healthcare. MegaHealth Corp's strategic goal for this acquisition is to expand its market presence, particularly in the underserved regions where Parkland operates, and to leverage Parkland’s established network and strong patient base.

The acquisition terms involve a price of $XXX per share, primarily paid in cash, with a smaller portion potentially in MegaHealth Corp stock. The exact breakdown will be detailed in the shareholder proposal. The deal requires regulatory approvals from various agencies, including the Federal Trade Commission (FTC), to ensure compliance with antitrust laws. Several key approvals have already been obtained, but some are still pending.

- Acquisition price breakdown: Primarily cash, with a smaller portion potentially in MegaHealth Corp stock (exact percentages to be confirmed in the shareholder documents).

- Key executives involved: [Insert names and titles of key executives from both companies].

- Projected timeline for completion: Completion is expected within [Number] months of shareholder approval, contingent on regulatory clearances.

- Synergies and cost savings: MegaHealth Corp anticipates significant cost savings through economies of scale, streamlined operations, and the elimination of redundant infrastructure. They also project increased revenue through expanded service offerings and market penetration.

Arguments For and Against the Parkland Acquisition

Arguments in favor of the acquisition center around increased market share for MegaHealth Corp, enhanced operational efficiency, and access to Parkland's specialized services. The combined entity would become a dominant force in the healthcare market, potentially leading to improved bargaining power with insurers and suppliers. This merger will allow the integrated company to invest more aggressively in research and development, leading to improved patient care and technological advancements.

However, significant concerns exist. Potential job losses due to overlapping roles and departments are a major concern for employees and the community. Integration challenges, including merging different IT systems and adapting to varying operational procedures, could disrupt services and impact patient care during the transition. Antitrust regulators may also scrutinize the deal closely, potentially leading to conditions or even blocking the acquisition.

- Bullet Points (Pro):

- Increased market share and regional dominance.

- Enhanced operational efficiency and significant cost synergies.

- Access to Parkland's specialized expertise and patient base.

- Expansion into new geographic markets and service offerings.

- Bullet Points (Con):

- Potential job losses due to redundancies and streamlining.

- Significant integration challenges and potential service disruptions.

- Antitrust concerns and the risk of regulatory delays or rejection.

- Potential negative impact on patient care during the transition period.

Shareholder Sentiment and Expected Vote Outcome

Current shareholder sentiment is mixed. While some large institutional investors have publicly endorsed the acquisition, highlighting the long-term strategic benefits, others have expressed concerns about potential risks, particularly regarding job security and integration challenges. A significant portion of shareholders are likely to carefully weigh the pros and cons before casting their votes.

Predicting the outcome of the June vote is challenging. However, considering the arguments presented by both sides and the known positions of major shareholders, a close vote is anticipated. Analyst predictions vary, with some suggesting approval, citing the potential for long-term value creation, while others express caution regarding the potential execution risks.

- Percentage of shares owned by institutional investors: [Insert percentage, if available].

- Public statements from key shareholders: [Summarize public statements supporting or opposing the acquisition].

- Analyst ratings and predictions on vote outcome: [Summarize analyst opinions and predictions].

- Potential impact on share price: The share price is likely to fluctuate significantly in the lead-up to and following the vote, depending on the outcome.

How to Stay Informed about the Parkland Acquisition Vote

To stay informed about the Parkland Acquisition, regularly check the official websites of both Parkland Healthcare and MegaHealth Corp for press releases and shareholder updates. Monitor SEC filings for official documentation related to the acquisition, and follow reputable financial news outlets for expert analysis and commentary. Actively participate in shareholder meetings and communicate your concerns or questions directly to company management.

Conclusion

The US$9 billion Parkland acquisition represents a pivotal moment for both companies and the broader healthcare industry. The June shareholder vote will determine the success of this ambitious merger. While the potential benefits, including increased market share and operational efficiencies, are substantial, concerns about job losses, integration challenges, and antitrust issues remain. The outcome will significantly impact the future of Parkland Healthcare and its stakeholders.

The upcoming June vote on the US$9 billion Parkland acquisition is a pivotal moment. Stay informed about this significant healthcare merger by following reliable news sources and participating actively as a shareholder. Understanding the details of this Parkland Acquisition is crucial for investors and stakeholders alike. Don't miss crucial updates regarding this landmark deal.

Featured Posts

-

La Lucha De Simone Biles Tras La Revelacion De Mi Cuerpo Se Derrumbo

May 07, 2025

La Lucha De Simone Biles Tras La Revelacion De Mi Cuerpo Se Derrumbo

May 07, 2025 -

Skypes Prophetic Insights A Look Back At Its Bold Claims

May 07, 2025

Skypes Prophetic Insights A Look Back At Its Bold Claims

May 07, 2025 -

Draymond Greens Night Night Celebration The Inside Story From Steph Curry

May 07, 2025

Draymond Greens Night Night Celebration The Inside Story From Steph Curry

May 07, 2025 -

The Young And The Restless February 11 Nick Confronts Victor What Happened

May 07, 2025

The Young And The Restless February 11 Nick Confronts Victor What Happened

May 07, 2025 -

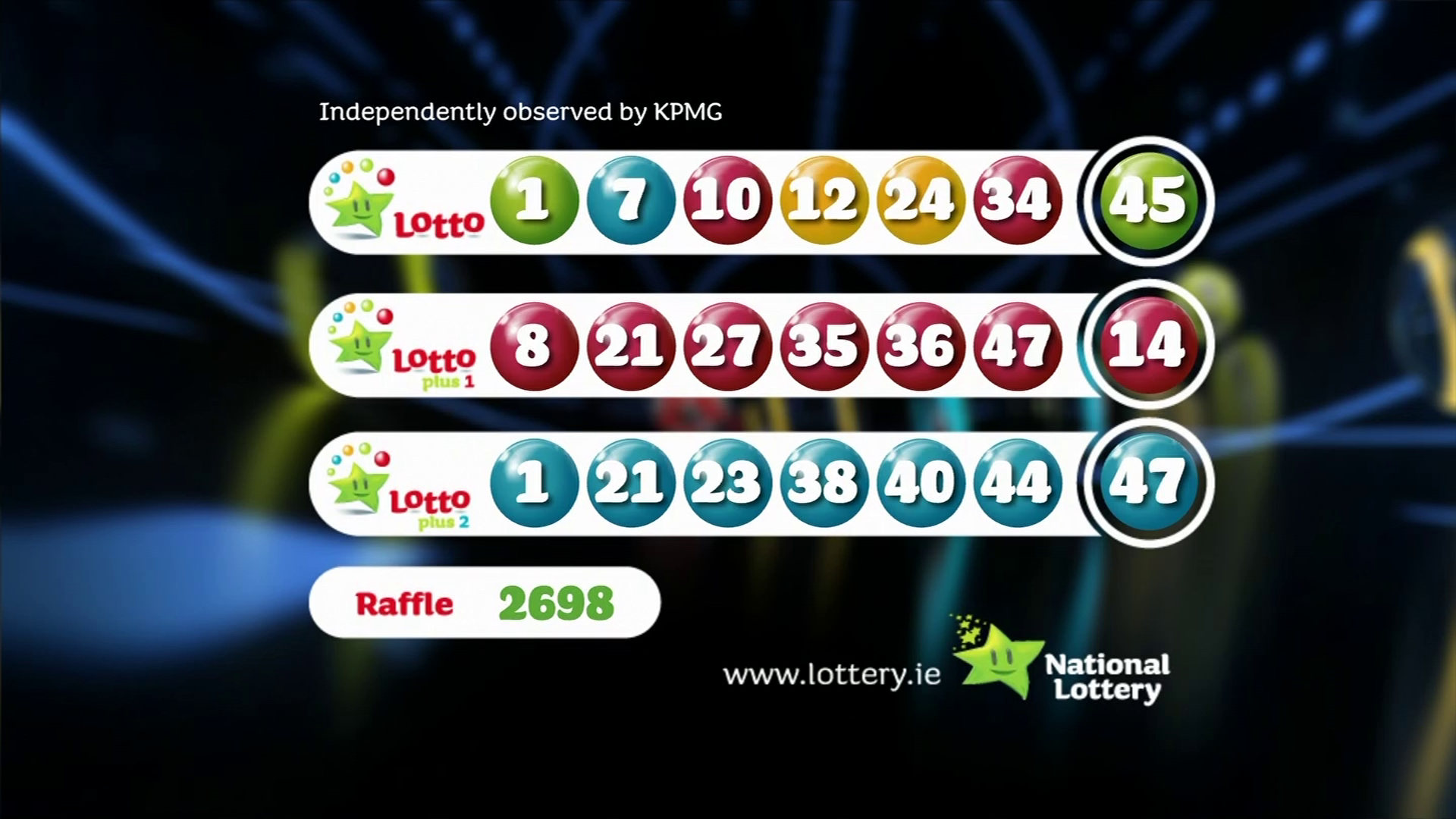

The Official Lotto Results Wednesday April 16th 2025

May 07, 2025

The Official Lotto Results Wednesday April 16th 2025

May 07, 2025

Latest Posts

-

Cleveland Cavaliers Vs San Antonio Spurs Injury Report March 27

May 07, 2025

Cleveland Cavaliers Vs San Antonio Spurs Injury Report March 27

May 07, 2025 -

March 27th Cavaliers Spurs Game Key Player Injury News

May 07, 2025

March 27th Cavaliers Spurs Game Key Player Injury News

May 07, 2025 -

Breaking Anthony Edwards Injury Update Timberwolves Vs Lakers

May 07, 2025

Breaking Anthony Edwards Injury Update Timberwolves Vs Lakers

May 07, 2025 -

Nba Playoffs Ashley Holder Gets The Inside Scoop From Donovan Mitchell

May 07, 2025

Nba Playoffs Ashley Holder Gets The Inside Scoop From Donovan Mitchell

May 07, 2025 -

Cavs Vs Spurs Updated Injury Report For March 27th

May 07, 2025

Cavs Vs Spurs Updated Injury Report For March 27th

May 07, 2025