Unicaja Investors And Sabadell: Discussions Regarding A Potential Deal

Table of Contents

H2: The Rationale Behind a Potential Unicaja-Sabadell Deal

The potential merger between Unicaja and Sabadell is driven by a desire for greater efficiency, market dominance, and improved financial stability within the increasingly competitive Spanish banking sector. Several key synergies are at play:

- Increased Market Share: A combined Unicaja and Sabadell would command a significantly larger market share in Spain, bolstering their competitive position against larger national and international players. This increased size would allow for greater influence and bargaining power.

- Significant Cost Savings: Consolidating operations, streamlining back-office functions, and eliminating redundancies would result in substantial cost savings. This increased efficiency is a major incentive for both banks.

- Enhanced Efficiency and Profitability: Economies of scale resulting from the merger would lead to improved operational efficiency and higher profitability margins. Resource optimization and shared infrastructure would contribute significantly to this.

- Improved Access to Capital and Reduced Financial Risks: A larger, more diversified bank is generally perceived as less risky by investors and lenders, resulting in better access to capital markets at more favorable terms.

- Potential Expansion Opportunities: The combined entity would possess greater financial strength and resources to pursue expansion opportunities, both within Spain and potentially into international markets.

H2: Investor Reactions and Market Analysis

The rumors of a Unicaja-Sabadell merger have caused considerable fluctuation in the stock prices of both banks. Market analysis reveals a mixed investor sentiment:

- Stock Price Fluctuations: Since the merger rumors surfaced, the stock prices of both Unicaja and Sabadell have shown significant volatility, reflecting the uncertainty and speculation surrounding the potential deal.

- Investor Sentiment: While some investors view the merger positively, anticipating potential synergies and increased value, others remain cautious, citing potential integration challenges and regulatory hurdles.

- Expert Opinions and Market Forecasts: Financial analysts offer varied perspectives, with some predicting a successful merger leading to significant long-term gains, while others express concerns about the potential risks and complexities involved.

- Valuation and Share Exchange Ratios: Determining a fair valuation for both banks and establishing an equitable share exchange ratio will be crucial for securing investor support and ensuring a smooth transaction.

H2: Potential Challenges and Obstacles to a Successful Merger

While the potential benefits are significant, several challenges could hinder the completion of a successful merger between Unicaja and Sabadell:

- Regulatory Approvals and Antitrust Concerns: Obtaining necessary regulatory approvals from the European Commission and Spanish authorities will be a critical hurdle. Antitrust concerns regarding market dominance could delay or even prevent the merger.

- Integration Challenges: Merging two distinct corporate cultures, operational systems, and IT infrastructures can be a complex and time-consuming process, potentially leading to disruptions and unforeseen costs.

- Workforce Management: Managing the workforce during and after the merger will be a delicate process. Potential redundancies and restructuring could lead to social and labor relations challenges.

- Due Diligence: Thorough due diligence processes are essential to identify and assess potential risks and liabilities before the deal is finalized. This comprehensive review could impact the timeline and the deal's ultimate outcome.

H3: The Role of Unicaja Investors in the Decision-Making Process

The success of the potential Unicaja-Sabadell merger hinges heavily on the approval of Unicaja's investors. Shareholder approval is critical for the deal to proceed.

- Shareholder Approval: Unicaja investors will have a significant say in the decision-making process, with their votes influencing the ultimate outcome of the merger.

- Investor Influence: Large institutional investors and significant shareholders will likely exert considerable influence on the discussions and the final decision.

- Voting Rights: The distribution of voting rights among Unicaja shareholders will determine the weight of each investor's opinion.

- Strategic Decisions: Investor engagement and communication will be crucial in shaping the strategic direction of the potential merged entity.

3. Conclusion:

The potential merger between Unicaja and Sabadell presents a significant opportunity to reshape the Spanish banking landscape. While the potential synergies and cost savings are attractive, numerous challenges related to regulation, integration, and investor sentiment must be addressed. The discussions surrounding this potential deal are ongoing, and the role of Unicaja investors in the decision-making process is paramount. Stay tuned for further updates and analysis as this important story unfolds. We will continue to provide comprehensive coverage of the Unicaja and Sabadell potential deal and its implications for the Spanish banking sector in future articles. Keep checking back for the latest developments on this crucial merger.

Featured Posts

-

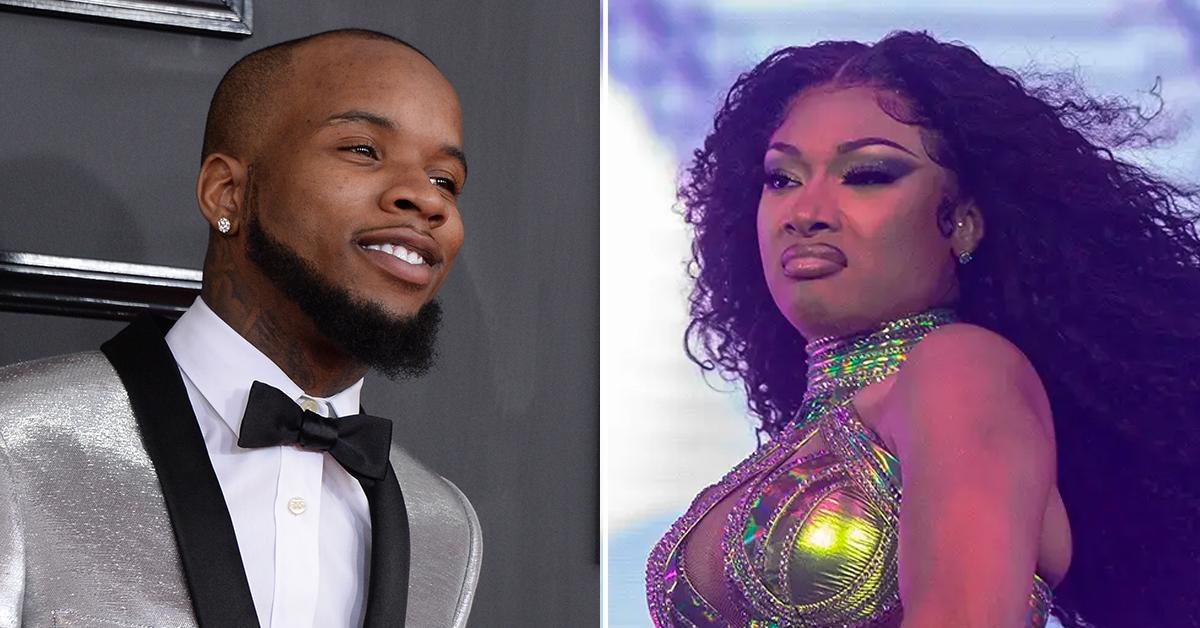

Megan Thee Stallion Seeks Sanctions Against Tory Lanez For Deposition Misconduct

May 13, 2025

Megan Thee Stallion Seeks Sanctions Against Tory Lanez For Deposition Misconduct

May 13, 2025 -

Mari Bersama Dukung Persipura Imbauan Kakanwil Papua

May 13, 2025

Mari Bersama Dukung Persipura Imbauan Kakanwil Papua

May 13, 2025 -

Remembering A Life Lost Funeral For Stabbed Teenager

May 13, 2025

Remembering A Life Lost Funeral For Stabbed Teenager

May 13, 2025 -

Big Issue Childrens Competition And The Winner Is

May 13, 2025

Big Issue Childrens Competition And The Winner Is

May 13, 2025 -

Gaza Hostages Families Endure Prolonged Nightmare

May 13, 2025

Gaza Hostages Families Endure Prolonged Nightmare

May 13, 2025