Unexpected Dragon Den Twist: Businessman's Controversial Investment Choice

Table of Contents

The Business Proposal: Analyzing the Business Plan's Strengths and Weaknesses

EcoPack Solutions presented a unique selling proposition (USP): fully biodegradable and compostable packaging made from recycled seaweed. Mark’s market analysis highlighted a significant gap in the market for environmentally friendly alternatives to traditional plastics. His business strategy focused on partnerships with large corporations and a phased rollout across key sectors. The financial projections, while ambitious, showed potential for substantial growth.

Strengths:

- Unique Technology: EcoPack’s seaweed-based packaging offers a truly innovative solution.

- Strong Market Potential: The growing demand for sustainable alternatives presents a significant opportunity.

- Scalable Business Model: The production process is designed for scalability, allowing for expansion.

Weaknesses:

- High Initial Investment: Setting up the manufacturing facilities requires considerable upfront capital.

- Unproven Market: While demand is growing, the market for seaweed-based packaging is still relatively nascent.

- Risk Assessment: The reliance on a single raw material (seaweed) introduces supply chain vulnerabilities.

The Dragons' Reactions: Differing Opinions Spark Debate

The Dragons’ responses were as diverse as their investment strategies. Deborah Meaden expressed concerns about market saturation and the challenges of scaling the business to meet potential demand. She questioned the long-term viability of the business model given the significant financial risks involved. Peter Jones, on the other hand, saw the potential for exceptional returns, emphasizing the first-mover advantage in this burgeoning market. Touker Suleyman focused on the management team’s experience, questioning Mark’s ability to navigate the complexities of rapid business growth.

- Deborah Meaden: "I see the environmental benefits, but I'm not convinced about the financial viability in the short term."

- Peter Jones: "This could be huge. The risk is high, but the potential reward is even higher."

- Touker Suleyman: "I like the idea, but I need to see more evidence of your team's experience in scaling a business of this magnitude."

The Controversial Investment Decision: Why the Unexpected Choice?

Mark Olsen ultimately accepted a smaller investment offer from Peter Jones, despite receiving a larger offer from a consortium of Dragons. His reasoning centered around Peter Jones’s extensive experience in scaling businesses and his access to a wider network of contacts. He viewed this as a more valuable long-term investment strategy than simply securing the largest sum of money. This investment decision-making process prioritized strategic partnerships over pure financial gain.

This decision carries significant implications. The lower investment might limit EcoPack’s initial growth, but the potential mentorship from Peter Jones could lead to a faster, more sustainable path to financial success. The opportunity cost – the potential profit forgone by not accepting the larger offer – is a significant risk. However, the potential rewards – increased market share and access to key networks – could outweigh the risks in the long term.

Public Reaction and Media Coverage: Analyzing the Aftermath

The public reaction has been divided. Social media has buzzed with opinions, ranging from praise for Mark's strategic choice to criticism of his apparent rejection of "easy money." News outlets have covered the event extensively, highlighting the controversy surrounding the investment decision-making process. Much of the media coverage has focused on the debate about risk versus reward and the importance of strategic partnerships in business growth. The long-term impact on both EcoPack Solutions and Mark’s reputation remains to be seen.

Conclusion: The Lasting Impact of Dragon Den's Controversial Investment

Mark Olsen’s decision to accept a smaller investment offer from Peter Jones, over a larger, more immediate sum from other Dragons, is a testament to the complexities of investment decision-making. The controversy surrounding this Dragon Den's controversial investment choice highlights the tension between short-term financial gains and long-term strategic growth. The future will tell whether this bold move proves to be a shrewd strategic choice or a costly gamble.

What are your thoughts on this unexpected Dragon Den twist? Share your opinions on this controversial investment choice in the comments below!

Featured Posts

-

Michael Sheens Million Pound Giveaway A Review By Christopher Stevens

May 01, 2025

Michael Sheens Million Pound Giveaway A Review By Christopher Stevens

May 01, 2025 -

Watch Eurovision 2025 Live From Australia Your Complete Guide

May 01, 2025

Watch Eurovision 2025 Live From Australia Your Complete Guide

May 01, 2025 -

Becciu Chat Segrete E Accuse Al Vaticano Il Cardinale Parla Di Complotto

May 01, 2025

Becciu Chat Segrete E Accuse Al Vaticano Il Cardinale Parla Di Complotto

May 01, 2025 -

New York Yankees Top Cleveland Guardians In Final Game

May 01, 2025

New York Yankees Top Cleveland Guardians In Final Game

May 01, 2025 -

Is Norwegian Cruise Line Nclh Stock A Smart Buy Hedge Fund Analysis

May 01, 2025

Is Norwegian Cruise Line Nclh Stock A Smart Buy Hedge Fund Analysis

May 01, 2025

Latest Posts

-

Play Station Plus Extra And Premium Full List Of New Games

May 02, 2025

Play Station Plus Extra And Premium Full List Of New Games

May 02, 2025 -

New Play Station Plus Extra And Premium Games Whats New This Month

May 02, 2025

New Play Station Plus Extra And Premium Games Whats New This Month

May 02, 2025 -

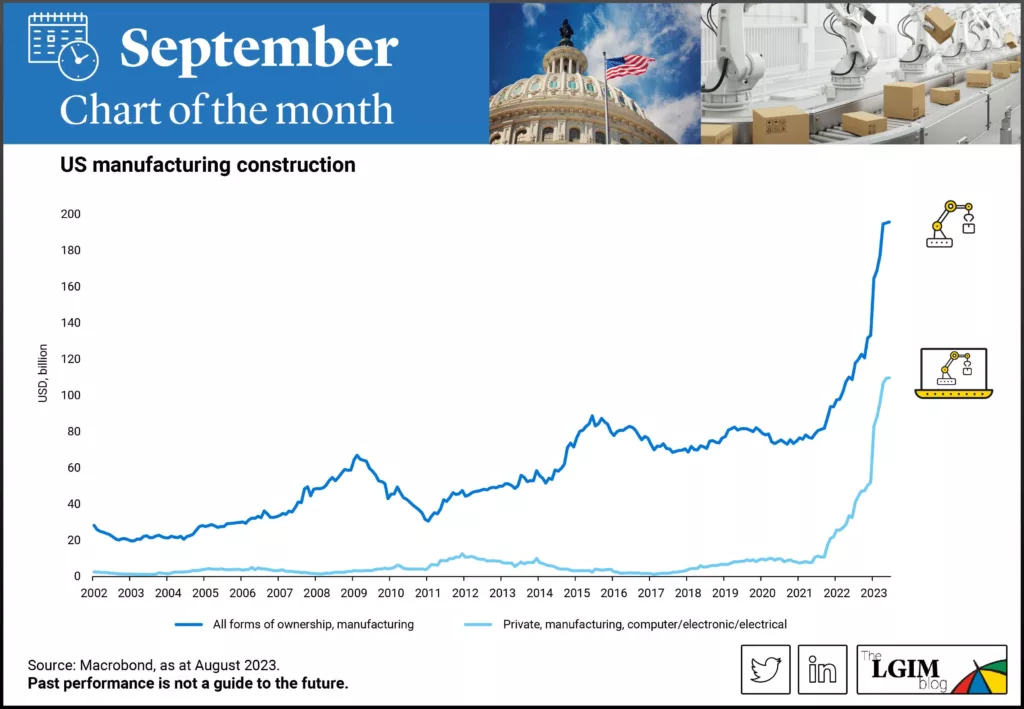

Tariffs Influence Brookfields Decision On Us Manufacturing Investment

May 02, 2025

Tariffs Influence Brookfields Decision On Us Manufacturing Investment

May 02, 2025 -

Brookfields Us Manufacturing Investment Weighing The Impact Of Tariffs

May 02, 2025

Brookfields Us Manufacturing Investment Weighing The Impact Of Tariffs

May 02, 2025 -

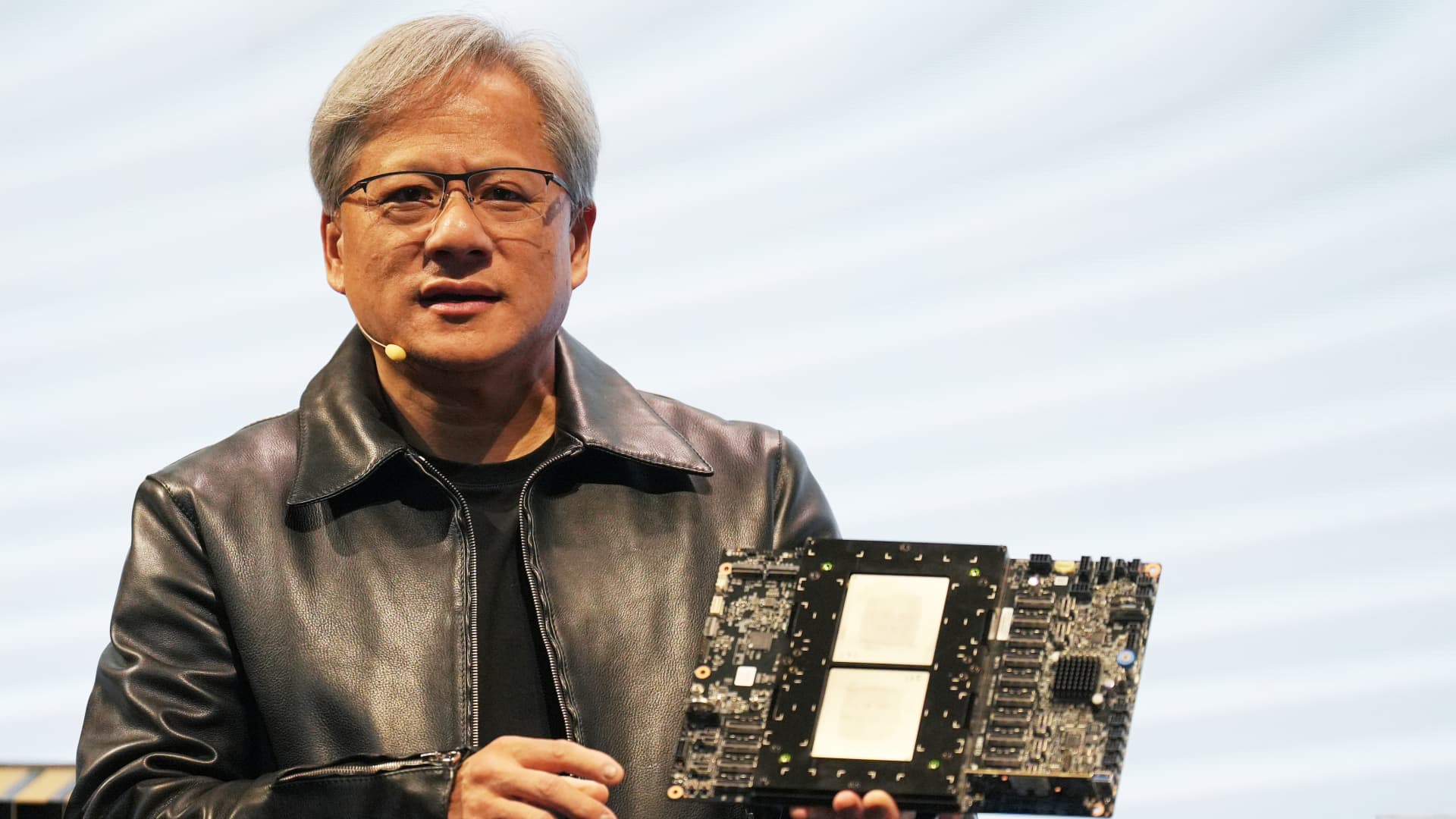

Nvidia Ceo Seeks Trump Administration Intervention On Ai Chip Export Controls

May 02, 2025

Nvidia Ceo Seeks Trump Administration Intervention On Ai Chip Export Controls

May 02, 2025