Understanding XRP (Ripple): Is It A Wise Investment For Financial Security?

Table of Contents

What is XRP (Ripple) and How Does it Work?

H3: Understanding the Ripple Network:

The Ripple network is a real-time gross settlement system (RTGS), currency exchange, and remittance network all rolled into one. Unlike many cryptocurrencies that operate on their own blockchain, Ripple uses a unique distributed ledger technology. This allows for faster and cheaper transactions compared to traditional banking systems, significantly reducing processing times and associated fees. The network facilitates seamless transfers of various currencies, including fiat currencies like USD and EUR, and other cryptocurrencies.

H3: XRP's Role in the Ripple Ecosystem:

XRP acts as a bridge currency within the Ripple network. When exchanging one currency for another (e.g., USD to EUR), XRP often serves as an intermediary, enabling faster and more efficient conversions. This reduces the need for multiple transactions and lowers overall costs.

- Ripple (the company) vs. XRP (the cryptocurrency): It's crucial to understand the distinction. Ripple Labs is the company behind the Ripple network, while XRP is the native cryptocurrency that fuels the network's transactions.

- Distributed Ledger Technology (DLT): The Ripple network utilizes a unique form of DLT, offering speed and scalability advantages over some other blockchain technologies.

- Speed and Low Transaction Fees: XRP transactions are known for their speed and relatively low fees, making it an attractive option for high-volume transactions.

Advantages of Investing in XRP for Financial Security:

H3: Potential for High Returns:

The cryptocurrency market is inherently volatile, meaning XRP's price can fluctuate significantly. This volatility presents the potential for high returns, but it’s crucial to remember that past performance is not indicative of future results. Thorough research and a well-defined risk management strategy are paramount.

H3: Diversification Benefits:

Adding XRP to a diversified investment portfolio can potentially reduce overall risk. By diversifying across different asset classes, including cryptocurrencies, you can mitigate losses if one asset performs poorly. XRP, with its distinct characteristics and use case, can serve as a valuable component of a broader portfolio strategy.

H3: Cross-Border Payment Efficiency:

XRP's potential to streamline international money transfers is a significant advantage. Faster and cheaper cross-border payments can benefit businesses and individuals alike, opening up new opportunities for global commerce and financial inclusion.

- Growing Institutional Adoption: Several financial institutions are exploring and adopting XRP for cross-border payments, signifying potential for increased demand and price appreciation.

- Future Applications and Partnerships: The Ripple network is continuously evolving, with potential for new applications and partnerships that could further boost XRP's value.

- Hedging Against Inflation: Some investors consider cryptocurrencies, including XRP, as a potential hedge against inflation, but this is a complex and debated topic that requires careful research.

Risks Associated with Investing in XRP:

H3: Volatility and Market Fluctuations:

The cryptocurrency market is highly volatile, and XRP is no exception. Its price can experience sharp increases and decreases, making it a high-risk investment. Investors should be prepared for significant price swings and potential losses.

H3: Regulatory Uncertainty:

The regulatory landscape surrounding cryptocurrencies is constantly evolving and varies across jurisdictions. This uncertainty poses a risk to XRP and the broader cryptocurrency market. Ongoing legal battles involving Ripple Labs (the company) also affect XRP's price and investor confidence.

H3: Competition in the Cryptocurrency Market:

The cryptocurrency market is highly competitive, with numerous other digital assets vying for attention and investment. XRP faces competition from other cryptocurrencies with similar or overlapping functionalities.

- Risk of Capital Loss: It's crucial to understand that you could lose all your invested capital when investing in XRP or any cryptocurrency.

- Thorough Research is Essential: Before investing in XRP, conduct extensive research to understand the technology, the market, and the associated risks.

- Diversification Minimizes Risk: Diversification across multiple asset classes is crucial for minimizing overall portfolio risk.

How to Invest in XRP Safely:

H3: Choosing a Reputable Exchange:

Selecting a secure and regulated cryptocurrency exchange is crucial for buying and storing XRP. Research different exchanges carefully and consider factors such as security measures, fees, and user reviews.

H3: Secure Wallet Storage:

Storing your XRP securely is paramount to protect against theft or loss. Consider using hardware wallets, which offer a higher level of security compared to software wallets. Always practice good security hygiene, such as using strong passwords and enabling two-factor authentication.

H3: Risk Management Strategies:

Responsible investing is crucial. Only invest what you can afford to lose and diversify your portfolio to minimize risk. Setting stop-loss orders can help limit potential losses if the price drops significantly.

- Reputable Exchanges: Research and compare various exchanges before choosing one. (Note: This article does not endorse any specific exchange.)

- Password Security: Use strong, unique passwords and enable two-factor authentication whenever possible.

- Stop-Loss Orders: Use stop-loss orders to automatically sell your XRP if the price falls below a predetermined level.

Conclusion:

Investing in XRP for financial security presents both opportunities and substantial risks. The potential for high returns is balanced by the market's volatility and regulatory uncertainty. Understanding XRP's role in the Ripple network and its unique characteristics is essential, but this should be coupled with extensive research and a well-defined risk management strategy. Consider XRP as part of your diversified portfolio only after careful consideration. While XRP offers exciting possibilities, thorough research and a well-defined investment strategy are crucial for navigating the complexities of the cryptocurrency market. Understand XRP's potential and risks before making any investment decisions. Consider XRP as part of your diversified portfolio only after careful consideration.

Featured Posts

-

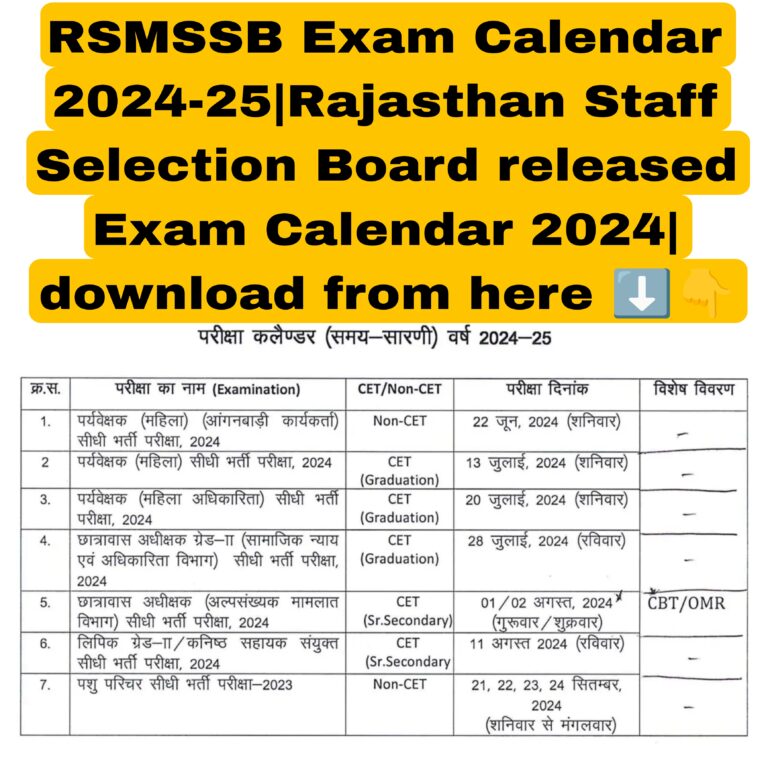

Rsmssb 2025 26 Exam Calendar Important Dates And Notifications

May 07, 2025

Rsmssb 2025 26 Exam Calendar Important Dates And Notifications

May 07, 2025 -

Sacramento River Cats Fall To Aviators In Series Loss

May 07, 2025

Sacramento River Cats Fall To Aviators In Series Loss

May 07, 2025 -

Epic April Fools Pranks That Will Make You Laugh

May 07, 2025

Epic April Fools Pranks That Will Make You Laugh

May 07, 2025 -

Randles Performance A Response To Critics

May 07, 2025

Randles Performance A Response To Critics

May 07, 2025 -

Lotto Lotto Plus 1 Lotto Plus 2 Latest Draw Results And Numbers

May 07, 2025

Lotto Lotto Plus 1 Lotto Plus 2 Latest Draw Results And Numbers

May 07, 2025

Latest Posts

-

Krypto The Superdog A Deeper Look At His Role In The New Superman Film

May 08, 2025

Krypto The Superdog A Deeper Look At His Role In The New Superman Film

May 08, 2025 -

Superman Footage Kryptos Not The Only Highlight A Deeper Look At A Key Scene

May 08, 2025

Superman Footage Kryptos Not The Only Highlight A Deeper Look At A Key Scene

May 08, 2025 -

New Superman Footage Reveals Expanded Role For Krypto The Superdog

May 08, 2025

New Superman Footage Reveals Expanded Role For Krypto The Superdog

May 08, 2025 -

A Whistle For Krypto Supermans Summer Special Next Week

May 08, 2025

A Whistle For Krypto Supermans Summer Special Next Week

May 08, 2025 -

Dc Comics July 2025 Superman Battles Darkseids Powerful Legion

May 08, 2025

Dc Comics July 2025 Superman Battles Darkseids Powerful Legion

May 08, 2025