Understanding The SEC's Stance On XRP: Implications For Investors

Table of Contents

The ongoing legal battle between the Securities and Exchange Commission (SEC) and Ripple Labs over the classification of XRP has created significant uncertainty for investors. This article delves into the SEC's position on XRP, analyzing its implications for current and prospective investors in the cryptocurrency market. We’ll explore the key arguments, potential outcomes, and the overall impact on the future of XRP and the broader crypto landscape.

The SEC's Case Against Ripple and XRP

The SEC's Argument

The SEC claims XRP is an unregistered security, arguing that Ripple sold XRP to raise capital, and investors anticipated profits based on Ripple's efforts. This argument hinges on the application of the Howey Test, a crucial element of US securities law.

- The Howey Test: This test determines whether an investment contract qualifies as a security. It considers whether there's an investment of money in a common enterprise with a reasonable expectation of profits derived primarily from the efforts of others. The SEC argues that XRP satisfies all these criteria.

- The SEC's Definition of a Security: The SEC's definition of a security is broad, encompassing a wide range of investment vehicles. They contend that XRP’s sale and distribution fit within this definition, particularly due to the perceived reliance on Ripple’s efforts to increase XRP's value.

- Details of the Alleged Unregistered Sales: The SEC alleges that Ripple engaged in unregistered sales of XRP, violating federal securities laws. They point to specific sales and marketing activities as evidence of this violation.

Ripple's Defense

Ripple counters that XRP is a decentralized digital asset and not a security. Their defense rests on several key arguments.

- Decentralized Nature and Operational Independence: Ripple argues that XRP operates independently of Ripple Labs, emphasizing its decentralized nature and use on various exchanges and payment networks. They highlight the community's involvement in its development and governance.

- Utility of XRP in its Payment Network: Ripple stresses the utility of XRP within its payment network, arguing its primary function is as a transactional currency, not an investment contract. They point to its speed and low transaction costs.

- Different Uses of XRP: Ripple differentiates between XRP used for payments within its network and XRP traded on exchanges as a speculative asset. They argue the latter doesn’t automatically classify XRP as a security.

Potential Outcomes and Their Impact on Investors

SEC Victory

If the SEC wins, XRP could be deemed a security, potentially leading to:

- Delisting from Major Exchanges: Exchanges might delist XRP to avoid legal ramifications, reducing accessibility and liquidity.

- Significant Price Drops: A security classification could trigger a significant drop in XRP's price as investors react to the regulatory uncertainty.

- Legal Repercussions for XRP Holders: While still debated, there's potential for legal action against investors who purchased XRP during the period of alleged unregistered sales.

Ripple Victory

A win for Ripple could mean:

- Price Increases and Increased Investor Confidence: A court decision validating XRP as a non-security could significantly boost investor confidence, leading to price appreciation.

- Potential for Increased Adoption of XRP: Clear legal precedent could pave the way for wider adoption of XRP as a payment currency and within decentralized finance (DeFi) applications.

- Greater Clarity Regarding the Regulatory Landscape for Cryptocurrencies: A Ripple win could provide more clarity on how other cryptocurrencies will be regulated, reducing uncertainty in the crypto market.

Settlement

A settlement between the SEC and Ripple could lead to various outcomes, including:

- Limited Restrictions on XRP Trading: A settlement might involve some restrictions on XRP's trading or distribution, but not a complete ban.

- Financial Penalties for Ripple: Ripple might be subject to financial penalties for past actions.

- Increased Regulatory Compliance for Ripple’s Future Activities: The settlement might include provisions requiring Ripple to enhance its regulatory compliance moving forward.

Navigating the Uncertainty: Advice for XRP Investors

Risk Assessment

Investing in XRP, particularly during this legal uncertainty, carries significant risk.

- Diversification Strategies for Crypto Portfolios: Don't put all your eggs in one basket. Diversify your crypto holdings to mitigate potential losses.

- Importance of Due Diligence and Independent Research: Thoroughly research any cryptocurrency before investing and understand the risks involved.

- Awareness of Potential Financial Losses: Be prepared for the possibility of significant financial losses. The XRP price could experience substantial volatility depending on the outcome of the SEC case.

Staying Informed

Keeping abreast of the legal proceedings is crucial for making informed investment decisions.

- Monitoring Reputable News Sources for Updates: Follow reputable news outlets and legal analysis to stay updated on case developments.

- Understanding Legal Terminology Related to Securities Law: Familiarize yourself with the legal terminology surrounding the case, including concepts like the Howey Test and unregistered securities.

- Following Expert Analysis and Commentary: Seek out expert opinions and analysis from legal professionals and cryptocurrency analysts.

Conclusion

The SEC's stance on XRP carries significant weight for investors, impacting the market value and future prospects of the cryptocurrency. The outcome of the ongoing legal battle remains uncertain, highlighting the need for careful risk assessment and informed decision-making. Whether you're already invested in XRP or considering it, staying informed about the SEC's actions and their implications is crucial. Understanding the SEC's stance on XRP is essential for navigating the complexities of this evolving legal landscape and making informed investment decisions. Continuously monitor the developments in the SEC vs. Ripple case to effectively manage your XRP investments.

Featured Posts

-

How Flooding Impacts Livestock And Farm Operations

May 07, 2025

How Flooding Impacts Livestock And Farm Operations

May 07, 2025 -

Analyzing Chris Finchs Impact On The Minnesota Timberwolves Trajectory

May 07, 2025

Analyzing Chris Finchs Impact On The Minnesota Timberwolves Trajectory

May 07, 2025 -

Check The Rsmssb Exam Calendar 2025 26 Complete Exam Schedule

May 07, 2025

Check The Rsmssb Exam Calendar 2025 26 Complete Exam Schedule

May 07, 2025 -

Hydrogen Or Battery Electric Buses Which Is Best For Europe

May 07, 2025

Hydrogen Or Battery Electric Buses Which Is Best For Europe

May 07, 2025 -

Understanding The Cobra Kai Karate Kid Relationship On Netflix

May 07, 2025

Understanding The Cobra Kai Karate Kid Relationship On Netflix

May 07, 2025

Latest Posts

-

The Lasting Legacy Of Counting Crows Saturday Night Live Performance

May 08, 2025

The Lasting Legacy Of Counting Crows Saturday Night Live Performance

May 08, 2025 -

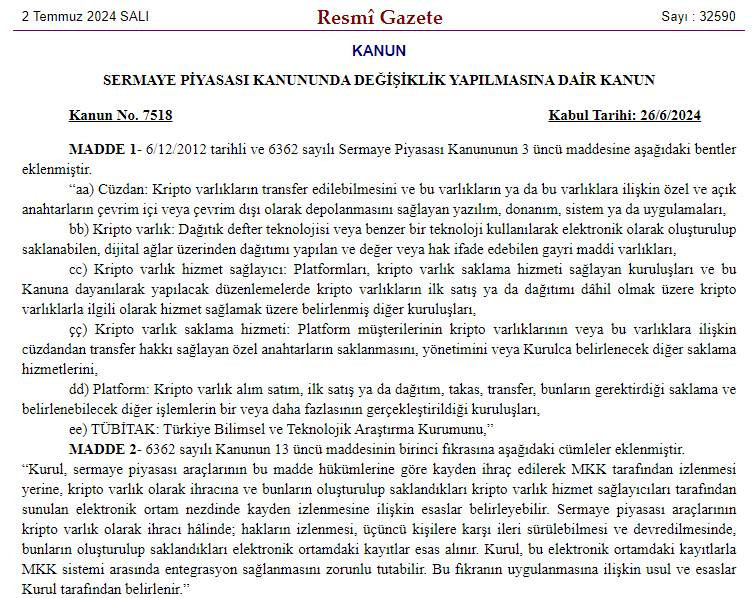

Sifrenizi Unuttunuz Mu Kripto Varliklarinizi Nasil Koruyabilirsiniz

May 08, 2025

Sifrenizi Unuttunuz Mu Kripto Varliklarinizi Nasil Koruyabilirsiniz

May 08, 2025 -

Son Dakika Bakan Simsek In Kripto Para Sektoeruene Yoenelik Uyarisi

May 08, 2025

Son Dakika Bakan Simsek In Kripto Para Sektoeruene Yoenelik Uyarisi

May 08, 2025 -

Kripto Varlik Mirasi Sifre Kaybi Ve Coezuem Yollari

May 08, 2025

Kripto Varlik Mirasi Sifre Kaybi Ve Coezuem Yollari

May 08, 2025 -

Ekonomi Haberleri Bakan Simsek Kripto Piyasasini Uyardi

May 08, 2025

Ekonomi Haberleri Bakan Simsek Kripto Piyasasini Uyardi

May 08, 2025