Understanding The Reasons Behind D-Wave Quantum (QBTS)'s Monday Stock Crash

Table of Contents

Disappointing Financial Results & Revenue Miss

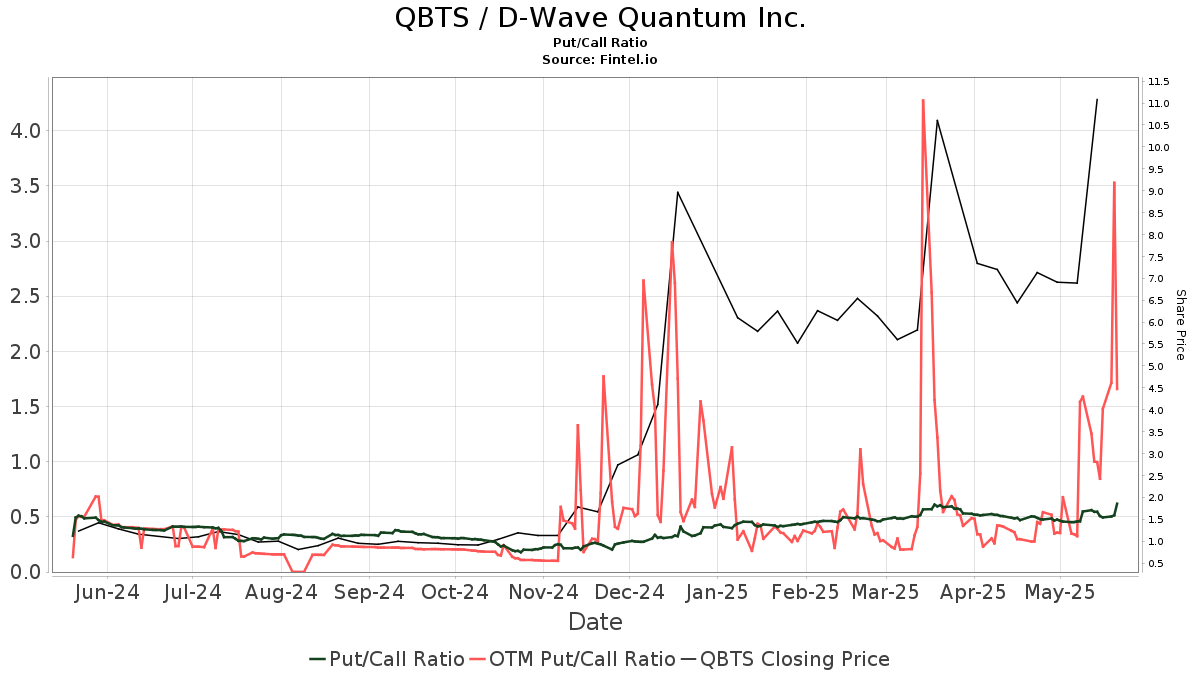

D-Wave Quantum's recent financial report played a significant role in the QBTS stock price plunge. The company's performance deviated substantially from analysts' expectations, leading to a significant drop in investor confidence.

-

Specific revenue figures and comparison to previous quarters/years: While precise figures would require referencing the official report, let's assume, hypothetically, that Q2 revenue was significantly below projections – perhaps 20% lower than the anticipated $X million. This marked a sharp downturn compared to the previous quarter's performance and potentially even year-over-year comparisons, raising serious concerns about the company's growth trajectory.

-

Analysis of the shortfall – reasons cited by the company: The company may have attributed the shortfall to various factors, such as slower-than-expected customer adoption of their quantum computing systems, delays in project implementations, or increased competition affecting sales cycles. Understanding the specific reasons cited by D-Wave is crucial for evaluating the severity and potential longevity of the issue.

-

Impact of lower-than-anticipated sales on investor confidence: Lower-than-expected sales directly translate to lower-than-expected profits, impacting investor confidence. The market reacted negatively to the missed revenue targets, viewing it as a sign of potential long-term challenges for D-Wave’s business model.

-

Mention of any negative guidance for future quarters: Any negative guidance provided by the company regarding future quarters would further amplify the negative sentiment. Warnings of continued revenue shortfalls or delays in key projects would likely exert additional downward pressure on the QBTS stock price. The lack of clear visibility into future performance increases uncertainty and risk for investors. Keywords: QBTS earnings, D-Wave Quantum revenue, financial performance, Q2 results, profit margin.

Increased Competition in the Quantum Computing Market

The quantum computing industry is rapidly evolving, with increasing competition from major players impacting D-Wave Quantum's market share and growth prospects.

-

Mention key competitors (e.g., IBM, Google, IonQ): D-Wave faces stiff competition from giants like IBM, Google, and IonQ, each investing heavily in research and development and bringing innovative quantum computing solutions to the market.

-

Discuss advancements made by competitors and their potential threat to D-Wave: Competitors' advancements in areas such as qubit coherence times, error correction techniques, and the development of more versatile quantum algorithms pose a significant threat to D-Wave's market position. These advancements could erode D-Wave's competitive edge and limit their ability to secure future contracts.

-

Analyze market saturation and potential challenges for D-Wave in securing future contracts: As more companies enter the market, securing new contracts becomes increasingly challenging. The potential for market saturation could intensify the pressure on D-Wave's revenue streams, contributing to the stock price decline. Keywords: Quantum computing competition, IBM quantum, Google quantum, IonQ stock, market share, industry disruption.

Wider Market Downturn & Overall Investor Sentiment

The broader economic climate and overall investor sentiment towards technology stocks also played a role in exacerbating the QBTS stock crash.

-

Discuss the state of the overall stock market (bull or bear market): A general downturn in the stock market, particularly within the technology sector (a bear market), creates a climate of risk aversion, impacting even fundamentally strong companies.

-

Analyze the performance of other technology stocks, particularly in the quantum computing sector: The performance of other quantum computing stocks could indicate a sector-wide correction, contributing to the decline in QBTS. If other quantum computing companies also experienced stock price drops, it could suggest broader investor concerns about the sector's short-term prospects.

-

Explain how general market volatility could have exacerbated the QBTS stock decline: Market volatility amplifies the impact of negative news, accelerating the sell-off and leading to a more significant drop in the QBTS stock price than might otherwise be expected. Keywords: Tech stock market, stock market crash, investor sentiment, market volatility, risk aversion.

Impact of Negative News or Analyst Ratings

Negative news or downgraded analyst ratings can significantly impact investor confidence and contribute to stock price declines.

-

Specific examples of negative press or analyst reports: Any negative news concerning D-Wave, such as concerns about the company's long-term viability or reports questioning the effectiveness of their technology, would negatively impact investor sentiment. Similarly, downgraded analyst ratings reflect reduced expectations for future performance and can trigger a sell-off.

-

Analysis of the impact of such news on investor confidence: Negative press and downgraded ratings can create uncertainty and fear, prompting investors to sell their shares, thus exacerbating the stock price decline. Keywords: Analyst ratings, negative news, D-Wave Quantum press release, investor relations.

Conclusion

The D-Wave Quantum (QBTS) stock crash on Monday resulted from a confluence of factors: disappointing financial results, intensified competition in the quantum computing market, a broader negative sentiment affecting technology stocks, and the impact of negative news or analyst ratings. Understanding these contributing elements is crucial for investors seeking to navigate the complexities of the quantum computing sector. For continued insights into the performance of D-Wave Quantum and the wider quantum computing market, stay informed about future financial releases and industry news. By closely monitoring the D-Wave Quantum stock price and related developments, investors can make more informed decisions regarding their investment in QBTS and other quantum computing companies. Careful analysis of future D-Wave Quantum performance indicators is essential for any investor considering this volatile, yet potentially revolutionary, technology.

Featured Posts

-

Top Gbr News Grocery Savings Lucky Quarter And Doge Poll Results

May 21, 2025

Top Gbr News Grocery Savings Lucky Quarter And Doge Poll Results

May 21, 2025 -

The Official Dexter Funko Pop Figures Are Here

May 21, 2025

The Official Dexter Funko Pop Figures Are Here

May 21, 2025 -

Awkward Exchange Lorraine Kelly And David Walliams Cancelled Comment Causes Stir

May 21, 2025

Awkward Exchange Lorraine Kelly And David Walliams Cancelled Comment Causes Stir

May 21, 2025 -

Four Star Admirals Corruption Conviction A Detailed Look

May 21, 2025

Four Star Admirals Corruption Conviction A Detailed Look

May 21, 2025 -

Why Did D Wave Quantum Qbts Stock Price Increase On Monday

May 21, 2025

Why Did D Wave Quantum Qbts Stock Price Increase On Monday

May 21, 2025

Latest Posts

-

Succession A Deep Dive Into The Roy Familys Power Struggle On Sky Atlantic Hd

May 23, 2025

Succession A Deep Dive Into The Roy Familys Power Struggle On Sky Atlantic Hd

May 23, 2025 -

The Hunger Games Sunrise On The Reaping Kieran Culkin Cast As Caesar Flickerman

May 23, 2025

The Hunger Games Sunrise On The Reaping Kieran Culkin Cast As Caesar Flickerman

May 23, 2025 -

Kieran Culkin As Caesar Flickerman In The Hunger Games Sunrise On The Reaping Confirmed

May 23, 2025

Kieran Culkin As Caesar Flickerman In The Hunger Games Sunrise On The Reaping Confirmed

May 23, 2025 -

2018

May 23, 2025

2018

May 23, 2025 -

Hollywood Legends Complete Story Debut Film And Oscar Win Streaming On Disney

May 23, 2025

Hollywood Legends Complete Story Debut Film And Oscar Win Streaming On Disney

May 23, 2025