Understanding The Net Asset Value (NAV) Of The Amundi MSCI All Country World UCITS ETF USD (Acc)

Table of Contents

Understanding the Calculation of Amundi MSCI All Country World UCITS ETF USD (Acc) NAV

The Amundi MSCI All Country World UCITS ETF USD (Acc) NAV, like any ETF NAV, represents the net asset value per share. It's calculated daily by taking the total market value of all the underlying assets held by the ETF, subtracting liabilities (like management fees and expenses), and then dividing the result by the total number of outstanding shares.

- Asset Valuation: The ETF holds a diversified portfolio of global equities. Each holding is valued at its closing market price.

- Liabilities: This includes management fees, operational expenses, and any other outstanding obligations.

- Outstanding Shares: The total number of ETF shares currently in circulation.

Illustrative Example:

Let's say the ETF holds $100 million in assets, has liabilities of $1 million, and 10 million shares outstanding. The Amundi MSCI All Country World UCITS ETF NAV calculation would be: ($100 million - $1 million) / 10 million shares = $9.90 per share. This is a simplified example; the actual calculation is significantly more complex, involving numerous holdings and currency conversions.

The Amundi MSCI All Country World UCITS ETF NAV calculation, along with the daily NAV, is typically published at the close of the market each day. Understanding this process clarifies how the UCITS ETF valuation is determined.

Factors Affecting the Amundi MSCI All Country World UCITS ETF USD (Acc) NAV

Several factors influence the fluctuations in the Amundi MSCI All Country World UCITS ETF USD (Acc) NAV:

- Market Fluctuations: Changes in the prices of the underlying stocks directly impact the ETF's NAV. A bull market generally leads to NAV appreciation, while a bear market results in a decline. This is a primary driver of NAV volatility.

- Currency Exchange Rates: Since the ETF is denominated in USD (Acc), fluctuations in exchange rates between the USD and the currencies of the underlying assets affect the overall NAV. A strengthening USD can decrease the NAV, while a weakening USD can increase it. This highlights the importance of considering currency risk when investing in global equity ETFs.

- Dividends and Distributions: Dividend payments from the underlying companies are typically reinvested, which may slightly increase the NAV. However, the actual impact depends on the dividend yield and the number of shares. This aspect of dividend reinvestment can slightly offset NAV volatility.

- Expenses: The ETF's expense ratio (management fees and other operational costs) gradually reduces the NAV over time. This impact, however, is usually relatively small compared to market fluctuations. The ETF expense ratio information is clearly outlined in the prospectus. The impact of the MSCI All Country World Index on the NAV is significant as the ETF tracks this benchmark index closely.

Accessing the Amundi MSCI All Country World UCITS ETF USD (Acc) NAV

Finding the current Amundi MSCI All Country World UCITS ETF NAV is straightforward:

- Official Sources: Amundi's official website is the primary source for accurate and up-to-date NAV data. Many financial news websites also publish this information.

- Brokerage Platforms: Most brokerage accounts display the current and historical NAV of your ETF holdings. You can easily find ETF NAV data through your brokerage account's online platform.

- Data Providers: Reputable financial data providers like Bloomberg, Refinitiv, and Yahoo Finance offer real-time and historical NAV data for various ETFs, including the Amundi MSCI All Country World UCITS ETF USD (Acc). You can find historical NAV and UCITS ETF price data through these providers.

Using NAV to Make Informed Investment Decisions

The Amundi MSCI All Country World ETF trading strategy often involves monitoring the relationship between the NAV and the ETF's market share price:

- NAV and Share Price: While the share price usually closely tracks the NAV, temporary discrepancies can occur. Understanding this relationship is vital for strategic trading.

- Premium/Discount: Sometimes the ETF's market price trades at a premium or discount to its NAV. A premium indicates investors are willing to pay more than the net asset value per share, while a discount signifies the opposite.

- Investment Strategies: Investors can use NAV data to implement strategies like dollar-cost averaging, buying low and selling high (when a discount or premium exists), and monitoring long-term performance.

Conclusion: Mastering the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD (Acc)

Understanding the Amundi MSCI All Country World UCITS ETF USD (Acc) NAV is essential for informed investment decisions. This article has explained the calculation, the factors influencing it, how to access the data, and how to use this information strategically. Regularly tracking your Amundi MSCI All Country World UCITS ETF USD (Acc) NAV allows you to monitor performance and make adjustments to your portfolio as needed. Remember to consult the ETF's prospectus for further details and always make informed decisions based on your risk tolerance and investment objectives. Start tracking your Amundi MSCI All Country World UCITS ETF USD (Acc) NAV today and make informed investment decisions!

Featured Posts

-

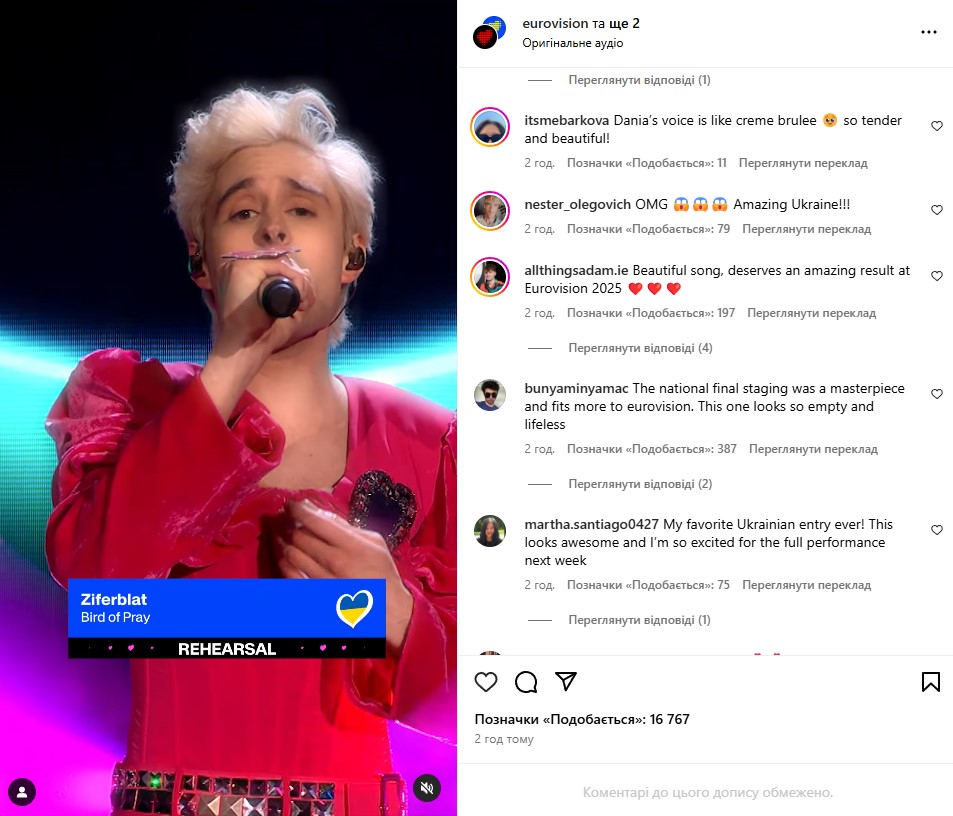

Yevrobachennya 2025 Chotiri Potentsiyni Peremozhtsi Za Versiyeyu Konchiti Vurst

May 24, 2025

Yevrobachennya 2025 Chotiri Potentsiyni Peremozhtsi Za Versiyeyu Konchiti Vurst

May 24, 2025 -

New York Times Connections Game Answers And Hints For Puzzle 646 March 18 2025

May 24, 2025

New York Times Connections Game Answers And Hints For Puzzle 646 March 18 2025

May 24, 2025 -

New Music From Joy Crookes The Carmen Single

May 24, 2025

New Music From Joy Crookes The Carmen Single

May 24, 2025 -

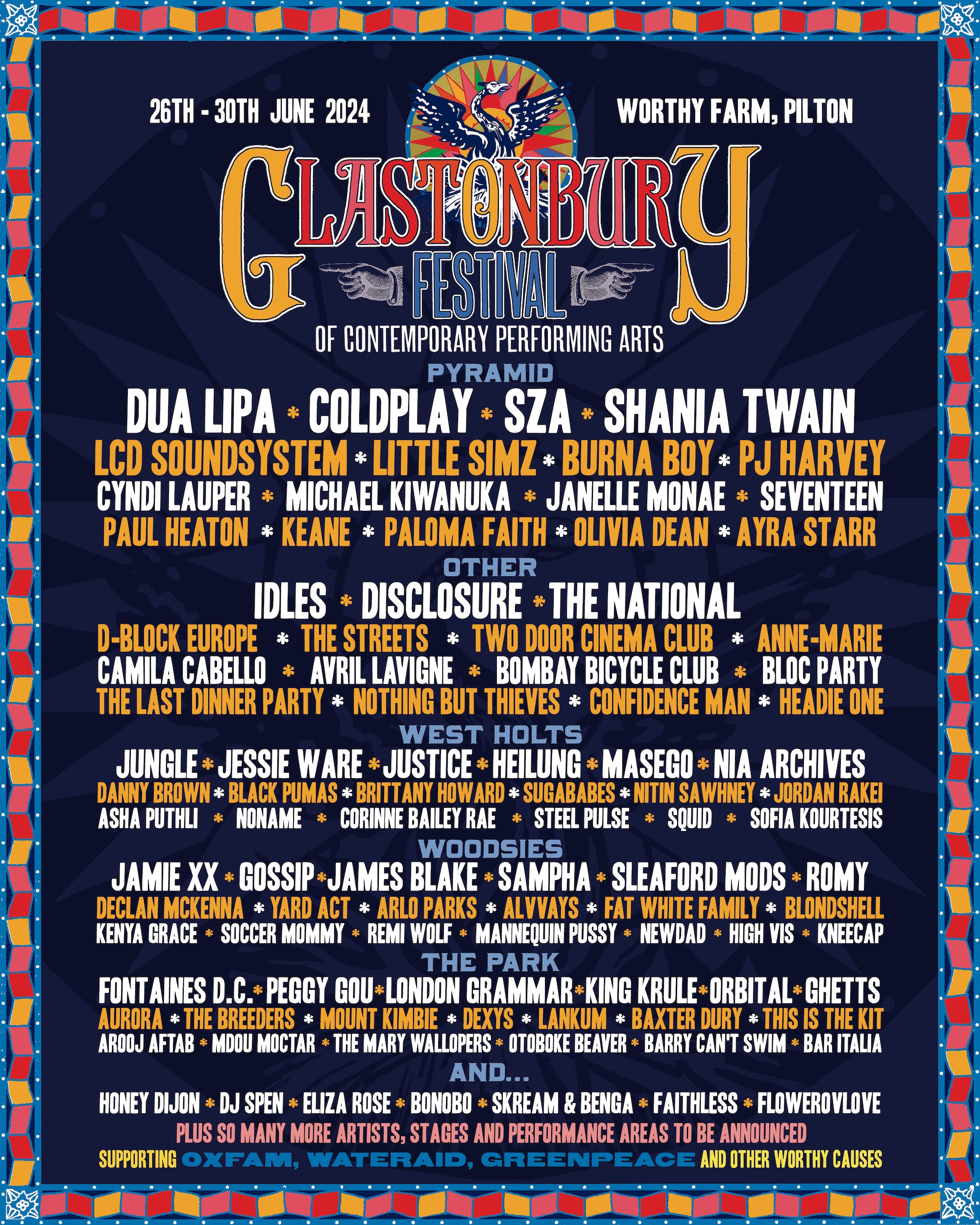

Is This Us Band Playing Glastonbury Social Media Ignites Debate

May 24, 2025

Is This Us Band Playing Glastonbury Social Media Ignites Debate

May 24, 2025 -

Official Glastonbury 2025 Lineup Where To Get Tickets Following Leak

May 24, 2025

Official Glastonbury 2025 Lineup Where To Get Tickets Following Leak

May 24, 2025

Latest Posts

-

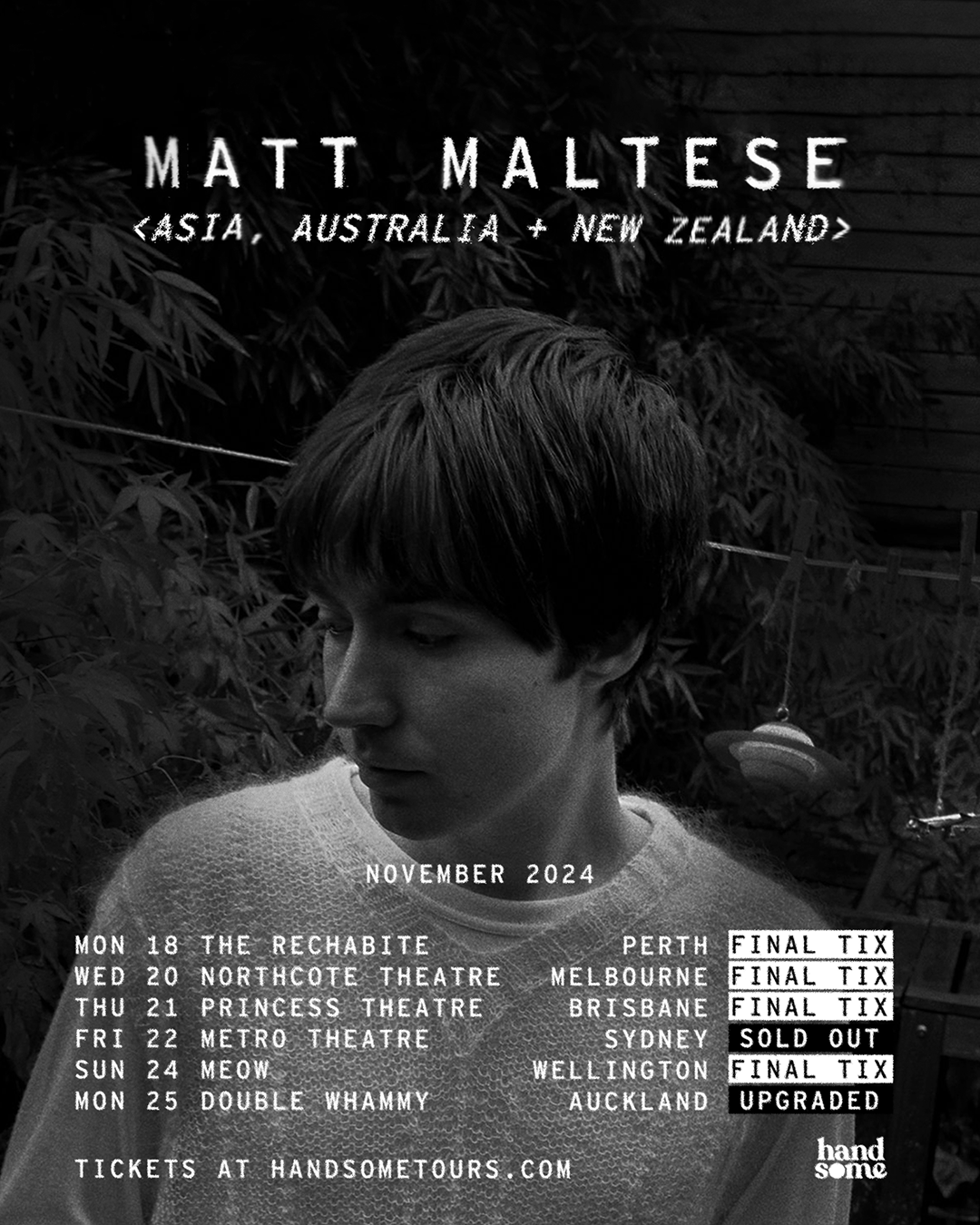

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025 -

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025 -

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025 -

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025 -

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025