Understanding The House Republicans' Trump Tax Cut Plan

Table of Contents

Key Provisions of the House Republicans' Trump Tax Cut Plan

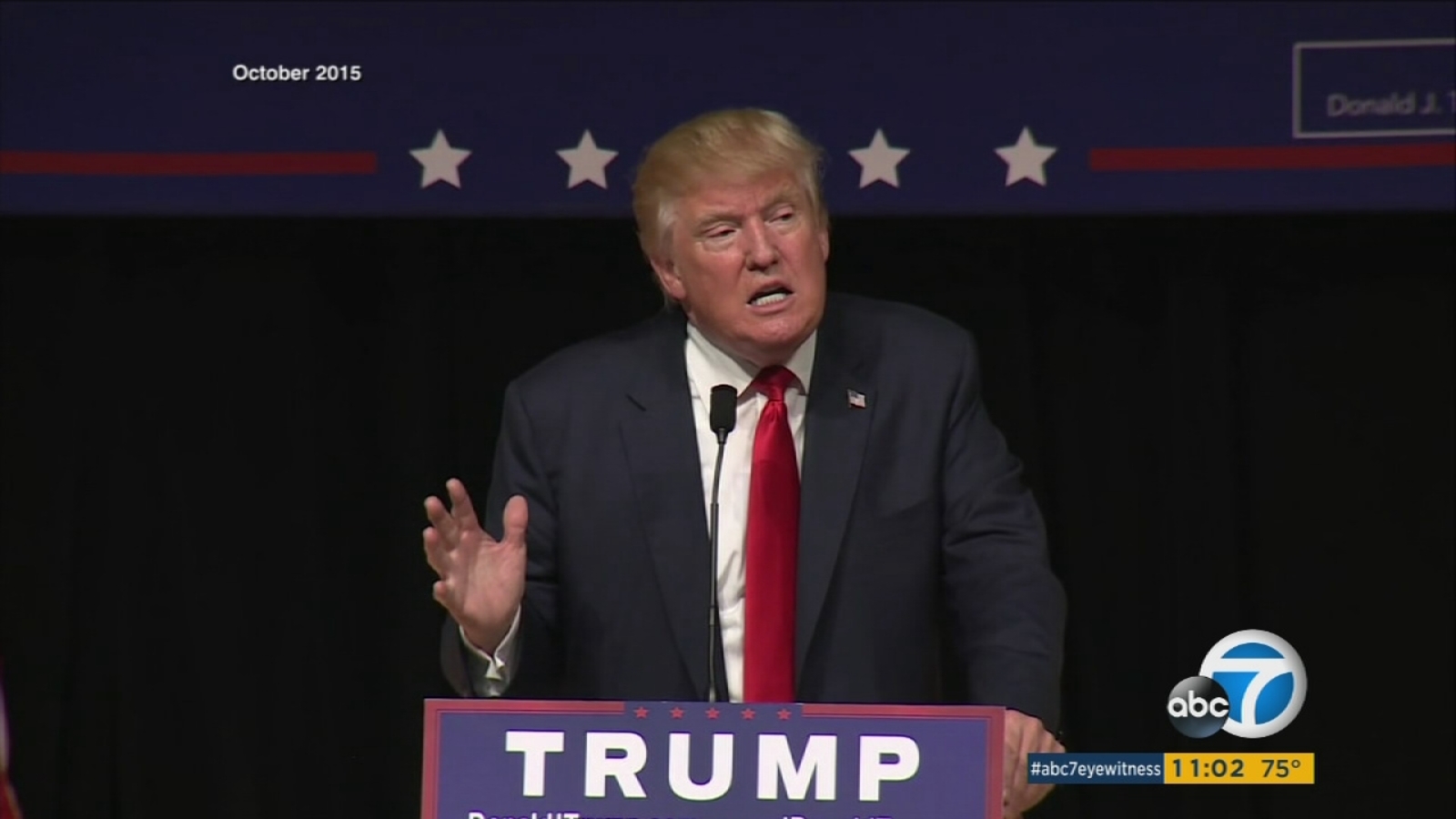

The overarching goals of the House Republicans' Trump tax cut plan, often referred to as the GOP tax plan, were to stimulate economic growth and job creation through significant tax reductions. The plan aimed to achieve this by implementing substantial changes to both individual and corporate tax rates, as well as modifying or eliminating certain tax deductions and credits.

Individual Income Tax Changes

The proposed plan included several key changes to the individual income tax system:

- Tax Bracket Reductions: The plan proposed reducing the number of individual income tax brackets and lowering the rates within those brackets. While the exact numbers varied depending on the specific iteration of the plan, the general aim was to significantly reduce tax burdens for many individuals.

- Increased Standard Deduction: The standard deduction was significantly increased, potentially benefiting lower- and middle-income taxpayers who previously itemized their deductions.

- Child Tax Credit Expansion: The Child Tax Credit was either increased or expanded to benefit a wider range of families.

- Impact on Income Groups: While proponents argued the plan benefited all income groups, critics pointed out that high-income earners would receive a disproportionately larger tax cut. Studies offered varying projections on the exact impact across different income levels, highlighting the complexity of predicting the real-world effects.

The potential benefits for individual taxpayers included lower tax bills and increased disposable income. However, drawbacks included potential reductions or eliminations of valuable tax deductions and credits, which could negatively impact certain groups.

Corporate Tax Rate Reductions

A central feature of the House Republicans' Trump tax cut plan was a dramatic reduction in the corporate tax rate. The plan aimed to lower the rate from a higher level to a significantly lower percentage.

- Stimulating Investment and Job Growth: Proponents argued that lower corporate taxes would incentivize businesses to invest more, expand operations, and create jobs. This was expected to boost economic activity and overall growth.

- Increased Competitiveness: The reduced corporate tax rate aimed to make American businesses more competitive on the global stage.

- Arguments Against Lower Corporate Taxes: Critics argued that the corporate tax cuts would disproportionately benefit large corporations and wealthy shareholders, exacerbating income inequality, and potentially leading to minimal job creation. Furthermore, concerns were raised about the potential impact on the national debt.

The proposed reductions in corporate taxes had profound implications for the national debt. Lower tax revenues could necessitate spending cuts in other areas or increased borrowing.

Elimination or Modification of Tax Deductions and Credits

To offset the revenue loss from tax rate reductions, the plan proposed eliminating or modifying several tax deductions and credits. Key examples included:

- State and Local Tax (SALT) Deduction: The plan proposed either limiting or eliminating the deduction for state and local taxes, potentially impacting taxpayers in high-tax states.

- Mortgage Interest Deduction: While not completely eliminated in all versions, the plan considered significant modifications to the mortgage interest deduction, potentially affecting homeowners.

The rationale behind these changes was to simplify the tax code and broaden the tax base. However, the elimination or reduction of these deductions could significantly impact taxpayers who relied on them, potentially leading to higher tax burdens.

Economic Impact and Projections

The projected economic effects of the House Republicans' Trump tax cut plan were a subject of intense debate. Various economic models and analyses provided different projections:

- GDP Growth: Proponents predicted significant increases in GDP growth due to increased investment and consumer spending.

- Inflation: Some models predicted increased inflation as a result of increased consumer demand.

- Employment: While job creation was a stated goal, the actual impact on employment was uncertain and varied considerably across different analyses.

- Fiscal Sustainability: A major concern was the plan's long-term fiscal sustainability. The substantial tax cuts, without corresponding spending cuts, raised concerns about increased national debt and potential future economic challenges.

- Income Inequality: Critics argued that the plan would exacerbate income inequality, as the benefits disproportionately flowed to higher-income individuals and corporations.

The long-term effects remained highly uncertain, making definitive predictions difficult.

Political Implications and Public Opinion

The House Republicans' Trump tax cut plan faced considerable political opposition and generated significant public debate.

- Legislative Process: The plan faced challenges navigating the legislative process, with significant debate and amendments within Congress.

- Public Opinion: Public opinion polls revealed divided sentiment towards the plan, with varying levels of support across different demographic groups and political affiliations.

- Political Debates and Controversies: The plan fueled heated political debates and controversies, highlighting the significant partisan divisions surrounding tax policy.

Conclusion

The House Republicans' Trump tax cut plan represented a significant attempt at tax reform, aiming to boost economic growth through substantial reductions in individual and corporate tax rates. However, the plan also involved controversial changes to deductions and credits, leading to debates concerning its long-term fiscal sustainability and impact on income inequality. Understanding the intricacies of this complex plan requires careful consideration of its various provisions and potential consequences. To gain a more comprehensive understanding, we encourage you to consult additional resources such as reports from the Congressional Budget Office, reputable news sources, and government websites. Understanding the complexities of the House Republicans' Trump tax cut plan is crucial for every American. Continue your research to ensure you're fully informed about this impactful legislation.

Featured Posts

-

Javna Obravnava Predloga Novele Zakona O Romski Skupnosti Analiza Predlogov

May 13, 2025

Javna Obravnava Predloga Novele Zakona O Romski Skupnosti Analiza Predlogov

May 13, 2025 -

Oleksiy Poroshenko Potochne Mistseznakhodzhennya Ostanni Novini Ta Foto

May 13, 2025

Oleksiy Poroshenko Potochne Mistseznakhodzhennya Ostanni Novini Ta Foto

May 13, 2025 -

India Heatwave Central Government Issues State Level Advisory

May 13, 2025

India Heatwave Central Government Issues State Level Advisory

May 13, 2025 -

Brexits Gibraltar Problem Talks Remain Deadlocked

May 13, 2025

Brexits Gibraltar Problem Talks Remain Deadlocked

May 13, 2025 -

Exploring Kanika House B R Ambedkars Contribution To The Indian Constitution

May 13, 2025

Exploring Kanika House B R Ambedkars Contribution To The Indian Constitution

May 13, 2025