Understanding The Dragon's Den: A Comprehensive Overview

Table of Contents

The Dragons: Key Players and Their Investment Strategies

The heart of Dragon's Den lies in its formidable panel of investors, the Dragons. Each Dragon brings a unique investment expertise, personality, and approach to the table, creating a dynamic and often unpredictable environment. Let's delve into some key personalities and their investment styles:

-

Deborah Meaden: Known for her shrewd business acumen and tough negotiating style, Deborah often favors established businesses with strong track records in retail and hospitality.

- Favored Industries: Retail, hospitality, property.

- Negotiation Tactics: Direct, detail-oriented, focuses on realistic valuations and potential ROI.

- Investment Criteria: Proven business model, strong management team, clear market opportunity.

- Examples: Successful investments in several established businesses, some unsuccessful ventures with flawed business plans.

-

Peter Jones: A seasoned entrepreneur and investor, Peter is known for his strategic thinking and long-term vision. He often invests in businesses with high growth potential, regardless of the industry.

- Favored Industries: Diverse portfolio, focusing on innovation and scalability.

- Negotiation Tactics: Calculated, seeks significant equity in exchange for investment.

- Investment Criteria: Strong intellectual property, innovative technology, demonstrable market demand.

- Examples: Investments in diverse sectors, some yielding significant returns.

-

(Add other Dragons with similar details)

The interaction between the Dragons is a key element of the show’s appeal. Their differing opinions, sharp disagreements, and occasionally heated debates provide captivating television and highlight the complexities of the investment world.

The Pitch Process: From Preparation to Presentation

Getting on Dragon's Den is no easy feat. Aspiring entrepreneurs must navigate a rigorous application process, submitting detailed business plans and showcasing their ideas in a compelling manner. A strong pitch deck is crucial, laying out a clear and concise roadmap to success. The following elements are essential for a successful Dragon's Den presentation:

- Clear Value Proposition: Articulate the unique selling proposition and how the business solves a problem or addresses a market need.

- Market Analysis: Demonstrate understanding of the target market, competition, and market size.

- Financial Projections: Present realistic and well-supported financial forecasts, including revenue projections and expense budgets.

- Team Expertise: Showcase the team's skills and experience relevant to the business.

- Handling Tough Questions: Anticipate the Dragons’ questions and prepare thoughtful responses.

Common mistakes include unrealistic projections, insufficient market research, and failing to articulate a clear path to profitability. Preparation is paramount for navigating the intense scrutiny of the Dragons.

Beyond the Television Show: The Real Impact of Dragon's Den

Dragon's Den’s impact extends far beyond the television screen. While the long-term success rate of businesses securing investment varies, the show has undeniably influenced entrepreneurship and business education. The media coverage generates significant publicity for participating businesses, boosting brand awareness and attracting further investment. Furthermore, the show’s focus on due diligence, market analysis, and financial planning has contributed to a higher standard of preparation among aspiring entrepreneurs. The broader economic impact is evident in the creation of jobs, revenue generation, and the fostering of a more vibrant startup ecosystem.

Learning from the Dragon's Den: Lessons for Aspiring Entrepreneurs

Analyzing successful and unsuccessful pitches on Dragon's Den offers valuable insights for aspiring entrepreneurs. Key takeaways include:

- Perseverance: Rejection is a part of the process. Learn from setbacks and refine your approach.

- Adaptability: Be prepared to adjust your business plan based on feedback and market dynamics.

- Resilience: Maintain your passion and belief in your vision, even in the face of challenges.

- Mentorship: Seek guidance from experienced entrepreneurs and business advisors before approaching investors.

Understanding the Dragon's Den is not just about entertainment; it's a valuable learning experience. By studying past pitches, analyzing successful strategies, and learning from mistakes, aspiring entrepreneurs can significantly improve their chances of securing funding and building successful businesses.

Conclusion

This article has provided a comprehensive overview of the Dragon's Den, exploring the key players, the rigorous pitch process, and its broad impact on entrepreneurship. We’ve examined the diverse investment strategies of the Dragons, highlighted crucial elements of a winning pitch, and extracted valuable lessons from successful and unsuccessful ventures. Understanding the Dragon's Den requires analyzing past pitches, learning from the successes and failures of entrepreneurs who dared to enter the Den, and ultimately, applying these lessons to your own entrepreneurial journey. We encourage you to further research successful Dragon’s Den businesses, analyze past pitches for inspiration, and consider applying to the Dragon’s Den (or equivalent investment programs) to pursue your own entrepreneurial dreams and truly understand the Dragon’s Den experience firsthand.

Featured Posts

-

Chicago Welcomes New Harry Potter Shop A Visitors Review

May 02, 2025

Chicago Welcomes New Harry Potter Shop A Visitors Review

May 02, 2025 -

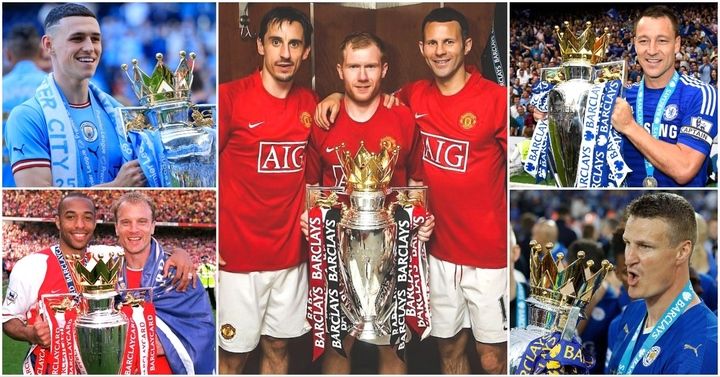

Souness Names His Top Premier League Player Of All Time

May 02, 2025

Souness Names His Top Premier League Player Of All Time

May 02, 2025 -

Daisy May Cooper Engaged To Boyfriend Anthony Huggins Confirmation And Details

May 02, 2025

Daisy May Cooper Engaged To Boyfriend Anthony Huggins Confirmation And Details

May 02, 2025 -

Bbc Celebrity Traitors Two Stars Quit Show

May 02, 2025

Bbc Celebrity Traitors Two Stars Quit Show

May 02, 2025 -

Louisiana School Desegregation Order Terminated By Justice Department

May 02, 2025

Louisiana School Desegregation Order Terminated By Justice Department

May 02, 2025