Understanding The Dollar's Decline And Its Effect On Asian Currencies

Table of Contents

Factors Contributing to the Dollar's Decline

Several interconnected factors contribute to the ongoing decline of the US dollar, creating uncertainty in the global financial markets and significantly impacting Asian currencies.

Inflation and Monetary Policy

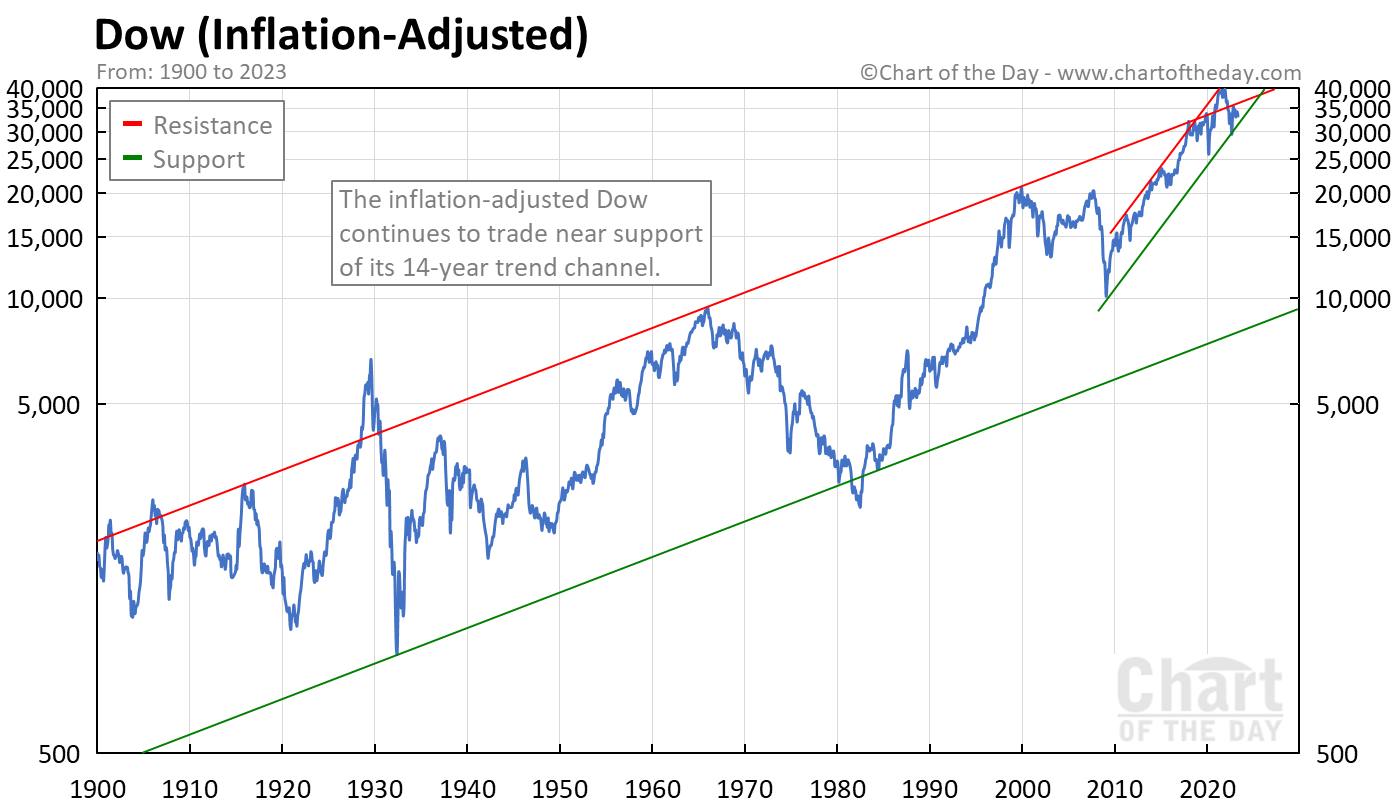

The US Federal Reserve's aggressive response to high inflation, primarily through significant interest rate hikes, has played a crucial role in influencing the dollar's value. While higher interest rates initially attract foreign investment, strengthening the dollar, prolonged high rates can stifle economic growth, leading to a decline.

- Initial Strengthening: Higher interest rates make US dollar-denominated assets more attractive, drawing in foreign investment and increasing demand for the dollar.

- Long-Term Weakening: However, persistently high interest rates can negatively impact economic activity, potentially leading to slower GDP growth and reduced investor confidence, ultimately weakening the dollar.

- Inflationary Pressures: High inflation erodes the purchasing power of the dollar, making it less attractive to hold as a store of value. This decreased demand contributes to its decline.

- Alternative Monetary Policies: The effectiveness of solely relying on interest rate hikes is debated, with some economists advocating for alternative monetary policies to manage inflation without severely hindering economic growth.

Geopolitical Uncertainty

Global political instability and conflicts significantly impact investor confidence, influencing capital flows and affecting the dollar's value.

- The War in Ukraine: The ongoing conflict in Ukraine has caused significant disruptions to global energy markets, fueling inflation and creating uncertainty, impacting investor sentiment toward the dollar.

- US-China Relations: Strained relations between the US and China, including trade disputes and geopolitical tensions, contribute to global uncertainty, reducing investor confidence in the dollar.

- Capital Flight: Geopolitical uncertainty often leads to capital flight, as investors move their assets to perceived safer havens, putting downward pressure on the dollar.

- Currency Volatility: This uncertainty translates into increased volatility in currency exchange rates, making it challenging for businesses and investors to plan and manage their financial risks.

US Economic Performance

The overall health of the US economy is intrinsically linked to the strength of the dollar. Key economic indicators significantly influence investor sentiment and capital flows.

- GDP Growth: Slower-than-expected GDP growth rates signal a weakening economy, reducing investor confidence and putting downward pressure on the dollar.

- Unemployment Rates: Rising unemployment rates reflect a weakening economy, further diminishing investor confidence and weakening the dollar's value.

- Trade Deficits: Persistent and widening trade deficits indicate that the US is importing more than it is exporting, potentially putting pressure on the dollar's value. This is because a persistent trade deficit can lead to a greater supply of dollars in the foreign exchange market.

Impact on Specific Asian Currencies

The dollar's decline has varying impacts on different Asian currencies, depending on each nation's unique economic structure, trade relationships, and monetary policies.

The Japanese Yen

The weakening dollar has significantly affected the Japanese yen, given Japan's close economic ties with the US and its own monetary policies.

- Export Competitiveness: A weaker dollar can boost the competitiveness of Japanese exports, making them cheaper for buyers in the US and other markets.

- Import Costs: However, the same dynamic increases the cost of imports for Japan, potentially contributing to inflationary pressures.

- Bank of Japan's Response: The Bank of Japan's monetary policy response to the yen's fluctuations plays a crucial role in shaping its overall trajectory.

The Chinese Yuan

China's role in global trade and its complex economic relationship with the US makes the impact of the dollar's decline on the yuan particularly intricate.

- Export-Oriented Economy: A weaker dollar generally benefits China's export-oriented economy, making its goods more competitive internationally.

- Import Costs: Similar to Japan, increased import costs could lead to inflationary pressures within the Chinese economy.

- Foreign Investment: The impact on foreign investment in China is complex, depending on other factors such as geopolitical risks and domestic economic policies.

Other Asian Currencies (e.g., Indian Rupee, South Korean Won)

The effects on other Asian currencies like the Indian Rupee and South Korean Won are diverse, reflecting the unique economic conditions in each country.

- Economic Diversification: Countries with more diversified economies and robust domestic demand might be less susceptible to the direct impact of dollar fluctuations.

- Trade Relationships: The strength of trade ties with the US and other major economies heavily influences each currency’s response.

- Monetary Policy Responses: Each country's central bank's monetary policy reaction to the dollar's decline can significantly moderate or amplify its effect on the local currency.

Opportunities and Challenges for Asian Economies

The dollar's decline presents both significant opportunities and challenges for Asian economies.

Opportunities

- Increased Export Competitiveness: A weaker dollar makes Asian exports cheaper in global markets, potentially boosting demand and economic growth.

- Increased Foreign Investment: The relatively weaker dollar may encourage foreign investment into Asian markets, seeking higher returns.

- Growth Opportunities: Certain sectors, such as manufacturing and tourism, could experience significant growth due to increased demand.

Challenges

- Increased Import Costs: A weaker dollar increases the cost of imports for Asian countries, potentially fueling inflation and impacting consumer spending.

- Inflationary Pressures: The combined effect of increased import costs and potential supply chain disruptions can lead to heightened inflationary pressures across the region.

- Currency Volatility: Fluctuations in exchange rates increase uncertainty and risk for businesses engaged in international trade and investment.

Conclusion

The decline of the US dollar presents a complex and multifaceted challenge and opportunity for Asian economies. Understanding the interplay between global economic factors, monetary policies, and geopolitical events is crucial for navigating this shifting landscape. While some Asian currencies may benefit from increased export competitiveness, others face the challenge of rising import costs and currency volatility. Careful monitoring of the dollar's trajectory and proactive economic management are essential for Asian nations to mitigate risks and capitalize on potential opportunities presented by the dollar's decline. Stay informed about the latest developments in global finance to effectively manage the implications of the dollar's decline and its impact on Asian currencies. Continue researching and analyzing shifts in the global currency market to make informed decisions related to Asian currency exchange rates.

Featured Posts

-

Live Stock Market Data Dow S And P 500 And Nasdaq May 5th

May 06, 2025

Live Stock Market Data Dow S And P 500 And Nasdaq May 5th

May 06, 2025 -

Romania Votes Far Right And Centrist Candidates Vie For Presidency

May 06, 2025

Romania Votes Far Right And Centrist Candidates Vie For Presidency

May 06, 2025 -

Assessing The Impact Of Trumps Tariffs On Us Manufacturing

May 06, 2025

Assessing The Impact Of Trumps Tariffs On Us Manufacturing

May 06, 2025 -

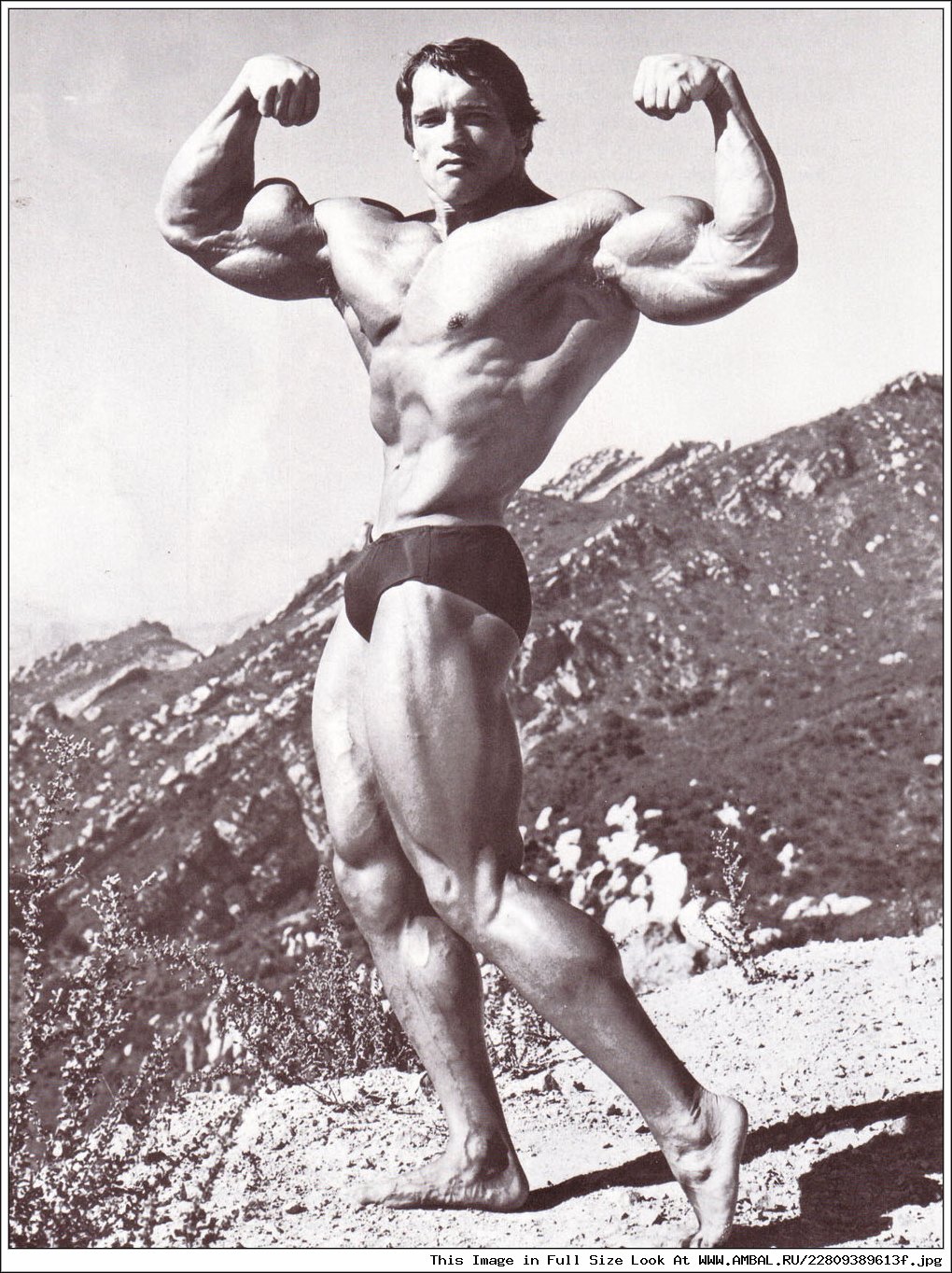

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025 -

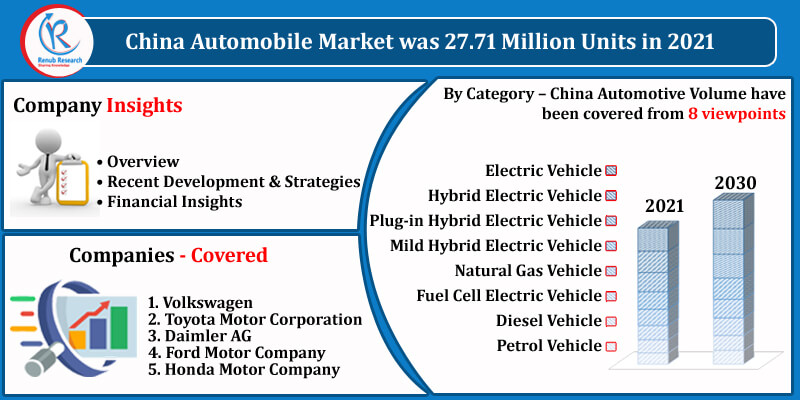

Navigating The Chinese Automotive Market Lessons From Bmw And Porsches Experiences

May 06, 2025

Navigating The Chinese Automotive Market Lessons From Bmw And Porsches Experiences

May 06, 2025

Latest Posts

-

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025 -

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025 -

Patrik Shvartsenegger I Ebbi Chempion Fotosessiya Dlya Kim Kardashyan

May 06, 2025

Patrik Shvartsenegger I Ebbi Chempion Fotosessiya Dlya Kim Kardashyan

May 06, 2025 -

Joseph Baena Arnold Schwarzenegger Fia Es A Siker Utja

May 06, 2025

Joseph Baena Arnold Schwarzenegger Fia Es A Siker Utja

May 06, 2025