Understanding The D-Wave Quantum (QBTS) Stock Decline On Monday

Table of Contents

Main Points: Dissecting the QBTS Stock Dip

2.1. Market Sentiment and Overall Tech Sector Performance

H3: Broader Market Trends:

Monday's market performance played a role in the overall downturn. The tech sector, often a bellwether for broader market sentiment, experienced a period of uncertainty. This general negativity likely contributed to the D-Wave Quantum (QBTS) stock decline.

- The Nasdaq Composite, a key indicator of tech stock performance, experienced a [insert percentage]% decline on Monday.

- Market sentiment was largely negative, driven by [mention specific news affecting market sentiment, e.g., inflation concerns, interest rate hikes].

- The broader tech sector saw a general pullback, with many companies experiencing similar price drops, indicating a market-wide correction rather than an issue specific to D-Wave.

H3: Investor Confidence in Quantum Computing:

The quantum computing sector, while brimming with long-term potential, faces challenges regarding its near-term viability. Investor confidence in this relatively nascent field can fluctuate significantly based on perceived progress and market speculation.

- Recent reports highlight the significant capital investment required for quantum computing research and development, causing some investors to remain cautious.

- Concerns about the time horizon before quantum computers become commercially viable may impact investor sentiment towards companies like D-Wave.

- Competition within the quantum computing landscape is fierce, leading to uncertainty about market share and profitability for individual players.

2.2. Specific News or Announcements Affecting D-Wave

H3: Company-Specific News:

Any company-specific news directly impacting D-Wave would be a major factor in the QBTS stock price movement. Analyzing press releases and announcements from the company itself is crucial for understanding the decline.

- [Mention any press releases or news items related to D-Wave from Monday, e.g., a delayed product launch, a missed earnings target, or a negative analyst report.] Explain how this news could have contributed to selling pressure.

- [If applicable, mention any changes in management or key personnel that could have influenced investor confidence.] Discuss the potential impact of such changes on the company's future direction.

- Absence of positive news could also contribute to a decline. If there were no significant positive announcements, this lack of positive momentum might have amplified the impact of broader market trends.

H3: Competitor Activity:

The actions of D-Wave's competitors can indirectly influence investor perception and the QBTS stock price. Any significant developments from rival companies could shift investor attention and capital.

- [Mention any news regarding competing quantum computing companies, such as successful funding rounds, product launches, or partnerships.] Explain how these events might affect D-Wave's relative market position and investor sentiment.

- Increased competition can heighten the pressure on D-Wave to deliver results, potentially impacting investor confidence if milestones are missed.

- Analysis of competitor progress helps to assess the overall health and viability of the quantum computing industry as a whole, impacting the attractiveness of QBTS as an investment.

2.3. Technical Analysis of QBTS Stock Chart

H3: Trading Volume and Price Action:

A technical analysis of the QBTS stock chart can offer additional insights into Monday's decline. Analyzing trading volume and price action helps understand the dynamics of the sell-off.

- [Describe the trading volume on Monday. Was it significantly higher than average, indicating increased selling pressure?] High volume alongside a price drop is a bearish signal.

- [Mention any significant price patterns or breaks of support levels observed on the chart.] Technical indicators can reveal underlying trends and potential future price movements.

- [If possible, mention any specific chart patterns relevant to the QBTS stock decline, such as a bearish engulfing candle or a significant gap down.]

H3: Short-Selling Activity:

Short-selling activity can amplify price declines. An increase in short positions indicates negative sentiment among institutional investors.

- [If data is available, discuss the changes in short interest for QBTS on Monday or in the preceding period.] A sudden increase in short selling could have exacerbated the price drop.

- High short interest can create a self-fulfilling prophecy, as short sellers may further drive down the price to cover their positions.

- Analyzing short interest helps determine if the price drop is primarily driven by market forces or by negative investor sentiment specifically targeting D-Wave.

Conclusion: Understanding and Navigating the D-Wave Quantum (QBTS) Stock Decline

The D-Wave Quantum (QBTS) stock decline on Monday was likely a multifaceted event, influenced by a combination of broader market trends, company-specific news (or the lack thereof), competitor activity, and technical factors. Understanding these contributing elements is crucial for navigating the complexities of investing in the quantum computing sector. While short-term market fluctuations are inevitable, investors should monitor these factors closely to make informed decisions about their QBTS holdings. The long-term potential of quantum computing remains significant, but careful consideration of both short-term market volatility and long-term industry prospects is essential when evaluating D-Wave Quantum (QBTS) investments. Continue researching the D-Wave Quantum (QBTS) stock and stay updated on future developments to make sound investment decisions.

Featured Posts

-

Manchester United Approaches Arsenal And Chelsea Target In 62 5m Transfer

May 20, 2025

Manchester United Approaches Arsenal And Chelsea Target In 62 5m Transfer

May 20, 2025 -

Flavio Cobollis Bucharest Triumph A Maiden Atp Victory

May 20, 2025

Flavio Cobollis Bucharest Triumph A Maiden Atp Victory

May 20, 2025 -

Fenerbahce De Yeni Bir Doenem Dusan Tadic In Tarihi Transferi

May 20, 2025

Fenerbahce De Yeni Bir Doenem Dusan Tadic In Tarihi Transferi

May 20, 2025 -

Nyt Mini Crossword Help March 20 2025 Solutions

May 20, 2025

Nyt Mini Crossword Help March 20 2025 Solutions

May 20, 2025 -

Securities Lawsuit Against Big Bear Ai A Detailed Analysis

May 20, 2025

Securities Lawsuit Against Big Bear Ai A Detailed Analysis

May 20, 2025

Latest Posts

-

Understanding The Billionaire Boy Phenomenon Wealth Influence And Legacy

May 20, 2025

Understanding The Billionaire Boy Phenomenon Wealth Influence And Legacy

May 20, 2025 -

The Old North State Report A Recap Of May 9 2025

May 20, 2025

The Old North State Report A Recap Of May 9 2025

May 20, 2025 -

The Billionaire Boys Guide To Success Lessons From The Top 1

May 20, 2025

The Billionaire Boys Guide To Success Lessons From The Top 1

May 20, 2025 -

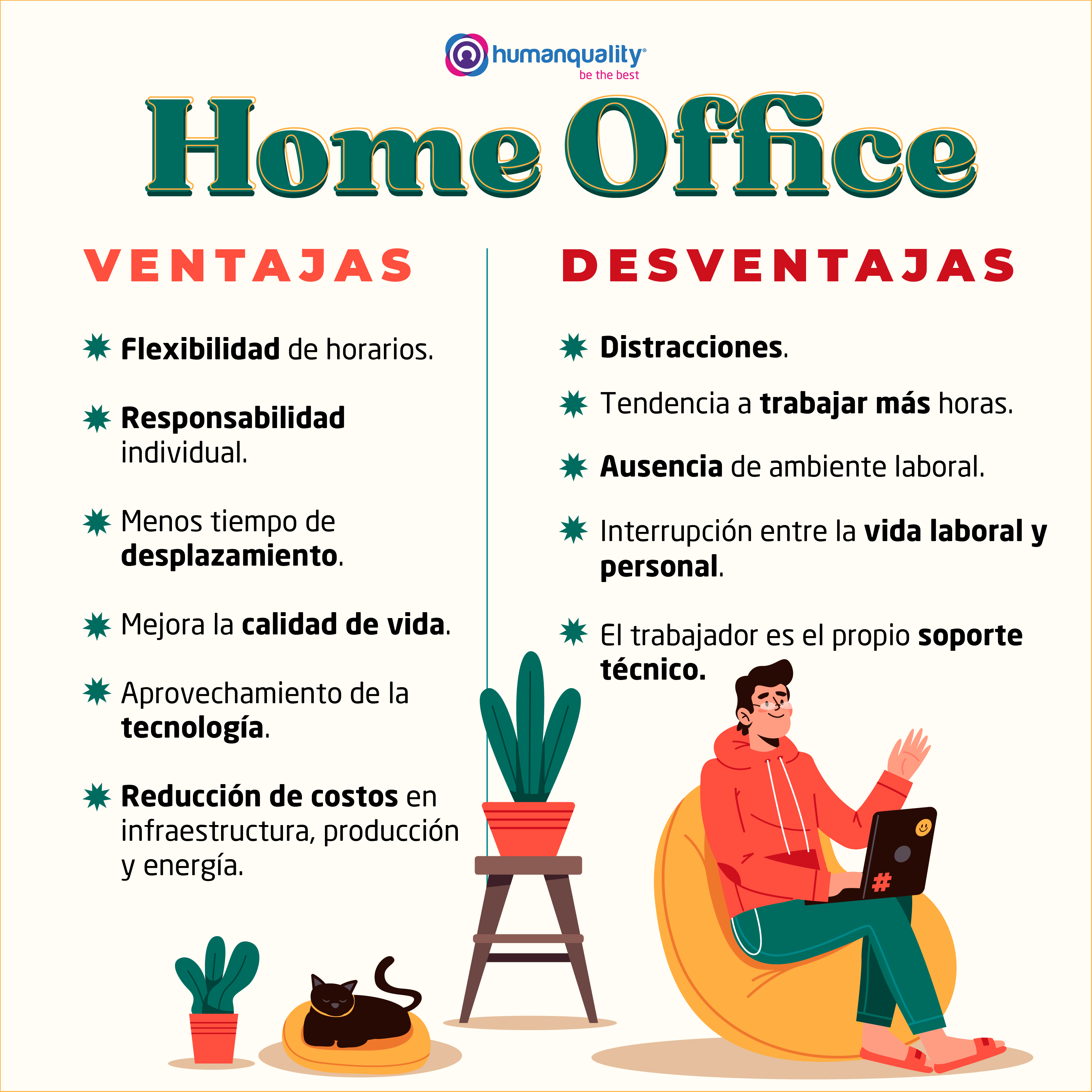

79 Manazerov Uprednostnuje Osobny Kontakt Home Office Vs Tradicna Kancelaria

May 20, 2025

79 Manazerov Uprednostnuje Osobny Kontakt Home Office Vs Tradicna Kancelaria

May 20, 2025 -

News From The Old North State Report For May 9 2025

May 20, 2025

News From The Old North State Report For May 9 2025

May 20, 2025