Understanding The Current CoreWeave Stock Situation

Table of Contents

CoreWeave, a leading player in the rapidly expanding GPU cloud computing sector, has experienced significant volatility in its stock price recently. Understanding the current CoreWeave stock situation requires a careful examination of its business model, competitive landscape, recent financial performance, and future growth prospects. This article aims to analyze the current CoreWeave stock situation and provide insights to help investors make informed decisions regarding CoreWeave stock.

CoreWeave's Business Model and Competitive Landscape

CoreWeave's Niche in Cloud Computing

CoreWeave specializes in providing high-performance GPU cloud computing solutions. Its infrastructure is built on a foundation of massive, sustainable data center solutions, leveraging thousands of NVIDIA GPUs to deliver unparalleled computing power for demanding applications. Their target customer base includes businesses and researchers in fields like AI, machine learning, deep learning, and high-performance computing.

- Key Features and Benefits:

- Unmatched GPU compute power and scalability.

- Access to cutting-edge NVIDIA hardware.

- Sustainable and environmentally conscious data center operations.

- Flexible pricing models tailored to various needs.

- Robust security and compliance features.

CoreWeave differentiates itself through its focus on providing specialized GPU cloud solutions, catering to the needs of users requiring significant processing power. This niche approach allows them to compete effectively against larger, more general-purpose cloud providers.

Competitive Analysis

CoreWeave faces stiff competition from established giants in the cloud computing industry, including:

- Amazon Web Services (AWS): Offers a comprehensive range of cloud services, including GPU instances.

- Google Cloud Platform (GCP): Provides a strong suite of GPU-based computing solutions.

- Microsoft Azure: Offers various virtual machine options with GPU acceleration.

However, CoreWeave's focus on dedicated GPU resources and tailored solutions provides a competitive advantage in specific market segments. While the larger players may offer broader services, CoreWeave excels in delivering specialized, high-performance GPU compute capabilities.

Recent Financial Performance and Stock Price Trends

Financial Highlights

Analyzing CoreWeave's recent financial reports is crucial to understanding its stock price movements. While specific numbers are subject to change and require access to up-to-date financial filings, key metrics like revenue growth, earnings per share (EPS), and profitability margins are essential indicators of its financial health and future potential. (Note: Investors should refer to official financial reports for the most accurate and up-to-date information.)

- Key Metrics to Monitor:

- Quarterly and annual revenue growth.

- Earnings per share (EPS).

- Profit margins and operating expenses.

- Cash flow from operations.

- Debt-to-equity ratio.

Monitoring these CoreWeave financials provides valuable insights into the company's financial stability and growth trajectory. The trend of these metrics can significantly impact investor sentiment and the CoreWeave stock price.

Stock Price Volatility and Market Sentiment

CoreWeave's stock price, like many technology stocks, has experienced volatility. This fluctuation is influenced by several factors:

- Overall market trends: Broad market movements and investor sentiment often impact technology stocks.

- News and announcements: Positive news, such as new partnerships or product launches, can boost the stock price, while negative news can lead to declines.

- Industry competition: The competitive landscape within the GPU cloud computing market influences investor confidence.

- Analyst ratings and reports: Changes in analyst ratings and the release of new research reports can impact the stock price.

Future Outlook and Investment Considerations

Growth Projections and Potential

Analysts have varying projections for CoreWeave's future growth, citing the increasing demand for GPU cloud computing resources in various sectors, particularly AI and machine learning. However, CoreWeave faces potential challenges:

- Intense competition: Maintaining its market share against established players is a significant challenge.

- Technological advancements: Keeping pace with rapid technological advancements within the cloud computing industry is crucial.

- Economic conditions: Broad economic downturns could impact demand for cloud computing services.

Despite these challenges, the long-term growth potential of the GPU cloud computing market remains substantial, creating opportunities for companies like CoreWeave to thrive.

Investment Recommendations (Disclaimer)

Investing in CoreWeave stock involves inherent risks. The information provided in this article is for informational purposes only and should not be considered financial advice. Before making any investment decision, it is crucial to conduct thorough due diligence, including consulting with a qualified financial advisor and carefully considering your own risk tolerance.

- Pros of Investing in CoreWeave Stock:

- Potential for high growth in a rapidly expanding market.

- Strong technology and competitive offerings.

- Cons of Investing in CoreWeave Stock:

- Significant competition in the cloud computing market.

- Stock price volatility.

- Potential for unforeseen risks.

Conclusion: Making Informed Decisions about CoreWeave Stock

In summary, understanding the CoreWeave stock situation requires considering its strong position in a rapidly growing market, its competitive challenges, and its financial performance. While the potential for significant growth exists, investors should be aware of the risks associated with investing in a relatively new and volatile stock. The key takeaways highlight the importance of monitoring financial reports, industry trends, and competitive dynamics to make informed investment decisions regarding CoreWeave stock. Before making any investment decisions regarding CoreWeave stock, or any CoreWeave investment, it’s crucial to conduct thorough due diligence and consider your personal risk tolerance. Remember to consult with a financial advisor before investing.

Featured Posts

-

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Wait Continues

May 22, 2025

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Wait Continues

May 22, 2025 -

The Enduring Appeal Of Little Britain To Gen Z

May 22, 2025

The Enduring Appeal Of Little Britain To Gen Z

May 22, 2025 -

Liverpools Psg Win A Tactical Breakdown By Arne Slot

May 22, 2025

Liverpools Psg Win A Tactical Breakdown By Arne Slot

May 22, 2025 -

Understanding Cassis Blackcurrant Production Taste And Pairings

May 22, 2025

Understanding Cassis Blackcurrant Production Taste And Pairings

May 22, 2025 -

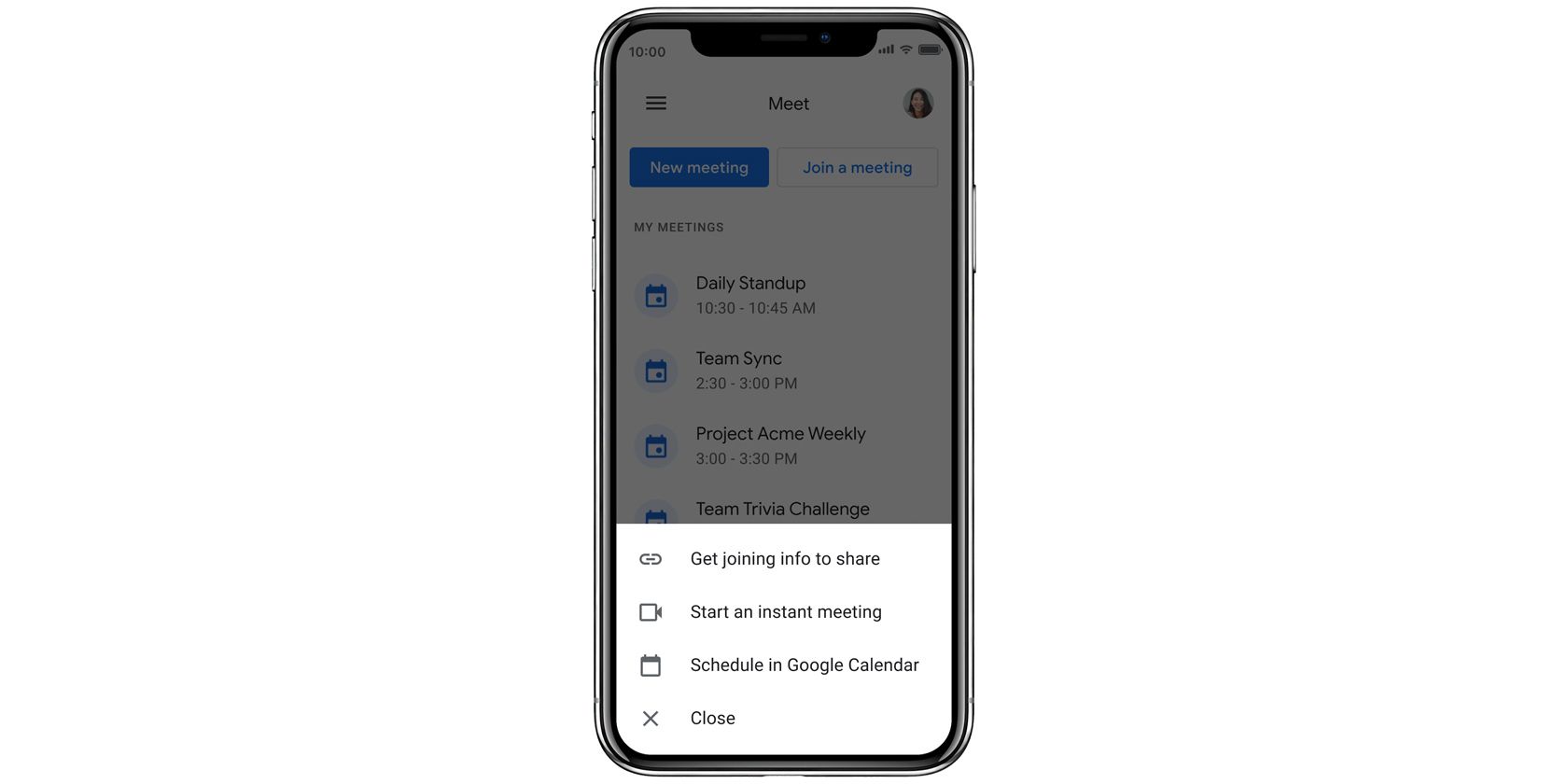

Googles Updates To Enhance Virtual Meetings

May 22, 2025

Googles Updates To Enhance Virtual Meetings

May 22, 2025