Understanding The April 8th Treasury Market Movements

Table of Contents

Pre-Market Conditions and Expectations

The economic climate leading up to April 8th was characterized by [Insert description of the overall economic climate e.g., persistent inflation, rising interest rates, geopolitical uncertainty]. Investor sentiment was [Insert description of investor sentiment e.g., cautiously optimistic, increasingly concerned, highly volatile] due to several factors.

- Summary of key economic indicators released before April 8th: [Insert details of key economic indicators like CPI, PPI, employment data, etc., and their values. Mention whether these figures exceeded or fell short of market expectations. For example: "The March Consumer Price Index (CPI) report, released the week before, showed inflation remaining stubbornly high at X%, exceeding analysts' forecasts by Y%."]

- Analysis of market sentiment and investor expectations regarding interest rates: [Explain the prevailing expectations regarding future interest rate hikes by the Federal Reserve. For example: "Market participants anticipated another interest rate increase by the Federal Reserve at its upcoming meeting, leading to increased uncertainty."]

- Mention any significant geopolitical events influencing the market: [Mention any significant geopolitical events, such as international conflicts or political instability, that might have affected investor confidence and market volatility. For example: "The ongoing conflict in Ukraine continued to cast a shadow over global markets, adding to the overall uncertainty."]

Impact of Inflation Data Release

The release of [Specific inflation data, e.g., March's Consumer Price Index (CPI)] on April 8th proved to be a pivotal moment. This data significantly impacted Treasury market movements.

- Detailed analysis of the released data and its deviation from expectations: [Analyze the specific numbers released and how they differed from market forecasts. For example: "The CPI figure came in higher than anticipated, fueling concerns about persistent inflationary pressures."]

- Explanation of the market’s immediate reaction (e.g., yield increases/decreases): [Explain the immediate market response to the data release. For example: "The unexpected rise in inflation led to an immediate surge in Treasury yields, as investors priced in the increased likelihood of further aggressive rate hikes by the Federal Reserve."]

- Discussion on how different maturities of Treasuries were affected: [Describe how the impact varied across different Treasury maturities (short-term, long-term). For example: "Shorter-term Treasury yields experienced a more pronounced increase compared to longer-term yields, flattening the yield curve."]

The Role of the Federal Reserve

The Federal Reserve's role in shaping the April 8th Treasury market movements cannot be overstated. [Mention any statements or actions taken by the Fed before or on April 8th that may have impacted the market. For example: "While the Fed did not announce any new policy decisions on April 8th, recent statements by Federal Reserve officials had already indicated a hawkish stance."]

- Summary of any recent Federal Reserve announcements or statements: [Summarize any relevant communications from the Fed, such as press releases or speeches by Fed officials. For example: "Chair Powell's recent comments emphasized the Fed's commitment to bringing inflation down, even at the cost of slower economic growth."]

- Analysis of the Fed's potential future policy moves and their anticipated impact on Treasury yields: [Analyze the market’s expectations for future Federal Reserve actions and their likely impact on Treasury yields. For example: "The market was already anticipating further interest rate increases, which contributed to the upward pressure on Treasury yields."]

- Discussion on the relationship between the Fed's actions and market confidence: [Discuss how the Fed's actions and communications influenced market confidence and investor behavior. For example: "The perceived lack of decisive action by the Fed to curb inflation contributed to increased market volatility."]

Analysis of Treasury Yield Curve Movements

The Treasury yield curve on April 8th exhibited [Describe the shape of the yield curve, e.g., steepening, flattening, inversion]. [Include a visual representation of the yield curve if possible.]

- Graphical representation of the yield curve on April 8th: [Insert a chart or graph showing the Treasury yield curve on April 8th.]

- Interpretation of the slope of the yield curve and its implications for economic growth: [Explain the significance of the yield curve's slope and what it implies about future economic growth. For example: "The flattening yield curve suggested a growing divergence in expectations for short-term and long-term economic growth."]

- Discussion on the potential for inversion and its signaling effect: [Discuss whether the yield curve was close to inverting and the potential implications of an inversion (recessionary signals). For example: "While the yield curve did not invert on April 8th, the narrowing spread between short-term and long-term yields raised concerns about a potential future inversion and its implications for economic growth."]

Market Volatility and Investor Sentiment

April 8th witnessed [Describe the level of market volatility, e.g., heightened volatility, relatively calm trading]. Investor sentiment shifted from [Initial sentiment] to [Later sentiment] throughout the day.

- Data on trading volume and price fluctuations throughout the day: [Provide data on trading volume and price fluctuations to illustrate the level of volatility. For example: "Trading volume in Treasury securities increased significantly throughout the day, reflecting heightened investor activity."]

- Assessment of the prevailing investor sentiment (risk-on or risk-off): [Analyze the prevailing investor sentiment and explain why it shifted. For example: "Initially, investor sentiment was cautiously optimistic, but the inflation data release triggered a shift towards risk-aversion, leading to increased selling pressure in the Treasury market."]

- Analysis of how market volatility affected different investor groups: [Analyze how different types of investors (e.g., hedge funds, pension funds) reacted to the market volatility. For example: "Hedge funds, known for their short-term trading strategies, likely profited from the increased volatility, while long-term investors like pension funds may have been more concerned about the potential impact on their portfolios."]

Conclusion

The April 8th Treasury market movements were primarily driven by the unexpected inflation data release, heightened investor uncertainty, and anticipation of further Federal Reserve actions. The resulting shifts in Treasury yields and the shape of the yield curve offer valuable insights into the evolving economic outlook and potential future interest rate changes. Understanding these complex interactions is vital for informed investment strategies in the bond market. Stay updated on future Treasury market movements by subscribing to our updates, following reliable financial news sources, and seeking professional financial advice to navigate the intricacies of the Treasury market and master the art of interpreting Treasury market fluctuations.

Featured Posts

-

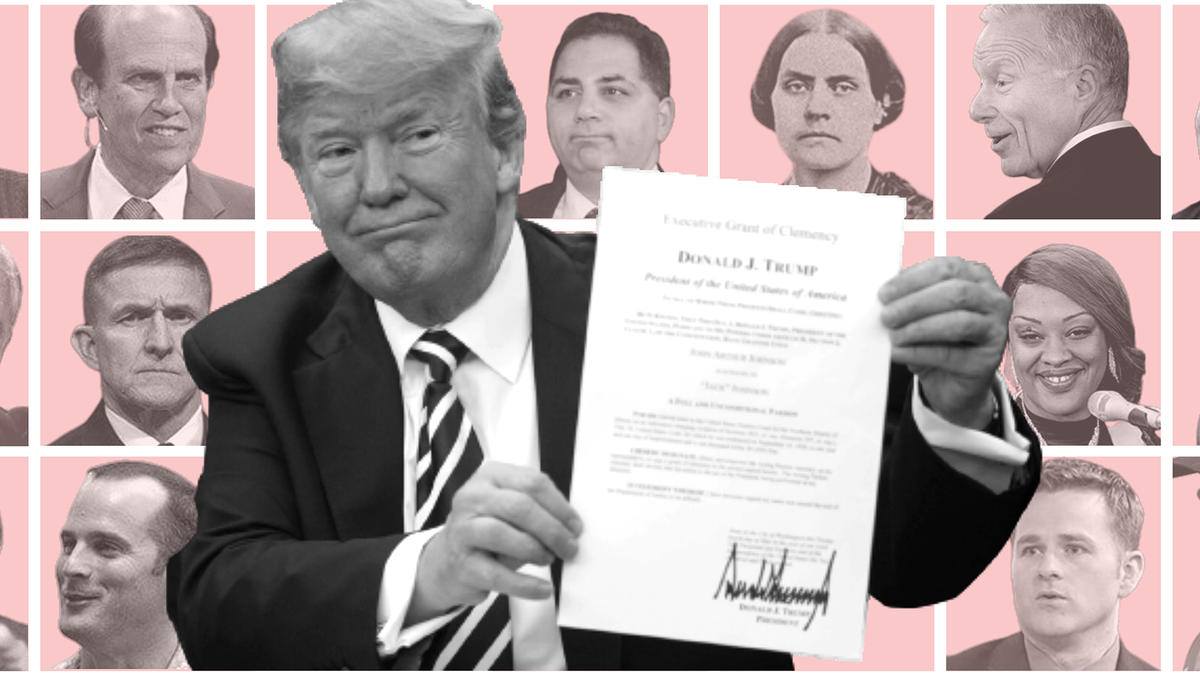

Trumps Posthumous Pardon For Pete Rose A Presidential Promise

Apr 29, 2025

Trumps Posthumous Pardon For Pete Rose A Presidential Promise

Apr 29, 2025 -

Unionized Starbucks Employees Turn Down Companys Pay Raise Proposal

Apr 29, 2025

Unionized Starbucks Employees Turn Down Companys Pay Raise Proposal

Apr 29, 2025 -

Cybercrime Investigation Executive Office365 Accounts Targeted Millions Lost

Apr 29, 2025

Cybercrime Investigation Executive Office365 Accounts Targeted Millions Lost

Apr 29, 2025 -

Beirut Under Fire Israeli Airstrike Prompts Urgent Evacuation

Apr 29, 2025

Beirut Under Fire Israeli Airstrike Prompts Urgent Evacuation

Apr 29, 2025 -

Solve The Nyt Spelling Bee Answers And Pangram For April 27 2025

Apr 29, 2025

Solve The Nyt Spelling Bee Answers And Pangram For April 27 2025

Apr 29, 2025