Understanding Stock Market Valuations: BofA's Argument For Continued Investment

Table of Contents

BofA's Key Valuation Metrics and Their Interpretations

BofA's analysis of stock market valuations relies heavily on traditional metrics, but with a nuanced approach. They utilize a combination of price-to-earnings ratio (P/E), price-to-sales ratio (P/S), market capitalization, dividend yield, and earnings growth to form a comprehensive picture.

-

Traditional Metrics with a Twist: BofA doesn't simply rely on raw P/E and P/S ratios. They adjust these metrics to account for industry-specific factors, considering variations in growth rates, profitability, and risk profiles across different sectors. For example, a high P/E ratio for a high-growth technology company might be justified compared to a mature, slow-growth utility company.

-

Identifying Undervalued and Overvalued Sectors: By applying these adjusted metrics, BofA identifies sectors they deem undervalued or overvalued. Their research may highlight opportunities in sectors showing strong earnings growth despite seemingly high P/E ratios, or conversely, warn against sectors with high valuations and sluggish growth prospects. Understanding this nuanced approach is key to interpreting their findings.

-

Beyond Traditional Ratios: While P/E and P/S ratios are central, BofA's analysis likely incorporates other valuation models, possibly including discounted cash flow (DCF) analysis or other more sophisticated techniques, to paint a more complete picture of intrinsic value. These additional methods provide a broader perspective beyond simple ratios.

BofA's Macroeconomic Outlook and Its Impact on Stock Market Valuations

BofA's stock market valuation assessment is deeply intertwined with their macroeconomic outlook. Their predictions for key economic indicators significantly influence their assessment of stock market valuations.

-

Key Macroeconomic Predictions: BofA's forecasts on inflation, interest rates, economic growth, recession risk, and monetary policy are crucial. Their analysis considers the potential impact of geopolitical risks and other unforeseen events that could significantly influence market behavior.

-

Influence on Stock Market Valuations: A positive macroeconomic outlook, characterized by moderate inflation, sustainable economic growth, and stable interest rates, generally supports higher stock valuations. Conversely, a pessimistic outlook, involving high inflation, recessionary risks, and aggressive monetary policy tightening, might justify lower valuations.

-

Risk Assessment: BofA's analysis thoroughly considers potential risks. They weigh the probability and potential impact of various scenarios, such as a sharp increase in inflation or a significant economic downturn. This risk assessment is integrated into their overall valuation assessment, informing their recommendations.

-

Comparison to Other Forecasts: It’s important to compare BofA's macroeconomic outlook with forecasts from other reputable economic institutions. This comparative analysis helps gauge the consensus view and identify potential areas of divergence or consensus.

Sector-Specific Analysis from BofA: Identifying Opportunities and Risks

BofA provides detailed sector-specific analyses, identifying both opportunities and risks within various market segments.

-

Attractive Investment Opportunities: BofA might highlight sectors like technology stocks (driven by innovation and growth), energy stocks (benefiting from high energy prices), or healthcare stocks (with long-term growth potential), as attractive investment opportunities.

-

Rationale Behind Recommendations: For each sector, BofA explains the rationale behind their recommendations, considering factors such as earnings growth, industry trends, competitive dynamics, and regulatory changes.

-

Sector-Specific Risks: They also discuss potential risks associated with investing in each sector. For example, technology stocks may be vulnerable to interest rate hikes, while energy stocks can be susceptible to commodity price fluctuations.

-

Comparison with Other Analyses: Comparing BofA's sector-specific outlooks with analyses from other financial institutions helps identify areas of agreement and disagreement, enriching the overall investment perspective.

Addressing Concerns About High Valuations in Certain Sectors

Concerns about high valuations, particularly in growth stocks, are valid. However, BofA's analysis likely attempts to justify its recommendations even within seemingly overvalued sectors.

-

Justifying High Valuations: BofA might argue that high valuations in certain growth sectors are justified by exceptionally strong earnings growth potential or disruptive innovation driving significant future returns. They may use discounted cash flow (DCF) models to project future cash flows and justify current pricing.

-

Potential for Market Corrections: They may acknowledge the risk of a market correction, but suggest that well-chosen growth stocks with strong fundamentals are likely to outperform the broader market even during periods of volatility.

-

Mitigation Strategies: To mitigate the risks associated with high valuations, BofA may recommend diversification strategies, focusing on quality companies with solid balance sheets and sustainable growth prospects. They might advise against chasing high-flying, speculative stocks and emphasize careful risk management.

Conclusion

This article explored BofA's arguments for continued investment in the stock market, despite concerns about valuations. We examined their key valuation metrics, macroeconomic outlook, and sector-specific analyses. BofA's perspective incorporates several factors, showcasing a nuanced approach to current market conditions. Understanding their interpretation of traditional valuation metrics like P/E and P/S ratios, their macroeconomic forecasts, and their sector-specific views provides a robust understanding of their bullish case for continued investment.

Call to Action: Understanding stock market valuations is crucial for informed investment decisions. While BofA's analysis offers a compelling perspective, remember to conduct your own thorough research before making any investment choices. Continue learning about stock market valuations and developing your own investment strategy. Consider consulting a financial advisor to help you navigate the complexities of stock market investment. Remember to always assess your own risk tolerance before making any investment decisions based on any analysis, including this overview of BofA's perspective on stock market valuations.

Featured Posts

-

Fortnite Down Chapter 6 Season 2 Server Downtime And Maintenance

May 02, 2025

Fortnite Down Chapter 6 Season 2 Server Downtime And Maintenance

May 02, 2025 -

Bebe De L Annee Une Boulangerie Normande Offre Son Poids En Chocolat

May 02, 2025

Bebe De L Annee Une Boulangerie Normande Offre Son Poids En Chocolat

May 02, 2025 -

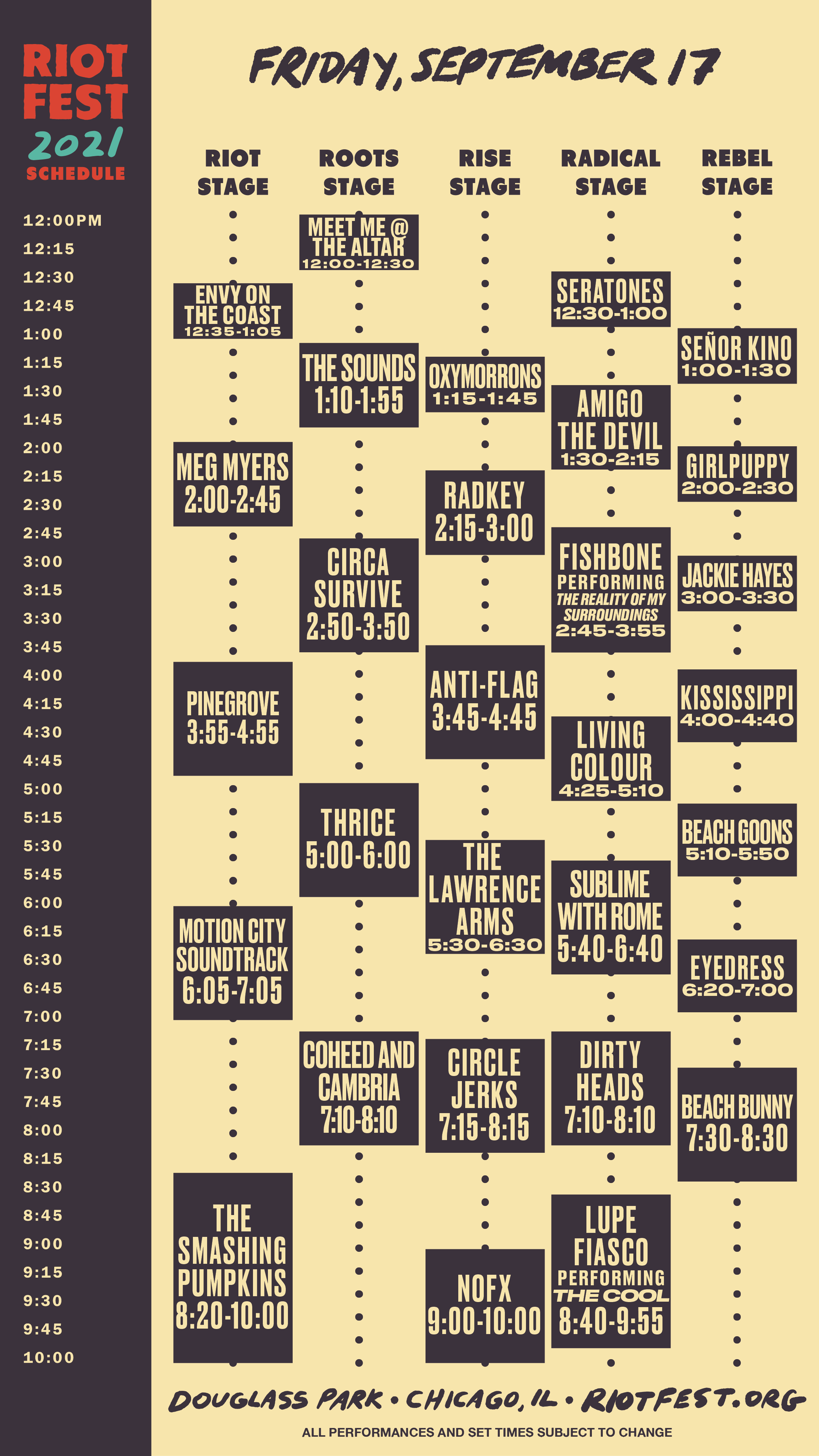

Riot Fest 2025 Lineup Revealed Green Day Weezer Lead The Charge

May 02, 2025

Riot Fest 2025 Lineup Revealed Green Day Weezer Lead The Charge

May 02, 2025 -

Kshmyr Ansaf Amn Awr Jnwby Ayshyae Ka Mstqbl

May 02, 2025

Kshmyr Ansaf Amn Awr Jnwby Ayshyae Ka Mstqbl

May 02, 2025 -

Kampen Dagvaardt Enexis Weigering Stroomnetaansluiting

May 02, 2025

Kampen Dagvaardt Enexis Weigering Stroomnetaansluiting

May 02, 2025