Understanding Personal Loan Interest Rates Today: A Borrower's Guide

Table of Contents

Factors Influencing Personal Loan Interest Rates

Several factors significantly impact the interest rate you'll receive on a personal loan. Understanding these factors empowers you to improve your chances of securing a lower rate.

Credit Score: The Cornerstone of Your Interest Rate

Your credit score is arguably the most significant factor determining your personal loan interest rate. Lenders use your credit score to assess your creditworthiness – essentially, your ability to repay the loan.

- Excellent credit (750+): May qualify you for rates as low as 6% to 8%.

- Good credit (700-749): Could result in rates between 8% and 12%.

- Fair credit (650-699): Might lead to rates around 12% to 18%, or even higher.

- Poor credit (below 650): Often results in significantly higher rates, or loan rejection.

Regularly checking your credit report from agencies like Experian, Equifax, and TransUnion is crucial for identifying and resolving any errors that could negatively impact your score and, consequently, your interest rate. Addressing any negative marks on your credit history can significantly improve your chances of getting a favorable interest rate. Keywords: Credit score, credit report, credit history, interest rate range, creditworthiness.

Loan Amount and Term: Size and Duration Matter

The amount you borrow and the length of your repayment term also influence your interest rate.

- Larger loan amounts: Typically come with higher interest rates due to increased risk for the lender.

- Longer loan terms: While making monthly payments more manageable, longer terms usually result in higher overall interest costs because you're paying interest for a longer period.

For example, a $10,000 loan over 3 years might have a lower interest rate than a $10,000 loan over 5 years. Understanding this relationship helps you balance affordability with the total cost of borrowing. Keywords: Loan amount, loan term, repayment period, APR (Annual Percentage Rate), loan cost.

Lender Type: Banks, Credit Unions, and Online Lenders

Different types of lenders offer varying interest rates.

- Banks: Often have competitive rates, especially for borrowers with excellent credit, but may have stricter eligibility requirements.

- Credit Unions: May offer lower rates and more personalized service, but membership requirements might apply.

- Online Lenders: Frequently provide convenient online applications and potentially faster approvals, but interest rates can vary widely.

Comparing offers from multiple lenders is crucial to finding the most competitive personal loan interest rates. Keywords: Bank loan, credit union loan, online loan, lender comparison, loan eligibility.

Debt-to-Income Ratio (DTI): A Key Eligibility Factor

Your debt-to-income ratio (DTI) – the percentage of your gross monthly income that goes towards debt payments – plays a vital role in your loan application. A high DTI indicates you're already carrying a substantial debt load, making lenders perceive you as a higher risk.

- Calculating DTI: Divide your total monthly debt payments (including credit cards, loans, etc.) by your gross monthly income.

- Impact on Interest Rates: A high DTI can lead to higher interest rates or even loan rejection.

Aim for a DTI below 43% to improve your chances of approval and securing a competitive interest rate. Keywords: Debt-to-income ratio, DTI, loan approval, loan eligibility, debt consolidation.

How to Find the Best Personal Loan Interest Rates

Securing the best personal loan interest rates requires proactive steps.

Shop Around and Compare: Don't Settle for the First Offer

Never accept the first loan offer you receive. Use online comparison tools to gather multiple quotes from various lenders. This process allows you to compare interest rates, fees, and loan terms to identify the most favorable option. Keywords: Rate comparison, loan comparison, best interest rates, online comparison tools.

Negotiate with Lenders: Don't Be Afraid to Ask

Don't hesitate to negotiate with lenders. If you have excellent credit and have received a better offer elsewhere, you may be able to negotiate a lower interest rate. Keywords: Interest rate negotiation, lower interest rates, loan negotiation.

Consider Pre-qualification: Check Your Eligibility

Pre-qualifying for a loan allows you to get an estimate of your potential interest rate without impacting your credit score. This step helps you gauge your eligibility and allows you to shop more effectively. Keywords: Pre-qualification, loan pre-approval, credit score impact.

Understanding APR and Other Fees

Understanding the Annual Percentage Rate (APR) and other associated fees is vital for comparing loan offers accurately.

APR Explained: The True Cost of Borrowing

The APR represents the total cost of borrowing, including the interest rate and other fees. It's expressed as a yearly percentage and helps you compare loans more accurately than simply comparing interest rates alone. Keywords: APR, annual percentage rate, interest rate, total loan cost.

Other Fees: Hidden Costs Can Add Up

Be aware of potential fees like origination fees (charged by the lender for processing your loan), late payment fees, and prepayment penalties. These fees can significantly impact the overall cost of your loan. Keywords: Origination fees, late payment fees, loan fees, hidden fees.

Conclusion

Securing a favorable personal loan interest rate depends on several key factors, including your credit score, loan amount, loan term, lender type, and debt-to-income ratio. By shopping around, comparing offers from multiple lenders, and negotiating effectively, you can significantly improve your chances of getting the best personal loan interest rates. Remember to thoroughly understand the APR and associated fees to make an informed decision. By understanding personal loan interest rates and employing the strategies outlined above, you can secure the best possible financing for your needs. Start comparing personal loan interest rates today! Find low personal loan interest rates and the best personal loan rates by actively comparing lenders.

Featured Posts

-

Seven Players Amorim Wants Man United To Sign This Summer

May 28, 2025

Seven Players Amorim Wants Man United To Sign This Summer

May 28, 2025 -

Direct Lender Tribal Loans Bad Credit And Guaranteed Approval Options

May 28, 2025

Direct Lender Tribal Loans Bad Credit And Guaranteed Approval Options

May 28, 2025 -

Why Are More Marlin Fishermen Using Torpedo Bats

May 28, 2025

Why Are More Marlin Fishermen Using Torpedo Bats

May 28, 2025 -

Trump Delays Eu Tariffs Until July 9th What It Means

May 28, 2025

Trump Delays Eu Tariffs Until July 9th What It Means

May 28, 2025 -

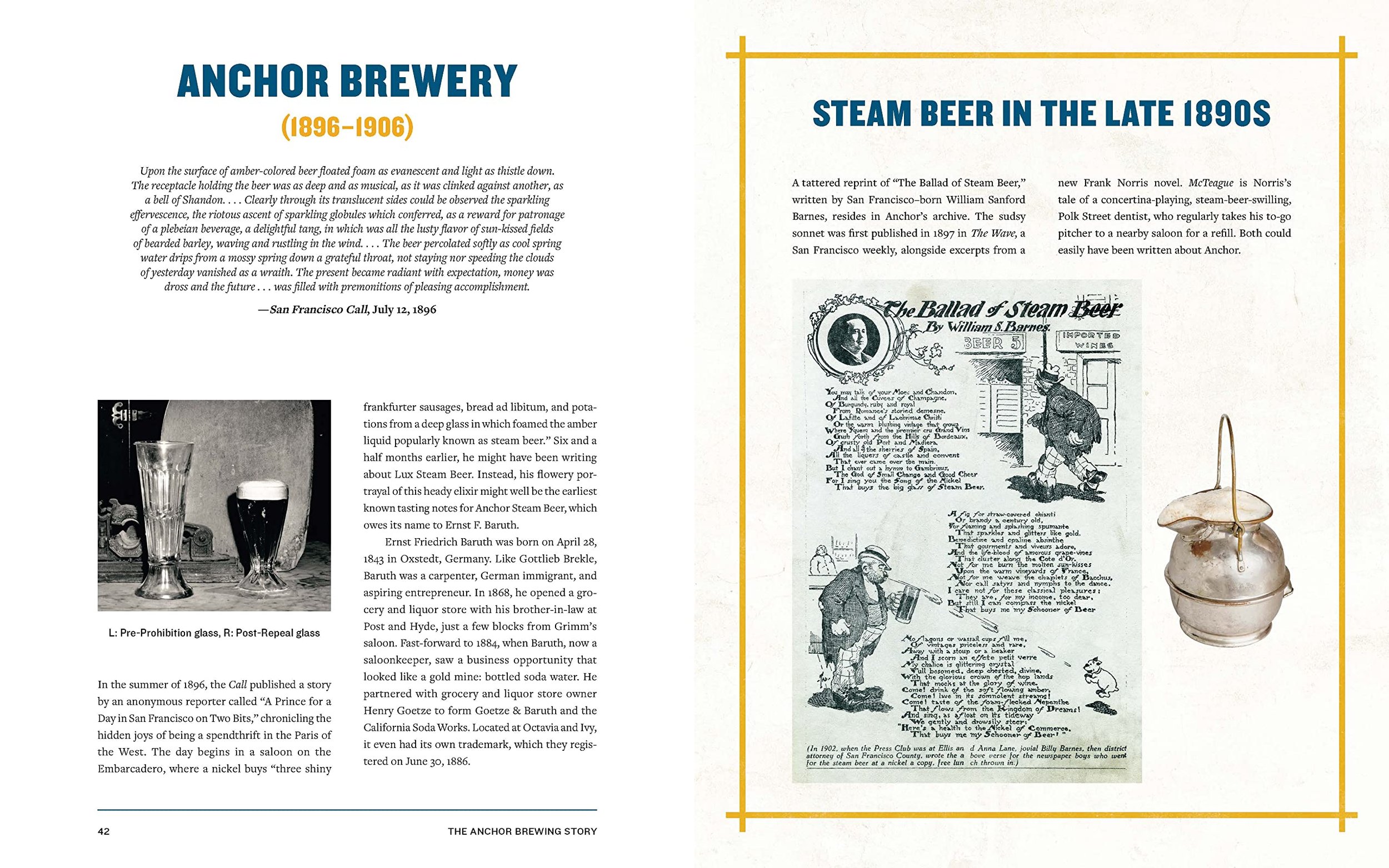

Anchor Brewing Companys Closure Whats Next For San Franciscos Iconic Brewery

May 28, 2025

Anchor Brewing Companys Closure Whats Next For San Franciscos Iconic Brewery

May 28, 2025

Latest Posts

-

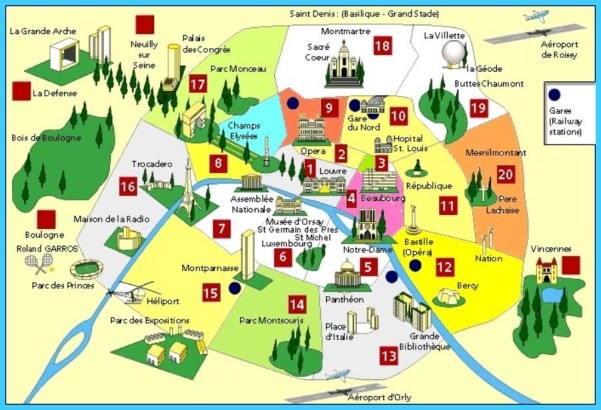

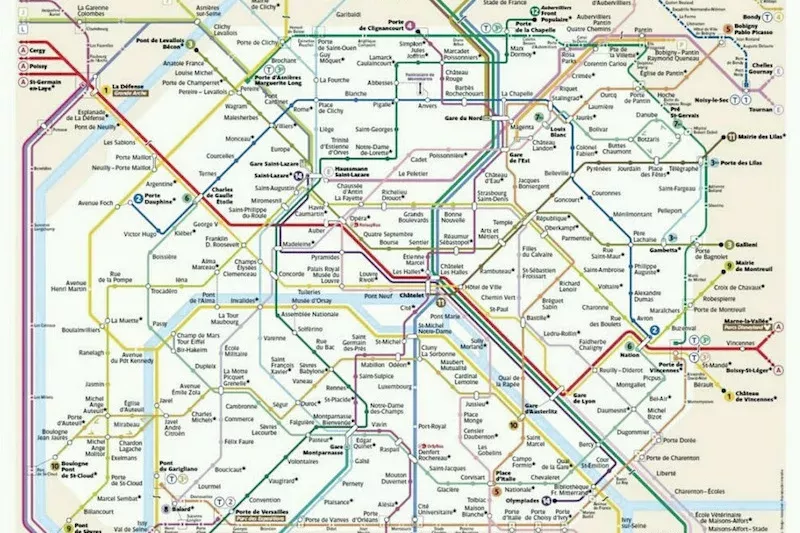

Exploring Paris A Guide To Its Finest Neighborhoods

May 30, 2025

Exploring Paris A Guide To Its Finest Neighborhoods

May 30, 2025 -

Discover The Best Areas To Stay In Paris

May 30, 2025

Discover The Best Areas To Stay In Paris

May 30, 2025 -

Paris Neighborhood Guide Expert Recommendations

May 30, 2025

Paris Neighborhood Guide Expert Recommendations

May 30, 2025 -

Top Paris Neighborhoods An Insiders Review

May 30, 2025

Top Paris Neighborhoods An Insiders Review

May 30, 2025 -

The Best Neighborhoods In Paris A Locals Perspective

May 30, 2025

The Best Neighborhoods In Paris A Locals Perspective

May 30, 2025