Understanding No Credit Check Loans With Guaranteed Approval From Direct Lenders

Table of Contents

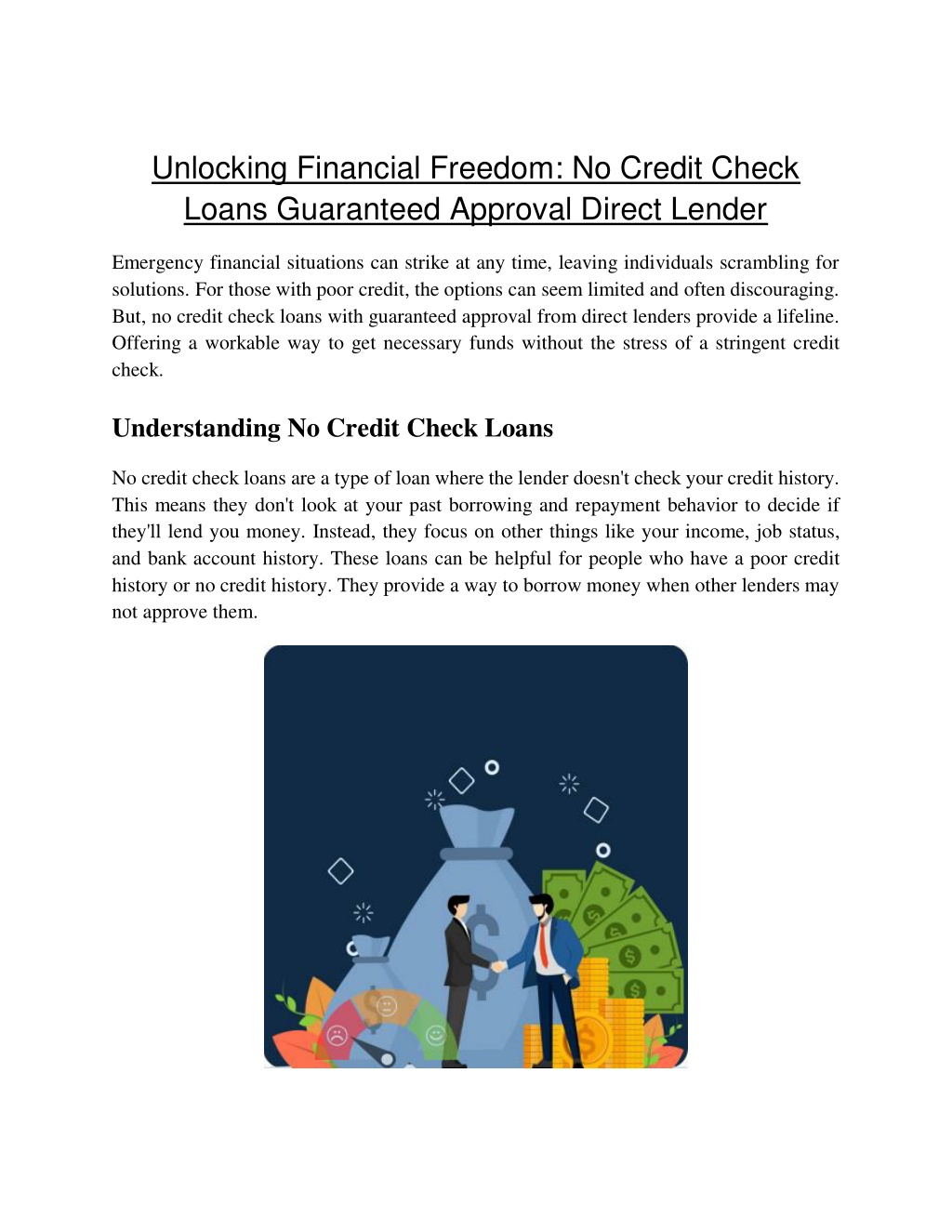

Finding yourself in a financial bind with bad credit can feel overwhelming. Many believe the solution lies in "no credit check loans with guaranteed approval from direct lenders." This article will explore the reality of these loans, helping you understand the advantages, disadvantages, and crucial factors to consider before applying. We’ll demystify the process and guide you toward making informed financial decisions.

What are No Credit Check Loans with Guaranteed Approval?

The term "no credit check loans with guaranteed approval" often conjures up images of easy, instant money. However, the reality is more nuanced. While some lenders advertise "no credit check," this rarely means a complete absence of credit assessment. Instead, it often refers to a soft credit check, which doesn't impact your credit score as significantly as a hard inquiry. A hard credit check is what happens when a lender pulls your full credit report.

- How Lenders Assess Risk Without a Traditional Credit Check: To mitigate risk, lenders offering no credit check loans often rely on alternative methods of assessment. These might include verifying your income through pay stubs or bank statements, checking your employment history, and assessing your debt-to-income ratio. They may also utilize alternative credit scoring models that consider factors beyond your traditional credit report.

- Higher Interest Rates: Because these loans carry a higher risk for lenders due to the lack of comprehensive credit history, they usually come with significantly higher interest rates than traditional loans. This means you'll pay more in interest over the life of the loan.

- "Guaranteed Approval" is Misleading: The phrase "guaranteed approval" is often a marketing tactic. While you may have a higher chance of approval compared to a traditional loan application, it doesn't guarantee that you'll receive the loan. Lenders still need to assess your ability to repay, even without a formal credit check.

Advantages and Disadvantages of No Credit Check Loans

Advantages:

- Quick Access to Funds: No credit check loans can provide a rapid solution for urgent financial needs, such as unexpected medical bills or car repairs. The application process is often faster than traditional loan applications.

- Option for Poor Credit: Individuals with poor credit scores or a limited credit history may find it easier to qualify for a no credit check loan than a traditional loan. This can be a lifeline in situations where other financing options are unavailable.

- Potential Credit Building: While rare, some lenders report timely payments from no credit check loans to credit bureaus. This could potentially help you establish or improve your credit score, providing a path toward better financial opportunities in the future.

Disadvantages:

- Extremely High Interest Rates: The most significant drawback is the substantially higher interest rates compared to loans that require a credit check. These high rates can quickly lead to a debt trap if not managed carefully.

- Short Repayment Terms: No credit check loans often have shorter repayment periods than traditional loans. This results in higher monthly payments, making repayment more challenging for some borrowers.

- Risk of Predatory Lending: Unfortunately, some lenders offering no credit check loans engage in predatory lending practices, such as charging excessive fees or using deceptive marketing tactics.

- Debt Cycle: The high interest rates and short repayment terms can easily trap borrowers in a cycle of debt, leading to further financial hardship.

Finding Reputable Direct Lenders for No Credit Check Loans

Finding a trustworthy lender is crucial when considering no credit check loans. The risks associated with unregulated or predatory lenders are substantial. Therefore, rigorous research is essential before applying for any loan.

- Check Licensing and Registration: Ensure the lender is properly licensed and registered with the relevant authorities in your state or country. This helps protect you from fraudulent operations.

- Read Online Reviews: Consult online review platforms to gauge the experiences of other borrowers. Look for consistent patterns of positive or negative feedback.

- Compare Interest Rates and Fees: Obtain quotes from multiple lenders before committing to a loan. Carefully compare interest rates, fees, and repayment terms to find the most favorable offer.

- Understand the Loan Agreement: Before signing any agreement, thoroughly read and understand all the terms and conditions. Don't hesitate to seek clarification from the lender if anything is unclear.

- Be Wary of "Guaranteed Approval": Be cautious of lenders who promise "guaranteed approval" without asking for any information about your financial situation. This is a red flag for potentially predatory practices.

Alternatives to No Credit Check Loans

While no credit check loans might seem appealing in a pinch, exploring alternative financing options is always recommended. These alternatives usually come with better terms and conditions.

- Secured Loans: Secured loans require collateral, such as a car or house. This lowers the lender's risk, potentially resulting in lower interest rates.

- Credit Unions: Credit unions often offer more favorable loan terms than traditional banks, especially for members with less-than-perfect credit.

- Personal Loans from Banks: While more challenging to obtain with poor credit, a personal loan from a bank (possibly with a co-signer) can offer better rates than no credit check loans.

- Debt Consolidation Programs: Consolidating high-interest debts into a single, lower-interest loan can simplify repayment and reduce overall interest costs.

- Secured Credit Cards: Building credit through secured credit cards can improve your credit score over time, making it easier to obtain more favorable loan terms in the future.

Conclusion

No credit check loans with guaranteed approval from direct lenders can provide quick access to funds but come with substantial risks. Understanding the advantages, disadvantages, and alternatives is crucial for making responsible financial choices. Thorough research and careful comparison of lenders are essential to avoid predatory practices and ensure you obtain the best possible terms.

Call to Action: Need funds quickly? While "guaranteed approval" on no credit check loans is often a misconception, you can find responsible direct lenders offering alternatives. Start your research today and find a loan that works for your financial situation. Remember to compare offers from multiple lenders specializing in no credit check loans or alternatives before making a decision.

Featured Posts

-

Wildfire Woes Analyzing The Market For Los Angeles Wildfire Bets

May 28, 2025

Wildfire Woes Analyzing The Market For Los Angeles Wildfire Bets

May 28, 2025 -

Bandung Besok 22 4 Prakiraan Cuaca And Kemungkinan Hujan Siang Hari

May 28, 2025

Bandung Besok 22 4 Prakiraan Cuaca And Kemungkinan Hujan Siang Hari

May 28, 2025 -

1968 And 2024 A Springtime Comparison And Summer Drought Outlook

May 28, 2025

1968 And 2024 A Springtime Comparison And Summer Drought Outlook

May 28, 2025 -

Arsenals Key Transfer Target Ahead Of Real Madrid And Manchester United

May 28, 2025

Arsenals Key Transfer Target Ahead Of Real Madrid And Manchester United

May 28, 2025 -

Key Transfer Target Arsenal Beats Real Madrid And Man Utd To Signing

May 28, 2025

Key Transfer Target Arsenal Beats Real Madrid And Man Utd To Signing

May 28, 2025

Latest Posts

-

Ira Khans Unexpected Agassi Meeting A Revelation

May 30, 2025

Ira Khans Unexpected Agassi Meeting A Revelation

May 30, 2025 -

Andre Agassi Declaratie Socanta Despre Nervi

May 30, 2025

Andre Agassi Declaratie Socanta Despre Nervi

May 30, 2025 -

Andre Agassi To Play First Professional Pickleball Tournament

May 30, 2025

Andre Agassi To Play First Professional Pickleball Tournament

May 30, 2025 -

Agassi Rios Uno De Mis Mas Grandes Desafios En El Tenis

May 30, 2025

Agassi Rios Uno De Mis Mas Grandes Desafios En El Tenis

May 30, 2025 -

Andre Agassis Pickleball Debut First Pro Tournament Appearance

May 30, 2025

Andre Agassis Pickleball Debut First Pro Tournament Appearance

May 30, 2025