Understanding Jim Cramer's Opinion On CoreWeave (CRWV) And Its OpenAI Ties

Table of Contents

Jim Cramer's Public Statements on CoreWeave (CRWV): A Deep Dive

Finding explicit, direct statements from Jim Cramer regarding CoreWeave (CRWV) proves challenging. A thorough search of transcripts from his CNBC shows ("Mad Money," "Squawk on the Street"), his Twitter feed, and other publicly available media reveals a surprising lack of dedicated discussion about the company. This absence of commentary doesn't necessarily equate to a negative opinion; rather, it highlights the complexities of analyzing a relatively new player in a rapidly evolving market.

-

Summarizing Positive Comments: To date, there are no publicly documented positive comments specifically mentioning CoreWeave from Jim Cramer. The lack of positive statements shouldn't be interpreted as negative, however. It simply reflects the limited public engagement with the CRWV stock from Cramer.

-

Summarizing Negative Comments or Criticisms: Similarly, there's no record of Cramer publicly criticizing CoreWeave. This silence leaves room for interpretation, prompting further analysis of the company's fundamentals.

-

Instances of Silence: The most prominent observation is the consistent absence of CoreWeave from Cramer's discussions. This silence, within the context of his frequent commentary on other tech stocks and the AI sector, is noteworthy.

-

Analyzing Contextual Factors: The timing of CoreWeave's IPO and subsequent market performance needs to be considered. Market volatility, prevailing economic conditions, and other competing news cycles can all influence which stocks Cramer chooses to highlight.

CoreWeave's Business Model and its Dependence on OpenAI

CoreWeave's business model centers on providing cloud computing services, specifically tailored for high-performance computing (HPC) and artificial intelligence (AI) workloads. They offer scalable infrastructure solutions, utilizing powerful GPUs and other specialized hardware to meet the demanding needs of AI applications. Their critical partnership with OpenAI represents a significant portion of their business.

CoreWeave’s relationship with OpenAI is strategic and mutually beneficial. CoreWeave provides the crucial infrastructure for OpenAI's large language models (LLMs) and other AI initiatives. This partnership fuels CoreWeave's growth and provides valuable real-world experience within the cutting-edge AI domain.

-

Specific Services for OpenAI: CoreWeave provides OpenAI with significant compute power, allowing them to train and deploy their large language models. This involves providing access to specialized hardware, software, and networking capabilities.

-

Impact on Revenue Streams: OpenAI's business constitutes a major part of CoreWeave's revenue, highlighting the strategic importance of this partnership. This dependence, however, also presents potential risks.

-

Risks of Close Relationship: Reliance on a single, albeit significant, client like OpenAI carries inherent risk. If the OpenAI partnership were to significantly change or diminish, it could negatively impact CoreWeave's financial performance.

Market Analysis and Investment Implications

CoreWeave's market valuation fluctuates, reflecting the inherent volatility of the tech sector and investor sentiment surrounding AI-related companies. Analyzing CoreWeave's potential requires a careful assessment of its financial performance, competitive landscape, and growth trajectory.

-

Key Financial Metrics: Investors should closely examine CoreWeave's revenue growth, profitability, and cash flow. Analyzing these metrics alongside industry benchmarks is essential for a fair valuation.

-

Competitive Landscape: CoreWeave competes with established cloud giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). The competitive intensity requires CoreWeave to maintain its technological edge and innovative offerings.

-

Risks and Rewards: The potential rewards of investing in CoreWeave include exposure to the rapidly expanding AI market. However, risks include reliance on key partnerships, intense competition, and inherent volatility within the technology sector. Diversification within a broader investment portfolio is crucial to mitigate risk.

Conclusion

This article explored Jim Cramer's (or lack thereof) known opinions on CoreWeave (CRWV) and dissected the company's vital partnership with OpenAI. While Cramer hasn't publicly commented extensively on CRWV, understanding CoreWeave's business model, its dependence on the OpenAI partnership, and prevailing market sentiment is crucial for prospective investors. We analyzed CoreWeave's financial performance, competitive position, and the inherent risks and rewards associated with investing in this high-growth, high-risk company.

Call to Action: While this analysis offers valuable insights into Jim Cramer's (potential) perspective and CoreWeave's prospects, further independent research is paramount before making any investment decisions regarding Jim Cramer CoreWeave and its OpenAI connections. Remember, always conduct thorough due diligence before investing in any stock, especially within the volatile technology sector.

Featured Posts

-

Five Fugitives Remain At Large New Orleans Sheriff Withdraws

May 22, 2025

Five Fugitives Remain At Large New Orleans Sheriff Withdraws

May 22, 2025 -

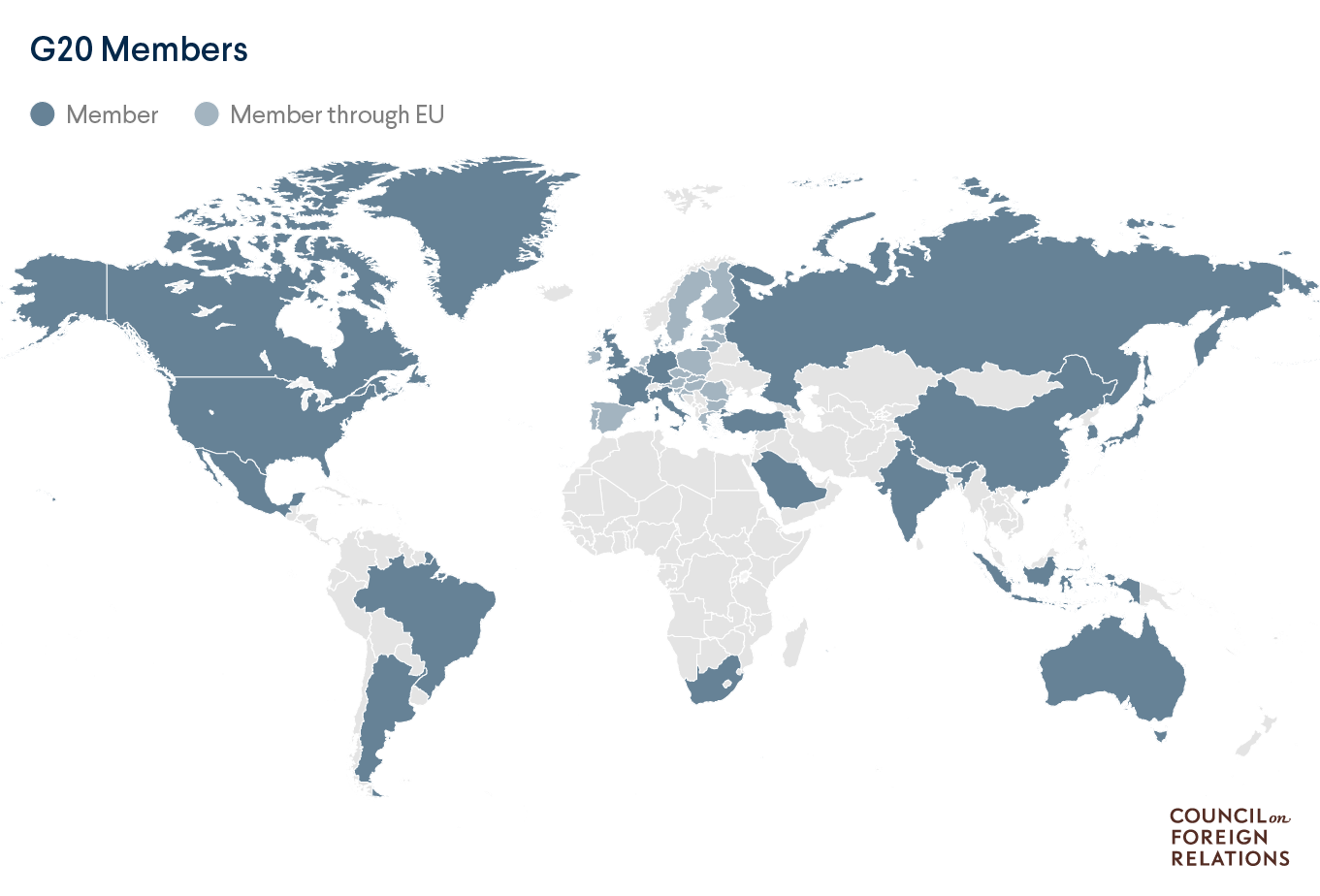

Soaring Us China Trade Impact Of The Trade Truce Extension

May 22, 2025

Soaring Us China Trade Impact Of The Trade Truce Extension

May 22, 2025 -

Bwtshytynw Ystdey 3 Wjwh Jdydt Lmntkhb Alwlayat Almthdt

May 22, 2025

Bwtshytynw Ystdey 3 Wjwh Jdydt Lmntkhb Alwlayat Almthdt

May 22, 2025 -

Concert Hellfest Mulhouse Accueille L Evenement

May 22, 2025

Concert Hellfest Mulhouse Accueille L Evenement

May 22, 2025 -

Le Matin Auto Experience De Conduite De L Alfa Romeo Junior 1 2 Turbo Speciale

May 22, 2025

Le Matin Auto Experience De Conduite De L Alfa Romeo Junior 1 2 Turbo Speciale

May 22, 2025

Latest Posts

-

Darkly Funny Netflix Drama Series Features White Lotus And Oscar Winning Talent

May 22, 2025

Darkly Funny Netflix Drama Series Features White Lotus And Oscar Winning Talent

May 22, 2025 -

Un Serial Netflix Cu O Distributie Stelara Ce Asteptari Putem Avea

May 22, 2025

Un Serial Netflix Cu O Distributie Stelara Ce Asteptari Putem Avea

May 22, 2025 -

Siren Trailer Julianne Moore Addresses Monster Accusations

May 22, 2025

Siren Trailer Julianne Moore Addresses Monster Accusations

May 22, 2025 -

Exploring Netflixs Sirens Limited Series A Comprehensive Guide

May 22, 2025

Exploring Netflixs Sirens Limited Series A Comprehensive Guide

May 22, 2025 -

Netflix Un Serial Nou Cu O Distributie Care Aspira La Oscar

May 22, 2025

Netflix Un Serial Nou Cu O Distributie Care Aspira La Oscar

May 22, 2025