Understanding HMRC's Changes To Side Hustle Tax: A Guide To The New US-Inspired Approach

Table of Contents

The Shift Towards a US-Style Tax System for Side Hustles

HMRC is increasingly adopting a US-style approach to taxing side hustle income, moving away from a more lenient system. This means greater emphasis on individual responsibility and accurate reporting. The core changes include:

- Increased scrutiny of side hustle income declarations: HMRC is using sophisticated data-matching techniques to identify discrepancies between declared income and other financial information. This means it’s more important than ever to accurately report all your earnings.

- Emphasis on accurate record-keeping and expense tracking: Meticulous record-keeping is now crucial for demonstrating compliance and avoiding penalties. Simply estimating income won't suffice. You'll need detailed records to support your tax return.

- New thresholds for tax reporting: While the specific thresholds may vary depending on the type of side hustle, HMRC is increasingly lowering the limits for mandatory tax reporting, meaning more individuals will need to file self-assessment tax returns.

- Potential implications for self-assessment: Many more side hustlers will find themselves needing to complete a self-assessment tax return (SA100) annually, which requires a more detailed understanding of UK tax laws.

Understanding Your Tax Obligations with Your Side Hustle Income

Different side hustles have different tax implications. Understanding your specific obligations is key. Consider these examples:

- Freelance work: Income from freelance work is generally taxed as self-employment income. You'll need to pay Class 2 and Class 4 National Insurance contributions in addition to income tax.

- Selling goods online (e.g., Etsy, eBay): Profit from selling goods online is considered business profit and is subject to income tax and potentially VAT if your turnover exceeds the VAT threshold.

- Rental income: Rental income is taxed separately and you may need to register for self-assessment if your income exceeds certain limits.

Key considerations:

- Income thresholds: These vary depending on the type of income and your overall earnings. Familiarize yourself with the relevant thresholds to determine your reporting obligations.

- Relevant tax forms: The main form is the Self Assessment tax return (SA100), but other forms like SA103F may be required depending on your specific circumstances.

- Tax deductions and allowances: You can often deduct allowable business expenses from your side hustle income, reducing your overall tax liability. Ensure you are claiming all allowable expenses.

- Penalties for non-compliance: Failure to accurately report your side hustle income can result in significant penalties, including fines and interest charges.

Effective Record Keeping for Side Hustle Tax

Meticulous record-keeping is paramount for successful tax compliance. This involves:

- Tracking income and expenses: Use spreadsheets, accounting software (like Xero or FreeAgent), or dedicated side hustle apps to track every transaction accurately.

- Keeping receipts and invoices: Maintain digital and/or physical copies of all receipts and invoices for expenses and income.

- Organizing financial records: Develop a system for storing and organizing your financial records to make tax preparation easier and less stressful. Consider cloud storage for secure backup.

- Software recommendations: Explore accounting software designed for freelancers and small businesses to automate tasks such as invoicing, expense tracking, and tax reporting.

Seeking Professional Advice on Side Hustle Taxation

While managing your side hustle taxes might seem manageable initially, professional help can prove invaluable. Consider professional advice if:

- You have complex income streams: Multiple income sources or intricate business structures can make tax calculations complicated.

- Your income level is high: Higher income levels often trigger more complex tax considerations, making professional advice beneficial.

- You're unsure about your tax obligations: If you're unsure about which tax forms to use, what expenses you can claim, or other tax-related questions, seek guidance.

Benefits of professional help:

- Accurate tax calculations: Professionals ensure you pay the correct amount of tax and avoid costly mistakes.

- Identifying tax savings: They can help you identify and claim all eligible deductions and allowances, minimizing your tax burden.

- Compliance with HMRC regulations: Professional guidance helps you stay compliant with ever-evolving tax regulations.

Staying Updated on HMRC's Side Hustle Tax Regulations

Tax laws are dynamic. Staying updated is crucial to avoid penalties. Here’s how:

- Check the HMRC website: HMRC's website is the primary source for official tax information.

- Subscribe to HMRC newsletters: Sign up for email updates to receive notifications about changes in tax regulations.

- Follow reputable tax news sources: Stay informed about changes through reliable sources that provide up-to-date information on tax-related matters.

- Regular review: Regularly review your tax position to ensure your records are up-to-date and accurate.

Conclusion

HMRC's changes to side hustle tax represent a significant shift towards a more US-style system, emphasizing individual responsibility and accurate reporting. Maintaining meticulous records, understanding your tax obligations, and seeking professional advice when necessary are crucial for successful compliance. Don't get caught out: understand HMRC's changes to side hustle tax and take control of your financial future. Take proactive steps to ensure compliance with HMRC's new side hustle tax rules. For more information, visit the official HMRC website [link to HMRC website]. If you need assistance, contact us today for a free consultation.

Featured Posts

-

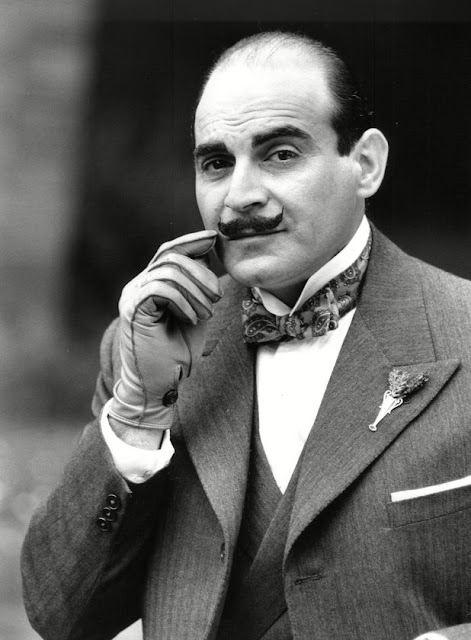

The World Of Agatha Christies Poirot Characters Settings And Adaptations

May 20, 2025

The World Of Agatha Christies Poirot Characters Settings And Adaptations

May 20, 2025 -

Tqnyat Aldhkae Alastnaey Mstqbl Ktabt Rwayat Aghatha Krysty

May 20, 2025

Tqnyat Aldhkae Alastnaey Mstqbl Ktabt Rwayat Aghatha Krysty

May 20, 2025 -

Man Utd Transfer News Matheus Cunha Update And Potential Alternatives

May 20, 2025

Man Utd Transfer News Matheus Cunha Update And Potential Alternatives

May 20, 2025 -

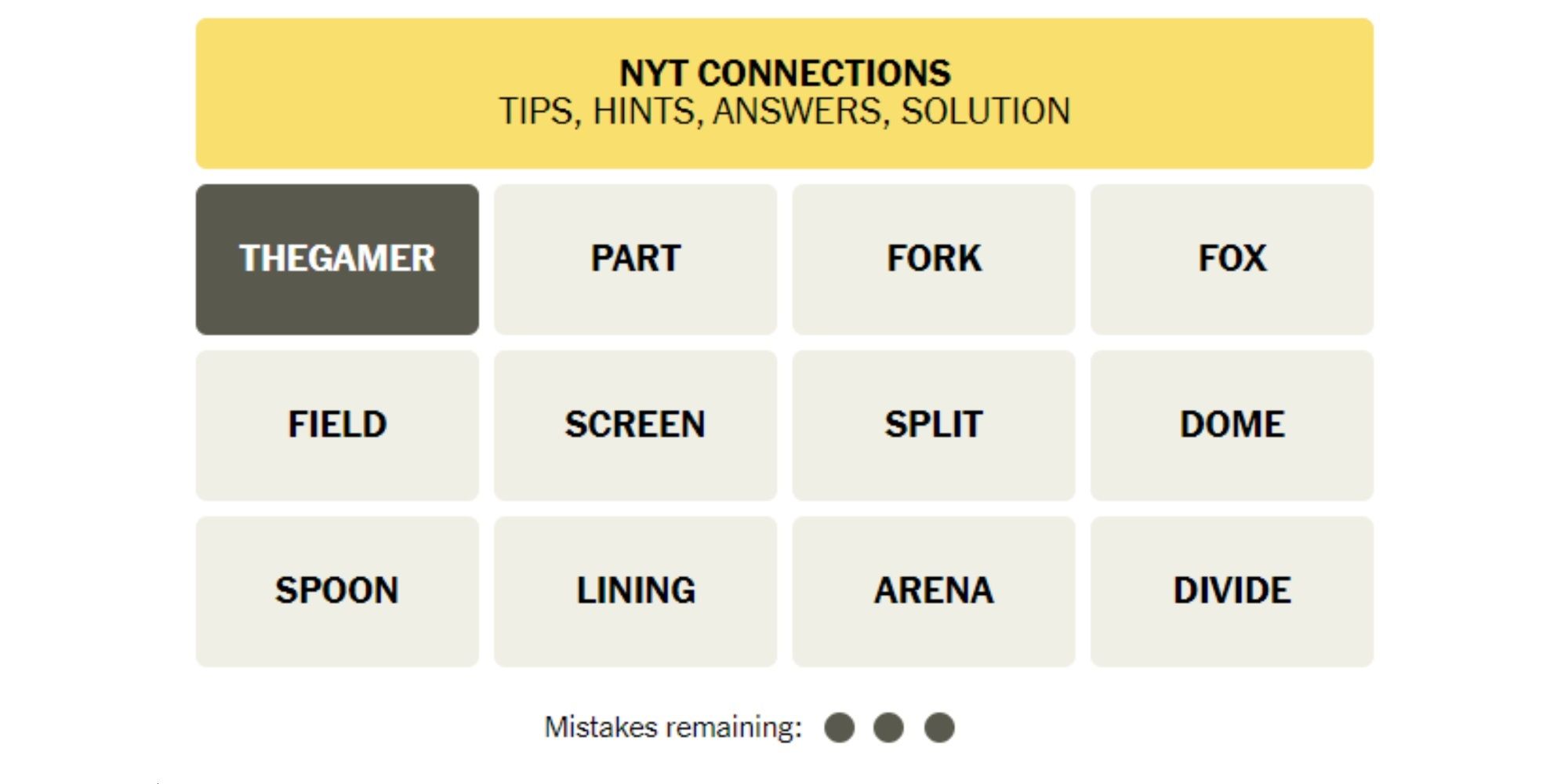

Nyt Mini Crossword Answers Today March 16 2025 Hints And Clues

May 20, 2025

Nyt Mini Crossword Answers Today March 16 2025 Hints And Clues

May 20, 2025 -

L Univers D Agatha Christie L Integrale Des Mysteres

May 20, 2025

L Univers D Agatha Christie L Integrale Des Mysteres

May 20, 2025

Latest Posts

-

Eurovision 2024 Louanes Song Revealed

May 20, 2025

Eurovision 2024 Louanes Song Revealed

May 20, 2025 -

Top 5 Eurovision 2025 Predictions Who Will Win

May 20, 2025

Top 5 Eurovision 2025 Predictions Who Will Win

May 20, 2025 -

Eurovision Song Contest 2025 Meet The Top 5 Frontrunners

May 20, 2025

Eurovision Song Contest 2025 Meet The Top 5 Frontrunners

May 20, 2025 -

Eurovision 2025 A Closer Look At The Top 5 Contenders

May 20, 2025

Eurovision 2025 A Closer Look At The Top 5 Contenders

May 20, 2025 -

Australia Us Missile Test Chinas Concerns Over Increased Regional Military Presence

May 20, 2025

Australia Us Missile Test Chinas Concerns Over Increased Regional Military Presence

May 20, 2025