Understanding High Stock Market Valuations: BofA's Rationale For Investors

BofA's Macroeconomic Outlook and its Impact on Valuations

BofA's macroeconomic outlook significantly influences their assessment of high stock market valuations. Their forecasts encompass growth predictions, inflation expectations, and interest rate projections, all of which interact to shape market valuations. Let's examine key aspects:

-

Bullet Point 1: Inflation's Long-Term Impact on Earnings Growth: BofA typically analyzes inflation's potential to erode corporate profit margins. High inflation can squeeze businesses, reducing earnings growth and impacting future stock prices. Their recent reports might highlight specific sectors particularly vulnerable to inflationary pressures, such as those with significant input costs. For example, a sustained period of high inflation could lead BofA to revise downward their earnings-per-share (EPS) forecasts for certain sectors, thus justifying lower valuations.

-

Bullet Point 2: Interest Rate Projections and Discounted Cash Flow Valuations: BofA's interest rate projections directly impact discounted cash flow (DCF) models, a crucial valuation tool. Higher interest rates increase the discount rate, reducing the present value of future cash flows and thus leading to lower valuations. BofA's predictions on the Federal Reserve's monetary policy are therefore critically important in determining their overall view on market valuations. Their analysis might include sensitivity analyses showing how different interest rate scenarios affect valuation multiples.

-

Bullet Point 3: Potential Economic Slowdown and its Effect on Stock Prices: BofA's assessment of the probability of an economic slowdown is crucial. A recessionary environment typically leads to lower corporate earnings and reduced investor confidence, resulting in lower stock prices. Their analysis might include leading economic indicators, such as consumer sentiment and manufacturing data, to predict the likelihood of a downturn and its potential impact on stock valuations.

Analyzing the Role of Corporate Earnings in Justifying High Valuations

BofA's assessment of corporate profitability is central to understanding their rationale on high valuations. They scrutinize profit margins, revenue growth, and sector-specific earnings to determine whether current valuations are justified.

-

Bullet Point 1: Profit Margin Sustainability: BofA analysts dissect profit margins, evaluating their sustainability in the current economic climate. They consider factors like input costs, competition, and pricing power to determine if current profit margins are realistic long-term expectations. A decline in profit margins could signal overvaluation.

-

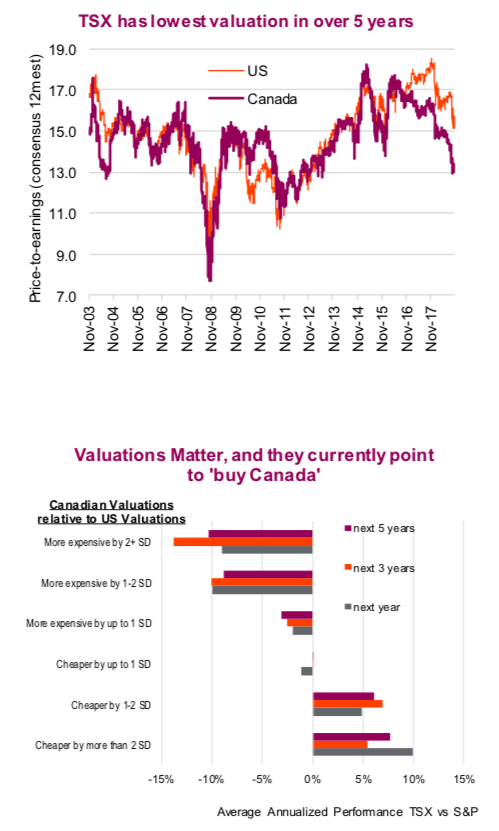

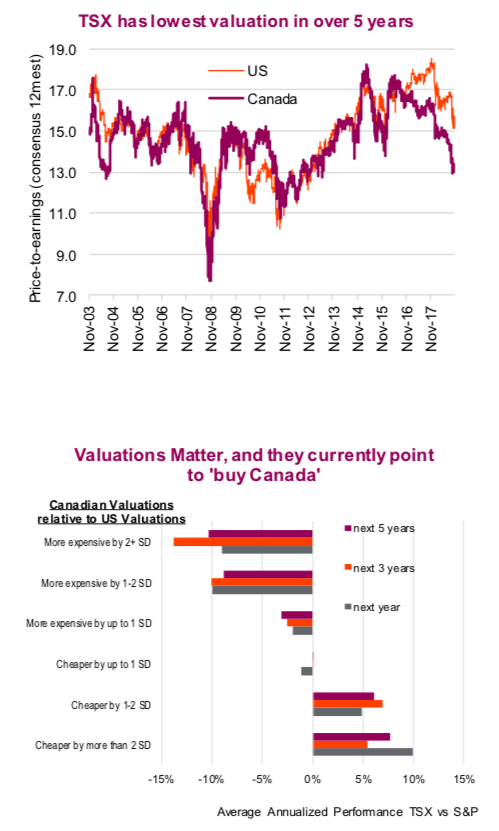

Bullet Point 2: Revenue Growth Forecasts and P/E Ratios: Revenue growth projections are key to justifying high Price-to-Earnings (P/E) ratios. Strong revenue growth can support higher valuations, while stagnant or declining revenue might suggest overvaluation. BofA's sector-specific revenue growth forecasts, coupled with their earnings predictions, inform their conclusions on whether current P/E ratios are reasonable.

-

Bullet Point 3: Sector-Specific Earnings Growth and Valuation Discrepancies: BofA's analysis often highlights valuation discrepancies across different sectors. Some sectors might be deemed overvalued relative to their earnings growth prospects, while others might be undervalued. They might highlight specific examples, indicating which sectors are exhibiting strong earnings growth and which are lagging.

The Influence of Interest Rates and Monetary Policy on Stock Market Valuations

BofA's understanding of interest rate hikes and monetary policy profoundly influences their valuation assessments. Interest rates and quantitative tightening (QT) directly impact market liquidity and investor behavior.

-

Bullet Point 1: Rising Interest Rates and the Discount Rate: As interest rates rise, the discount rate used in valuation models increases. This reduces the present value of future cash flows, lowering the intrinsic value of stocks. BofA's commentary on the Federal Reserve's actions and their impact on the discount rate is crucial in understanding their valuation perspective.

-

Bullet Point 2: Quantitative Tightening and Market Liquidity: Quantitative tightening (QT), where central banks reduce their balance sheets, can decrease market liquidity. Reduced liquidity can lead to increased volatility and potentially lower stock prices, impacting valuations. BofA's analysis considers the effects of QT on overall market sentiment and price discovery.

-

Bullet Point 3: Future Trajectory of Interest Rates and Valuation Multiples: BofA's predictions on the future path of interest rates heavily influence their assessment of valuation multiples. If they anticipate further rate hikes, they might suggest that current multiples are high relative to a future environment of higher interest rates.

Alternative Valuation Metrics Beyond P/E Ratios

BofA likely employs alternative valuation metrics beyond the traditional P/E ratio to gain a more holistic view.

-

Bullet Point 1: Alternative Metrics Explained: Metrics such as Price-to-Sales (P/S) ratio, Price-to-Earnings-Growth (PEG) ratio, and dividend yield offer different perspectives on valuation. The P/S ratio is useful for companies with negative earnings, while the PEG ratio considers growth rates. Dividend yield provides insights into income potential.

-

Bullet Point 2: Cross-Sector Comparison: BofA uses these alternative metrics to compare valuations across sectors, identifying potential over- or undervaluation relative to peers. This cross-sectional analysis provides a richer picture than solely relying on P/E ratios.

-

Bullet Point 3: Combined Metric Analysis: BofA likely uses a combination of valuation metrics to reach a more robust conclusion. No single metric provides a complete picture, and using several provides a more comprehensive assessment.

Conclusion

Understanding high stock market valuations requires a nuanced approach, considering macroeconomic factors, corporate earnings, and monetary policy. BofA's analysis provides valuable insights into these intertwined elements, offering investors a framework for evaluating market conditions. While BofA's perspective provides valuable guidance, individual investors should conduct thorough research and consider their own risk tolerance before making any investment decisions. Continue learning about navigating high stock market valuations to make informed choices for your portfolio. Stay updated on BofA's research and economic forecasts to better understand the dynamics of high stock market valuations and make sound investment strategies.

Understanding Ag Pam Bondis Decision Regarding The Release Of Jeffrey Epstein Files A Guide For Voters

Understanding Ag Pam Bondis Decision Regarding The Release Of Jeffrey Epstein Files A Guide For Voters

Lynk Lee Chuyen Gioi Nhan Sac Rang Ro Tinh Yeu Vien Man

Lynk Lee Chuyen Gioi Nhan Sac Rang Ro Tinh Yeu Vien Man

Us Deportations To El Salvador Concerns Over Due Process And Judicial Oversight

Us Deportations To El Salvador Concerns Over Due Process And Judicial Oversight

Mental Illness And Violence Challenging The Monster Myth

Mental Illness And Violence Challenging The Monster Myth

Transparency In Us Funding A Focus On Transgender Mouse Research

Transparency In Us Funding A Focus On Transgender Mouse Research