Understanding High Stock Market Valuations: BofA's Perspective For Investors

Table of Contents

BofA's Assessment of Current Stock Market Valuations

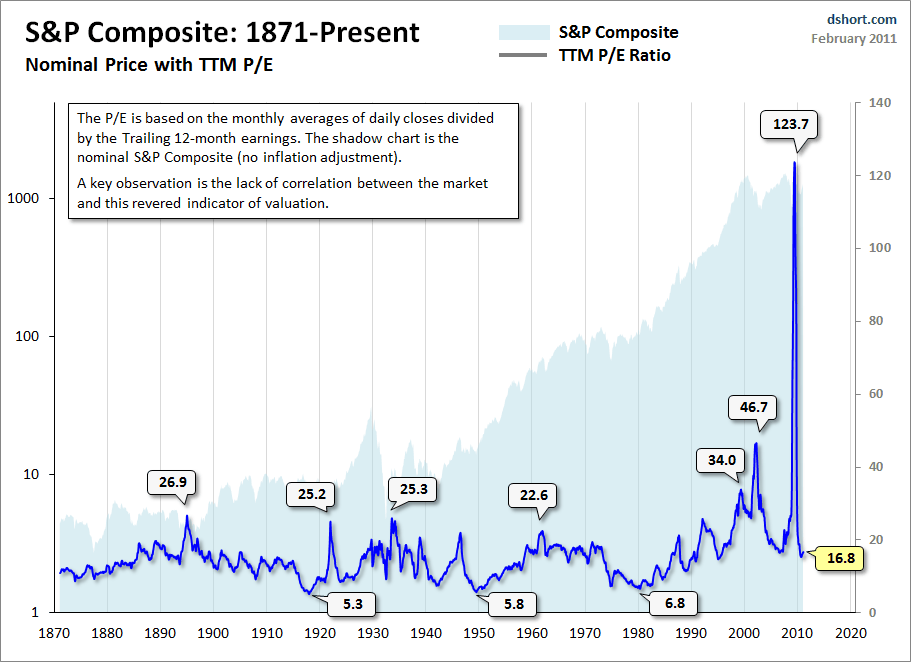

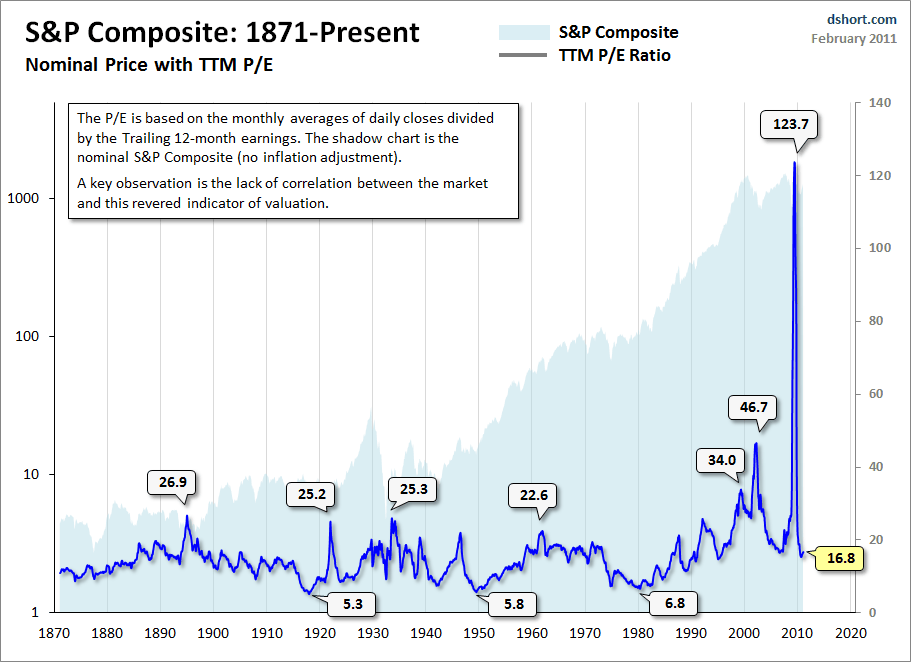

BofA regularly publishes reports and analyses evaluating current market conditions, including detailed assessments of stock market valuations. They utilize various metrics, such as price-to-earnings ratios (P/E ratios), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other valuation multiples to gauge the overall market health. Their research provides a comprehensive overview, considering both macroeconomic factors and individual company performance.

-

Key findings from BofA's research on valuation levels: BofA's recent reports often highlight whether the market is trading at a premium or discount compared to its historical average. They may point to specific sectors showing elevated or depressed valuations. For example, they might indicate that technology stocks are trading at high valuations relative to historical averages, while certain value sectors are relatively cheap.

-

Comparison of current valuations to historical averages: BofA's analysts compare current valuation metrics to historical data, helping investors understand if current prices reflect sustainable growth or potential overvaluation. This comparison offers context and helps investors assess the risks associated with current market levels.

-

BofA's outlook on future valuation trends: BofA's research includes forecasts and predictions regarding future valuation trends, often based on their economic outlook and expectations for corporate earnings growth. This forward-looking perspective helps investors anticipate potential shifts in market valuations.

-

Specific sectors BofA highlights as overvalued or undervalued: BofA's reports frequently single out specific sectors or industries as being particularly overvalued or undervalued, providing investors with actionable insights for portfolio adjustments. They may recommend overweighting undervalued sectors or reducing exposure to overvalued ones.

Factors Contributing to High Stock Market Valuations

Several economic and market forces contribute to periods of high stock market valuations. Understanding these factors is crucial for assessing the sustainability of current market levels and managing investment risk accordingly.

-

Low interest rates and their impact on valuations: Low interest rates reduce the cost of borrowing for companies and stimulate investment, leading to increased corporate earnings and higher stock prices. This makes alternative investments like bonds less attractive, driving more capital into the stock market, thereby pushing valuations higher.

-

Quantitative easing and its effect on market liquidity: Quantitative easing (QE) programs, where central banks inject liquidity into the market, can inflate asset prices, including stocks. Increased liquidity makes it easier for investors to buy stocks, driving up demand and potentially leading to higher valuations.

-

Strong corporate earnings (or expectations thereof): Strong current and projected future corporate earnings support higher stock valuations. High earnings justify higher price-to-earnings ratios, as investors are willing to pay more for companies demonstrating robust profitability.

-

Investor sentiment and market psychology: Positive investor sentiment and a general feeling of optimism can lead to higher valuations, even in the absence of significant improvements in underlying economic fundamentals. Market psychology plays a significant role in driving asset prices.

-

Technological advancements and their influence on growth stocks: Rapid technological innovation can boost the growth prospects of certain companies, particularly in the technology sector, driving up their valuations. Investors are often willing to pay a premium for companies expected to benefit from disruptive technologies.

Potential Risks Associated with High Valuations

Investing in a highly valued market carries inherent risks that investors should carefully consider. Understanding these risks is critical for developing a robust investment strategy.

-

Increased market volatility and potential for corrections: Highly valued markets are often more susceptible to sharp corrections or declines. When investor sentiment shifts, even slightly, the potential for large price swings increases.

-

The risk of a market bubble bursting: Extremely high valuations can be a sign of a market bubble, where asset prices are significantly detached from fundamental value. The bursting of a bubble can lead to significant losses for investors.

-

The impact of rising interest rates on valuations: Rising interest rates can negatively impact stock valuations, as they increase borrowing costs for companies and make bonds a more attractive investment alternative. This can lead to a decline in stock prices.

-

Geopolitical risks and their influence on market sentiment: Geopolitical events, such as wars or trade disputes, can significantly impact investor sentiment and market valuations. Uncertainty stemming from geopolitical risks often leads to increased market volatility.

-

Potential for lower future returns compared to historical averages: When markets are highly valued, future returns may be lower than historical averages. Investors should adjust their return expectations accordingly.

BofA's Investment Strategies for Navigating High Valuations

BofA's analysts often suggest several strategies to help investors manage risk in a high-valuation environment.

-

Diversification across asset classes (stocks, bonds, real estate, etc.): Diversification reduces the impact of a decline in any single asset class. Allocating investments across different asset classes helps to mitigate overall portfolio risk.

-

Focus on value investing and identifying undervalued companies: Value investing involves identifying companies trading below their intrinsic value. This strategy can offer potentially higher returns in a high-valuation market, as these undervalued companies may have more upside potential.

-

Considering defensive sectors less sensitive to market fluctuations: Defensive sectors, such as consumer staples and utilities, tend to be less volatile than other sectors during market downturns. Investing in these sectors can provide a buffer against overall market declines.

-

Utilizing hedging strategies to mitigate risk: Hedging strategies, such as options or short selling, can help protect against potential losses in a declining market. These strategies are more complex and require a strong understanding of the markets.

-

Regular portfolio rebalancing: Regularly rebalancing your portfolio to maintain your target asset allocation helps to manage risk and take advantage of market fluctuations. This strategy involves selling some assets that have performed well and buying assets that have underperformed, restoring the original allocation.

Conclusion

Understanding and managing the risks associated with high stock market valuations is crucial for successful investing. BofA's perspective highlights the significance of considering various valuation metrics, understanding the contributing factors, and acknowledging the potential risks involved. By utilizing strategies like diversification, value investing, and regular portfolio rebalancing, investors can navigate the complexities of high stock market valuations more effectively. BofA's ongoing analysis provides valuable insights, helping investors make informed decisions and build resilient portfolios. Stay informed about BofA's ongoing market analysis and adapt your investment strategy accordingly to manage these high stock market valuations. Learn more about BofA's market insights to make sound investment choices.

Featured Posts

-

Caso Arrayanes Oferta De G 1 250 Millones Por Homicidio Culposo

Apr 25, 2025

Caso Arrayanes Oferta De G 1 250 Millones Por Homicidio Culposo

Apr 25, 2025 -

April 1945 Analyzing The Months Most Important News

Apr 25, 2025

April 1945 Analyzing The Months Most Important News

Apr 25, 2025 -

Lab Owner Pleads Guilty To Falsifying Covid Test Results

Apr 25, 2025

Lab Owner Pleads Guilty To Falsifying Covid Test Results

Apr 25, 2025 -

Matthew Golden A Realistic Round One Option For The Dallas Cowboys

Apr 25, 2025

Matthew Golden A Realistic Round One Option For The Dallas Cowboys

Apr 25, 2025 -

A New Crime Drama Has Everyone Talking Is It The Most Stressful Show Ever

Apr 25, 2025

A New Crime Drama Has Everyone Talking Is It The Most Stressful Show Ever

Apr 25, 2025

Latest Posts

-

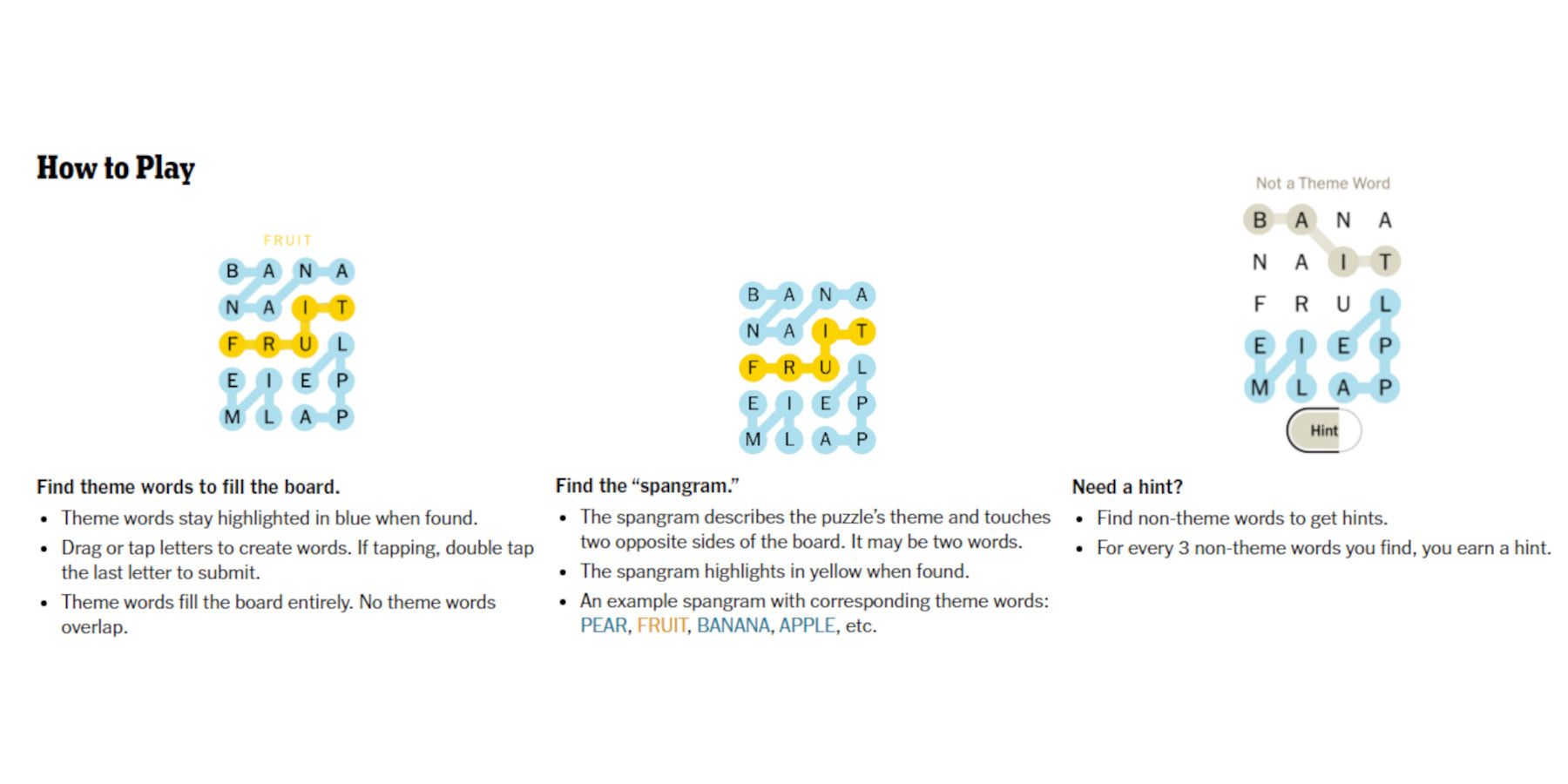

Nyt Strands Game 402 Solutions Wednesday April 9 Hints And Answers

May 09, 2025

Nyt Strands Game 402 Solutions Wednesday April 9 Hints And Answers

May 09, 2025 -

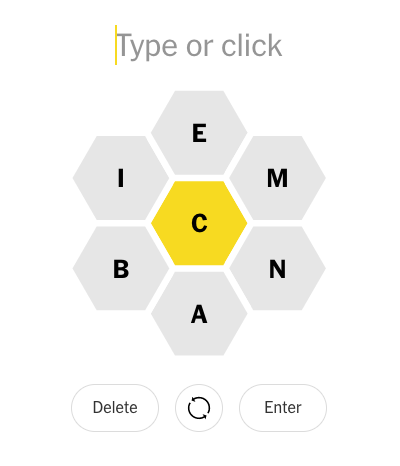

New York Times Spelling Bee April 1 2025 Hints Answers And Pangram Help

May 09, 2025

New York Times Spelling Bee April 1 2025 Hints Answers And Pangram Help

May 09, 2025 -

Nyt Strands Hints And Answers Wednesday April 9 Game 402

May 09, 2025

Nyt Strands Hints And Answers Wednesday April 9 Game 402

May 09, 2025 -

Unlocking The Nyt Spelling Bee April 1 2025 Solutions And Strategies

May 09, 2025

Unlocking The Nyt Spelling Bee April 1 2025 Solutions And Strategies

May 09, 2025 -

Nyt Crossword April 12 2025 Theme Clues And Pangram Revealed

May 09, 2025

Nyt Crossword April 12 2025 Theme Clues And Pangram Revealed

May 09, 2025