Understanding High Stock Market Valuations: BofA's Insights For Investors

Table of Contents

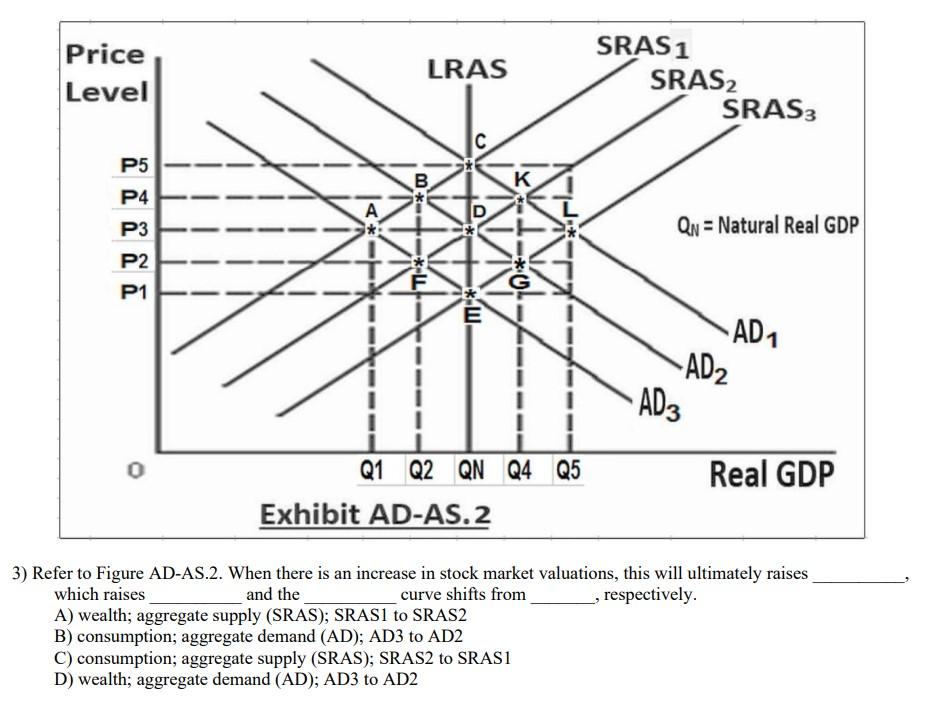

High stock market valuations are generally characterized by elevated price multiples relative to earnings, sales, or book value. Common metrics include the price-to-earnings ratio (P/E), the price-to-sales ratio (P/S), and the Shiller P/E (CAPE) ratio, which adjusts for inflation. When these ratios significantly exceed historical averages, it suggests the market might be overvalued, potentially increasing the risk of a correction. This article aims to explain BofA's take on these high valuations and provide actionable advice for investors.

BofA's Current Market Outlook and Valuation Concerns

BofA's recent reports have expressed cautious optimism, acknowledging the strong performance of the market but also highlighting significant valuation concerns. They regularly utilize various metrics like the P/E ratio, the Shiller P/E ratio, and other proprietary models to assess market valuations.

- Key Concerns: BofA highlights the potential for a market correction due to stretched valuations in certain sectors. They emphasize the risks associated with elevated investor sentiment and the potential impact of rising interest rates.

- Potentially Overvalued Sectors: BofA's analysis may identify specific sectors, such as technology or certain growth stocks, as potentially overvalued based on their current valuations relative to historical norms and projected earnings. (Note: Specific sectors mentioned would need to be updated with current BofA reports).

- Future Market Predictions: BofA's predictions, while acknowledging inherent uncertainty, often suggest a more moderate rate of return in the coming years compared to the recent past, reflecting the impact of high valuations on future growth potential.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current high valuations. These include:

- Low Interest Rates: Historically low interest rates make borrowing cheaper for corporations and reduce the attractiveness of fixed-income investments, pushing investors towards equities. This increased demand contributes to higher stock prices and valuations.

- Quantitative Easing (QE): Central bank policies like QE, involving the injection of liquidity into the market, can also inflate asset prices, including stocks.

- Strong Corporate Earnings: While valuations are high, robust corporate earnings in certain sectors help justify some of the high price multiples. However, the sustainability of these earnings remains a key concern.

- Inflation and Its Effects: Inflation can erode purchasing power, potentially driving investors towards assets like stocks seen as a hedge against inflation. However, rising inflation can also impact interest rates and company profits, creating challenges for stock valuations.

- Investor Sentiment and Market Psychology: Investor optimism and FOMO (fear of missing out) can drive prices beyond levels justified by fundamentals, fueling a speculative bubble.

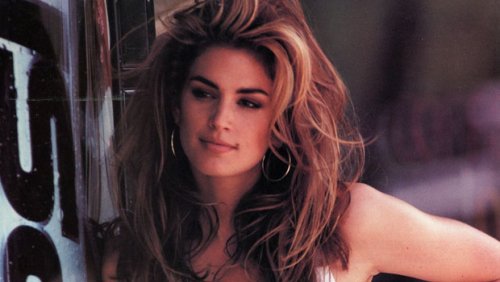

Strategies for Investors in a High-Valuation Market

Navigating a high-valuation market requires a cautious and strategic approach. BofA, and other financial experts, often suggest:

- Diversification: Spread investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk. Avoid over-concentration in potentially overvalued sectors.

- Risk Management: Employ hedging strategies to protect against potential market downturns. This might involve options trading or other risk mitigation techniques.

- Value Investing: Focus on undervalued companies with strong fundamentals and a margin of safety. This approach seeks to identify companies trading below their intrinsic value.

- Growth Investing (with caution): While growth stocks may be alluring, carefully assess valuations and future growth prospects. Avoid chasing high-growth stocks solely based on momentum.

- Alternative Investments: Consider alternative asset classes like real estate or private equity to diversify portfolios beyond traditional stocks and bonds.

Long-Term Perspective and Historical Context

Comparing current valuations to historical market cycles reveals that, while high, current valuations aren't unprecedented. However, past high valuations have often been followed by corrections or bear markets.

- Comparison to Previous Peaks: Analyzing past market peaks (e.g., the dot-com bubble or the 2008 financial crisis) and comparing valuation metrics provides valuable context.

- Long-Term Growth Prospects: Despite high valuations, long-term economic growth and technological advancements offer the potential for continued market expansion. Identifying sectors poised for long-term growth is crucial.

- Potential Risks and Opportunities: A high-valuation market presents both significant risks (potential corrections) and opportunities (identifying undervalued assets).

Conclusion: Navigating High Stock Market Valuations with BofA's Guidance

BofA's insights underscore the importance of understanding high stock market valuations and their implications for investors. While acknowledging the potential for continued growth, BofA highlights the risks associated with currently elevated price multiples. By diversifying investments, employing robust risk management strategies, and carefully considering value and growth opportunities, investors can navigate this complex market more effectively. Understanding high stock market valuations is crucial for success. Use BofA's insights and conduct thorough research, consult financial advisors, and stay informed about market trends to effectively manage your investments in this environment.

Featured Posts

-

Cindy Crawfords Daisy Dukes Return Pepsi Ad Recreation At 58

Apr 25, 2025

Cindy Crawfords Daisy Dukes Return Pepsi Ad Recreation At 58

Apr 25, 2025 -

Roche Q1 Sales Report Examining Growth And Future Pipeline Potential

Apr 25, 2025

Roche Q1 Sales Report Examining Growth And Future Pipeline Potential

Apr 25, 2025 -

From War To New Beginnings How Pope Francis Helped One Refugee Family

Apr 25, 2025

From War To New Beginnings How Pope Francis Helped One Refugee Family

Apr 25, 2025 -

Activision Blizzard Acquisition Ftc Challenges Court Decision In Favor Of Microsoft

Apr 25, 2025

Activision Blizzard Acquisition Ftc Challenges Court Decision In Favor Of Microsoft

Apr 25, 2025 -

5 Reasons Ridley Scotts Apple Tv Show Is Generating Buzz

Apr 25, 2025

5 Reasons Ridley Scotts Apple Tv Show Is Generating Buzz

Apr 25, 2025

Latest Posts

-

Palantirs Nato Deal Predicting The Future Of Public Sector Ai

May 10, 2025

Palantirs Nato Deal Predicting The Future Of Public Sector Ai

May 10, 2025 -

Palantir Stock Analyzing Q1 2024 Earnings Government Vs Commercial Performance

May 10, 2025

Palantir Stock Analyzing Q1 2024 Earnings Government Vs Commercial Performance

May 10, 2025 -

Bundesliga 2 Matchday 27 Results And Colognes Rise To The Top

May 10, 2025

Bundesliga 2 Matchday 27 Results And Colognes Rise To The Top

May 10, 2025 -

Palantir And Nato A New Ai Revolution In The Public Sector

May 10, 2025

Palantir And Nato A New Ai Revolution In The Public Sector

May 10, 2025 -

Bundesliga 2 Matchday 27 Overview Cologne Dethrones Hamburg

May 10, 2025

Bundesliga 2 Matchday 27 Overview Cologne Dethrones Hamburg

May 10, 2025