Understanding High Stock Market Valuations: A BofA Perspective

Table of Contents

Key Metrics Indicating High Valuations

Several key metrics highlight the current elevated levels in the stock market. Analyzing these metrics, alongside historical data and industry benchmarks, provides a clearer picture of the market's valuation.

Price-to-Earnings Ratio (P/E):

The Price-to-Earnings ratio (P/E) is a fundamental valuation metric calculated by dividing a company's stock price by its earnings per share (EPS). A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher expectations for future growth or overvaluation.

- Definition of P/E: Market Price per Share / Earnings per Share

- Calculation: Requires access to a company's stock price and its earnings per share data.

- Interpretation: Higher P/E ratios generally suggest higher growth expectations, but can also signal overvaluation if not supported by strong fundamentals. Comparing a company's P/E to its industry average and historical data is crucial.

- Sector-Specific P/E Analysis: P/E ratios vary significantly across sectors. Growth sectors often command higher P/E multiples than value sectors.

BofA's analysis shows the current S&P 500 P/E ratio is 25, significantly above the historical average of 15, suggesting potentially elevated valuations across the broad market. This warrants careful consideration by investors.

Other Valuation Metrics:

While the P/E ratio is widely used, other valuation metrics offer a more comprehensive picture.

- Price-to-Sales (P/S): This compares a company's market capitalization to its revenue. It's particularly useful for evaluating companies with negative earnings. BofA notes elevated P/S ratios across the tech sector, potentially indicating overvaluation in certain segments.

- Price-to-Book (P/B): This compares a company's market capitalization to its book value (assets minus liabilities). It's often used to assess the value of asset-heavy companies.

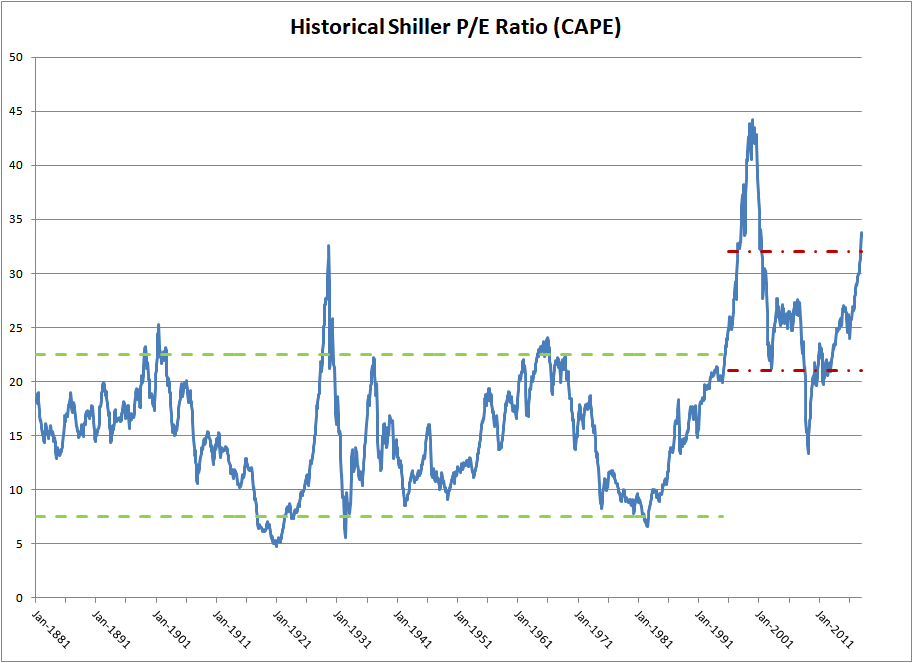

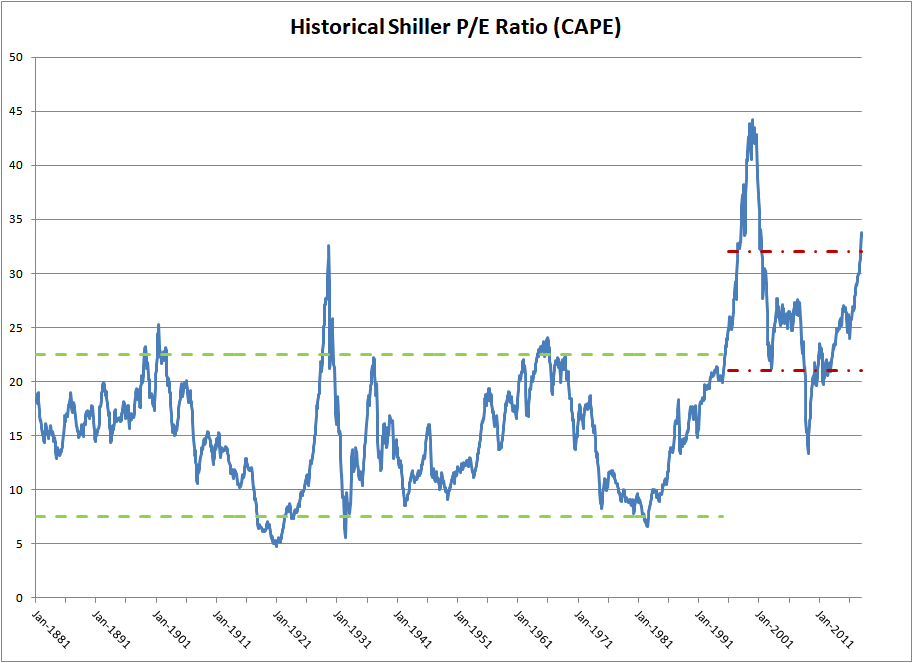

- Cyclically Adjusted Price-to-Earnings (CAPE) Ratio: This metric smooths out earnings fluctuations over a longer period (typically 10 years), providing a more stable measure of valuation. BofA's analysis of the CAPE ratio suggests that while historically high, it’s not at unprecedented levels.

These metrics, when analyzed together, provide a more complete understanding of market valuations and potential risks.

Interest Rate Sensitivity:

Rising interest rates generally exert downward pressure on stock valuations. This is because higher rates increase the attractiveness of fixed-income investments, diverting capital away from equities.

- Inverse Relationship: Higher interest rates lead to lower present values of future earnings, impacting stock prices.

- BofA's Projections: BofA's economic forecasts suggest a gradual increase in interest rates over the next year.

- Implications for Investors: High-growth stocks, particularly those with long durations, are most sensitive to interest rate changes.

According to BofA's economic forecasts, higher interest rates could pressure high-growth stocks with long durations, impacting overall market valuations.

Factors Contributing to High Valuations

Several factors have contributed to the current environment of high stock market valuations. Understanding these contributing elements is crucial for informed decision-making.

Low Interest Rates:

Historically low interest rates have played a significant role in driving up stock market valuations.

- Reduced Returns on Bonds: Low bond yields force investors to seek higher returns in the equity market, increasing demand and driving up prices.

- Increased Demand for Equities: The search for yield has pushed investors towards higher-risk assets like stocks.

- Effect on Risk Appetite: Low interest rates can also foster a greater appetite for risk, leading to higher valuations for riskier assets.

BofA research suggests that low interest rates have driven a significant portion of the recent stock market rally.

Strong Corporate Earnings:

Strong corporate earnings have supported elevated valuations in many sectors.

- Analysis of Recent Earnings Reports: Many companies have reported robust earnings growth, justifying higher valuations.

- Impact of Economic Recovery: The economic recovery post-pandemic has fueled strong corporate performance, contributing to higher stock prices.

- Sector-Specific Performance: Performance varies widely across sectors, with some experiencing exceptionally strong growth.

BofA's analysis indicates that strong earnings growth in specific sectors has justified higher valuations, while other sectors show weaker fundamentals.

Quantitative Easing (QE):

Quantitative easing (QE) programs implemented by central banks have increased market liquidity.

- Influence on Investor Behavior: QE policies inject liquidity into the market, encouraging investment and potentially inflating asset prices.

- Effect on Risk-Taking: Increased liquidity can lead to higher risk tolerance among investors.

- BofA’s Assessment of Long-Term Effects: BofA analysts believe the effects of past QE programs are still influencing current market dynamics, though the impact is gradually diminishing.

Potential Risks and Opportunities

While the market shows signs of strength, potential risks and opportunities exist within this high-valuation environment.

Risk of a Market Correction:

The elevated valuations raise concerns about the potential for a market correction.

- Valuation Concerns: High P/E ratios and other valuation metrics signal potential vulnerability to a correction.

- Potential Economic Slowdown: Economic slowdown or recession could trigger a market downturn.

- Geopolitical Risks: Global geopolitical instability can significantly impact market sentiment and valuations.

- BofA's Assessment of Likelihood: BofA analysts acknowledge the risks but don’t predict an imminent crash, emphasizing the need for cautious optimism.

Investment Strategies in a High-Valuation Environment:

BofA suggests several strategies to navigate the current market:

- Diversification: Spread investments across different asset classes to reduce risk.

- Value Investing: Focus on undervalued companies with strong fundamentals.

- Sector Rotation: Shift investments from overvalued to undervalued sectors.

- Focusing on Quality and Cash Flow: Prioritize companies with strong balance sheets and consistent cash flow generation.

- Defensive Strategies: Consider defensive sectors like utilities and consumer staples.

Long-Term Growth Potential:

Despite high stock market valuations, there remains considerable long-term growth potential.

- Technological Innovation: Continuous technological advancements drive growth and create new investment opportunities.

- Demographic Shifts: Global demographic changes present both challenges and opportunities for investors.

- Emerging Markets: Emerging markets offer significant long-term growth prospects.

- BofA’s Long-Term Market Outlook: BofA maintains a cautiously optimistic long-term outlook, emphasizing selective investment choices.

Conclusion

Understanding high stock market valuations requires a nuanced perspective, considering multiple factors and potential risks. While BofA acknowledges concerns about elevated metrics like P/E ratios, other factors – such as strong corporate earnings and low interest rates – are also influential. This analysis suggests that a diversified approach with a focus on quality and risk management is key for investors navigating this complex market environment. By carefully considering these insights, investors can make more informed decisions regarding their portfolios and effectively manage their exposure to high stock market valuations. Remember to consult a financial advisor for personalized guidance on navigating high stock market valuations.

Featured Posts

-

Secret Service Closes White House Cocaine Investigation

Apr 22, 2025

Secret Service Closes White House Cocaine Investigation

Apr 22, 2025 -

Post La Fire Housing Crisis Are Landlords Price Gouging Renters

Apr 22, 2025

Post La Fire Housing Crisis Are Landlords Price Gouging Renters

Apr 22, 2025 -

Death Of Pope Francis Remembering A Compassionate Leader

Apr 22, 2025

Death Of Pope Francis Remembering A Compassionate Leader

Apr 22, 2025 -

The Impact Of The Los Angeles Wildfires On The Disaster Betting Market

Apr 22, 2025

The Impact Of The Los Angeles Wildfires On The Disaster Betting Market

Apr 22, 2025 -

Los Angeles Wildfires A Reflection Of Our Times Through Gambling Trends

Apr 22, 2025

Los Angeles Wildfires A Reflection Of Our Times Through Gambling Trends

Apr 22, 2025