Understanding Elevated Stock Market Valuations: A BofA Analysis

Table of Contents

The stock market is buzzing, yet a growing unease permeates investor circles. Record highs are being hit, but the question on everyone's mind is: are these elevated stock market valuations sustainable? Concerns about a potential market correction are increasing, leaving many wondering how to navigate this complex landscape. This analysis delves into a recent BofA report to understand their perspective on these elevated valuations and what it means for your investment strategy. We will explore the contributing factors, assess the inherent risks, and examine BofA's recommendations for investors facing this crucial market juncture.

2. Main Points:

H2: BofA's Key Findings on Elevated Stock Market Valuations:

BofA's recent report paints a nuanced picture of current market valuations. While acknowledging the significant gains, they don't necessarily label them as entirely unjustified, but rather as historically high and potentially vulnerable. They highlight a divergence between some market sectors and the underlying economic fundamentals.

- Bullet Points:

- BofA cites elevated Price-to-Earnings (P/E) ratios, significantly above historical averages for certain sectors, indicating potentially overvalued assets. They also point to high price-to-sales ratios, suggesting that investors are paying a premium for future growth. Specific numbers from their report, such as an average P/E ratio of 25 compared to a historical average of 15 for the S&P 500, should be included here, referencing the actual BofA report for accurate data.

- The report highlights the technology sector and certain growth stocks as particularly susceptible to valuation adjustments, while sectors like utilities or consumer staples might be considered relatively undervalued based on their analysis.

- BofA's methodology relies heavily on comparative valuation metrics, historical data analysis, and projections of future earnings growth, incorporating both quantitative and qualitative factors.

H2: Factors Contributing to Elevated Stock Market Valuations:

Several interconnected factors contribute to the current landscape of elevated stock market valuations.

H3: Low Interest Rates and Monetary Policy:

Exceptionally low interest rates, a consequence of years of quantitative easing (QE) by central banks, have played a significant role.

- Bullet Points:

- QE injected massive liquidity into the financial system, driving down bond yields, making equities a more attractive investment option. This capital influx fueled demand, thereby increasing stock prices.

- The actions of central banks, aiming to stimulate economic growth, have inadvertently supported higher stock valuations, creating a supportive environment for higher risk-taking.

H3: Strong Corporate Earnings and Growth Projections:

Robust corporate earnings and positive growth projections have partially justified higher valuations.

- Bullet Points:

- Sectors such as technology and healthcare have shown impressive earnings growth, fueling investor optimism and demand. Specific examples of high-growth companies and their performance should be included.

- Analysts' upward revisions to future earnings forecasts have further strengthened the case for higher valuations, suggesting a continued positive trend. However, it's crucial to note that such projections are inherently uncertain and subject to revision.

H3: Investor Sentiment and Market Psychology:

Investor psychology significantly impacts stock prices, often surpassing purely fundamental analysis.

- Bullet Points:

- "Fear of missing out" (FOMO) has driven significant investment inflows, especially into high-growth stocks. The influence of social media and online trading platforms has amplified this effect, creating a herd mentality.

- The potential for speculative bubbles in certain sectors, driven by hype and optimism, cannot be ignored. These bubbles can quickly burst, leading to sharp corrections.

H2: Assessing the Risks of Elevated Stock Market Valuations:

Despite positive factors, high valuations also bring significant risks.

- Bullet Points:

- A market correction, or even a crash, is a possibility. High valuations leave the market more vulnerable to negative news events or shifts in investor sentiment.

- Economic downturns or unexpected negative news could trigger a sharp sell-off, especially in sectors exhibiting the highest valuations.

- Increased market volatility is an inherent risk associated with these conditions. Rapid and substantial price swings can create significant uncertainty and losses for investors.

- BofA suggests diversifying portfolios, focusing on fundamentally sound companies with sustainable growth prospects, and establishing appropriate stop-loss orders to mitigate risk.

H2: BofA's Recommendations for Investors:

Navigating elevated stock market valuations requires a cautious approach.

- Bullet Points:

- BofA recommends a strategy of selective investment, focusing on undervalued sectors and companies with strong fundamentals rather than chasing speculative growth stocks. Sector rotation, moving investments from overvalued to undervalued sectors, is a key suggestion.

- Diversification across asset classes (equities, bonds, real estate, etc.) is crucial to mitigate risk and protect against market downturns. A balanced portfolio is advised.

- BofA advises exercising caution, acknowledging the potential for increased volatility and the possibility of a correction.

3. Conclusion:

BofA's analysis reveals a complex market environment characterized by elevated stock market valuations. While strong earnings and low interest rates contribute to higher prices, the elevated valuations also present substantial risks. The potential for a correction, heightened volatility, and the influence of market sentiment underline the need for a prudent investment strategy. It is crucial to understand your personal risk tolerance and make informed decisions based on thorough research. Consult with a financial advisor to develop a personalized strategy for navigating these elevated stock market valuations. The market's ongoing evolution demands constant vigilance and adaptation, making a comprehensive understanding of market dynamics essential for informed investment.

Featured Posts

-

Shane Lowrys Joy For Rory Mc Ilroy A Friends Celebration

May 11, 2025

Shane Lowrys Joy For Rory Mc Ilroy A Friends Celebration

May 11, 2025 -

Celtics Guard Payton Pritchard Earns Sixth Man Of The Year Award

May 11, 2025

Celtics Guard Payton Pritchard Earns Sixth Man Of The Year Award

May 11, 2025 -

The Case Against John Wick 5 Why Enough Is Enough

May 11, 2025

The Case Against John Wick 5 Why Enough Is Enough

May 11, 2025 -

Instagrams Survival Strategy Ceos Testimony Highlights Tik Toks Impact

May 11, 2025

Instagrams Survival Strategy Ceos Testimony Highlights Tik Toks Impact

May 11, 2025 -

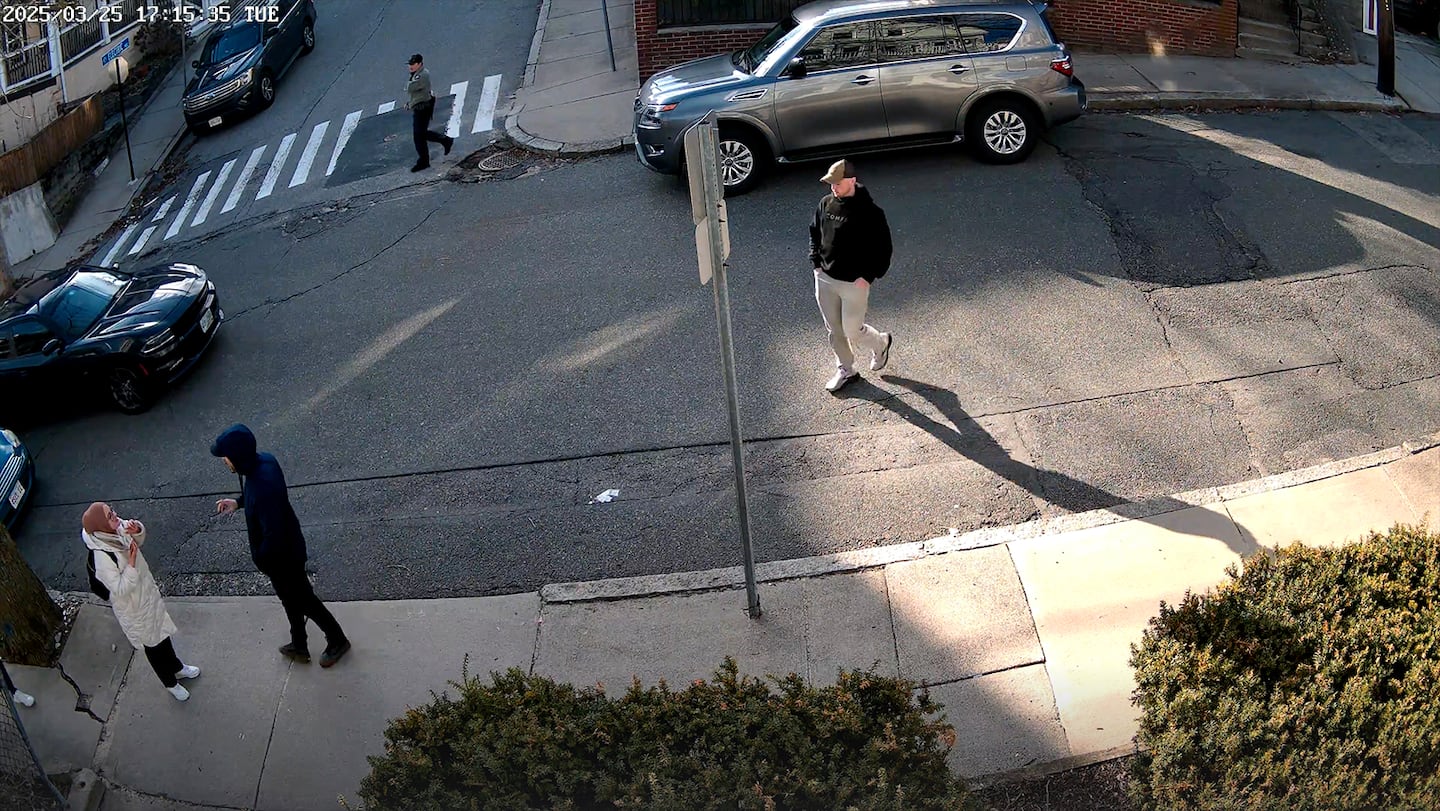

Court Orders Release Of Rumeysa Ozturk Tufts University Student Held By Ice

May 11, 2025

Court Orders Release Of Rumeysa Ozturk Tufts University Student Held By Ice

May 11, 2025