Understanding CoreWeave's (CRWV) Wednesday Stock Price Increase

Table of Contents

CoreWeave (CRWV) is a rapidly growing cloud computing company specializing in high-performance computing (HPC) and artificial intelligence (AI) workloads. They provide powerful, scalable cloud infrastructure tailored to the demanding needs of AI model training, scientific computing, and other computationally intensive applications, positioning them strategically within a rapidly expanding market. The purpose of this analysis is to explore the key factors that contributed to Wednesday's remarkable CRWV stock price surge.

Market Sentiment and Investor Confidence

Positive market sentiment plays a crucial role in driving stock prices, and the cloud computing sector, particularly companies focused on AI, is currently enjoying a period of significant investor enthusiasm. Several factors likely contributed to the boost in investor confidence regarding CRWV:

- Positive analyst ratings and price target increases: Leading financial analysts may have issued positive reports on CoreWeave, raising their price targets, which can significantly influence investor perception and trading activity. Such positive assessments often highlight strong growth potential and reinforce a bullish outlook.

- Increased institutional investment: Large institutional investors, such as mutual funds and hedge funds, may have increased their holdings in CRWV, signaling their belief in the company's long-term prospects and further fueling demand for the stock. This influx of institutional money can drive up the price significantly.

- Growing demand for AI-related cloud services: The explosive growth of the AI industry has created a massive demand for the type of high-performance computing infrastructure that CoreWeave provides. This increased demand translates directly into potential revenue growth for CRWV, making it an attractive investment.

- Successful partnerships or collaborations announced: A recent announcement of a significant partnership or collaboration with a major player in the AI or technology industry could have ignited investor confidence and contributed to the stock price increase. Strategic alliances often signal increased market reach and potential for future growth.

CoreWeave's (CRWV) Business Performance and Growth

CoreWeave's own performance and growth trajectory are undoubtedly significant factors in the stock price surge. Analyzing their recent financial reports and milestones reveals some potential contributing factors:

- Strong quarterly earnings report: A better-than-expected quarterly earnings report, exceeding analyst expectations in key metrics like revenue growth and customer acquisition, would almost certainly boost investor confidence. Positive earnings demonstrate financial health and stability.

- New customer acquisitions in key sectors (e.g., AI, gaming, finance): Securing new high-profile clients in key growth sectors showcases the demand for CoreWeave's services and validates their market position. The addition of major clients provides tangible evidence of the company's success.

- Expansion into new geographical markets: Extending CoreWeave's reach into new geographic regions opens up significant opportunities for further revenue growth and market penetration. International expansion demonstrates ambition and scalability.

- Successful product launches or upgrades: Introducing new products or enhancing existing offerings can attract new customers and increase revenue streams. Innovation is crucial for maintaining a competitive edge in the rapidly evolving cloud computing market.

Industry-Wide Trends Impacting CRWV's Stock Price

Broader industry trends also played a pivotal role in the CRWV stock price increase. CoreWeave benefits significantly from several powerful forces shaping the cloud computing and AI landscapes:

- Increased adoption of cloud-based AI solutions: The shift towards cloud-based AI solutions is a major trend, and CoreWeave is ideally positioned to benefit from this movement. Their infrastructure is specifically designed for AI workloads, making them a key player in this expanding market segment.

- Growing demand for high-performance computing resources: The increasing complexity of AI models and other computationally intensive tasks drives demand for powerful computing resources, which is CoreWeave's core offering. This fundamental industry trend is directly beneficial to CRWV's business model.

- Consolidation in the cloud computing market: Consolidation within the industry can create opportunities for growth and market share gains for companies like CoreWeave. Mergers and acquisitions can lead to increased demand and strategic advantages.

- Government initiatives supporting AI development: Government initiatives aimed at boosting AI development and infrastructure investment can indirectly benefit companies like CoreWeave. Government support stimulates the market and fosters a favorable environment for growth.

Technical Analysis of CRWV Stock Price Movement

While a deep dive into technical analysis is beyond the scope of this article, some key chart patterns and indicators may help explain the price movement. It's important to note that technical analysis should not be the sole basis for investment decisions:

- Breakout from a resistance level: A significant price increase could be due to a breakout from a previous resistance level, indicating a shift in market sentiment and increased buying pressure.

- Increased trading volume: A surge in trading volume accompanying the price increase suggests strong participation from investors, confirming the significance of the upward movement.

- Positive price momentum: Sustained upward price movement generates positive momentum, which can attract further investment and amplify the price increase.

Understanding the CoreWeave (CRWV) Stock Price Rally and Future Outlook

In summary, CoreWeave's (CRWV) Wednesday stock price surge likely resulted from a confluence of factors: positive market sentiment towards cloud computing and AI stocks, strong business performance and growth exhibited by CoreWeave itself, favorable industry-wide trends, and potentially supportive technical indicators. However, it is crucial to remember that past performance is not indicative of future results. While the outlook for CoreWeave appears promising given its position in the rapidly expanding AI and HPC market, investors should always conduct thorough due diligence before making any investment decisions.

We encourage you to conduct your own comprehensive research, considering factors beyond those discussed here, before making any investment decisions related to CRWV stock price. For further information on CoreWeave (CRWV) and the broader cloud computing sector, refer to reputable financial news sources, SEC filings, and independent analyst reports. Consider CoreWeave (CRWV) as a potential addition to your portfolio only after careful consideration and alignment with your individual investment strategy.

Featured Posts

-

Toledo Gas Prices Drop Lower Costs Per Gallon

May 22, 2025

Toledo Gas Prices Drop Lower Costs Per Gallon

May 22, 2025 -

Scandalous Ceo Affair A Business Implosion

May 22, 2025

Scandalous Ceo Affair A Business Implosion

May 22, 2025 -

Peppa Pigs Mums Lavish Gender Reveal At Iconic London Location

May 22, 2025

Peppa Pigs Mums Lavish Gender Reveal At Iconic London Location

May 22, 2025 -

Agents Statement On Klopps Potential Real Madrid Move

May 22, 2025

Agents Statement On Klopps Potential Real Madrid Move

May 22, 2025 -

600 Year Old Chinese Tower Partially Collapses Tourists Scramble To Safety

May 22, 2025

600 Year Old Chinese Tower Partially Collapses Tourists Scramble To Safety

May 22, 2025

Latest Posts

-

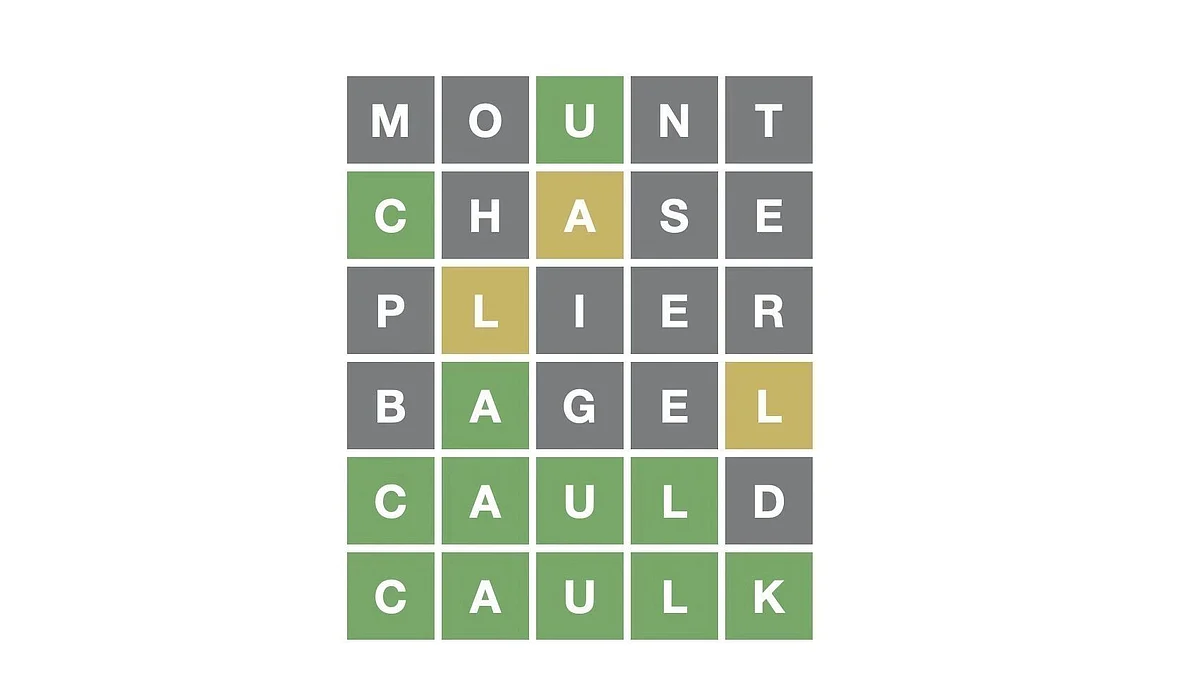

Wordle Game 370 March 20 Hints Clues And Solution

May 22, 2025

Wordle Game 370 March 20 Hints Clues And Solution

May 22, 2025 -

Solve Wordle April 26 2025 Hints And Solution For Puzzle 1407

May 22, 2025

Solve Wordle April 26 2025 Hints And Solution For Puzzle 1407

May 22, 2025 -

Wordle 370 Solution Clues And Answer For March 20th

May 22, 2025

Wordle 370 Solution Clues And Answer For March 20th

May 22, 2025 -

Wordle Today 370 March 20 Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20 Hints Clues And The Answer

May 22, 2025 -

Todays Wordle Puzzle March 26 Nyt Wordle Solution

May 22, 2025

Todays Wordle Puzzle March 26 Nyt Wordle Solution

May 22, 2025