Understanding CoreWeave's (CRWV) Recent Stock Market Success

Table of Contents

CoreWeave's (CRWV) Competitive Advantage in the Cloud Computing Market

CoreWeave's remarkable ascent can be attributed to several key competitive advantages within the fiercely competitive cloud computing landscape. Its innovative approach and strategic maneuvers have allowed it to carve a significant niche for itself.

Superior Infrastructure and Scalability

CoreWeave differentiates itself through its strategic utilization of repurposed GPUs. This approach not only leads to significant cost-effectiveness but also enables unparalleled scalability. Unlike competitors who may rely on purchasing brand-new hardware, CoreWeave's model allows for efficient resource allocation and rapid scaling to meet the ever-growing demands of its clients. This focus on high-performance computing (HPC) and AI workloads further solidifies its position. Compared to giants like AWS, Google Cloud, and Azure, CoreWeave often offers a more cost-effective and agile solution for demanding AI projects.

- Cost advantages: Repurposed GPUs translate to lower infrastructure costs, passed on to clients.

- Scalability for large projects: Easily handle massive AI training and deployment needs.

- GPU specialization: Optimized infrastructure tailored specifically for GPU-intensive workloads.

- Ease of access for developers: User-friendly interfaces and robust APIs simplify development and deployment.

Strategic Partnerships and Customer Acquisition

CoreWeave's success isn't solely reliant on its innovative infrastructure; its strategic partnerships and targeted customer acquisition strategy are equally crucial. The company has successfully forged alliances with major tech companies and AI developers, securing a robust pipeline of enterprise clients. This focus on large-scale partnerships ensures sustainable growth and market penetration. Their market penetration strategy targets companies heavily invested in AI development and deployment, a demographic experiencing exponential growth.

- Key partnerships: Collaborations with leading AI developers and technology providers.

- Client portfolio: A growing list of major enterprise clients across various sectors.

- Market share growth: Rapid expansion within the niche AI cloud computing market.

- Customer retention rate: High client satisfaction leads to strong customer loyalty and repeat business.

Impact of Artificial Intelligence (AI) Boom on CRWV's Performance

The current AI boom is undeniably a major catalyst for CoreWeave's success. The insatiable demand for processing power to fuel AI development and deployment has created a perfect storm for companies like CRWV.

The Growing Demand for AI Processing Power

The increasing reliance on cloud computing for AI development and deployment is undeniable. Training complex AI models requires immense computing power, primarily driven by GPUs. The exponential growth of the AI market directly correlates with the heightened demand for GPU-based cloud computing services, a market where CoreWeave is exceptionally well-positioned.

- AI market size projections: Continued significant growth predicted for the foreseeable future.

- Increased demand for GPU computing: A critical component of AI model training and inference.

- Growth of AI-related applications: Expansion across various industries fuels the demand for processing power.

CoreWeave's Positioning within the AI Revolution

CoreWeave is not just benefiting from the AI boom; it's actively contributing to it. The company’s infrastructure directly supports the advancements in AI, providing the crucial computing resources necessary for innovation. This strategic positioning ensures long-term growth and relevance in the evolving AI landscape.

- AI-specific services offered: Specialized solutions designed to meet the unique needs of AI companies.

- Contribution to AI research: Facilitating groundbreaking AI research through its advanced computing infrastructure.

- Future outlook in the AI landscape: A strong position to capitalize on continued AI market expansion.

Financial Performance and Investor Sentiment

CoreWeave's strong stock market performance is mirrored in its impressive financial results and positive investor sentiment.

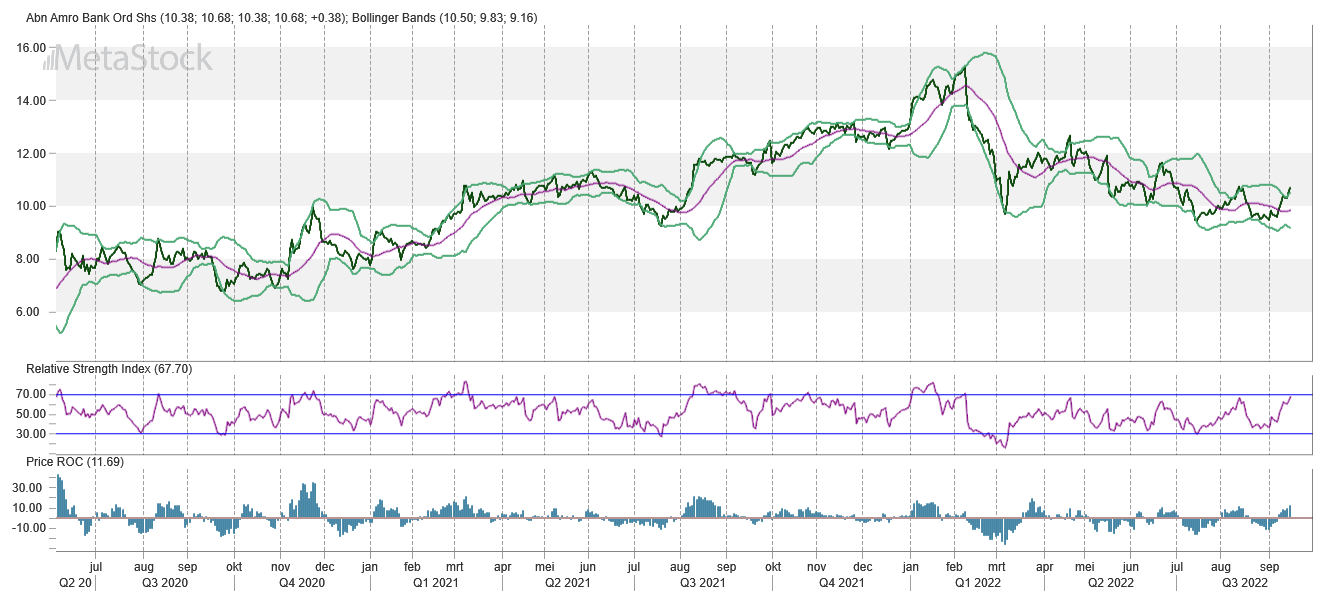

Analysis of CRWV's Stock Price Trajectory

CRWV's stock price has shown a remarkable upward trend since its public listing, marking key milestones and navigating market fluctuations with relative resilience. Factors contributing to these price movements include strong earnings reports, positive market trends, and growing investor confidence. Analyzing key financial data such as revenue growth and market capitalization reveals a healthy and expanding business.

- Key price points: Tracking significant highs and lows in the stock's performance.

- Significant events affecting stock price: Analyzing news and events impacting investor perception.

- Investor reactions to financial reports: Gauging market response to earnings announcements and other disclosures.

Investor Confidence and Future Projections

The overall investor sentiment towards CoreWeave is largely positive, fueled by its strong growth trajectory and promising future prospects. While potential risks and challenges exist in any investment, CoreWeave's strategic positioning within the burgeoning AI market mitigates many potential concerns. Analyst ratings and projected revenue growth paint a picture of continued expansion.

- Analyst ratings: Gathering insights from financial experts assessing CRWV's potential.

- Projected revenue growth: Analyzing future revenue forecasts based on current trends and market conditions.

- Potential risks and mitigation strategies: Identifying potential challenges and the company's plans to address them.

Conclusion: Investing in CoreWeave's (CRWV) Future

CoreWeave's (CRWV) recent stock market success is a result of its unique competitive advantages in the cloud computing market, its strategic alignment with the explosive growth of the AI industry, and its strong financial performance. The company's innovative approach to utilizing repurposed GPUs, its strategic partnerships, and its ability to cater to the increasing demands of AI development and deployment all contribute to its compelling investment narrative. Understanding CoreWeave's business model and its potential for future growth is crucial for investors considering this opportunity. Further research into CoreWeave stock, CRWV investment prospects, and CoreWeave's market success is strongly encouraged. This analysis is for informational purposes only and should not be considered financial advice. Conduct your own thorough due diligence before making any investment decisions.

Featured Posts

-

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025 -

Abn Amro Sterke Stijging Occasionverkoop Door Toename Autobezit

May 22, 2025

Abn Amro Sterke Stijging Occasionverkoop Door Toename Autobezit

May 22, 2025 -

Nato Ta Ukrayina Rezultati Peregovoriv Ta Komentar Yevrokomisara

May 22, 2025

Nato Ta Ukrayina Rezultati Peregovoriv Ta Komentar Yevrokomisara

May 22, 2025 -

Recent Drop In Virginia Gasoline Prices A Gas Buddy Report

May 22, 2025

Recent Drop In Virginia Gasoline Prices A Gas Buddy Report

May 22, 2025 -

Route 15 On Ramp Closure Impacts Morning Commute

May 22, 2025

Route 15 On Ramp Closure Impacts Morning Commute

May 22, 2025

Latest Posts

-

Remembering Adam Ramey Dropout Kings Vocalist Dies At 32

May 22, 2025

Remembering Adam Ramey Dropout Kings Vocalist Dies At 32

May 22, 2025 -

Music World Mourns Dropout Kings Adam Ramey Dead At 32

May 22, 2025

Music World Mourns Dropout Kings Adam Ramey Dead At 32

May 22, 2025 -

Death Of Adam Ramey Dropout Kings Vocalist Passes Away At 32

May 22, 2025

Death Of Adam Ramey Dropout Kings Vocalist Passes Away At 32

May 22, 2025 -

Dropout Kings Lose Vocalist Adam Ramey At 32

May 22, 2025

Dropout Kings Lose Vocalist Adam Ramey At 32

May 22, 2025 -

Adam Ramey Dropout Kings Dead Fans Mourn Singers Passing At 31

May 22, 2025

Adam Ramey Dropout Kings Dead Fans Mourn Singers Passing At 31

May 22, 2025