Understanding Canadian Mortgage Preferences: Avoiding 10-Year Terms

Table of Contents

The Allure (and Pitfalls) of 10-Year Mortgage Terms

Longer mortgage terms, like 10-year terms, are attractive because they often come with lower interest rates initially. Lenders might offer a slightly better rate for a longer commitment. However, this initial perceived saving can quickly become a significant disadvantage. The risks associated with a 10-year mortgage term in Canada far outweigh the minor rate advantage for many borrowers.

-

Higher penalty costs for breaking the mortgage early: Life happens. Job loss, unexpected medical expenses, or a desire to move could necessitate breaking your mortgage before the 10-year term is up. The penalties for doing so on a 10-year mortgage are substantially higher than for shorter terms. These penalties can wipe out any initial interest savings and then some.

-

Predicting your financial situation 10 years out is difficult: It’s nearly impossible to accurately forecast your financial stability a decade into the future. A new baby, a career change, or even a fluctuating Canadian economy can significantly impact your ability to manage your mortgage payments over such a long period.

-

Interest rates are not guaranteed to stay low for the entire term: Locking into a 10-year fixed rate mortgage means you're committed to that rate regardless of market fluctuations. If interest rates drop during your term, you'll be stuck paying a potentially higher rate than you could get with a shorter-term mortgage and refinancing. Conversely, rates could increase drastically, creating significant financial strain. Understanding Canadian mortgage rates and their volatility is crucial.

Exploring Shorter-Term Mortgage Options (1-5 years)

Shorter-term mortgages, typically 1- to 5-year terms, offer a significantly higher degree of flexibility and control. While the initial interest rate might be slightly higher than a 10-year term, the long-term benefits often outweigh this small difference.

-

Flexibility – allows for refinancing when rates drop: The Canadian mortgage market is dynamic. Shorter terms give you the opportunity to refinance your mortgage when interest rates decline, potentially saving you thousands of dollars over the life of your mortgage.

-

Better control over your financial future; easier to adjust payments if needed: Shorter terms provide greater financial agility. If your circumstances change, you have more flexibility to adjust your payment plan or even switch lenders with fewer financial penalties.

-

Lower penalty costs if you need to break the mortgage: Breaking a shorter-term mortgage incurs far lower penalties compared to a 10-year mortgage. This provides crucial peace of mind and financial protection. Understanding mortgage prepayment penalties is essential before choosing a term.

Considering Your Personal Financial Situation

Choosing the right mortgage term is intensely personal and depends entirely on your individual financial circumstances and risk tolerance. There's no one-size-fits-all answer.

-

Assess your current financial stability and risk tolerance: Are you in a stable financial position with a predictable income? Or do you anticipate potential financial volatility in the coming years? Your risk tolerance directly impacts your choice of mortgage term.

-

Consult a financial advisor for personalized mortgage advice: A qualified financial advisor in Canada can help you assess your financial situation, understand your options, and create a personalized mortgage strategy.

-

Consider your future plans (home renovations, family growth): Significant life events, like starting a family or undertaking major home renovations, can impact your financial capacity. Planning for these events is crucial when choosing a mortgage term. Consider your long-term financial goals and how your mortgage fits into them.

Understanding the Mortgage Renewal Process

In Canada, mortgages typically renew after the initial term. Understanding this process is essential for making informed decisions.

-

The importance of shopping around for the best rates at renewal: Don't automatically renew with your current lender. Shop around and compare rates from multiple lenders to ensure you're getting the best possible deal. This could save you considerable money.

-

Negotiating with your current lender: Even if you decide to stay with your existing lender, negotiating a better interest rate at renewal is always an option. Be prepared to compare their offer to those from other lenders.

-

Understanding the different types of mortgage options available during renewal (open, closed): Each type of mortgage has its own advantages and disadvantages in terms of flexibility and penalties. Choose wisely based on your risk tolerance and financial predictions. Consider the implications of open versus closed mortgages.

Conclusion

While a 10-year mortgage term might seem attractive initially due to potentially lower interest rates, it’s crucial to weigh the risks carefully. Understanding Canadian mortgage preferences involves prioritizing flexibility and aligning your mortgage term with your personal financial circumstances and risk tolerance. Shorter-term mortgages offer more control and adaptability, allowing you to navigate the fluctuating Canadian mortgage market more effectively. Before committing to a 10-year mortgage term, thoroughly assess your financial situation, explore shorter-term options, and consult with a financial advisor to make an informed decision. Make smart choices for your financial future and avoid the pitfalls of long-term mortgage commitments. Remember, understanding your Canadian mortgage preferences is key to securing your financial well-being. Start planning your mortgage strategy today and avoid the potential problems of a 10-year term.

Featured Posts

-

Public Reaction To Lizzos Comments On Britney Spears And Janet Jackson

May 05, 2025

Public Reaction To Lizzos Comments On Britney Spears And Janet Jackson

May 05, 2025 -

Lizzos Weight Loss A Health And Fitness Update

May 05, 2025

Lizzos Weight Loss A Health And Fitness Update

May 05, 2025 -

Is Marvels Thunderbolts Team The Answer To Its Problems

May 05, 2025

Is Marvels Thunderbolts Team The Answer To Its Problems

May 05, 2025 -

Blake Lively And Anna Kendricks Relationship Body Language Reveals Potential Feud

May 05, 2025

Blake Lively And Anna Kendricks Relationship Body Language Reveals Potential Feud

May 05, 2025 -

Singapores Ruling Party Faces Toughest Election Yet

May 05, 2025

Singapores Ruling Party Faces Toughest Election Yet

May 05, 2025

Latest Posts

-

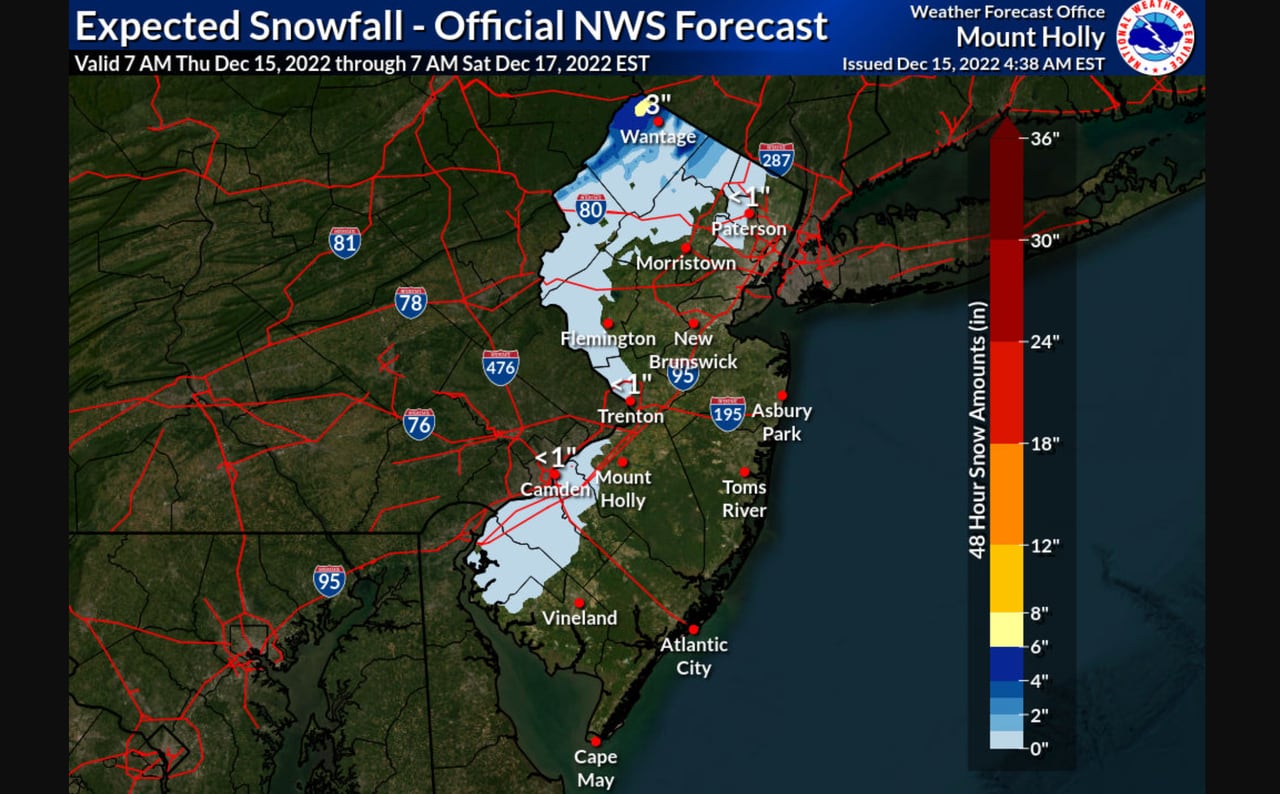

Snow Storm Forecast When Will Snow Return To Ny Nj And Ct

May 05, 2025

Snow Storm Forecast When Will Snow Return To Ny Nj And Ct

May 05, 2025 -

Ufc 314 The Complete Fight Card And Bout Order

May 05, 2025

Ufc 314 The Complete Fight Card And Bout Order

May 05, 2025 -

Colder Temperatures Predicted For West Bengal Current Weather Update

May 05, 2025

Colder Temperatures Predicted For West Bengal Current Weather Update

May 05, 2025 -

Announced Ufc 314 Main Card And Preliminary Bout Order

May 05, 2025

Announced Ufc 314 Main Card And Preliminary Bout Order

May 05, 2025 -

West Bengal Weather Alert Significant Temperature Decrease Expected

May 05, 2025

West Bengal Weather Alert Significant Temperature Decrease Expected

May 05, 2025