Understanding And Managing Stock Market Volatility: A Guide For Investors

Table of Contents

What Causes Stock Market Volatility?

Stock market volatility, characterized by significant price swings in short periods, stems from a complex interplay of factors. Understanding these root causes is the first step in developing effective strategies to manage risk and protect your investments.

Economic Factors:

Macroeconomic conditions significantly influence market sentiment and price movements. Key economic factors driving stock market volatility include:

- Inflation rates and their impact on interest rates: High inflation often prompts central banks to raise interest rates, impacting borrowing costs for businesses and potentially slowing economic growth, thus increasing market uncertainty.

- Economic growth forecasts and their influence on investor sentiment: Positive growth projections generally boost investor confidence, while negative forecasts can trigger sell-offs and increased volatility.

- Geopolitical events and their effect on global markets: International conflicts, political instability, and trade wars can create significant uncertainty and ripple effects throughout global markets.

- Unexpected economic data releases (e.g., employment reports, CPI): Surprises in key economic indicators can lead to immediate market reactions, impacting investor confidence and driving short-term volatility. For example, unexpectedly high inflation data can trigger a sharp market downturn.

Company-Specific Factors:

Individual company performance and news also contribute significantly to overall market volatility. These factors include:

- Earnings reports and their impact on individual stock prices: Strong earnings typically boost stock prices, while disappointing results can lead to sharp declines and increased volatility.

- Unexpected news events (e.g., product recalls, lawsuits): Negative news, such as product recalls or major lawsuits, can significantly impact a company's stock price and overall market sentiment.

- Changes in management or corporate strategy: Shifts in leadership or significant strategic changes can create uncertainty and lead to short-term volatility as investors assess the implications.

- Competitive pressures and market share changes: Increased competition, loss of market share, or the emergence of disruptive technologies can negatively affect a company's stock price and contribute to market volatility.

Market Sentiment and Psychology:

Market psychology plays a crucial role in driving stock market volatility. Investor behavior, influenced by fear and greed, often amplifies market fluctuations.

- Investor fear and greed (market psychology): These powerful emotions drive short-term market movements, often leading to irrational exuberance during bull markets and panic selling during bear markets.

- Herd behavior and its influence on market trends: Investors often mimic the actions of others, leading to amplified price swings as everyone rushes in or out of a particular market segment.

- Media influence and market narratives: Media coverage, both positive and negative, can shape market narratives and influence investor sentiment, contributing to heightened volatility.

- Speculative trading and its contribution to short-term volatility: Speculative trading, focused on short-term profits, can significantly amplify short-term price swings and create periods of increased market instability.

Strategies for Managing Stock Market Volatility

While eliminating stock market volatility is impossible, investors can mitigate its impact through careful planning and strategic approaches.

Diversification:

Diversification is a cornerstone of effective risk management. Spreading investments across different asset classes reduces the impact of poor performance in any single asset.

- Spreading investments across different asset classes (stocks, bonds, real estate): This reduces your reliance on any single market sector and helps to cushion potential losses.

- Diversification across different sectors and geographies: Investing in a variety of sectors and geographical regions can reduce your exposure to industry-specific or region-specific risks.

- Benefits of a diversified portfolio in reducing overall risk: Diversification helps to smooth out returns over time, resulting in a more stable and less volatile portfolio.

Dollar-Cost Averaging (DCA):

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market price.

- Investing a fixed amount of money at regular intervals: This eliminates the need for trying to time the market, reducing the risk of buying high and selling low.

- Reducing the impact of market timing: By investing consistently, you automatically buy more shares when prices are low and fewer shares when prices are high.

- Averaging the cost basis over time: This strategy helps to reduce your overall average cost per share, mitigating the impact of market fluctuations.

Long-Term Investing:

Maintaining a long-term investment horizon is crucial for weathering market storms.

- Focusing on long-term growth rather than short-term fluctuations: Long-term investors can ride out short-term market downturns, knowing that markets historically trend upwards over the long run.

- The importance of patience and discipline: Sticking to your investment plan, even during periods of high volatility, is essential for achieving long-term goals.

- Riding out market corrections and volatility: Market corrections and periods of high volatility are a normal part of the market cycle and present opportunities for long-term investors to buy at lower prices.

Risk Tolerance Assessment:

Understanding your personal risk tolerance is paramount in building an appropriate investment strategy.

- Understanding your personal risk tolerance: Consider your financial goals, time horizon, and emotional comfort level with potential losses.

- Aligning your investment strategy with your risk profile: Choose investments that align with your risk tolerance, avoiding investments that cause you undue stress or anxiety.

- Avoiding investments that exceed your comfort level: Don't invest in assets you don't understand or that make you uncomfortable.

Tools and Resources for Monitoring Stock Market Volatility

Staying informed about market conditions is essential for effective stock market volatility management.

Market Indices:

Tracking major market indices provides a broad overview of market performance and sentiment. Key indices include:

- S&P 500

- Dow Jones Industrial Average

- Nasdaq Composite

Volatility Indexes (VIX):

The VIX, often called the "fear index," measures market volatility and investor uncertainty. Higher VIX readings suggest increased market fear and potential for increased volatility.

Financial News and Analysis:

Reputable financial news sources provide valuable insights into market trends, economic conditions, and company-specific events. Choose credible and unbiased sources.

Investment Platforms and Tools:

Many investment platforms offer real-time market data, charting tools, and analytical resources to help investors monitor market conditions and manage their portfolios effectively.

Conclusion:

Successfully navigating stock market volatility requires a combination of understanding its causes, employing effective management strategies, and maintaining a long-term perspective. By diversifying your portfolio, utilizing dollar-cost averaging, and assessing your risk tolerance, you can build a more resilient investment strategy. Remember to continuously monitor market conditions and adapt your approach as needed. Don't let fear paralyze you; use this guide to manage stock market volatility and achieve your financial goals. Start planning your long-term investment strategy today to mitigate the impact of future stock market volatility and build a financially secure future.

Featured Posts

-

The China Market Headwinds For Bmw Porsche And Other Automakers

Apr 25, 2025

The China Market Headwinds For Bmw Porsche And Other Automakers

Apr 25, 2025 -

Is It Possible To Bet On The Los Angeles Wildfires Exploring The Dark Side Of Disaster

Apr 25, 2025

Is It Possible To Bet On The Los Angeles Wildfires Exploring The Dark Side Of Disaster

Apr 25, 2025 -

Okc March Concerts Your Guide To Big Name Shows And Tickets

Apr 25, 2025

Okc March Concerts Your Guide To Big Name Shows And Tickets

Apr 25, 2025 -

Understanding Wrongful Death Dispelling Persistent Misconceptions

Apr 25, 2025

Understanding Wrongful Death Dispelling Persistent Misconceptions

Apr 25, 2025 -

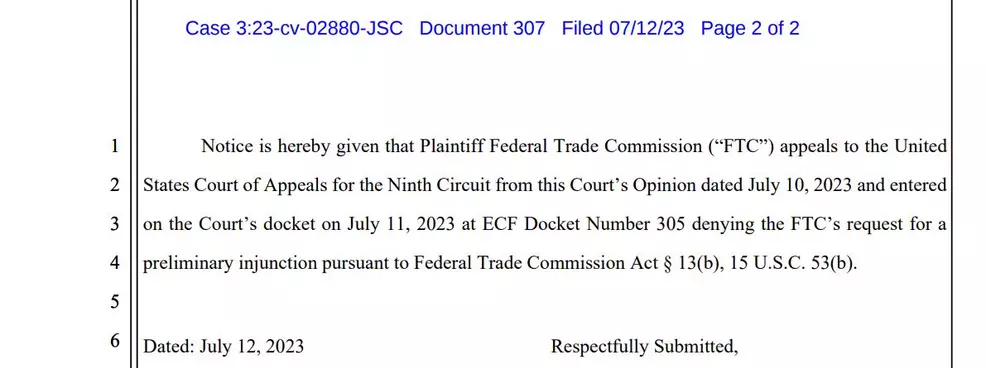

Ftc Appeals Activision Blizzard Merger Ruling A Deep Dive

Apr 25, 2025

Ftc Appeals Activision Blizzard Merger Ruling A Deep Dive

Apr 25, 2025

Latest Posts

-

Nhls Leading Goal Scorer Leon Draisaitl Injured

May 10, 2025

Nhls Leading Goal Scorer Leon Draisaitl Injured

May 10, 2025 -

Edmonton Oilers Draisaitl Exits Game With Injury

May 10, 2025

Edmonton Oilers Draisaitl Exits Game With Injury

May 10, 2025 -

Oilers Draisaitl Out Cautious Approach Against Winnipeg

May 10, 2025

Oilers Draisaitl Out Cautious Approach Against Winnipeg

May 10, 2025 -

Edmonton Oilers Playoff Hopes Hinge On Draisaitls Recovery From Lower Body Injury

May 10, 2025

Edmonton Oilers Playoff Hopes Hinge On Draisaitls Recovery From Lower Body Injury

May 10, 2025 -

Draisaitls Absence Impact On Oilers Vs Winnipeg Jets

May 10, 2025

Draisaitls Absence Impact On Oilers Vs Winnipeg Jets

May 10, 2025