Uncovering The Methods Of The Stealthy Wealthy: Building Wealth The Boring Way

Table of Contents

The Power of Consistent Saving and Budgeting

Building a solid financial foundation starts with mastering saving and budgeting. It’s the bedrock of building wealth the boring way. This isn't about deprivation; it's about mindful spending and strategic saving.

Developing a Realistic Budget

Creating a budget is crucial for understanding your financial inflows and outflows.

- Track your expenses: Use budgeting apps like Mint, YNAB (You Need A Budget), or Personal Capital, or a simple spreadsheet, to monitor where your money goes. This step is often the hardest, but essential for identifying areas for improvement.

- Identify areas for reduction: Once you see your spending patterns, you can pinpoint areas where you can cut back. This might involve reducing subscriptions, eating out less, or finding cheaper alternatives for everyday expenses.

- The 50/30/20 rule: A good starting point is the 50/30/20 rule: allocate 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment.

- Automate your savings: Set up automatic transfers from your checking account to your savings account each month. This ensures consistent saving without requiring extra effort.

Prioritizing Saving Over Spending

Saving consistently, even small amounts, is crucial for long-term wealth building.

- Save a significant portion: Aim to save at least 20% of your income, ideally more. The more you save, the faster your wealth grows.

- The power of compounding: Compounding interest is your silent partner in building wealth the boring way. The interest earned on your savings earns interest itself, accelerating your growth over time.

- Set financial goals: Establish both short-term (e.g., emergency fund) and long-term (e.g., retirement) goals to stay motivated and track your progress.

- High-yield savings accounts: Maximize your returns by utilizing high-yield savings accounts or other low-risk, interest-bearing investments.

Strategic Debt Management and Elimination

Debt can significantly hinder your wealth-building journey. Strategic debt management is vital for building wealth the boring way.

Understanding Good Debt vs. Bad Debt

Not all debt is created equal.

- Good debt: This includes debt used for appreciating assets like a mortgage or education loans.

- Bad debt: This refers to high-interest debt, such as credit card debt, which can quickly spiral out of control.

- Prioritize high-interest debt: Focus on paying off high-interest debt first to minimize interest payments and accelerate your progress.

- Debt repayment strategies: Explore methods like the debt avalanche (highest interest rate first) or the debt snowball (smallest debt first) to efficiently manage your debt.

Building a Strong Credit Score

A good credit score opens doors to better financial opportunities.

- Importance of a good credit score: A strong credit score is essential for securing loans, mortgages, and even some rental agreements at favorable rates.

- Improving your credit score: Pay your bills on time, keep your credit utilization low (ideally under 30%), and avoid applying for too much new credit.

- Credit monitoring: Consider using credit monitoring services to track your credit report and identify any potential issues.

Long-Term Investing in Index Funds and ETFs

Investing wisely is key to building wealth the boring way. Avoid chasing quick riches and focus on long-term, sustainable growth.

The Benefits of Diversification

Diversification reduces risk and improves returns over the long term.

- Diversify across asset classes: Spread your investments across different asset classes, such as stocks, bonds, and real estate, to minimize your exposure to any single market downturn.

- Low-cost index funds and ETFs: These offer broad market exposure at low costs, making them ideal for long-term investors.

- Dollar-cost averaging: Invest a fixed amount regularly, regardless of market fluctuations. This strategy mitigates risk and benefits from buying low and high over time.

Understanding Risk Tolerance and Investment Horizons

Align your investment strategy with your risk tolerance and time horizon.

- Risk tolerance: Your comfort level with potential investment losses will dictate your investment choices.

- Investment horizon: Your investment time frame (e.g., retirement) will influence your investment strategy. Longer horizons allow for greater risk-taking.

- Seek professional advice: If you're unsure about investment decisions, seek advice from a qualified financial advisor.

Continuous Learning and Skill Enhancement

Building wealth is a lifelong journey that requires continuous learning and skill enhancement.

Investing in Personal Development

Improving your skills can lead to higher earning potential.

- Acquire new skills: Take online courses, attend workshops, or pursue certifications to enhance your skillset and increase your earning capacity.

- Networking and mentorship: Build relationships with professionals in your field for guidance, advice, and potential opportunities.

Seeking Financial Literacy

Financial literacy is crucial for making informed financial decisions.

- Expand your knowledge: Read books, attend seminars, and utilize online resources to improve your understanding of finance.

- Understand investment strategies: Learn about different investment strategies and financial planning techniques to make better decisions.

- Continuous learning: Commit to ongoing learning to stay ahead and adapt to changing financial landscapes.

Conclusion

Building wealth the boring way requires patience, discipline, and a long-term perspective. By consistently saving, strategically managing debt, investing wisely, and continuously learning, you can steadily build your wealth without relying on risky or unsustainable strategies. The stealthy wealthy understand the power of these seemingly "boring" methods. Start implementing these strategies today and begin your journey to building wealth the boring way—a journey that will lead you to sustainable financial security and long-term success. Don't wait – start building your wealth the boring way today!

Featured Posts

-

Wnba Debut City Honors Paige Bueckers With Honorary Day

May 19, 2025

Wnba Debut City Honors Paige Bueckers With Honorary Day

May 19, 2025 -

Ufc 313 Pereira Vs Ankalaev Where To Watch The Livestream

May 19, 2025

Ufc 313 Pereira Vs Ankalaev Where To Watch The Livestream

May 19, 2025 -

Is Eurovisions Lumo The Worst Mascot Ever A Mick Hucknall Crazy Frog Hybrid

May 19, 2025

Is Eurovisions Lumo The Worst Mascot Ever A Mick Hucknall Crazy Frog Hybrid

May 19, 2025 -

7 Excellent Irish Sci Fi Films To Rival Hollywood This St Patricks Day

May 19, 2025

7 Excellent Irish Sci Fi Films To Rival Hollywood This St Patricks Day

May 19, 2025 -

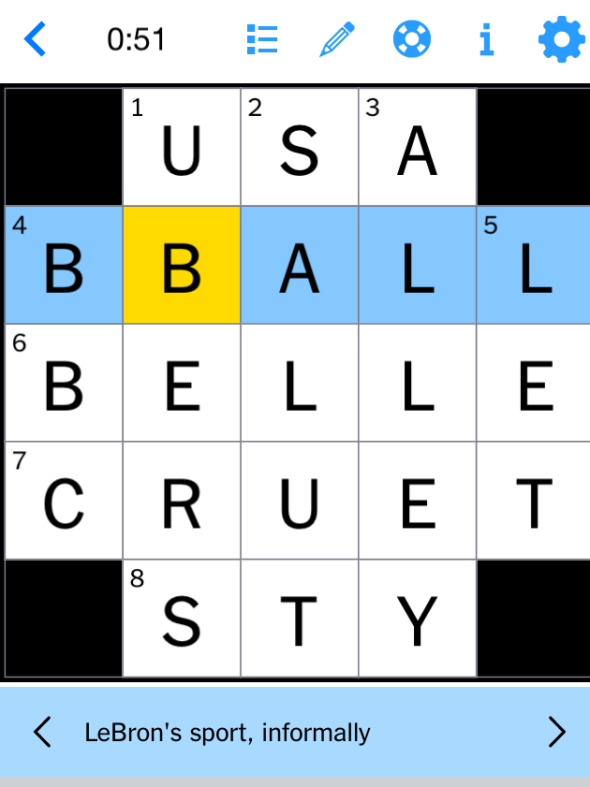

Find The Answers Nyt Mini Crossword March 24 2025

May 19, 2025

Find The Answers Nyt Mini Crossword March 24 2025

May 19, 2025