Unclaimed HMRC Refunds: How To Check Your Payslip And Claim Yours

Table of Contents

Understanding Potential Reasons for HMRC Refunds

Several reasons could lead to an overpayment of tax, resulting in an unclaimed HMRC refund. Understanding these possibilities is the first step in identifying if you're eligible for a refund. Common reasons include:

- Incorrect tax code: Your tax code determines how much Income Tax is deducted from your salary. An incorrect code, either too high or assigned to the wrong tax band, can result in significant overpayments. Using a tax code checker can help verify your code's accuracy.

- Overpayment of income tax: This can happen due to various reasons, including errors in your tax return or changes in your circumstances that weren't immediately reflected in your tax code.

- Overpayment of National Insurance contributions: Similar to income tax, errors or changes in employment status can lead to overpayments of National Insurance.

- Entitlement to tax reliefs not claimed: Many tax reliefs are available, such as pension contributions tax relief, marriage allowance, and others. If you haven't claimed these, you might be entitled to a refund. Using the HMRC tax calculator can help determine potential tax relief you may have missed.

- Marriage Allowance: If you're married or in a civil partnership, you might be eligible for the marriage allowance, which can reduce your tax bill.

How to Check Your Payslips for Overpayments

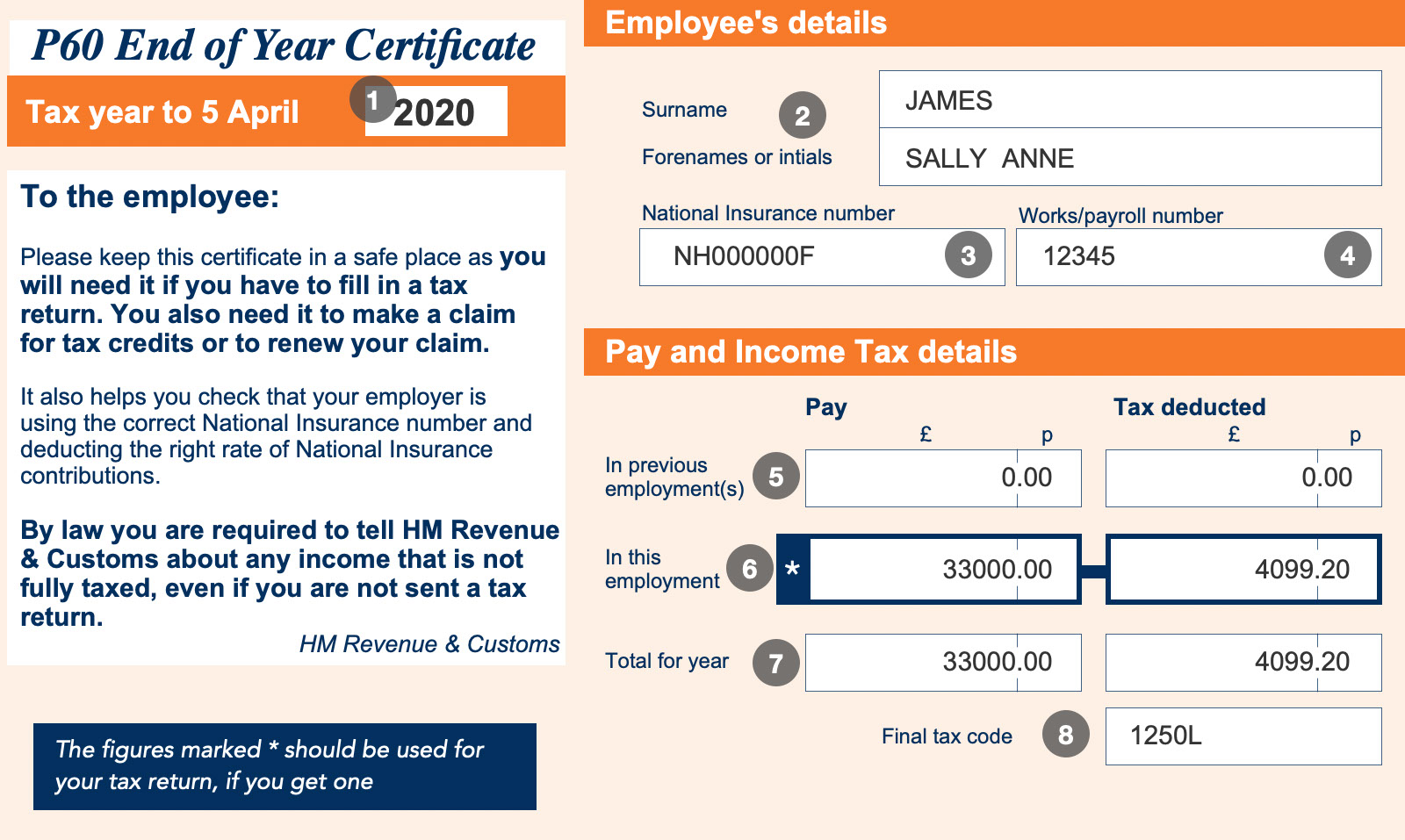

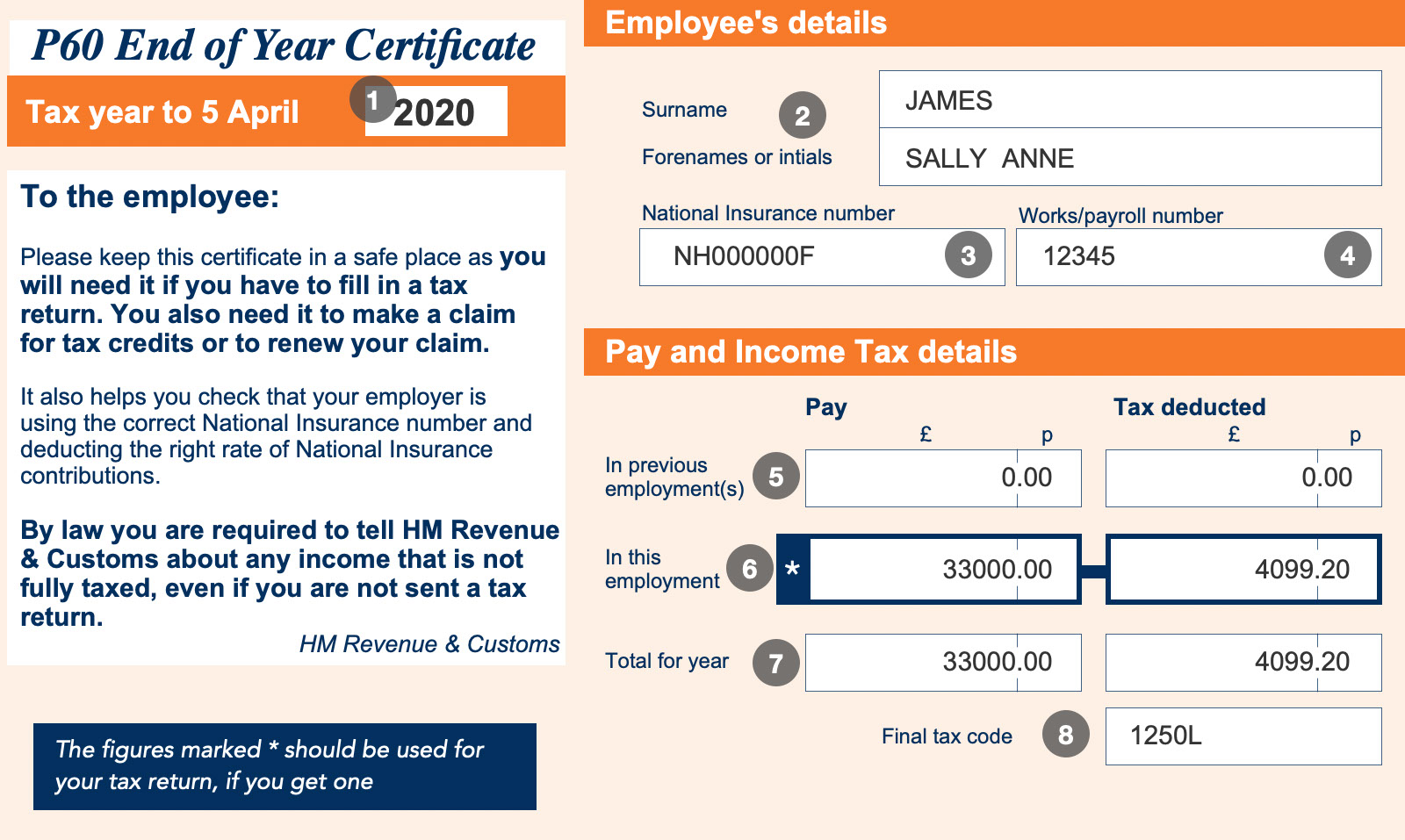

Your payslips contain crucial information to identify potential overpayments. Carefully review your payslips, focusing on the following:

- Identify your tax code on your payslip: This is usually a letter followed by numbers (e.g., 1257L). Compare this to the tax code you believe is correct for your circumstances.

- Compare your tax paid to your expected tax liability: Estimate your tax liability based on your income and tax-free allowances. If the tax deducted significantly exceeds your expected liability, you might have an overpayment.

- Look for any inconsistencies or unusual deductions: Any unexpected deductions or variations in your tax payments warrant further investigation.

- Keep records of all your payslips (at least the last 4 years): HMRC typically allows claims for up to four tax years. Digital record-keeping using payslip apps is a convenient and secure method for storing your payslips.

Gathering Necessary Documents for Your HMRC Refund Claim

To successfully claim your HMRC refund, you'll need to gather the following essential documents:

- Your National Insurance number: This is crucial for HMRC to identify your tax record.

- Recent payslips (ideally for the last 4 tax years): These provide details of your earnings and tax deductions.

- P60 forms for each relevant tax year: These annual summaries show your total earnings and tax paid during the tax year.

- P45 forms if applicable (job changes): These forms are issued when you leave a job and show your tax details up to your leaving date.

- Bank details for refund payment: HMRC will need your bank account details to process your refund.

Organize your documents carefully to ensure a smooth and efficient claim process. Consider using a filing system or digital storage to keep everything safe and readily accessible.

How to Make an HMRC Refund Claim

Claiming your unclaimed HMRC refund is primarily done online through the HMRC website. While you can seek professional help from a tax advisor, the process is generally straightforward:

- Access the HMRC website: Go to the official HMRC website.

- Navigate to the online tax refund portal: Find the relevant section dedicated to tax refund claims.

- Complete the online application form: Accurately fill out all required information.

- Submit your supporting documentation: Upload scanned copies of your payslips, P60s, P45s, and any other relevant documents.

- Track the progress of your claim: HMRC will provide updates on the status of your claim. You may need to check your online account.

The processing time for an HMRC refund can vary, but it generally takes several weeks.

Conclusion

Claiming unclaimed HMRC refunds involves checking your payslips for discrepancies, gathering necessary documents like payslips, P60s, and P45s, and then completing the online HMRC application. Don't delay! Check your payslips today and reclaim your unclaimed HMRC refund. Take control of your finances and ensure you receive all the tax relief you are entitled to. Use this guide to navigate the process and get the money you deserve back. Start your claim now!

Featured Posts

-

F1 Diskvalifikation Foer Hamilton Och Leclerc Vad Haende

May 20, 2025

F1 Diskvalifikation Foer Hamilton Och Leclerc Vad Haende

May 20, 2025 -

U Dzhennifer Lourens Popolnenie V Seme

May 20, 2025

U Dzhennifer Lourens Popolnenie V Seme

May 20, 2025 -

April 13 Nyt Mini Crossword Solutions

May 20, 2025

April 13 Nyt Mini Crossword Solutions

May 20, 2025 -

Aghatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Jdydt Lihyae Rwayatha

May 20, 2025

Aghatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Jdydt Lihyae Rwayatha

May 20, 2025 -

Lekler I Khemilton Perviy Duet Ferrari Diskvalifitsirovanniy Za Odnu Gonku

May 20, 2025

Lekler I Khemilton Perviy Duet Ferrari Diskvalifitsirovanniy Za Odnu Gonku

May 20, 2025

Latest Posts

-

Iznenadenje Jennifer Lawrence Ponovno Mama

May 20, 2025

Iznenadenje Jennifer Lawrence Ponovno Mama

May 20, 2025 -

Jennifer Lawrence Majcinstvo I Drugo Dijete

May 20, 2025

Jennifer Lawrence Majcinstvo I Drugo Dijete

May 20, 2025 -

Novo Dijete Jennifer Lawrence Obiteljska Sreca

May 20, 2025

Novo Dijete Jennifer Lawrence Obiteljska Sreca

May 20, 2025 -

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025