UBS Revises India And Hong Kong Market Forecasts

Table of Contents

Revised India Market Forecast

UBS's updated India market forecast reflects a nuanced perspective on the country's economic trajectory. The revision incorporates recent developments impacting India's growth, including evolving consumer behavior, government policy adjustments, and the ripple effects of the global economic climate. Understanding these factors is key to assessing the investment outlook for India.

-

Specific GDP Growth Projection by UBS: UBS's revised forecast projects a [Insert specific GDP growth percentage] for the Indian economy in [Insert year]. This is [higher/lower] than their previous projection, primarily due to [explain the reason for the revision – e.g., stronger-than-expected consumer spending, successful government initiatives, etc.].

-

Analysis of Key Sectors: The revised forecast highlights the differential performance across various sectors. The IT sector is expected to [continue growth/experience slowdown] due to [explain the reason], while the manufacturing sector is predicted to show [growth/contraction] based on [explain the reason]. The agricultural sector, vital to the Indian economy, is anticipated to [show positive growth/face challenges] due to [explain reasons such as monsoon patterns, government support, etc.].

-

Impact on the Indian Rupee: The projected GDP growth and global economic conditions will influence the Indian Rupee's value. UBS forecasts [explain the projected trend and volatility of the Rupee, e.g., moderate appreciation, potential for fluctuation based on global factors, etc.].

-

Assessment of RBI Policy: The Reserve Bank of India's (RBI) monetary policy will play a crucial role. UBS's analysis suggests that the RBI's [explain the anticipated RBI policy stance - e.g., continued rate hikes to curb inflation, potential easing of monetary policy depending on economic indicators] will [positively/negatively] impact the Indian stock market.

-

Updated Outlook for the Indian Stock Market: Based on the revised economic forecasts and RBI policy expectations, UBS anticipates [explain the projected performance of the Indian stock market - e.g., moderate growth, potential for increased volatility, etc.]. This underscores the need for a balanced investment strategy.

Revised Hong Kong Market Forecast

UBS's revised forecast for Hong Kong reflects the complex interplay of local and global factors influencing its economic health. The close relationship between Hong Kong and mainland China makes the economic outlook particularly sensitive to changes in China's policies and the global geopolitical landscape.

-

Specific GDP Growth Projection for Hong Kong: UBS projects a [Insert specific GDP growth percentage] for Hong Kong's economy in [Insert year]. This revision is largely attributed to [explain the primary factors impacting this forecast – e.g., the recovery of the tourism sector, the impact of China's economic policies, etc.].

-

Analysis of Key Economic Sectors: Hong Kong's economy is heavily reliant on several key sectors. The finance sector is anticipated to [show resilience/experience challenges] due to [explain the reason]. The tourism sector, after a period of downturn, is expected to [recover gradually/continue to struggle] based on [explain the reasons]. The real estate market is predicted to [show signs of stability/experience further correction] influenced by [explain the reasons, such as government policies, interest rates etc.].

-

Assessment of China-Hong Kong Relations: The evolving relationship between China and Hong Kong will continue to significantly shape Hong Kong's economic outlook. UBS's analysis suggests that [explain the anticipated impact of this relationship – e.g., further integration with mainland China could stimulate growth, while increased regulatory scrutiny may pose challenges].

-

Outlook for the Hong Kong Dollar: The Hong Kong dollar is pegged to the US dollar; however, its stability could be impacted by broader global economic conditions and shifts in China's monetary policy. UBS’s forecast suggests [explain the projected stability or volatility of the Hong Kong dollar].

-

Evaluation of the Hong Kong Stock Market: Considering the economic factors and the relationship with China, UBS anticipates [explain the predicted performance of the Hong Kong stock market – e.g., cautious optimism, potential for volatility depending on geopolitical factors].

Comparison of Revised Forecasts and Implications for Investors

Comparing the revised forecasts for India and Hong Kong reveals distinct opportunities and risks. While India presents a higher growth potential, it also carries higher volatility. Hong Kong, though experiencing more moderate growth, offers potentially greater stability in the short term.

- Comparison Table:

| Feature | India | Hong Kong |

|---|---|---|

| GDP Growth | [Insert Percentage] | [Insert Percentage] |

| Stock Market | [Growth/Volatility Assessment] | [Growth/Volatility Assessment] |

| Currency | [Rupee Forecast] | [HKD Forecast] |

| Key Risk Factors | [List key risks, e.g., inflation] | [List key risks, e.g., geopolitical] |

-

Investment Strategies: Investors seeking higher growth potential may favor India, while those prioritizing stability might opt for Hong Kong. A diversified portfolio, incorporating both markets, could mitigate risk.

-

Risk Assessment: It is crucial to conduct thorough due diligence and assess the associated risks before making any investment decisions. Factors like political stability, regulatory changes, and global economic uncertainties must be considered.

-

Portfolio Diversification: Given the distinct characteristics of both markets, diversification is key. Investors should carefully assess their risk tolerance and allocate assets accordingly across various asset classes within both markets.

Conclusion

UBS's revised India and Hong Kong market forecasts highlight the dynamic nature of these economies. While India presents a higher growth trajectory with associated volatility, Hong Kong offers a more moderate but potentially stable investment environment. Investors must carefully consider the specific characteristics of each market and their own risk tolerance when constructing their portfolios. Staying abreast of the latest updates on the UBS India and Hong Kong market forecasts and other reliable sources is vital for making well-informed investment decisions. Consider seeking professional financial advice to tailor your investment strategy based on the revised UBS India and Hong Kong market forecasts to optimize your investment returns.

Featured Posts

-

Federal Investigation Millions Stolen Via Executive Office365 Compromise

Apr 25, 2025

Federal Investigation Millions Stolen Via Executive Office365 Compromise

Apr 25, 2025 -

Executive Office365 Accounts Compromised Crook Makes Millions

Apr 25, 2025

Executive Office365 Accounts Compromised Crook Makes Millions

Apr 25, 2025 -

Dallas Cowboys Jeantys Potential And The Draft Dilemma

Apr 25, 2025

Dallas Cowboys Jeantys Potential And The Draft Dilemma

Apr 25, 2025 -

Mgm Japan Casino Groundbreaking After Years Of Delays

Apr 25, 2025

Mgm Japan Casino Groundbreaking After Years Of Delays

Apr 25, 2025 -

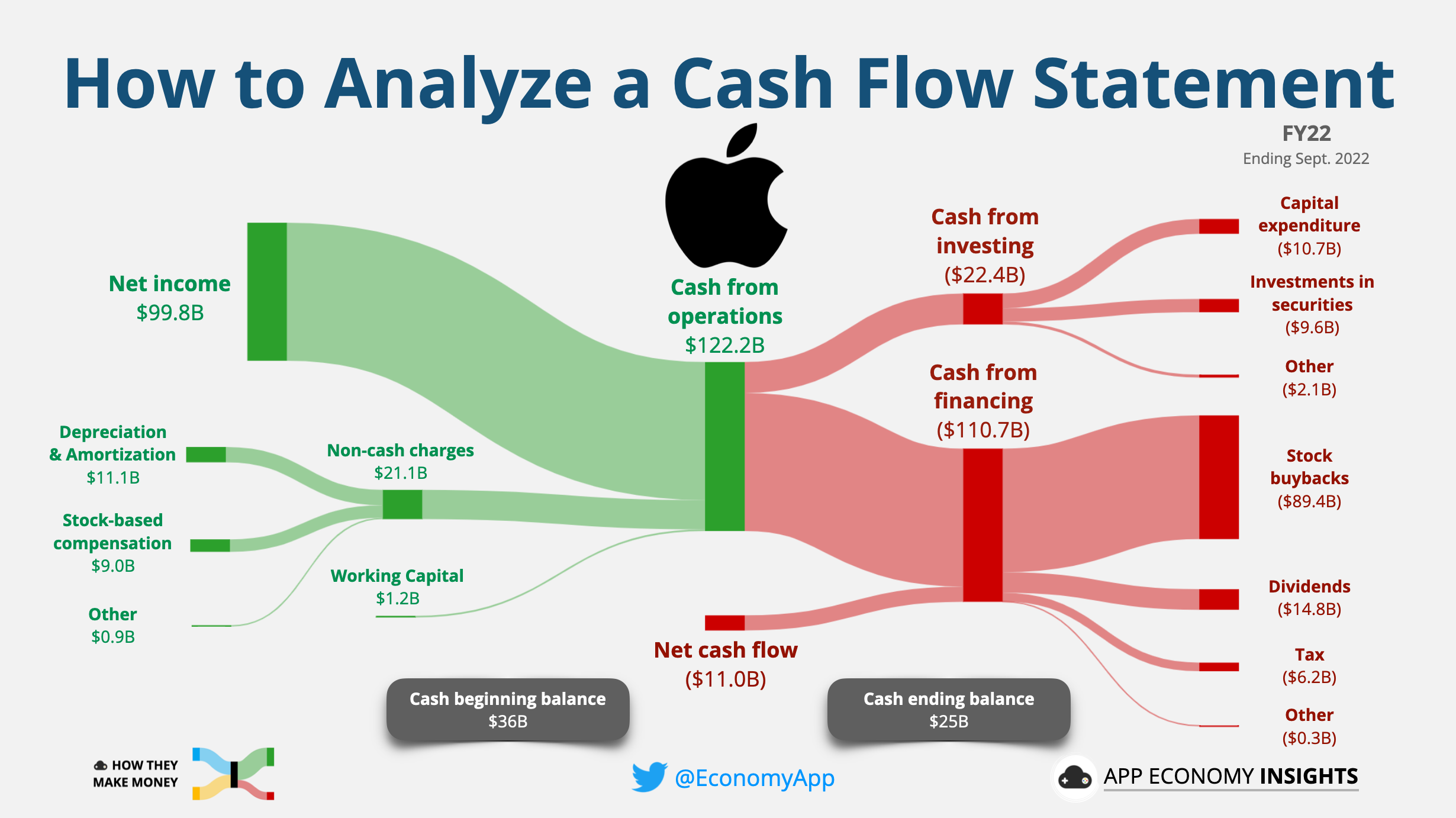

Lower Cash Flow For Eni Impact On Share Buyback And Cost Cutting Measures

Apr 25, 2025

Lower Cash Flow For Eni Impact On Share Buyback And Cost Cutting Measures

Apr 25, 2025

Latest Posts

-

Snls Failed Harry Styles Impression His Reaction Will Shock You

May 10, 2025

Snls Failed Harry Styles Impression His Reaction Will Shock You

May 10, 2025 -

Harry Styles Snl Impression The Reaction That Broke The Internet

May 10, 2025

Harry Styles Snl Impression The Reaction That Broke The Internet

May 10, 2025 -

Harry Styles Honest Feelings About His Terrible Snl Impression

May 10, 2025

Harry Styles Honest Feelings About His Terrible Snl Impression

May 10, 2025 -

The Snl Impression That Left Harry Styles Devastated

May 10, 2025

The Snl Impression That Left Harry Styles Devastated

May 10, 2025 -

Harry Styles Snl Impression Backlash The Singers Response

May 10, 2025

Harry Styles Snl Impression Backlash The Singers Response

May 10, 2025