Uber's Resilience: Analyzing The Stock's Recession Resistance

Table of Contents

Uber's Diversified Revenue Streams

Uber's success in navigating economic uncertainty stems significantly from its diversified revenue streams. Rather than relying on a single service, Uber offers a portfolio of options, mitigating the risk associated with any single sector's downturn.

Ridesharing's Adaptability

Uber's core ridesharing business demonstrates remarkable adaptability. During economic downturns, Uber adjusts its pricing strategies to maintain rider demand.

- Dynamic Pricing: Uber utilizes surge pricing during periods of high demand, ensuring driver availability while maximizing revenue. Conversely, during economic slowdowns, they often implement promotional pricing to incentivize ridership.

- Demand Fluctuations: Data reveals that while ride frequency might decrease during recessions, it doesn't plummet as drastically as some might expect. Essential travel remains consistent, cushioning the impact.

- Marketing Initiatives: Targeted marketing campaigns focusing on affordability and convenience help maintain ridership even during challenging economic times.

The Robustness of Uber Eats

Uber Eats has proven to be a remarkably resilient revenue stream, especially during periods of economic hardship and lockdowns. Its performance often outpaces other sectors during such times.

- Increased Demand: Economic uncertainty often leads to increased demand for food delivery, as consumers curtail restaurant visits or seek cost-effective meal solutions.

- Lockdown Resilience: The COVID-19 pandemic highlighted the strength of Uber Eats, showcasing its ability to thrive even under strict lockdown measures.

- Grocery Delivery Partnerships: The expansion into grocery delivery has further diversified Uber Eats, reducing reliance on restaurant partnerships and increasing revenue streams. Data suggests a significant growth in this sector during periods of economic uncertainty.

Freight and Other Emerging Businesses

Uber Freight and other emerging services, though smaller contributors currently, demonstrate a promising avenue for future recession resistance. This diversification is key to reducing overall volatility.

- Mitigating Risk: The growth of Uber Freight offers a hedge against potential downturns in the ridesharing and food delivery sectors.

- Long-Term Growth Potential: These emerging businesses represent potential future revenue streams, further strengthening Uber's position as a diversified player in the transportation and logistics industries.

Cost-Cutting Measures and Efficiency Improvements

Uber's ability to maintain profitability during economic downturns is also linked to its efficient cost management and technological advancements.

Technological Advancements and Automation

Uber's significant investments in technology lead to operational efficiencies and substantial cost savings.

- AI-Driven Optimization: Machine learning algorithms optimize driver allocation, routing, and pricing, maximizing efficiency and minimizing fuel consumption.

- Autonomous Vehicle Initiatives: While still in development, Uber's pursuit of self-driving technology holds the potential for significant long-term cost reductions by minimizing labor costs.

Strategic Workforce Management

Uber's reliance on a flexible gig-worker model allows for efficient workforce adjustments during economic downturns.

- Gig Worker Flexibility: The ability to scale the workforce up or down rapidly enables Uber to adjust operational costs based on demand fluctuations.

- Controlled Headcount: Reducing non-essential personnel in corporate roles during economic uncertainty minimizes fixed costs.

Financial Management and Debt Reduction

Uber's financial management and strategic debt reduction initiatives contribute significantly to its recession resilience.

- Debt-to-Equity Ratio: Improvements in Uber's debt-to-equity ratio demonstrate a commitment to financial health and stability.

- Cash Reserves: Maintaining substantial cash reserves provides a financial buffer during economic downturns.

- Profitability Improvements: Uber's focus on improving profitability strengthens its ability to weather economic storms.

Market Position and Competitive Advantages

Uber's strong market position and competitive advantages solidify its recession resistance.

Network Effects and Brand Recognition

Uber's vast network and strong brand recognition create significant barriers to entry for competitors.

- Network Effects: The larger Uber's network, the more attractive it becomes for both riders and drivers, creating a self-reinforcing cycle.

- Brand Loyalty: Established brand recognition and user loyalty make it difficult for new entrants to gain market share.

Global Reach and Diversification across Markets

Operating in numerous global markets diversifies Uber's revenue streams, reducing its reliance on any single economy's performance.

- Geographic Diversification: Strong performance in diverse markets mitigates the impact of economic downturns in any one region.

- Global Market Opportunities: Continued expansion into new markets offers further diversification and long-term growth potential.

Conclusion: Investing in Uber's Recession Resistance

Uber's resilience during economic downturns is underpinned by its diversified revenue streams, efficient cost management, and strong market position. This demonstrates its potential as a recession-resistant investment. Consider adding Uber to your portfolio for its demonstrated recession resistance. Learn more about how Uber's recession resistance makes it an attractive investment opportunity. Uber's adaptability and strategic positioning suggest a positive outlook on its long-term prospects, making it a compelling addition to a diversified investment strategy.

Featured Posts

-

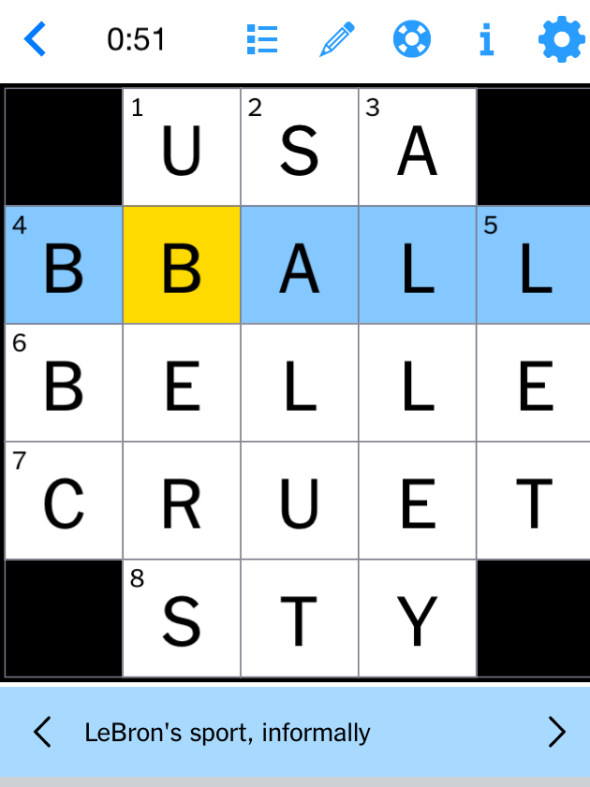

Complete Guide To Nyt Mini Crossword Answers March 24 2025

May 19, 2025

Complete Guide To Nyt Mini Crossword Answers March 24 2025

May 19, 2025 -

Report Bueckers Headed To Wnba Poised For Top Selection

May 19, 2025

Report Bueckers Headed To Wnba Poised For Top Selection

May 19, 2025 -

2025 Nevresim Takimi Trendleri Gencler Ve Aileler Icin Dinamik Tasarimlar

May 19, 2025

2025 Nevresim Takimi Trendleri Gencler Ve Aileler Icin Dinamik Tasarimlar

May 19, 2025 -

Vote Now Your Favourite Eurovision Song Of The 21st Century Bbc Radio 2

May 19, 2025

Vote Now Your Favourite Eurovision Song Of The 21st Century Bbc Radio 2

May 19, 2025 -

The Fallout From Trumps Order Libraries Reel From Funding Losses

May 19, 2025

The Fallout From Trumps Order Libraries Reel From Funding Losses

May 19, 2025