Uber's Foodpanda Taiwan Acquisition Fails: Regulatory Challenges Cited

Table of Contents

The Key Regulatory Obstacles

The failure of the Uber's Foodpanda Taiwan acquisition can be largely attributed to several key regulatory obstacles. The deal faced intense scrutiny from Taiwanese regulatory bodies, ultimately proving insurmountable.

-

Antitrust Concerns and Market Dominance: The Fair Trade Commission (FTC) in Taiwan likely raised concerns about the potential creation of a monopoly or oligopoly in the food delivery market. A combined Uber-Foodpanda entity would have controlled a significant market share, potentially stifling competition and harming consumers. This investigation into potential antitrust violations proved to be a major hurdle. The FTC's focus on maintaining fair competition in the Taiwanese market played a crucial role in the deal's demise.

-

Data Privacy Regulations: Taiwan has increasingly stringent data privacy regulations. The merger raised concerns regarding the handling and protection of user data collected by both Uber and Foodpanda. The integration of two vast databases containing sensitive customer information required significant assurances about compliance with regulations like the Personal Data Protection Act (PDPA), and any failure to provide sufficient guarantees would likely have led to regulatory pushback.

-

Stringent Foreign Investment Regulations: Taiwanese regulations governing foreign investment present additional complexities for multinational corporations. Uber's attempt to fully acquire Foodpanda likely encountered obstacles related to foreign ownership limits, approval processes, and potentially restrictions on data transfer outside of Taiwan. Navigating these regulations requires significant legal expertise and careful planning.

-

Licensing and Permitting Difficulties: Obtaining the necessary licenses and permits for such a large-scale merger in Taiwan is a complex and time-consuming process. Delays or denials in obtaining the required approvals likely contributed to the deal's failure. This highlights the importance of proactive engagement with regulatory bodies throughout the acquisition process.

-

Specific Regulations: While specific details may not be publicly available, the problematic regulations likely involved a combination of the Fair Trade Act (governing competition), the Personal Data Protection Act (governing data privacy), and the Statute for Investment by Foreign Nationals (governing foreign investment). These laws impose strict requirements that must be meticulously addressed during any major merger or acquisition.

Impact on the Taiwanese Food Delivery Market

The failed Uber's Foodpanda Taiwan acquisition significantly impacts the Taiwanese food delivery market, already a fiercely competitive landscape with players like Deliveroo and local startups vying for market share.

-

Competitive Landscape: The absence of a merged entity leaves the market fragmented, potentially creating opportunities for smaller players to expand their market share. Competition is likely to intensify, with existing companies focusing on aggressive marketing and strategic partnerships to attract customers.

-

Consumer Impact: While the short-term impact on consumer prices and service quality remains to be seen, the increased competition could potentially lead to improved services or pricing adjustments in the long run. Consumers will likely benefit from the continued competition and innovation in the market.

-

Employment Effects: The effects on employment within the food delivery sector are unclear. While the merger might have resulted in some consolidation, the increased competition could also create new job opportunities within different companies.

-

Future Mergers and Acquisitions: This failed acquisition serves as a cautionary tale for future mergers and acquisitions in the Taiwanese food delivery sector. Companies will need to carefully consider regulatory hurdles and conduct thorough due diligence before pursuing similar transactions.

-

Market Share Dynamics: The failed deal leaves the door open for other players to challenge the existing dominant players. We may see a surge in consolidation and acquisition attempts, but each deal will have to navigate the regulatory landscape very carefully.

Implications for Uber's Global Strategy

The failed acquisition has significant implications for Uber's global strategy and its future approach to mergers and acquisitions.

-

Asia Expansion Plans: This setback could influence Uber's expansion plans in Asia, prompting a reassessment of its approach to navigating regulatory complexities in other markets within the region. They will need to consider more carefully the regulatory environments in countries where they seek to expand.

-

Regulatory Compliance: The failure underscores the importance of thorough regulatory due diligence and compliance for Uber's future M&A activities globally. This event serves as a valuable lesson in understanding the nuances of each local regulatory framework.

-

Future M&A Strategies: Uber may adjust its future M&A strategies to incorporate more extensive risk assessment and regulatory planning. They are likely to engage with local legal experts early in the process to avoid similar situations.

-

Financial Repercussions: While the direct financial impact may be limited, the failure could negatively influence investor confidence and potentially affect Uber's stock price in the short term. However, the long-term impacts on Uber's financial health should be minimal.

-

Investor Reaction: Investors will be watching Uber's response closely. A successful navigation of future mergers and acquisitions will be crucial to regaining investor confidence.

Conclusion

The failed Uber's Foodpanda Taiwan acquisition serves as a stark reminder of the crucial role regulatory compliance plays in successful mergers and acquisitions, particularly in a highly regulated market like Taiwan. The deal's collapse highlights the complexities of antitrust concerns, data privacy regulations, and foreign investment laws. This outcome significantly alters the dynamics of Taiwan's food delivery landscape, presenting opportunities for other players while simultaneously raising questions about Uber’s future expansion strategies in the region. Understanding the intricacies of the Uber's Foodpanda Taiwan acquisition failure is vital for businesses considering similar transactions in Taiwan. Thorough due diligence and expert legal counsel are crucial to successfully navigating the complex regulatory environment surrounding mergers and acquisitions in Taiwan. Learn more about navigating the legal landscape of business acquisitions in Taiwan to avoid similar pitfalls.

Featured Posts

-

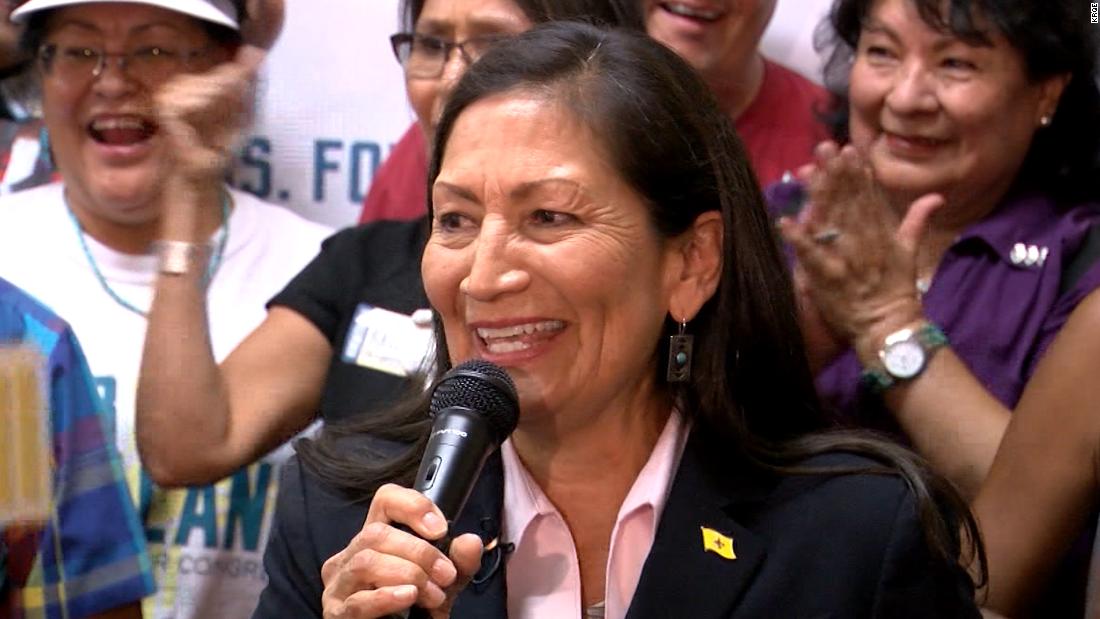

Haaland Announces New Mexico Gubernatorial Bid

May 19, 2025

Haaland Announces New Mexico Gubernatorial Bid

May 19, 2025 -

Gazze Ye Yardim Malzemesi Tasiyan Tirlarin Girisi Guencel Durum

May 19, 2025

Gazze Ye Yardim Malzemesi Tasiyan Tirlarin Girisi Guencel Durum

May 19, 2025 -

The Eurovision Song Contest How Does The Voting Work

May 19, 2025

The Eurovision Song Contest How Does The Voting Work

May 19, 2025 -

Michael Morales A Deep Dive Into The Undefeated Ufc Fighter

May 19, 2025

Michael Morales A Deep Dive Into The Undefeated Ufc Fighter

May 19, 2025 -

Legendary Singer Announces Farewell Concert Amidst Memory Concerns

May 19, 2025

Legendary Singer Announces Farewell Concert Amidst Memory Concerns

May 19, 2025