Uber's Autonomous Future: A Guide To Investing With ETFs

Table of Contents

Understanding the Autonomous Vehicle Market and Uber's Role

The autonomous vehicle market is booming, projected to reach a valuation of trillions of dollars within the next decade. This explosive growth is fueled by advancements in artificial intelligence, sensor technology, and mapping capabilities. Uber, a major player in the transportation industry, is significantly contributing to this revolution through its Advanced Technologies Group (ATG). Uber ATG is actively developing and testing self-driving technology, aiming to integrate autonomous vehicles into its ride-hailing platform. This strategic move positions Uber for significant future growth in the autonomous vehicle market.

- Market size projections for the next 5-10 years: Analysts predict a compound annual growth rate (CAGR) exceeding 20% for the autonomous vehicle market over the next decade.

- Key players in the autonomous vehicle space besides Uber: Other significant players include Waymo (Google), Tesla, Cruise (General Motors), and Aurora Innovation. Competition is fierce, but the overall market is vast enough for multiple winners.

- Specific examples of Uber's autonomous vehicle initiatives: Uber has conducted numerous pilot programs in various cities, testing its self-driving technology in real-world conditions. They have also formed strategic partnerships with technology companies to enhance their autonomous driving capabilities.

Identifying Relevant ETFs for Uber Autonomous Vehicle Investments

Investing directly in Uber's autonomous vehicle division might be difficult for individual investors. However, Uber Autonomous Vehicles ETFs provide a diversified approach to participate in this growing market. Several ETFs focus on technology companies involved in AI, sensor technology, mapping, and other crucial components of autonomous driving systems. These ETFs indirectly provide exposure to Uber's success, as its progress benefits the entire ecosystem.

- Examples of specific ETFs (with tickers): While specific ETF tickers change and new ones emerge, look for ETFs focusing on technology, robotics, and AI. You might find suitable options by searching for ETFs with holdings in companies like Nvidia (NVDA), which supplies crucial AI chips. Always check the ETF's holdings to ensure alignment with your investment goals. Consult a financial professional for specific recommendations.

- Explanation of ETF expense ratios and other relevant fees: Before investing, carefully review the expense ratio of each ETF. This fee represents the annual cost of owning the ETF. Lower expense ratios are generally preferable.

- Mention the importance of diversification within ETF portfolios: Diversification is key to mitigating risk. Don't put all your eggs in one basket; spread your investments across multiple ETFs to reduce the impact of any single company's underperformance.

Assessing the Risks and Rewards of Investing in Autonomous Vehicle ETFs

Investing in Uber Autonomous Vehicles ETFs, or any investment in the autonomous vehicle sector, carries inherent risks. The technology is still developing, and regulatory hurdles could significantly impact market growth. Intense competition also poses a challenge. However, the potential rewards are considerable, offering investors exposure to a potentially transformative industry.

- Potential regulatory setbacks and their impact on the market: Government regulations concerning autonomous vehicle testing and deployment can significantly affect the timeline and profitability of the industry.

- Technological risks and the possibility of unforeseen challenges: Autonomous driving technology is complex. Unexpected technical glitches or safety concerns could negatively impact investor confidence.

- Competitive landscape and the risk of market share erosion: The autonomous vehicle market is highly competitive. Companies may struggle to maintain market share if their technology falls behind.

- Potential returns based on market forecasts: While past performance isn't indicative of future results, the market's high growth projections suggest potentially significant returns for successful investments in this sector.

A Step-by-Step Guide to Investing in Uber Autonomous Vehicle ETFs

Investing in ETFs is relatively straightforward. Here's a simple guide:

- Steps to open an online brokerage account: Choose a reputable online brokerage platform (e.g., Fidelity, Charles Schwab, TD Ameritrade). Complete the necessary paperwork and fund your account.

- Strategies for selecting the right ETF based on risk tolerance: Assess your risk tolerance. If you're risk-averse, consider ETFs with a lower volatility. For higher-risk tolerance, you might choose ETFs with higher growth potential but greater volatility.

- Importance of regular portfolio review and adjustments: Regularly review your portfolio's performance and adjust your investments as needed based on market conditions and your financial goals. Consider consulting with a financial advisor.

Conclusion

Investing in Uber's autonomous future through ETFs can be a rewarding but risky venture. By understanding the market dynamics, identifying relevant ETFs, and carefully assessing the risks and rewards, investors can potentially capitalize on the transformative potential of autonomous vehicles. Remember to conduct thorough research and, if necessary, seek professional financial advice before investing in any Uber Autonomous Vehicles ETFs or similar investments. Start exploring your investment options in the exciting world of autonomous vehicle technology today!

Featured Posts

-

Top Australian Crypto Casinos 2025 A Comprehensive Guide

May 18, 2025

Top Australian Crypto Casinos 2025 A Comprehensive Guide

May 18, 2025 -

Late 2025 Deadline Analysts See Trumps 30 China Tariffs Continuing

May 18, 2025

Late 2025 Deadline Analysts See Trumps 30 China Tariffs Continuing

May 18, 2025 -

Living In Japans Metropolis An Expats Perspective

May 18, 2025

Living In Japans Metropolis An Expats Perspective

May 18, 2025 -

The Rat Packs Casinos Then And Now

May 18, 2025

The Rat Packs Casinos Then And Now

May 18, 2025 -

Poker Stars Casino St Patricks Day Spin Daily Bonus And Prizes

May 18, 2025

Poker Stars Casino St Patricks Day Spin Daily Bonus And Prizes

May 18, 2025

Latest Posts

-

Film No Other Land Raih Oscar Cerminan Konflik Palestina Israel

May 18, 2025

Film No Other Land Raih Oscar Cerminan Konflik Palestina Israel

May 18, 2025 -

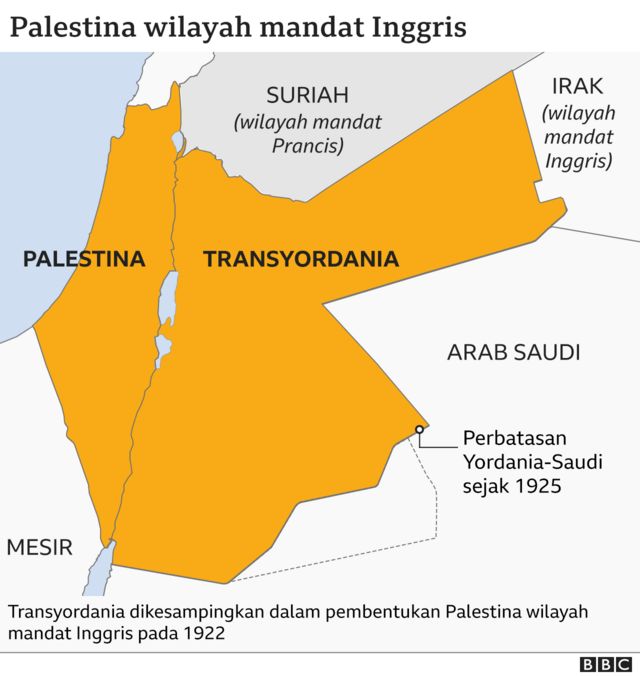

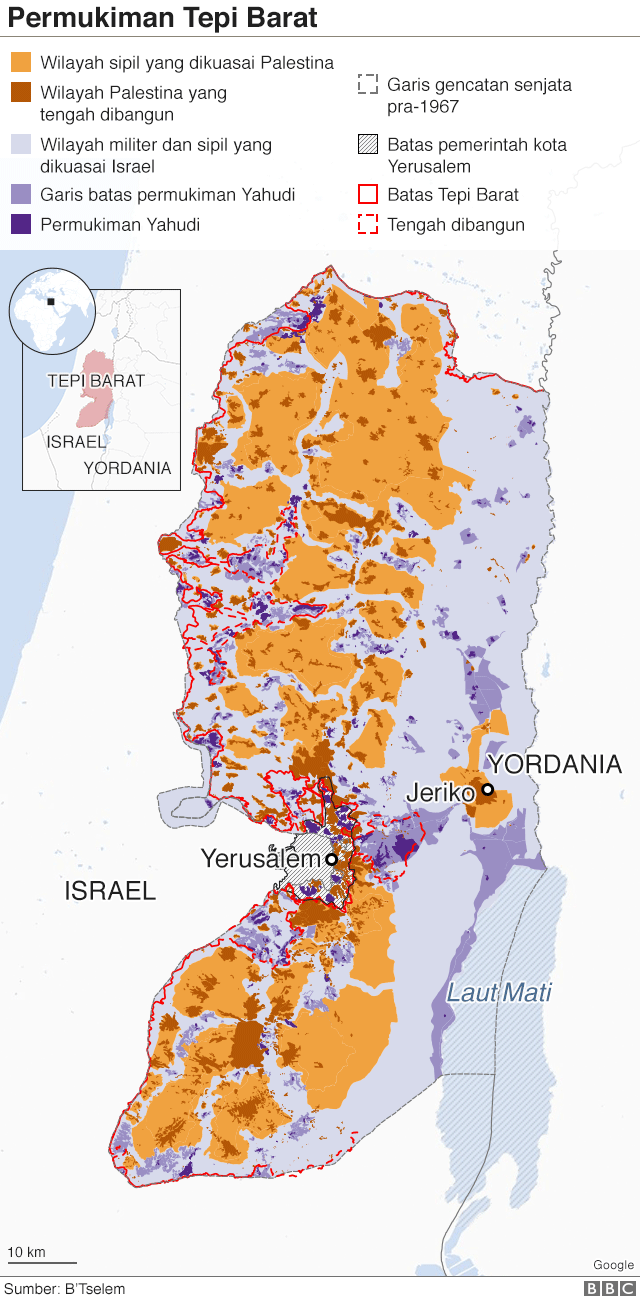

Analisis Infografis Pandangan Pbb Jalan Buntu Perdamaian Israel Palestina Dan Peran Indonesia

May 18, 2025

Analisis Infografis Pandangan Pbb Jalan Buntu Perdamaian Israel Palestina Dan Peran Indonesia

May 18, 2025 -

Realita Konflik Palestina Israel Terungkap Dalam Film Pemenang Oscar No Other Land

May 18, 2025

Realita Konflik Palestina Israel Terungkap Dalam Film Pemenang Oscar No Other Land

May 18, 2025 -

Infografis Pbb Pesimistis Solusi Dua Negara Israel Palestina Terancam

May 18, 2025

Infografis Pbb Pesimistis Solusi Dua Negara Israel Palestina Terancam

May 18, 2025 -

No Other Land Oscar Untuk Realita Konflik Palestina Israel

May 18, 2025

No Other Land Oscar Untuk Realita Konflik Palestina Israel

May 18, 2025