Uber Technologies (UBER): Investment Prospects In The Ride-Sharing Market

Table of Contents

Uber's Financial Performance and Growth Potential

Uber's success hinges on its diverse revenue streams and ambitious growth strategy. Understanding its financial performance is key to evaluating its investment prospects.

H3: Revenue Streams and Diversification:

Uber's revenue isn't solely reliant on its ride-hailing services. The company has successfully diversified its offerings, including:

- Uber Rides: The flagship service, still a major contributor to overall revenue, continues to expand into new markets and offer various service tiers.

- Uber Eats: The food delivery service has seen explosive growth, becoming a significant competitor in the online food delivery market.

- Uber Freight: Targeting the logistics sector, this service connects shippers with trucking companies, providing another avenue for revenue generation.

- Other Bets: Uber continues to explore other avenues, including autonomous vehicles and micromobility solutions, showcasing a commitment to future growth.

Analyzing Uber's year-over-year revenue growth reveals consistent expansion, despite economic fluctuations. Successful market penetration in new geographic regions and the strategic acquisition of smaller companies have contributed significantly to this diversification. This multi-pronged approach mitigates risk associated with relying on a single service.

H3: Profitability and Sustainability:

Achieving sustainable profitability remains a key challenge for Uber. While revenue is strong, operational costs, including driver compensation and marketing expenses, significantly impact profit margins.

- Profit Margins: Uber's profit margins have shown improvement in recent years, but they remain relatively thin compared to other established tech companies.

- Operating Expenses: Efforts to improve efficiency and reduce operational costs are ongoing, including technological advancements and optimized routing algorithms.

- Debt Levels: Managing debt levels is crucial for long-term financial health. Uber's debt load and its ability to manage it will significantly influence its profitability.

Uber's strategies to enhance profitability include dynamic pricing, cost-cutting measures, and increased operational efficiency. The success of these strategies will be vital in determining the long-term investment attractiveness of Uber stock.

Competitive Landscape and Market Share

The ride-sharing market is competitive, with Uber facing several formidable rivals. Understanding this landscape is critical when assessing Uber's investment prospects.

H3: Key Competitors and Market Dynamics:

Uber's main competitors include Lyft in the US, Didi Chuxing in China, and various regional players. Competition varies by geographic location and service type.

- Market Share: Uber maintains a substantial global market share, but competitive pressures in specific regions and service categories impact its overall dominance.

- Competitive Advantages: Uber's brand recognition, extensive network, and technological innovation provide a strong competitive edge.

- Pricing Strategies: Aggressive pricing strategies often impact short-term profitability but are crucial for maintaining market share and attracting customers.

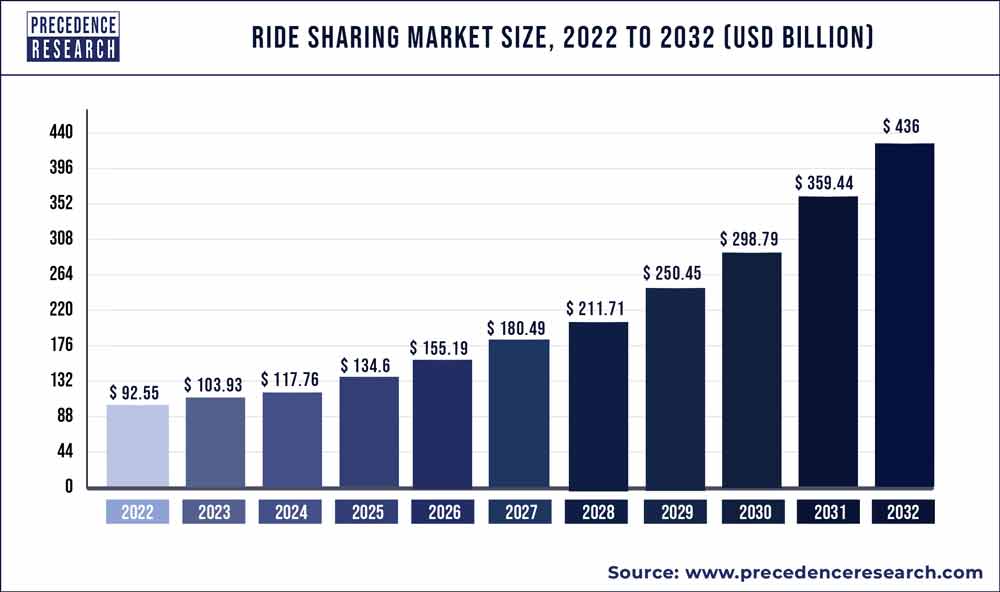

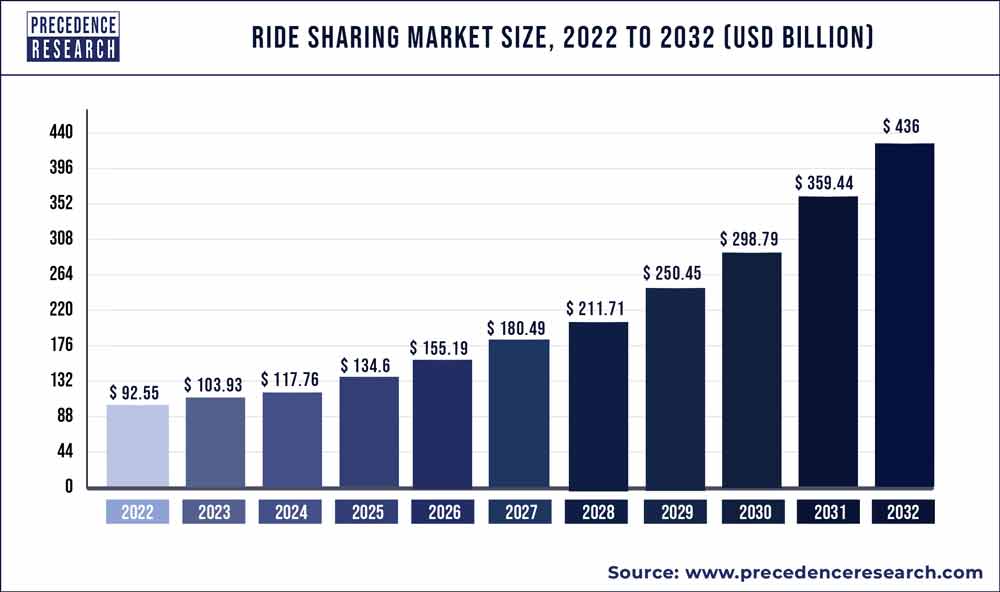

H3: Future Market Trends and Growth Opportunities:

The future of the ride-sharing market will be shaped by several key trends:

- Autonomous Vehicles: The successful implementation of self-driving technology holds the potential to significantly reduce operational costs and increase efficiency for Uber.

- Micromobility: Expanding into micromobility solutions (e.g., e-scooters, e-bikes) opens new revenue streams and caters to evolving customer preferences.

- Strategic Partnerships: Collaborations with other companies in adjacent industries can accelerate growth and open up new opportunities.

Risks and Challenges Facing Uber

Despite its growth potential, Uber faces significant risks and challenges. A realistic assessment of these factors is crucial for evaluating investment prospects.

H3: Regulatory Hurdles and Legal Battles:

Uber operates in a heavily regulated environment, facing numerous legal and regulatory challenges globally:

- Licensing Requirements: Obtaining and maintaining necessary licenses and permits in different jurisdictions can be complex and costly.

- Labor Laws: Classifying drivers as independent contractors versus employees is a significant legal battleground with potential for significant financial impacts.

- Safety Regulations: Ensuring the safety of both drivers and passengers is paramount and necessitates adherence to stringent regulations.

H3: Economic Factors and External Risks:

Macroeconomic factors and unforeseen events can significantly impact Uber's business:

- Economic Fluctuations: Ride-sharing demand is sensitive to economic downturns, impacting revenue during periods of recession.

- Geopolitical Instability: Political instability and global events can disrupt operations in specific regions.

- Pandemics: The COVID-19 pandemic demonstrated the vulnerability of the ride-sharing industry to unforeseen global events.

Conclusion:

Uber Technologies presents a compelling investment opportunity, driven by its diverse revenue streams and strategic growth initiatives. However, significant risks related to competition, regulation, and macroeconomic factors need careful consideration. The company's ability to navigate these challenges and successfully capitalize on emerging trends like autonomous vehicles and micromobility will be crucial for its long-term success. The potential returns associated with Uber stock investment are substantial, but so are the inherent risks. Therefore, conducting thorough due diligence and assessing your personal risk tolerance before investing in Uber stock is paramount. Consider further research into Uber investment opportunities and carefully analyze Uber investment prospects before making any investment decisions.

Featured Posts

-

Stock Market Update Rockwell Automation Disney And Others Fuel Wednesdays Gains

May 17, 2025

Stock Market Update Rockwell Automation Disney And Others Fuel Wednesdays Gains

May 17, 2025 -

112

May 17, 2025

112

May 17, 2025 -

Fortnites In Game Store Under Fire Again Epic Games Faces New Legal Challenges

May 17, 2025

Fortnites In Game Store Under Fire Again Epic Games Faces New Legal Challenges

May 17, 2025 -

Blue Origins Rocket Launch Delayed Subsystem Malfunction

May 17, 2025

Blue Origins Rocket Launch Delayed Subsystem Malfunction

May 17, 2025 -

Student Loans And Homeownership Navigating The Challenges

May 17, 2025

Student Loans And Homeownership Navigating The Challenges

May 17, 2025

Latest Posts

-

Nba Playoffs Knicks Vs Pistons Odds Predictions And Bet365 Bonus Code Nypbet

May 17, 2025

Nba Playoffs Knicks Vs Pistons Odds Predictions And Bet365 Bonus Code Nypbet

May 17, 2025 -

Bet365 Nypbet Bonus Code Your Guide To Knicks Vs Pistons Betting

May 17, 2025

Bet365 Nypbet Bonus Code Your Guide To Knicks Vs Pistons Betting

May 17, 2025 -

New York Knicks Thibodeau Demands More Resolve After Crushing Defeat

May 17, 2025

New York Knicks Thibodeau Demands More Resolve After Crushing Defeat

May 17, 2025 -

Knicks Vs Pistons Series Bet365 Bonus Code Nypbet And Betting Odds

May 17, 2025

Knicks Vs Pistons Series Bet365 Bonus Code Nypbet And Betting Odds

May 17, 2025 -

Ujedinjeni Arapski Emirati Planiranje Savrsenog Odmora

May 17, 2025

Ujedinjeni Arapski Emirati Planiranje Savrsenog Odmora

May 17, 2025