Uber Stock Recession-Proof? Analyst Insights

Table of Contents

- Uber's Business Model: Resilience and Vulnerability During Economic Slowdowns

- The Two Sides of the Coin:

- Pricing Strategies and Market Share:

- Analyst Opinions and Predictions on Uber Stock's Recession Resistance

- Bullish vs. Bearish Sentiment:

- Key Financial Indicators to Watch:

- Investing in Uber Stock During Uncertain Times: Strategies and Considerations

- Risk Assessment and Diversification:

- Long-Term vs. Short-Term Investment Strategies:

- Conclusion: Is Uber Stock Truly Recession-Proof? Your Investment Decision

Uber's Business Model: Resilience and Vulnerability During Economic Slowdowns

The Two Sides of the Coin:

Uber operates on a dual revenue stream: ridesharing and Uber Eats. These two segments exhibit different sensitivities to economic fluctuations.

- Ridesharing: During a recession, discretionary spending often decreases. This can lead to reduced demand for ridesharing services, impacting Uber's revenue from this segment. People may opt for less expensive transportation options or reduce their overall travel.

- Uber Eats: Conversely, Uber Eats might see increased demand during a recession. As consumers cut back on dining out, they may increasingly rely on food delivery services for convenience and cost savings. However, increased competition and the pressure to maintain competitive pricing can offset this potential benefit. Profitability hinges on careful management of operational costs and driver incentives.

- Historical data on Uber's performance during previous economic slowdowns is limited, as the company's current business model has only existed for a relatively short period in the context of larger economic cycles. Analyzing past performance of similar companies in the transportation sector might offer some insights.

Pricing Strategies and Market Share:

Uber's pricing strategies and competitive landscape play a crucial role in its recession resilience.

- Dynamic Pricing: Uber's ability to adjust pricing dynamically in response to fluctuations in demand is a key factor. While this can increase revenue during peak periods, it also requires careful management to avoid alienating customers during economic downturns.

- Competitive Advantage: Uber's competitive position against other ride-sharing and food delivery services is critical. Maintaining market share and attracting and retaining customers is essential to navigating economic uncertainty.

- Driver Availability and Retention: The availability and retention of drivers are paramount. During recessions, driver compensation and incentives become vital for maintaining sufficient service levels to meet demand. Attracting and retaining drivers requires competitive pay and benefits, affecting Uber's overall profitability.

Analyst Opinions and Predictions on Uber Stock's Recession Resistance

Bullish vs. Bearish Sentiment:

Analyst opinions on Uber's stock performance during a potential recession are varied.

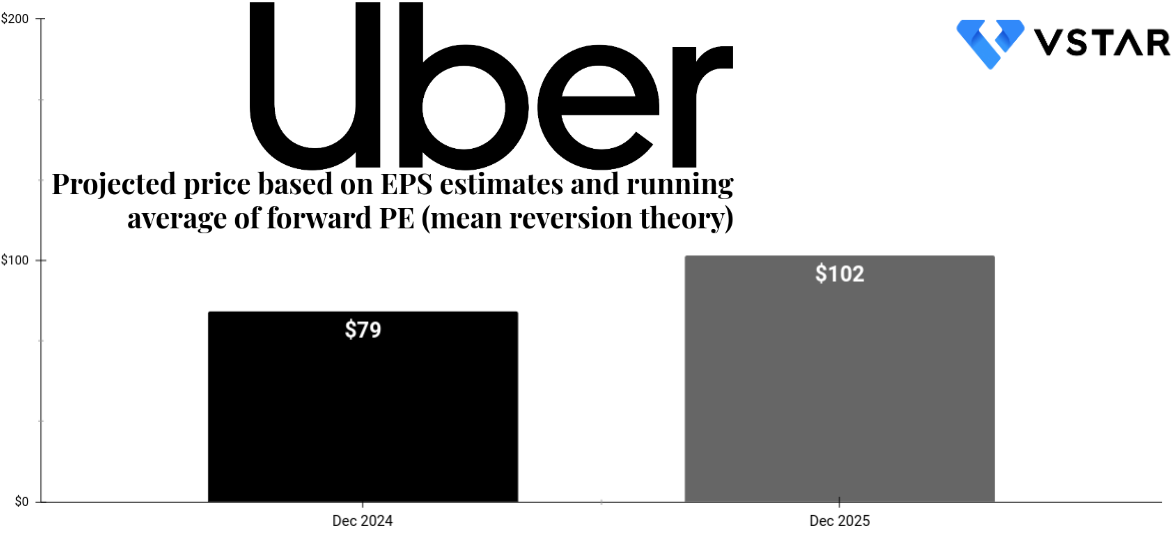

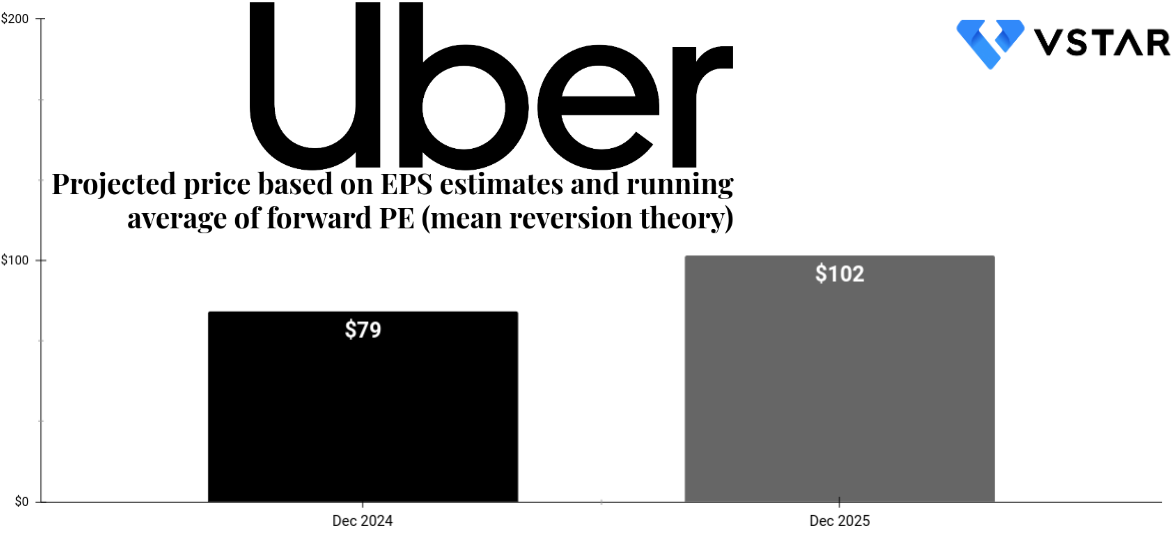

- Divergent Views: Some analysts hold a bullish outlook, citing Uber's diversification across rides and food delivery, its potential for cost optimization, and its overall growth potential in emerging markets. They might point to price targets suggesting significant growth even in a downturn.

- Cautious Predictions: Others maintain a more bearish stance, emphasizing the vulnerability of discretionary spending on ridesharing and the impact of intense competition in the food delivery sector. They might highlight the potential for reduced margins and slower revenue growth.

- Lack of Consensus: A clear consensus among analysts remains elusive, reflecting the inherent uncertainty surrounding the impact of a recession on a company like Uber. It's crucial to analyze various perspectives and form your own informed opinion.

Key Financial Indicators to Watch:

To gauge Uber's recession resilience, investors should closely monitor key financial indicators.

- Revenue Growth and Profitability Margins: Sustained revenue growth and healthy profit margins demonstrate resilience. A decline in these metrics could signal trouble.

- Customer Acquisition and Retention Rates: Strong customer acquisition and retention rates are crucial for sustained growth, regardless of economic conditions.

- Driver Satisfaction and Retention: High driver satisfaction and low turnover are vital for maintaining service quality and operational efficiency.

- Debt Levels and Cash Flow: Managing debt levels and maintaining healthy cash flow are essential for navigating financial uncertainty. High debt levels can be problematic during economic downturns.

Investing in Uber Stock During Uncertain Times: Strategies and Considerations

Risk Assessment and Diversification:

Investing in Uber stock involves inherent risks, particularly considering the volatility of the tech sector.

- Tech Sector Volatility: The tech sector is known for its significant price swings, and Uber stock is no exception. Economic downturns often disproportionately impact this sector.

- Diversification: Diversifying investments across different asset classes is crucial to mitigate risk. Don't put all your eggs in one basket, especially in a volatile sector like tech.

Long-Term vs. Short-Term Investment Strategies:

Uber stock's suitability depends on your investment timeline.

- Long-Term Growth Potential: The long-term growth potential of the ride-sharing and food delivery markets remains significant. A long-term investment strategy might be appropriate for investors with a higher risk tolerance.

- Short-Term Trading Risks: Short-term trading strategies in Uber stock carry significant risk due to its price volatility.

Conclusion: Is Uber Stock Truly Recession-Proof? Your Investment Decision

The question of whether Uber stock is truly recession-proof remains complex. While Uber's dual revenue streams offer some degree of diversification, the sensitivity of ridesharing to economic downturns and the intense competition in the food delivery sector pose significant challenges. Its success during a recession will depend on its ability to adapt its pricing strategies, maintain driver satisfaction, and manage operational costs effectively. Therefore, it's not truly "recession-proof."

Remember that investing in Uber stock or any other stock involves risk. Conduct thorough research, considering the key factors discussed above and your personal risk tolerance, before making any investment decisions. Use reliable financial tools and resources to track Uber stock performance and stay updated on market trends. Make informed decisions regarding your Uber stock investment.

Jose Sorianos Dominance Leads Angels To 1 0 Win Over White Sox

Jose Sorianos Dominance Leads Angels To 1 0 Win Over White Sox

Official Lotto And Lotto Plus Results Saturday April 12 2025

Official Lotto And Lotto Plus Results Saturday April 12 2025

Canterbury Castle Sold For 705 499 A New Chapter Begins

Canterbury Castle Sold For 705 499 A New Chapter Begins

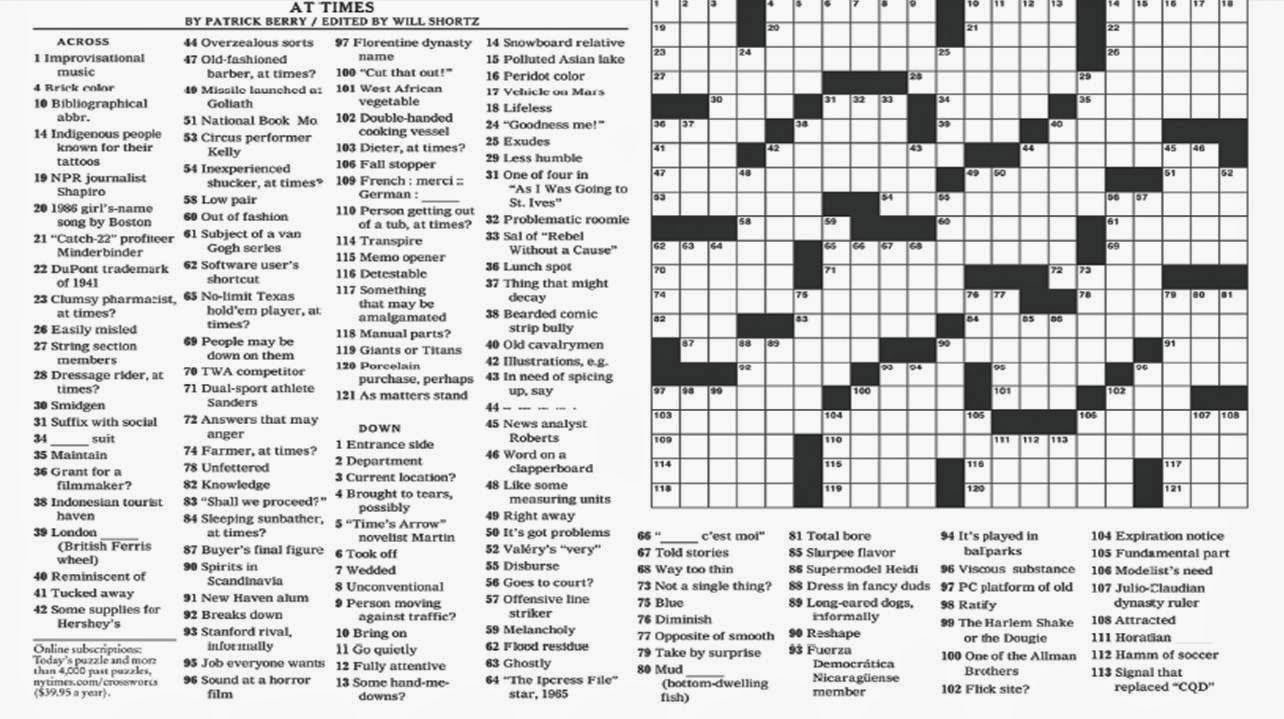

February 27 2025 Nyt Mini Crossword Complete Solution

February 27 2025 Nyt Mini Crossword Complete Solution

The Face Of Japans Metropolis A Look At Its Urban Landscapes

The Face Of Japans Metropolis A Look At Its Urban Landscapes