U.S. Economy Contracts: 0.2% Shrinkage Due To Spending And Tariffs

Table of Contents

Impact of Reduced Consumer Spending on the U.S. Economy

The decline in consumer spending played a pivotal role in the 0.2% contraction. Several factors contributed to this weakening consumer demand.

Decreased Disposable Income

Inflation and rising interest rates significantly impacted consumer purchasing power. The cost of living has increased dramatically, leaving less disposable income for discretionary spending.

- Retail Sales Decline: Retail sales figures showed a [Insert Percentage]% decrease in [Insert Month/Quarter], indicating reduced spending on non-essential goods.

- Automotive Sector Slowdown: The automotive sector experienced a significant slowdown, with [Insert Percentage]% fewer vehicles sold compared to the previous quarter, reflecting a decline in consumer confidence.

- Consumer Confidence Index: The Consumer Confidence Index (CCI) plummeted to [Insert Number], its lowest point in [Number] months, reflecting widespread pessimism about the economy and future prospects. This directly correlates with reduced consumer spending.

Shift in Consumer Priorities

Consumers are prioritizing savings and debt reduction over discretionary spending, contributing to the economic slowdown.

- Increased Savings Rate: The personal savings rate increased to [Insert Percentage]%, indicating a shift towards financial security.

- Credit Card Debt Reduction: Many consumers are focusing on reducing credit card debt, leading to decreased spending on non-essential items.

- Impact on Economic Growth: This shift in consumer behavior represents a significant drag on economic growth, as consumer spending constitutes a large portion of the GDP.

The Role of Inflation in Dampening Consumer Demand

High inflation erodes purchasing power, leading to reduced consumer spending. Real wages, adjusted for inflation, have declined, further squeezing household budgets.

- Inflation Rate: The inflation rate reached [Insert Percentage]%, significantly impacting real wages and consumer purchasing power.

- Impact on Different Income Brackets: Lower-income households are disproportionately affected by inflation, as a larger portion of their income is spent on essential goods and services.

- Reduced Consumer Confidence: Persistent inflation fuels uncertainty and pessimism, leading to further decreases in consumer confidence and spending.

The Effect of Tariffs on U.S. Economic Growth

Tariffs imposed on imported goods have added to the economic challenges.

Increased Import Costs

Tariffs increase the prices of imported goods for both consumers and businesses, reducing demand and increasing the cost of production.

- Steel and Aluminum Tariffs: Tariffs on steel and aluminum, for example, increased the cost of manufacturing goods across various sectors.

- Impact on Specific Industries: The automotive, construction, and manufacturing industries have been particularly affected by increased import costs.

- Price Increases for Consumers: Consumers face higher prices for various goods due to the increased cost of imported components and raw materials.

Impact on International Trade

Tariffs have negatively impacted international trade relationships and disrupted supply chains, leading to reduced trade volumes.

- Trade Wars: Trade disputes with other countries have led to retaliatory tariffs, further harming U.S. exports and economic growth.

- Disrupted Supply Chains: Tariffs have disrupted global supply chains, leading to delays and increased costs for businesses.

- Decline in Trade Volume: The volume of international trade has decreased significantly, contributing to the overall economic slowdown.

Retaliatory Tariffs and Their Economic Fallout

Retaliatory tariffs imposed by other countries further exacerbate the negative economic impacts.

- Retaliation from Trading Partners: Countries like [Insert Examples] have imposed retaliatory tariffs on U.S. goods.

- Impact on U.S. Exports: These retaliatory tariffs have severely impacted U.S. exports, leading to job losses and reduced economic activity.

- Reduced Competitiveness: Increased costs resulting from tariffs have reduced the competitiveness of U.S. businesses in the global market.

Other Contributing Factors to the U.S. Economic Contraction

Beyond consumer spending and tariffs, several other factors contributed to the economic contraction.

Global Economic Slowdown

Global economic uncertainties and slowdowns in other major economies negatively impacted the U.S. economy.

- Slowdown in Europe and Asia: Economic slowdowns in Europe and Asia have reduced demand for U.S. exports.

- Geopolitical Instability: Geopolitical instability in various parts of the world has created uncertainty and dampened investor confidence.

- Impact on Global Trade: The global economic slowdown has led to a reduction in global trade, negatively affecting the U.S. economy.

Supply Chain Disruptions

Ongoing supply chain disruptions have impacted production and increased costs for businesses.

- Shipping Bottlenecks: Shipping bottlenecks and port congestion have delayed the delivery of goods, impacting production schedules and increasing costs.

- Shortage of Raw Materials: Shortages of raw materials have also contributed to production delays and increased prices.

- Impact on Manufacturing: The manufacturing sector has been significantly impacted by supply chain disruptions, leading to reduced output and increased costs.

Geopolitical Uncertainty

Geopolitical events and uncertainty contribute to economic instability and reduced investor confidence.

- [Insert Example of Geopolitical Event]: This event has created uncertainty in the markets, leading to decreased investment and economic activity.

- Impact on Investor Confidence: Geopolitical uncertainty often leads to decreased investor confidence, impacting investment decisions and economic growth.

- Increased Volatility: Geopolitical events can also increase volatility in financial markets, creating further uncertainty and hindering economic growth.

Conclusion: Analyzing the 0.2% U.S. Economic Contraction and Looking Ahead

The 0.2% contraction in the U.S. economy is a result of a confluence of factors, including reduced consumer spending due to inflation and rising interest rates, and the negative impact of tariffs on international trade. The resulting decrease in consumer confidence, coupled with supply chain disruptions and global economic uncertainties, created a perfect storm for economic slowdown. The implications of this contraction could include further job losses, reduced investment, and a potential increase in the national debt.

Understanding the intricacies of the U.S. economic contraction, including the impact of reduced consumer spending and tariffs, is crucial for navigating this period. Stay informed about key economic indicators and monitor developments in consumer spending, inflation, and trade relations to understand the evolving economic landscape. Consult reputable economic news sources for ongoing updates and analysis.

Featured Posts

-

Enroll Now Meteorologist Tom Atkins Bi Annual Skywarn Class

May 31, 2025

Enroll Now Meteorologist Tom Atkins Bi Annual Skywarn Class

May 31, 2025 -

Investigating The Effectiveness Of Veterinary Watchdog Organizations

May 31, 2025

Investigating The Effectiveness Of Veterinary Watchdog Organizations

May 31, 2025 -

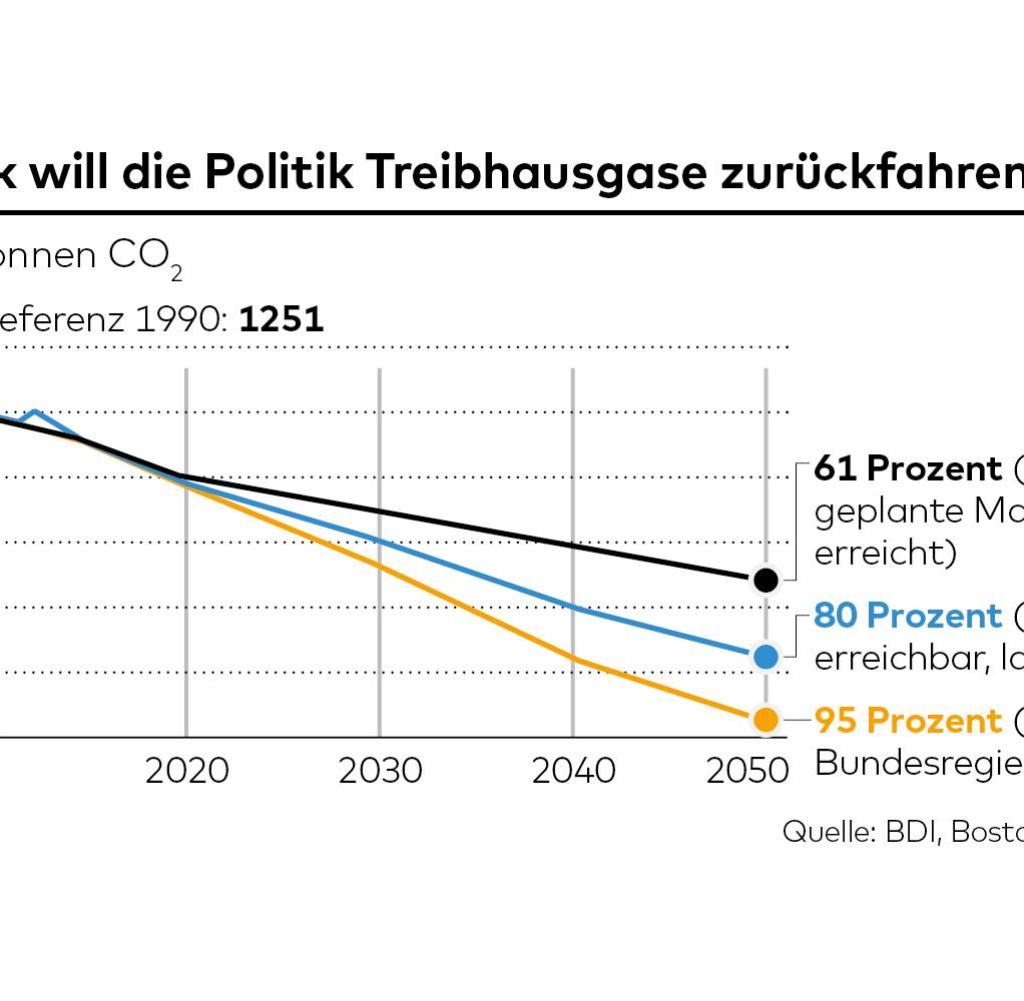

Der Bodensee In 20 000 Jahren Ist Klimaschutz Dann Noch Noetig

May 31, 2025

Der Bodensee In 20 000 Jahren Ist Klimaschutz Dann Noch Noetig

May 31, 2025 -

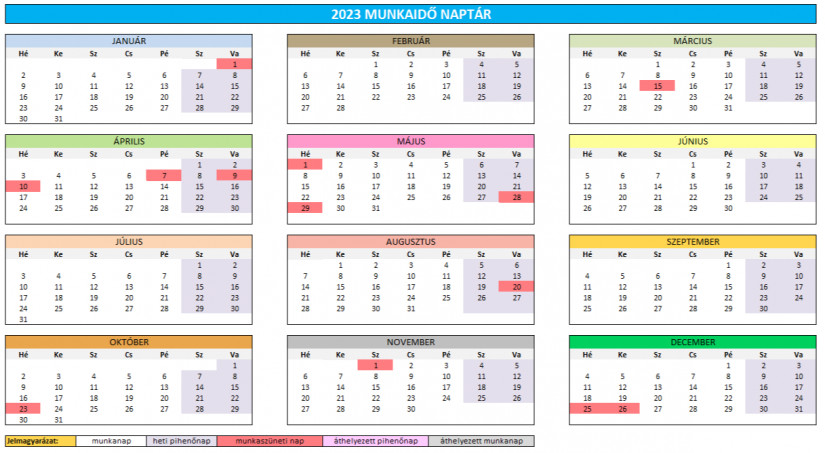

Magyarorszag Csapadekos Napok Es Tavaszias Homerseklet Varhato

May 31, 2025

Magyarorszag Csapadekos Napok Es Tavaszias Homerseklet Varhato

May 31, 2025 -

Thursday April 10th Nyt Mini Crossword Solutions

May 31, 2025

Thursday April 10th Nyt Mini Crossword Solutions

May 31, 2025