U.S. Dollar Faces Steepest Decline Since Nixon Era: A Presidential Economic Analysis

Table of Contents

Historical Context: The Nixon Shock and its Lasting Impact

The Nixon Shock of August 15, 1971, serves as a crucial historical benchmark in understanding the current U.S. dollar decline. President Richard Nixon's decision to unilaterally end the convertibility of the U.S. dollar to gold effectively dismantled the Bretton Woods system, a post-World War II agreement that pegged major currencies to the dollar. This shift marked a transition to a fiat currency system, where the value of the dollar is determined by market forces rather than a fixed gold standard.

- Date of the Nixon Shock and key decisions: August 15, 1971; closing the gold window, imposing a 90-day freeze on wages and prices.

- Impact on gold standard and international trade: Ended the gold standard, leading to increased currency volatility and impacting international trade balances.

- Long-term implications for US economic policy: Created a more flexible, but also more volatile, international monetary system; shifted the focus towards managing inflation and exchange rates through monetary policy.

The Nixon Shock's long-term consequences continue to shape the global monetary landscape, contributing to the complexities of understanding the current U.S. dollar decline. The move away from a fixed exchange rate system created the environment for the fluctuations we see today.

Current Economic Factors Contributing to the U.S. Dollar Decline

Several macroeconomic factors are currently contributing to the weakening of the U.S. dollar. High inflation rates, a consequence of increased consumer spending and supply chain disruptions, are eroding the purchasing power of the dollar, making it less attractive to international investors. Simultaneously, the Federal Reserve's efforts to combat inflation through rising interest rates, while aiming to strengthen the dollar, can also have a paradoxical effect in the short term. Higher interest rates attract foreign investment, but they also slow economic growth, potentially impacting the dollar's value.

- Current inflation rates and their projected trajectory: Inflation remains stubbornly high, exceeding the Federal Reserve's target rate, creating uncertainty about future dollar strength.

- Federal Reserve's recent interest rate adjustments and their rationale: The Fed's aggressive interest rate hikes aim to curb inflation, but this tightening of monetary policy can negatively impact economic growth.

- Impact of global economic uncertainty on the dollar: Geopolitical instability and global economic slowdowns reduce demand for the dollar as a safe haven asset.

- Comparison with other major currencies (Euro, Yen, Pound): The dollar's performance is relative; comparisons with other major currencies highlight its relative weakness.

The interplay between inflation, interest rates, and global economic conditions creates a complex dynamic impacting the U.S. dollar decline.

Presidential Economic Policies and their Influence

Presidential economic policies have significantly influenced the U.S. dollar's trajectory. Fiscal policy decisions, such as government spending and taxation, directly impact the money supply and can contribute to inflation or deflation, influencing the dollar's value. Trade policies and international relations also play a crucial role; trade deficits, for example, can weaken a currency's value. Comparing and contrasting the approaches of different administrations reveals how varying economic philosophies affect the dollar's strength.

- Specific policies implemented by each relevant president: Analyzing specific policies – for example, tax cuts or increased government spending – under different administrations reveals their direct and indirect impact on the dollar.

- Short-term and long-term effects of these policies on the dollar's value: Some policies might offer short-term boosts but lead to long-term consequences.

- Analysis of trade deficits and their contribution to the dollar's decline: Persistent trade deficits can put downward pressure on the dollar's exchange rate.

- Impact of geopolitical events on the dollar's strength: International conflicts and political uncertainties can affect the dollar's role as a safe-haven asset.

Understanding the historical context of presidential economic choices is vital to grasping the current U.S. dollar decline.

Global Economic Competition and the Weakening Dollar

The rise of other global currencies, particularly the Chinese Yuan, challenges the U.S. dollar's historical dominance. Emerging markets are increasingly influencing the global monetary system, diversifying investment opportunities and reducing the dollar's relative importance. Globalization, while fostering interconnectedness, has also contributed to the increased competition among currencies.

- Growth of the Chinese Yuan and other major currencies: The increasing use of the Yuan in international trade directly competes with the dollar's role.

- Shift in global trade dynamics and their influence on currency valuations: Changing trade relationships and partnerships redistribute economic power and impact currency values.

- The impact of increased global interconnectedness on the dollar: While globalization has benefits, it has also made the dollar more vulnerable to global economic fluctuations.

The U.S. dollar's future strength hinges on navigating this complex landscape of global economic competition.

Conclusion: Understanding the U.S. Dollar Decline: A Presidential Economic Perspective

The U.S. dollar decline is a multifaceted issue stemming from a confluence of historical factors, current economic conditions, and presidential economic policies. From the lasting impact of the Nixon Shock to the current challenges of high inflation and global competition, understanding this decline requires a nuanced perspective. The interplay between domestic fiscal and monetary policies, trade relations, and geopolitical events significantly influences the dollar's value on the global stage. Ignoring any of these elements provides an incomplete picture of this significant economic trend.

Stay updated on the latest developments regarding the U.S. dollar decline and its impact on your investments and financial future. Continue your research into presidential economic policies and their influence on the global currency markets. Understanding the U.S. dollar decline is crucial for navigating the complexities of the modern global economy.

Featured Posts

-

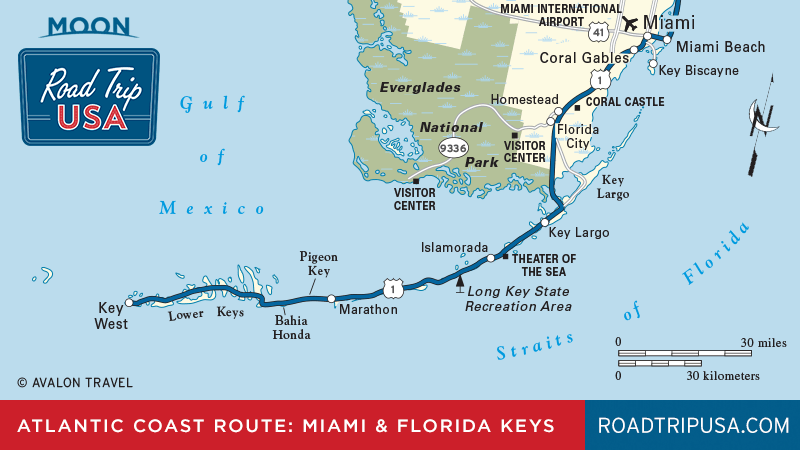

From Railroad To Overwater Highway A Florida Keys Road Trip

Apr 28, 2025

From Railroad To Overwater Highway A Florida Keys Road Trip

Apr 28, 2025 -

Kuxius Innovation Exploring The Solid State Power Bank Advantage

Apr 28, 2025

Kuxius Innovation Exploring The Solid State Power Bank Advantage

Apr 28, 2025 -

Will The Red Sox Deliver Espns 2025 Season Prediction

Apr 28, 2025

Will The Red Sox Deliver Espns 2025 Season Prediction

Apr 28, 2025 -

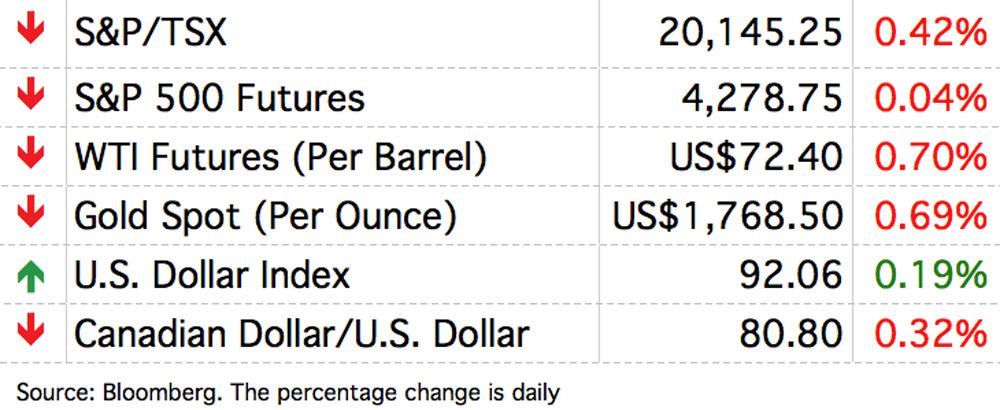

Posthaste Canadian Travel Boycotts Real Time Impact On The Us Economy

Apr 28, 2025

Posthaste Canadian Travel Boycotts Real Time Impact On The Us Economy

Apr 28, 2025 -

As Markets Swooned Pros Sold And Individuals Pounced A Market Analysis

Apr 28, 2025

As Markets Swooned Pros Sold And Individuals Pounced A Market Analysis

Apr 28, 2025

Latest Posts

-

Yankees Aaron Judges Family Grows Baby Announcement

Apr 28, 2025

Yankees Aaron Judges Family Grows Baby Announcement

Apr 28, 2025 -

Aaron Judges Wife Gives Birth Couple Welcomes First Baby

Apr 28, 2025

Aaron Judges Wife Gives Birth Couple Welcomes First Baby

Apr 28, 2025 -

Aaron Judge And Wife Welcome First Child

Apr 28, 2025

Aaron Judge And Wife Welcome First Child

Apr 28, 2025 -

Remembering Cassidy Hubbarth Espns Final Broadcast Tribute

Apr 28, 2025

Remembering Cassidy Hubbarth Espns Final Broadcast Tribute

Apr 28, 2025 -

A Sweet Goodbye Espn Honors Cassidy Hubbarth

Apr 28, 2025

A Sweet Goodbye Espn Honors Cassidy Hubbarth

Apr 28, 2025