U.S. Companies Slash Costs Amid Tariff Uncertainty

Table of Contents

Restructuring Supply Chains to Minimize Tariff Impacts

The unpredictable nature of tariffs necessitates a fundamental re-evaluation of supply chain strategies. Companies are actively seeking ways to minimize their exposure to tariff fluctuations, resulting in two major trends: nearshoring and reshoring, and supply chain diversification.

Nearshoring and Reshoring Initiatives

Nearshoring, the relocation of manufacturing to nearby countries, and reshoring, the return of manufacturing to the U.S., are becoming increasingly popular strategies for mitigating tariff impacts. These shifts, while often costly upfront, offer long-term stability and reduced vulnerability to tariff increases.

- Examples: Several apparel companies have begun reshoring production to reduce reliance on Asian manufacturing, while automotive parts manufacturers are increasingly nearshoring production to Mexico to avoid tariffs on parts imported from China.

- Cost Analysis: While initial investments in new facilities or equipment can be substantial, the long-term cost savings from avoiding tariffs often outweigh the initial expenses. A detailed cost-benefit analysis is crucial before undertaking such a significant shift.

- Challenges: Reshoring and nearshoring initiatives face hurdles, including higher labor costs in the U.S. compared to some overseas locations, and the need for improved infrastructure in certain regions.

Diversifying Sourcing

Reducing reliance on single-source suppliers is another crucial aspect of supply chain optimization. Diversifying sourcing across multiple countries and suppliers helps mitigate the risk of disruptions caused by tariffs or other unforeseen events.

- Advantages: Diversification minimizes the impact of any single supplier facing tariff increases or experiencing production difficulties. It offers greater flexibility and resilience in the face of global uncertainty.

- Examples: Technology companies are increasingly diversifying their semiconductor sourcing to avoid over-reliance on any one supplier, geographically or politically.

- Challenges: Finding reliable alternative suppliers with comparable quality and pricing can be challenging, and managing relationships with multiple suppliers adds complexity to supply chain management. Thorough due diligence is paramount.

Implementing Cost-Cutting Measures Across Operations

Beyond supply chain restructuring, U.S. companies are implementing various cost-cutting measures across their operations to maintain profitability in the face of tariff uncertainty.

Automation and Technological Upgrades

Investment in automation and technology is a key strategy for enhancing cost efficiency. Automation reduces labor costs, improves productivity, and minimizes errors.

- Examples: Manufacturing facilities are increasingly adopting robotics and AI-powered systems for tasks like assembly and quality control. Warehouses are utilizing automated guided vehicles (AGVs) and other technologies to optimize logistics.

- ROI Calculations: While the upfront investment in automation can be significant, the long-term return on investment (ROI) is often substantial due to increased efficiency and reduced labor costs. Careful ROI analysis is crucial for justifying such investments.

- Potential Job Displacement: The increased use of automation raises concerns about potential job displacement. However, many believe that automation will create new jobs in areas like software development, maintenance, and AI management.

Negotiating with Suppliers and Reducing Material Costs

Effective negotiation with suppliers is crucial for securing favorable pricing and payment terms. Exploring alternative, cost-effective materials also contributes to significant savings.

- Effective Negotiation Techniques: Strategies include leveraging market intelligence, building strong supplier relationships, and exploring alternative sourcing options to enhance negotiating power.

- Exploring Alternative Materials: Companies are actively researching and implementing the use of substitute materials that offer comparable performance at lower costs.

- Stronger Supplier Relationships: Building long-term, collaborative relationships with suppliers can lead to better pricing, improved communication, and increased efficiency.

Lean Manufacturing and Waste Reduction

Implementing lean manufacturing principles focuses on eliminating waste in all aspects of production, resulting in significant cost savings and improved efficiency.

- Examples: Lean manufacturing techniques include just-in-time inventory management, kaizen (continuous improvement), and 5S (sort, set in order, shine, standardize, sustain).

- Benefits of Waste Reduction: Reducing waste in materials, time, and effort leads to significant cost savings and improves overall operational efficiency.

- Implementation Challenges: Implementing lean manufacturing principles requires a cultural shift within the organization, strong leadership commitment, and employee training.

The Impact of Tariff Uncertainty on Investment and Growth

Tariff uncertainty has a chilling effect on business investment and overall economic growth. The instability discourages companies from committing to long-term investments, hindering innovation and job creation.

Reduced Capital Expenditures

The unpredictability associated with tariffs leads many companies to postpone or cancel expansion plans and new projects. This reduced capital expenditure negatively impacts job creation and overall economic growth.

- Statistics on Decreased Investment: Data from various sources show a clear correlation between periods of high tariff uncertainty and reduced business investment.

- Impact on Job Creation: Delayed or canceled investment projects directly impact employment opportunities, potentially slowing down job growth.

- Long-Term Economic Implications: Continued uncertainty can lead to a decline in overall economic productivity and competitiveness in the long run.

Impact on Innovation and Research & Development

The instability created by tariff uncertainty discourages companies from investing in research and development (R&D). This reluctance can have severe long-term consequences for the competitiveness of U.S. industries.

- Examples of Reduced R&D Budgets: Many companies are scaling back their R&D budgets in response to the uncertainty surrounding future tariffs.

- Long-Term Consequences for Competitiveness: A reduction in R&D can hinder the development of new technologies and products, potentially undermining the long-term competitiveness of U.S. businesses.

- Government Policies to Mitigate the Impact: Government policies aimed at providing stability and predictability in international trade are crucial for encouraging investment in innovation and R&D.

Conclusion: Navigating the Challenges of Tariff Uncertainty

U.S. companies are employing a multi-pronged approach to navigate the challenges of tariff uncertainty, including restructuring supply chains through nearshoring, reshoring, and diversification; implementing cost-cutting measures like automation and lean manufacturing; and carefully managing supplier relationships. However, the impact of tariff uncertainty extends beyond immediate cost-cutting measures; it significantly dampens investment and innovation, creating long-term economic risks. Understanding the impact of tariff uncertainty and proactively implementing effective cost-cutting strategies is crucial for U.S. businesses to thrive. Explore resources and consult with experts to develop a resilient business plan that mitigates the risks associated with tariff uncertainty and builds a strong foundation for future success.

Featured Posts

-

Anthony Edwards Adidas 2 Everything We Know So Far

Apr 29, 2025

Anthony Edwards Adidas 2 Everything We Know So Far

Apr 29, 2025 -

March 3 2025 Nyt Strands Solutions And Help

Apr 29, 2025

March 3 2025 Nyt Strands Solutions And Help

Apr 29, 2025 -

Celebrate Independence Day Willie Nelsons Texas Picnic

Apr 29, 2025

Celebrate Independence Day Willie Nelsons Texas Picnic

Apr 29, 2025 -

Remembering Italian Greats A Look At Barzagli Toni Immobile Grifo And Rizzitelli In The Bundesliga

Apr 29, 2025

Remembering Italian Greats A Look At Barzagli Toni Immobile Grifo And Rizzitelli In The Bundesliga

Apr 29, 2025 -

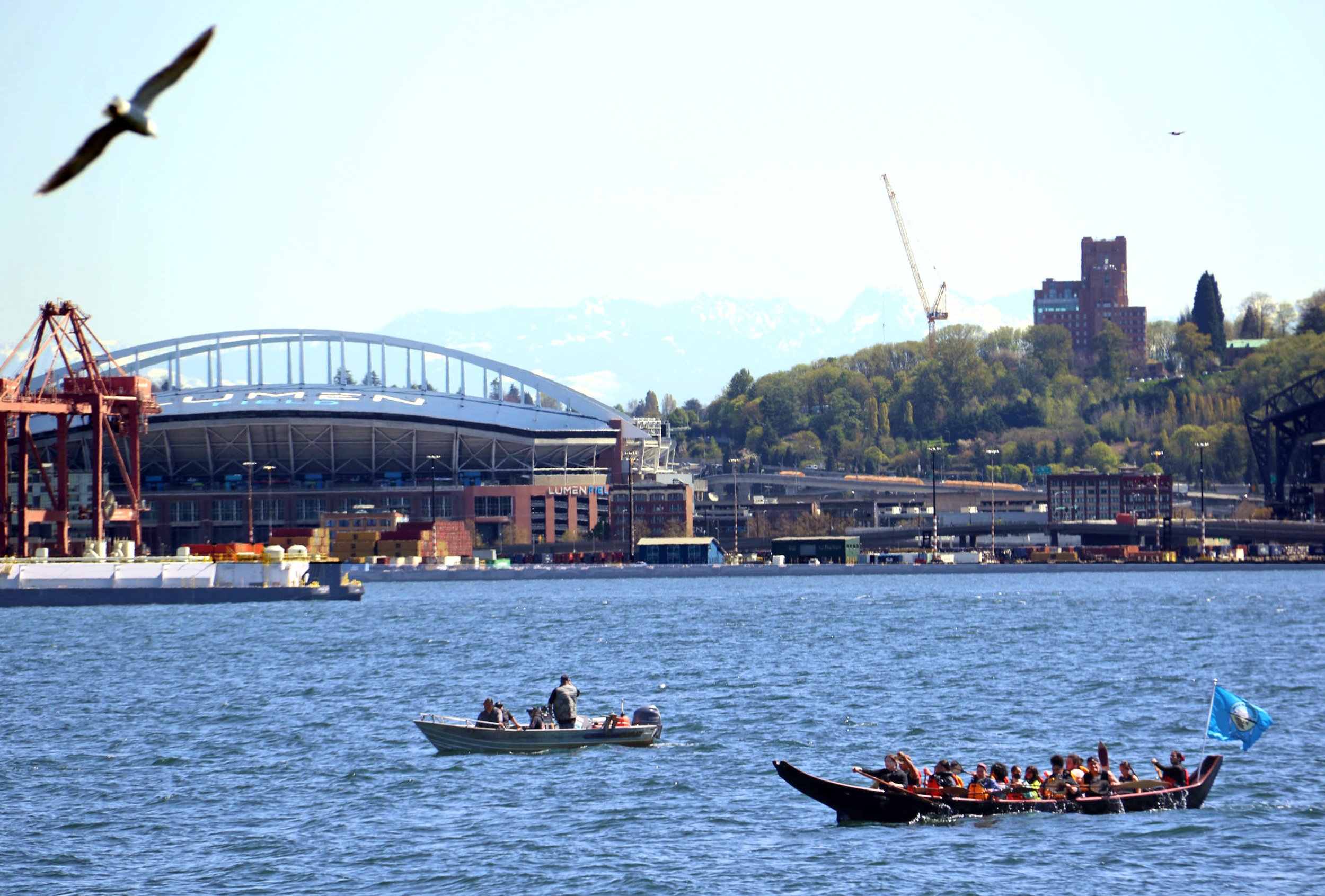

Canoe Awakening A Celebration Hosted By The Culture Department

Apr 29, 2025

Canoe Awakening A Celebration Hosted By The Culture Department

Apr 29, 2025