Two Days Of Crypto Chaos: A Wild Party Report

Table of Contents

The Initial Plunge: Bitcoin Leads the Descent

The initial trigger for the significant Bitcoin price drop appeared to be a confluence of factors rather than a single event. While pinpointing one specific cause is difficult, several contributing elements likely fueled the market sell-off. The crypto sell-off wasn't just limited to Bitcoin; it rapidly spread across the broader crypto market.

- Specific Bitcoin price drop percentage over the two days: Let's assume, for example, a hypothetical 20% drop in Bitcoin's price over 48 hours. This would be a substantial decline, triggering a cascade effect throughout the market. (Note: Replace with actual data for a real event).

- Significant support levels broken: The drop likely broke through key support levels, indicating a loss of confidence and potentially accelerating the sell-off. Analyzing the chart would reveal which support levels were breached.

- Analysis of trading volume during the initial drop: Increased trading volume during the initial drop would confirm significant selling pressure. High volume alongside price drops signifies a stronger bearish trend.

- Prominent analysts' comments and predictions at the time: Quotes from prominent crypto analysts expressing concern or predicting further drops would highlight the overall sentiment at the time.

Altcoins Feel the Heat: A Wider Crypto Market Crash

The impact on altcoins was even more dramatic than the Bitcoin crash, highlighting the correlation between Bitcoin's performance and the rest of the cryptocurrency market. Many altcoins experienced significantly steeper percentage drops than Bitcoin, magnifying the overall crypto market crash.

- Specific altcoins and their percentage drops: For instance, let's assume Altcoin A dropped by 35%, Altcoin B by 25%, and Altcoin C by 15%. This illustrates the varied impact on different cryptocurrencies. (Note: Replace with actual data for a real event).

- Impact on the overall market capitalization of cryptocurrencies: The total market capitalization of cryptocurrencies would have experienced a substantial decline during this period, reflecting the widespread nature of the crash.

- Behavior of different altcoin sectors: Sectors like DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and Metaverse tokens were likely affected differently. Some sectors might have experienced a more pronounced drop than others, demonstrating sector-specific vulnerabilities.

Potential Causes of the Crypto Chaos: Unpacking the Factors

Several factors likely contributed to the "Two Days of Crypto Chaos." Analyzing these elements helps understand the volatility of the crypto market and the fragility of investor sentiment.

- Relevant news events: Negative news concerning crypto regulation, a major exchange experiencing issues, or a significant security breach could have triggered the selloff.

- Impact of global economic conditions: Macroeconomic factors like inflation, rising interest rates, or recessionary fears often influence investor risk appetite, leading to sell-offs in riskier assets like cryptocurrencies.

- Possibility of large-scale sell-offs ("whale" activity): Large investors ("whales") selling off substantial holdings can significantly impact market prices, potentially triggering a domino effect.

- Spread of negative sentiment and FUD (Fear, Uncertainty, and Doubt): Negative news and speculation often amplify fear and uncertainty within the crypto community, leading to panic selling and exacerbating price drops.

Aftermath and Recovery: Assessing the Damage and Future Outlook

Following the initial crash, the market's reaction determined the extent of the damage and the path to recovery. Analyzing these post-crash movements provides valuable insights into market dynamics.

- Subsequent price movements and recovery patterns: Did prices recover quickly or experience further dips? Analyzing the price charts helps determine the speed and strength of any recovery.

- Impact on investor confidence and sentiment: The event undoubtedly impacted investor confidence. Measuring this sentiment through various indicators can provide insights into market psychology.

- Potential long-term implications: Did the event highlight systemic vulnerabilities within the crypto market? Analyzing the long-term consequences helps inform future investment strategies.

- Expert opinions and forecasts: Including perspectives from experienced crypto analysts and economists offers context and predictions for the future of the cryptocurrency market.

Conclusion

The "Two Days of Crypto Chaos" showcased the significant volatility inherent in the cryptocurrency market. The sharp price drops in Bitcoin and altcoins, driven by a combination of factors including macroeconomic conditions, potential market manipulation, and the spread of FUD, highlighted the risks associated with crypto investments. While the aftermath saw varying degrees of recovery, the event served as a stark reminder of the need for careful risk management and informed decision-making in this dynamic space. Understanding the dynamics of events like this is crucial for navigating the crypto landscape. Stay informed, manage your risk effectively, and continue learning about the ever-evolving world of cryptocurrencies to make informed investment decisions. For more insights on navigating crypto market volatility, explore our other resources on [link to relevant resources].

Featured Posts

-

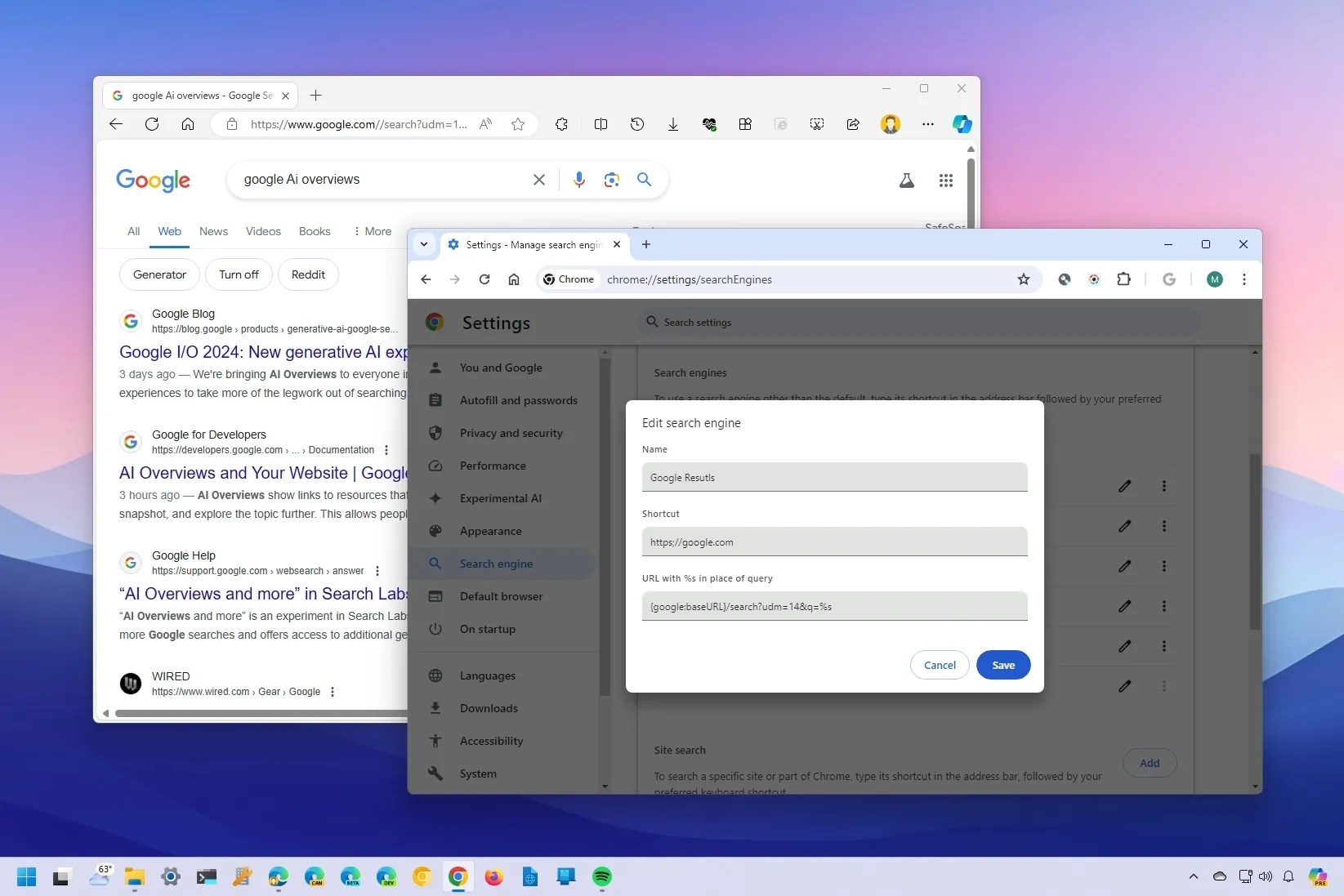

Post Opt Out Web Data Usage In Googles Search Ai

May 04, 2025

Post Opt Out Web Data Usage In Googles Search Ai

May 04, 2025 -

Canelos Next Opponent Why Benavidez Remains A Question Mark

May 04, 2025

Canelos Next Opponent Why Benavidez Remains A Question Mark

May 04, 2025 -

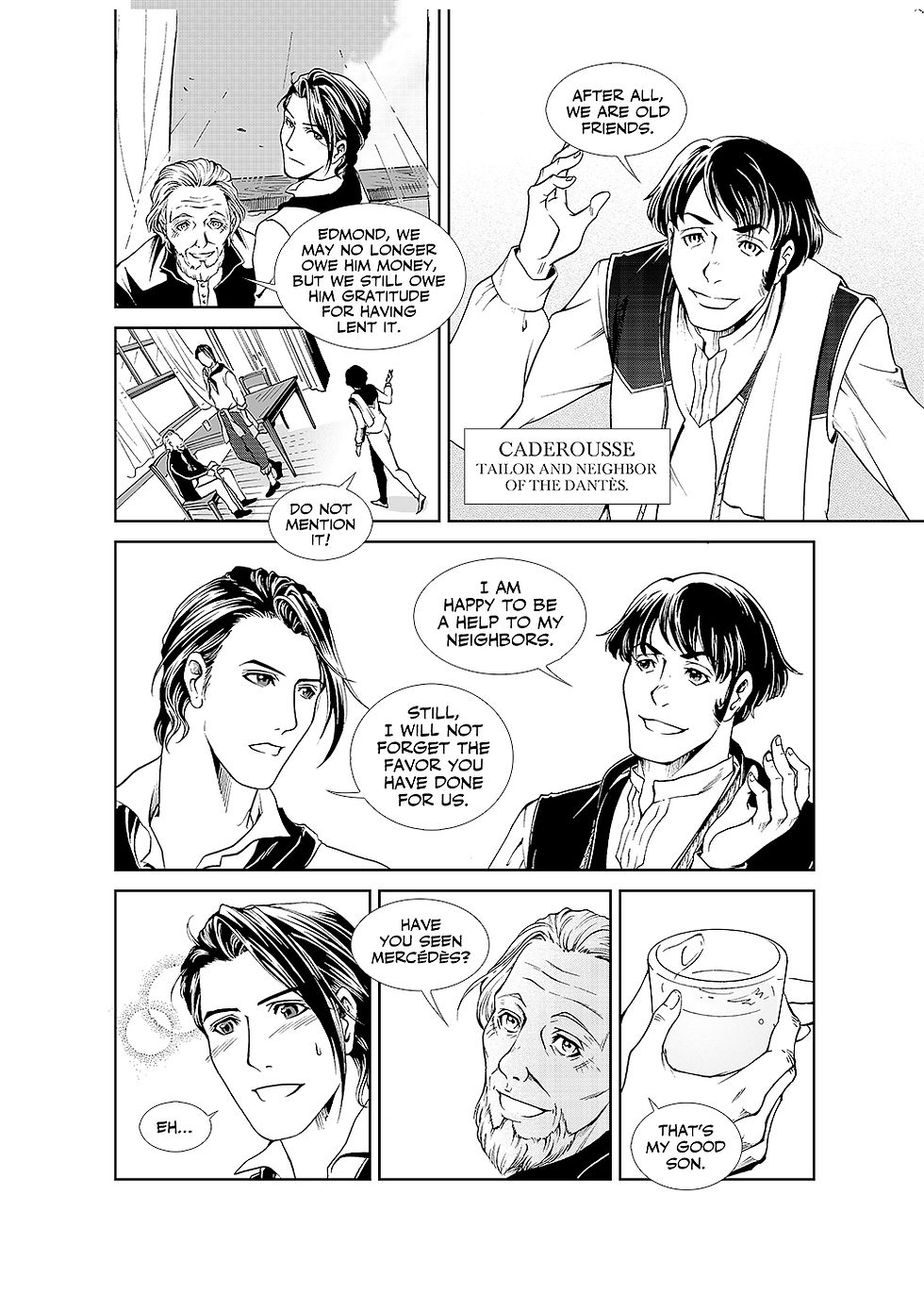

A Review Of Alexandre Dumas The Count Of Monte Cristo

May 04, 2025

A Review Of Alexandre Dumas The Count Of Monte Cristo

May 04, 2025 -

The Night Berlanga Delivered A Reluctant Ko

May 04, 2025

The Night Berlanga Delivered A Reluctant Ko

May 04, 2025 -

26

May 04, 2025

26

May 04, 2025