Trump's Trade Policies And The Impact On European Stock Market Strategy

Table of Contents

The Impact of Tariffs on European Exports

Trump's protectionist stance resulted in significant tariffs on European goods, directly impacting European businesses reliant on the US market. This had far-reaching consequences for European stock market strategies.

Reduced Demand for European Goods

Trump's tariffs on European goods, particularly steel and aluminum, immediately reduced demand. This led to several negative consequences:

- Decreased export revenue: European companies saw a sharp decline in sales to the US, impacting their bottom line.

- Reduced profitability: Profit margins were squeezed, forcing companies to cut costs or find new markets.

- Job losses in affected sectors: Companies were forced to lay off workers due to reduced production and demand.

- Pressure to relocate production: Many businesses felt pressure to move production outside of Europe to avoid tariffs, impacting European economies.

Retaliatory Tariffs and Their Ripple Effects

The EU's response to Trump's tariffs involved implementing its own retaliatory measures, escalating the trade conflict. This created a cycle of trade restrictions that negatively impacted multiple sectors:

- Agricultural exports: European agricultural products faced reduced demand in the US market, affecting farmers and related industries.

- Manufacturing industries: Numerous manufacturing sectors were affected by reduced exports and increased input costs due to tariffs on raw materials.

- Consumer goods prices: Tariffs led to higher prices for consumers, impacting purchasing power and overall economic growth. This impacted investor confidence and investment decisions, further complicating stock market strategies.

Volatility and Uncertainty in the Market

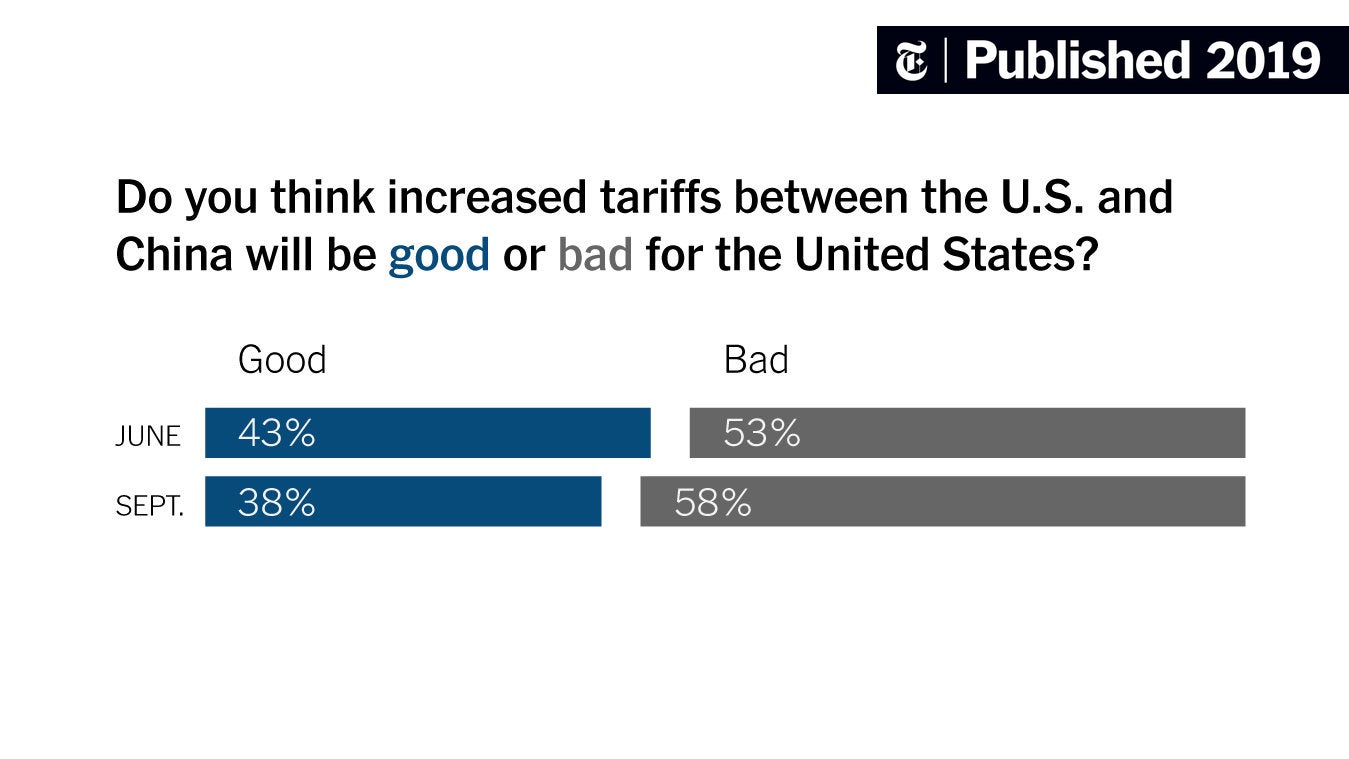

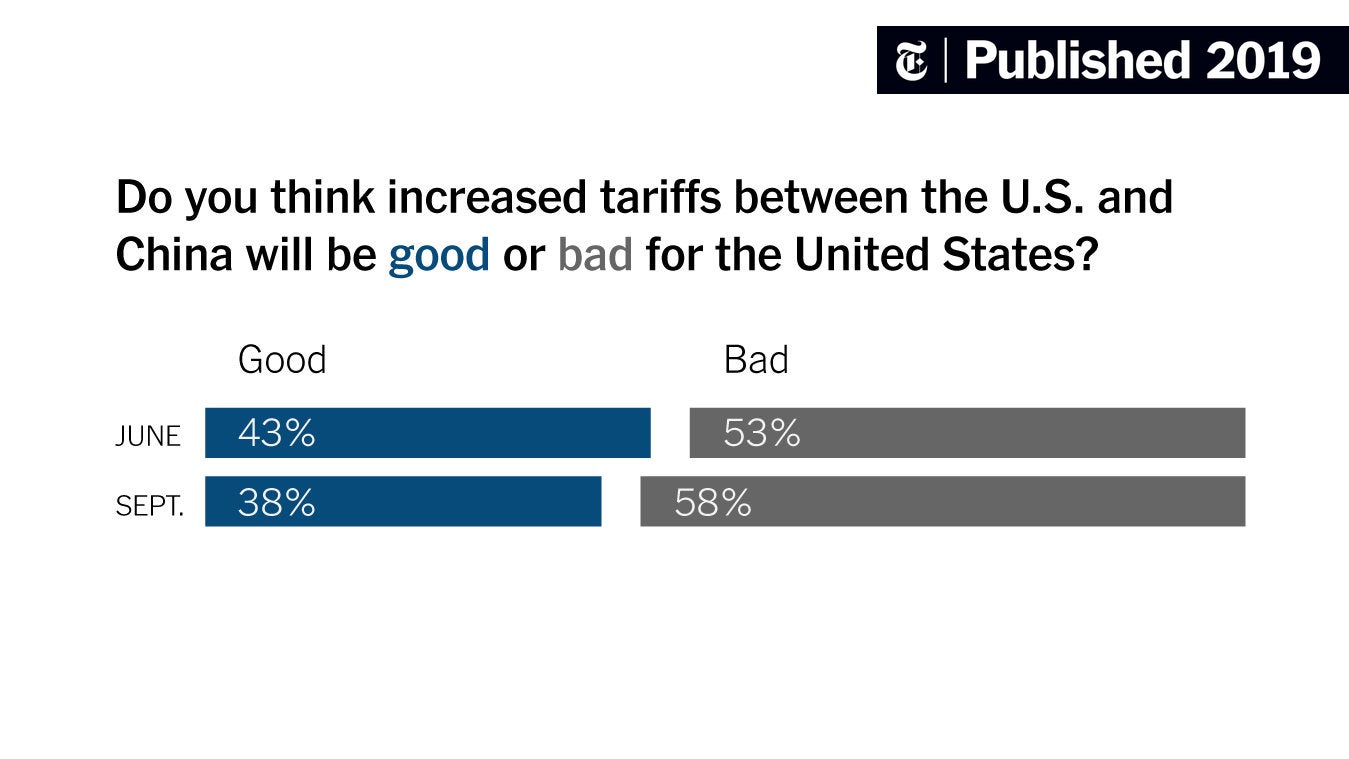

Trump's unpredictable trade policies introduced significant volatility and uncertainty into the European stock market. Investors had to contend with:

Increased Market Fluctuations

The constant threat of new tariffs and trade disputes made accurate market forecasting exceptionally difficult. Investors faced:

- Difficulty in forecasting returns: Predicting future stock performance became significantly more challenging.

- Increased risk associated with long-term investments: The volatile environment increased the risk of substantial losses on long-term holdings.

- Need for agile investment strategies: Investors needed to develop more dynamic and adaptable investment strategies to react to changing circumstances.

Impact on Investor Sentiment

The uncertainty surrounding trade relations negatively impacted investor sentiment and confidence. This resulted in:

- Reduced investment in affected sectors: Investors became hesitant to invest in sectors heavily reliant on US trade.

- Shift towards defensive investment strategies: Investors sought safer investments, such as bonds and government securities.

- Increased demand for safe haven assets: Assets like gold experienced increased demand as investors sought protection from market volatility.

Sector-Specific Impacts and Strategic Adjustments

Trump's trade policies impacted various sectors differently, necessitating specific adjustments to investment strategies.

Automotive Industry

The automotive industry was particularly hard-hit due to its heavy reliance on US exports and complex supply chains. Investors needed to:

- Assess long-term viability of US-focused companies: Investors had to evaluate the future prospects of companies heavily dependent on the US market.

- Diversify investments across geographies and product lines: Diversification became critical to reduce dependence on any single market.

Technology Sector

While less directly impacted by tariffs, the tech sector faced indirect challenges due to increased uncertainty and concerns around data privacy regulations influenced by geopolitical tensions. Investors had to consider:

- Potential impact on supply chains: Trade disputes could disrupt supply chains, impacting production and profitability.

- Risks associated with geopolitical tensions: Geopolitical instability could impact cross-border data flows and technological collaboration.

Adapting Investment Strategies

To successfully navigate this turbulent period, investors needed to incorporate a greater degree of risk management into their strategies by:

- Diversifying portfolios across sectors and geographies: Spreading investments reduced reliance on any single sector or region.

- Implementing hedging strategies: Hedging strategies helped mitigate potential losses from unforeseen trade disputes.

- Closely monitoring geopolitical developments: Staying informed about global events and their impact on markets became crucial.

Conclusion

Trump's trade policies presented significant challenges for European stock market investors. The imposition of tariffs, retaliatory measures, and the resulting uncertainty created volatility and demanded adaptable strategies. Understanding the sector-specific impacts and employing diversified, risk-managed approaches is crucial for navigating the complexities of global trade relations. To effectively manage your investments in light of future geopolitical shifts and trade negotiations, continuous monitoring and strategic adjustments are vital. Therefore, staying informed about evolving trade policies and their influence on European markets is essential for successful long-term investment strategies involving Trump's trade policies.

Featured Posts

-

Desert Island Survival Amanda Holden And Tess Dalys Children Star In New Show

Apr 26, 2025

Desert Island Survival Amanda Holden And Tess Dalys Children Star In New Show

Apr 26, 2025 -

Intact Car Found Inside Sunken Wwii Warship Cnn Exclusive

Apr 26, 2025

Intact Car Found Inside Sunken Wwii Warship Cnn Exclusive

Apr 26, 2025 -

Thaksins Political Comeback And Its Impact On Us Thai Trade Agreements

Apr 26, 2025

Thaksins Political Comeback And Its Impact On Us Thai Trade Agreements

Apr 26, 2025 -

Vingegaard Recovers From Concussion Eyes Tour De France Victory

Apr 26, 2025

Vingegaard Recovers From Concussion Eyes Tour De France Victory

Apr 26, 2025 -

Nyt Spelling Bee February 3rd Hints Solutions And Gameplay Help For Puzzle 337

Apr 26, 2025

Nyt Spelling Bee February 3rd Hints Solutions And Gameplay Help For Puzzle 337

Apr 26, 2025

Latest Posts

-

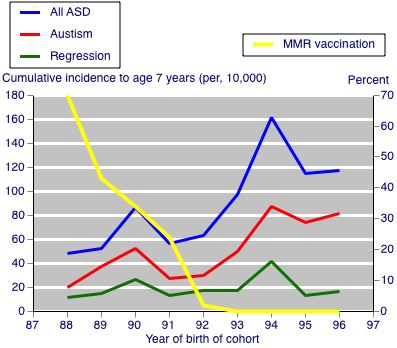

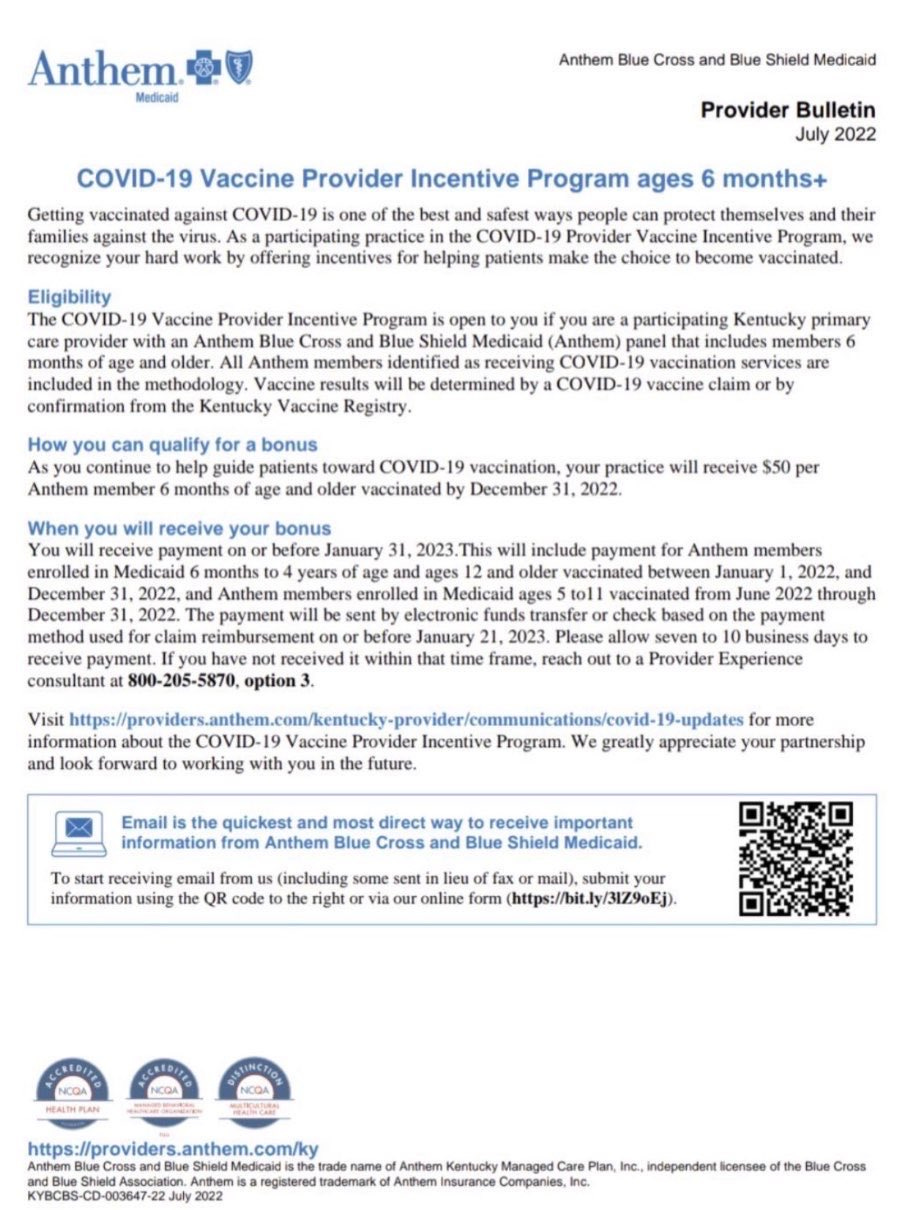

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025 -

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025 -

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Connection

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Connection

Apr 27, 2025