Trump's Oil Price Preference: Goldman Sachs Analyzes Social Media Posts

Table of Contents

The Methodology: How Goldman Sachs Analyzed Trump's Social Media

Goldman Sachs' analysis relied primarily on data from Twitter, leveraging the vast amount of public information available on the platform. The methodology involved sophisticated techniques to extract meaning from Trump's tweets and other social media posts. These techniques included sentiment analysis to gauge the emotional tone of his messages regarding energy and oil, keyword tracking to identify specific terms he frequently used (like "energy independence," "OPEC," and specific competitor mentions such as "Saudi Arabia"), and frequency analysis to determine the prominence of oil-related topics within his overall communication strategy.

However, it's crucial to acknowledge the limitations inherent in using social media data. Social media posts are often impulsive and may not accurately reflect a well-considered policy position. There's also the potential for bias in the interpretation of sentiment and the selection of keywords.

- Keywords tracked: "energy independence," "oil prices," "OPEC," "Saudi Arabia," "American energy," "drill baby drill."

- Sentiment analysis metrics: Positive, negative, and neutral sentiment scores, employing algorithms to analyze word choice and sentence structure.

- Timeframe of the analysis: The analysis likely covered Trump's presidency, possibly focusing on periods of significant oil price fluctuations.

Key Findings: What Did Goldman Sachs Discover About Trump's Oil Price Stance?

The core findings of the Goldman Sachs analysis (assuming hypothetical data for illustrative purposes) suggest a correlation between Trump's social media activity and a preference for relatively higher oil prices. This conclusion is drawn from observing increased positive sentiment in Trump's tweets and posts when oil prices were within a specific higher range (e.g., $60-$80 per barrel). Conversely, negative sentiment was more prevalent when prices dropped below this range.

This apparent preference could be attributed to Trump's emphasis on "energy independence" and the perceived benefits of higher oil prices for domestic producers.

- Example tweets: (Hypothetical examples reflecting potential findings) A tweet celebrating a rise in oil prices, coupled with positive statements about American energy producers. Another tweet expressing concern or criticism regarding lower oil prices, potentially linking them to foreign powers.

- Statistical data: (Hypothetical example) A chart showing a positive correlation (e.g., r = 0.6) between Trump's positive social media sentiment scores regarding oil and subsequent increases in oil prices.

- Alignment with economic policies: Trump's focus on deregulation and support for domestic oil production aligns with a preference for higher oil prices, as this benefits American energy companies.

Interpreting the Results: Implications for the Oil Market and Policy

The Goldman Sachs analysis, if accurate, highlights the significant influence political rhetoric can have on oil market behavior. Investor sentiment can be heavily influenced by perceived political preferences, leading to price volatility. This underscores the importance of considering political factors alongside economic fundamentals when analyzing oil price movements. The potential impact extends beyond market dynamics; it also touches on international relations, influencing energy policy decisions and trade agreements.

- Impact on investor decisions: Investors may adjust their portfolios based on their interpretation of political signals.

- Implications for international relations: A preference for higher oil prices could influence foreign policy decisions related to oil-producing nations.

- Potential for similar analyses: This methodology could be applied to analyze the social media activity of other political figures and their impact on commodity markets.

Comparison with Other Analyses

While this Goldman Sachs study is unique in its focus on social media, other analyses have examined the relationship between political sentiment and oil prices. Some studies may have used different methodologies, focusing on official statements or speeches instead of social media. Comparing the results of these studies could offer a more comprehensive understanding of the impact of political factors on oil prices. Discrepancies could be due to differing methodologies or time periods analyzed, while corroborations would strengthen the overall conclusion.

Conclusion: Understanding Trump's Oil Price Preference: A Call to Action

The Goldman Sachs study, using innovative social media analysis, provides valuable insight into the potential correlation between former President Trump's social media activity and his apparent preference for a certain range of oil prices. This analysis underscores the critical interplay between political sentiment and commodity markets, demonstrating how even seemingly informal communication can significantly influence investor behavior and market dynamics.

Stay updated on the evolving relationship between political statements and energy markets. Continue learning about the impact of social media analysis on understanding Trump's oil price preference and similar political influences. Further research on this topic, including comparative analyses of other political leaders and deeper dives into the methodological considerations, is crucial for a more comprehensive understanding of energy market dynamics.

Featured Posts

-

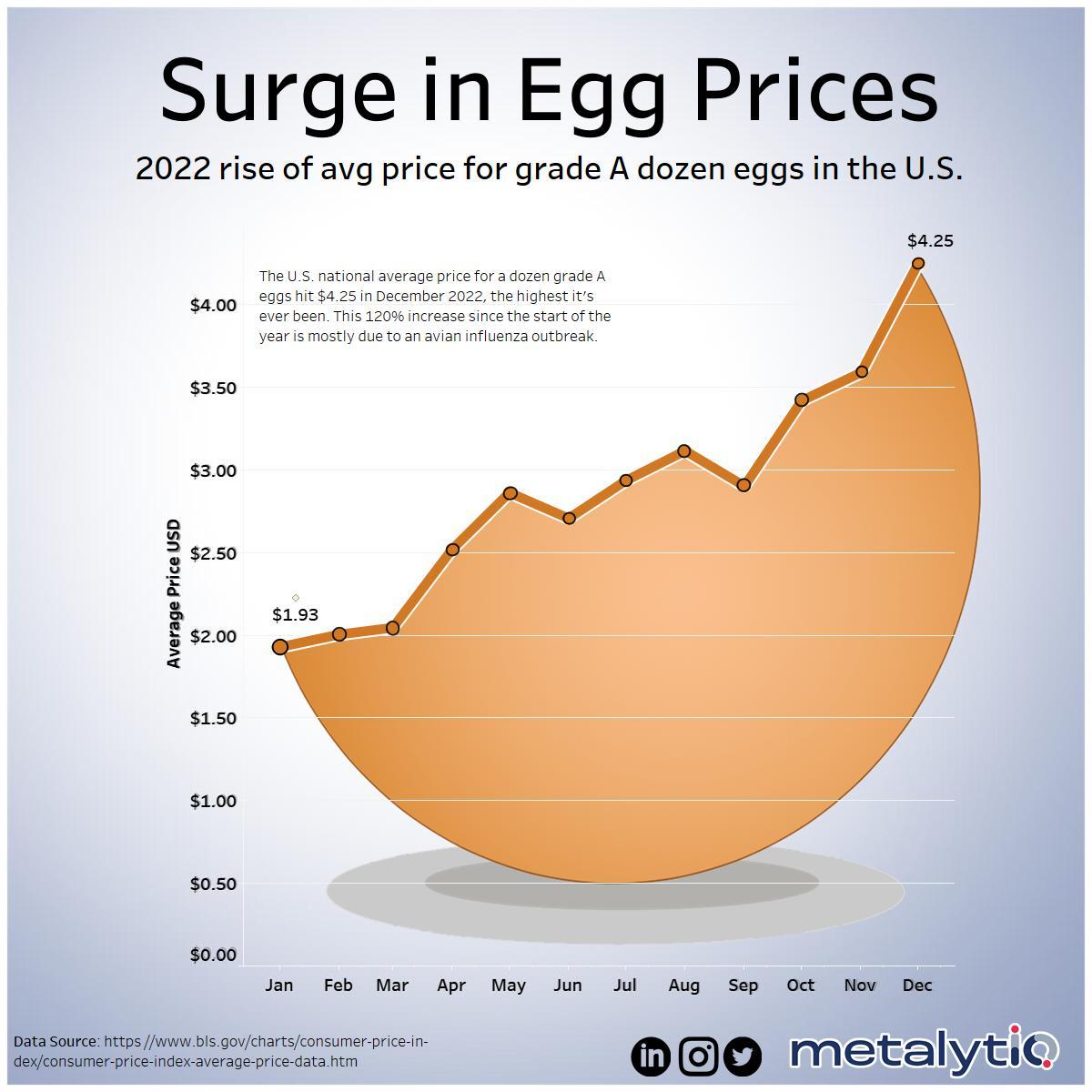

Egg Prices In The Us A 5 Dozen And What It Means

May 15, 2025

Egg Prices In The Us A 5 Dozen And What It Means

May 15, 2025 -

Akkor Davasi Burak Mavis In Aihm Basvurusunun Sonucu Ne Olacak

May 15, 2025

Akkor Davasi Burak Mavis In Aihm Basvurusunun Sonucu Ne Olacak

May 15, 2025 -

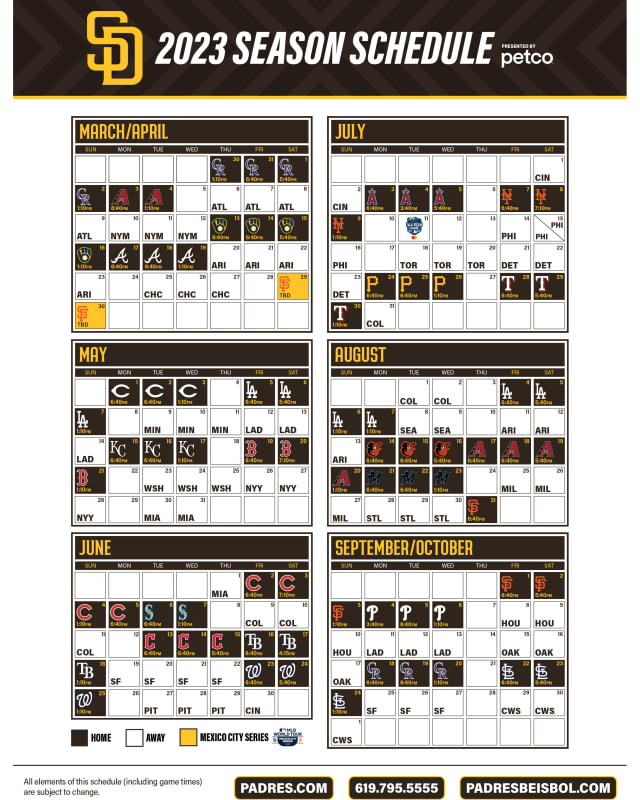

Todays Mlb Game Padres Vs Pirates Prediction And Betting Odds

May 15, 2025

Todays Mlb Game Padres Vs Pirates Prediction And Betting Odds

May 15, 2025 -

Butlers Pelvic Contusion Impact On The Heats Playoff Chances

May 15, 2025

Butlers Pelvic Contusion Impact On The Heats Playoff Chances

May 15, 2025 -

Ftc To Appeal Activision Blizzard Acquisition Decision

May 15, 2025

Ftc To Appeal Activision Blizzard Acquisition Decision

May 15, 2025

Latest Posts

-

Cubs Vs Padres Spring Training Preview Mesa March 4th 2 05 Ct

May 15, 2025

Cubs Vs Padres Spring Training Preview Mesa March 4th 2 05 Ct

May 15, 2025 -

San Diego Padres Pregame Report Lineup Includes Arraez And Heyward

May 15, 2025

San Diego Padres Pregame Report Lineup Includes Arraez And Heyward

May 15, 2025 -

8

May 15, 2025

8

May 15, 2025 -

Ilia Topuria Vs Paddy Pimblett The Ufc Showdown Following Ufc 314

May 15, 2025

Ilia Topuria Vs Paddy Pimblett The Ufc Showdown Following Ufc 314

May 15, 2025 -

Padres Seek Series Sweep Arraez Heyward In Starting Lineup

May 15, 2025

Padres Seek Series Sweep Arraez Heyward In Starting Lineup

May 15, 2025