Trump's Houthi Truce: Why Shippers Remain Skeptical

Table of Contents

The Fragility of the Truce Agreement

The terms of "Trump's Houthi truce" are limited in both scope and duration, casting doubt on its long-term effectiveness. While it promised a cessation of hostilities in certain areas and a temporary easing of restrictions, crucial enforcement mechanisms are lacking. The region has a history of broken agreements, making the current truce’s sustainability questionable.

- Limited scope: The truce's geographical reach is restricted, leaving some areas vulnerable to conflict. Its timeframe is also finite, creating a looming deadline for potential escalation.

- Weak international monitoring: The absence of robust international monitoring and verification makes it difficult to assess compliance and quickly respond to violations.

- Past failures: Similar ceasefires in Yemen have repeatedly failed, eroding trust and making shippers wary of relying on this agreement.

- Houthi compliance concerns: The Houthi rebels' past actions and continued rhetoric raise concerns about their commitment to upholding the truce's terms.

The potential for renewed conflict in Yemen, with its impact on Red Sea shipping, poses significant maritime security risks and considerable geopolitical uncertainties. Disruptions could severely impact global supply chains and create further instability in an already volatile region.

Economic Uncertainty and Insurance Costs

The uncertainty surrounding "Trump's Houthi truce" directly translates into increased costs for shippers. The risk of renewed conflict significantly impacts shipping insurance premiums and operational expenses. This uncertainty ripples throughout the global economy.

- Increased war risk insurance: Shippers face significantly higher premiums for war risk insurance, adding a substantial burden to their operational costs.

- Delays and rerouting: Potential disruptions force ships to take longer, more expensive routes, leading to delays and increased fuel consumption.

- Global supply chain impact: Disruptions to shipping routes inevitably affect global supply chains, leading to potential shortages and price increases for consumers worldwide.

- Uncertainty impacting investment: The volatile situation discourages investment in new shipping infrastructure and capacity, further hindering the industry's ability to adapt.

Freight rates are likely to remain elevated, reflecting the higher risk assessment associated with navigating the Red Sea. The resulting supply chain disruptions will have far-reaching consequences for businesses globally.

The Houthi's Track Record and Continued Threats

The Houthi rebels' past actions, including attacks on shipping vessels, cast a long shadow over the current truce. Their military capabilities, particularly their missile arsenal, pose a persistent threat to maritime traffic in the Red Sea.

- History of attacks: The Houthi rebels have a documented history of targeting shipping, highlighting their willingness to disrupt maritime trade.

- Missile capabilities: Their growing missile capabilities present a significant threat to vessels transiting the Red Sea.

- Potential for escalation: Any perceived violation of the truce by either side could trigger an escalation of hostilities, further endangering shipping.

- Lack of trust: A deep-seated lack of trust between the warring factions makes it difficult to believe that the truce will hold long-term.

The continued military conflict in Yemen and the Houthi rebels' actions make it impossible to ignore the potential for renewed attacks on shipping. This military conflict adds to the challenges faced by shippers.

Alternative Routes and Increased Transit Times

If "Trump's Houthi truce" collapses and the Red Sea becomes impassable, shippers will need to explore alternative routes. This will lead to significantly increased transit times and substantially higher costs.

- Longer routes: Ships may be forced to take significantly longer routes through the Suez Canal or around the Cape of Good Hope.

- Increased fuel costs: These longer routes increase fuel consumption, adding a substantial burden to operational costs.

- Delivery schedule impact: Increased transit times disrupt delivery schedules, affecting just-in-time inventory management systems.

- Logistics challenges: The logistical complexities of rerouting shipping and adapting to the changes pose a massive hurdle for global logistics.

The reliance on alternative shipping routes like the Suez Canal or the significantly longer journey around the Cape of Good Hope highlights the potential severity of a renewed conflict in the Red Sea.

Conclusion: Re-evaluating Trump's Houthi Truce and its Impact on Global Shipping

The fragility of "Trump's Houthi truce," coupled with the economic uncertainties, the Houthi rebels' continued threats, and the need for alternative shipping routes, paint a picture of considerable risk for shippers. Skepticism surrounding the truce's long-term viability is entirely understandable. Shippers must continuously monitor the situation in the Red Sea and conduct thorough risk assessments before committing to voyages through the region. Stay informed about developments related to Trump's Houthi truce and its implications for global shipping. Further reading on Yemen conflict analysis and maritime security updates is strongly recommended. Navigating the challenges of this volatile region demands vigilance and a careful approach to risk management.

Featured Posts

-

Will Apples Ai Strategy Succeed A Critical Analysis

May 10, 2025

Will Apples Ai Strategy Succeed A Critical Analysis

May 10, 2025 -

Yemen Truce And Shipping Uncertainty Persists Despite Trumps Announcement

May 10, 2025

Yemen Truce And Shipping Uncertainty Persists Despite Trumps Announcement

May 10, 2025 -

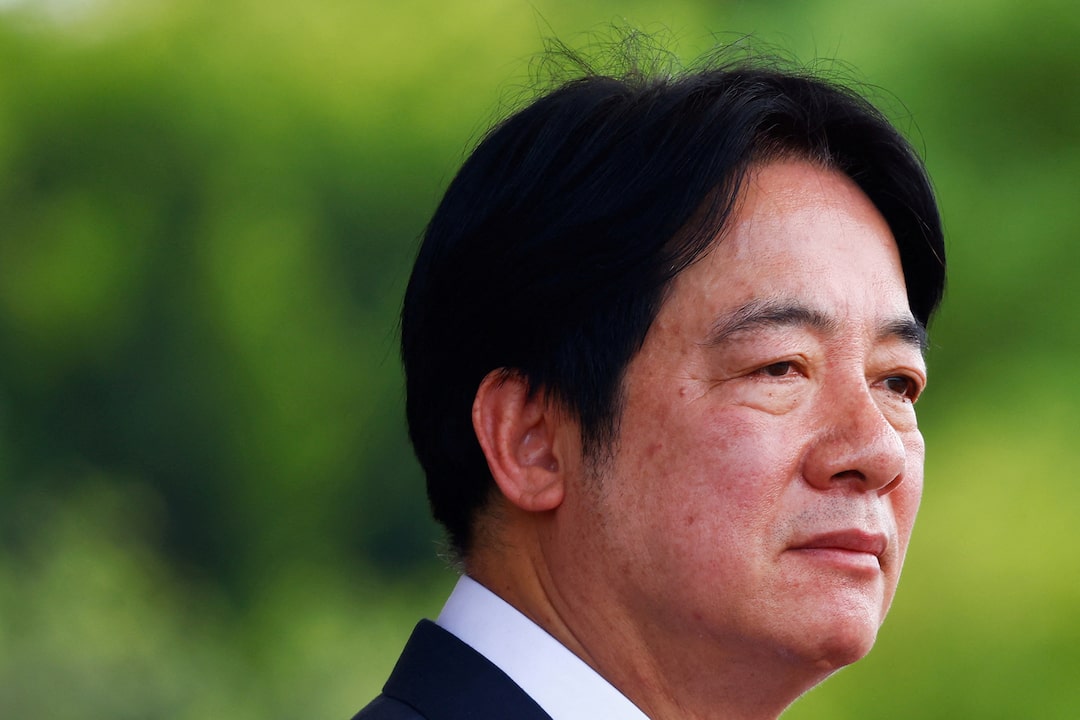

Taiwans Lai Sounds Alarm On Totalitarianism In Ve Day Speech

May 10, 2025

Taiwans Lai Sounds Alarm On Totalitarianism In Ve Day Speech

May 10, 2025 -

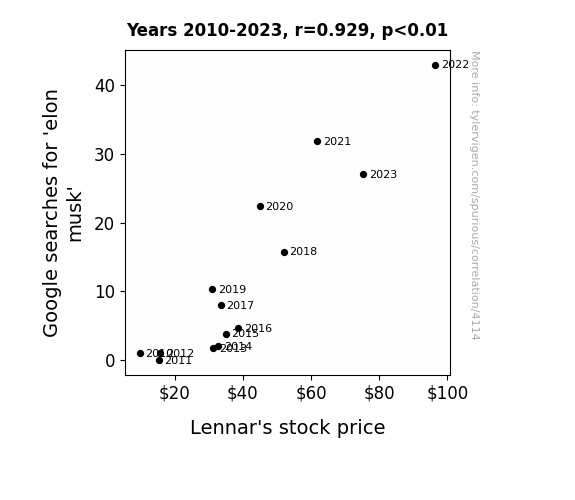

Dogecoins Recent Decline Analyzing The Correlation With Tesla And Elon Musk

May 10, 2025

Dogecoins Recent Decline Analyzing The Correlation With Tesla And Elon Musk

May 10, 2025 -

Dissecting The He Morgan Brother 5 Leading Theories Surrounding David In High Potential

May 10, 2025

Dissecting The He Morgan Brother 5 Leading Theories Surrounding David In High Potential

May 10, 2025