Trump's Economic Policies And The Difficult Road Ahead For The Next Fed Chair

Table of Contents

The Trump Tax Cuts and Their Long-Term Implications

The 2017 Tax Cuts and Jobs Act, a cornerstone of Trump's economic agenda, significantly lowered corporate and individual income tax rates. While proponents argued it would stimulate economic growth, critics raised concerns about its impact on the national debt and fiscal policy.

Increased National Debt and Deficit

The tax cuts led to a substantial increase in the national debt and the budget deficit. This is largely due to the reduced tax revenue collected by the government, coupled with increased government spending. The long-term consequences of this increased debt burden remain a subject of intense debate. Economists differ on the extent to which this will hinder future economic growth, with some warning of potential inflationary pressures and others arguing that the benefits of stimulated economic activity outweigh the costs.

- Specific Provisions: The tax cuts included reductions in corporate tax rates from 35% to 21%, as well as individual tax rate reductions across various brackets.

- Effect on Income Groups: While all income groups experienced some tax relief, the benefits disproportionately favored high-income earners.

- Long-Term Sustainability: The long-term sustainability of these tax cuts is questionable, given the projected growth in the national debt. Many economists believe significant fiscal reforms will be necessary in the future to address this issue.

- Relevant Statistics: The Congressional Budget Office (CBO) projected significant increases in the national debt as a result of the tax cuts. These projections should be considered when analyzing the long-term impacts.

Trade Wars and Their Impact on Global and Domestic Economies

Trump's administration initiated several trade wars, notably with China, imposing significant tariffs on imported goods. This protectionist approach, while aimed at protecting domestic industries and reducing the trade deficit, had far-reaching consequences for both the US and global economies.

Tariffs and Retaliation

The imposition of tariffs led to retaliatory measures from other countries, escalating trade tensions and disrupting global supply chains. This created uncertainty for businesses and impacted consumer prices.

- Specific Examples: The trade dispute with China involved tariffs on hundreds of billions of dollars worth of goods, affecting various sectors.

- Effects on Industries: Industries like agriculture and manufacturing were particularly affected by the tariffs, facing reduced exports and increased input costs.

- Impact on Inflation: The tariffs contributed to inflationary pressures, as businesses passed on increased costs to consumers.

- Consequences for International Relations: The trade wars strained relationships with key trading partners, raising questions about the future of global trade cooperation.

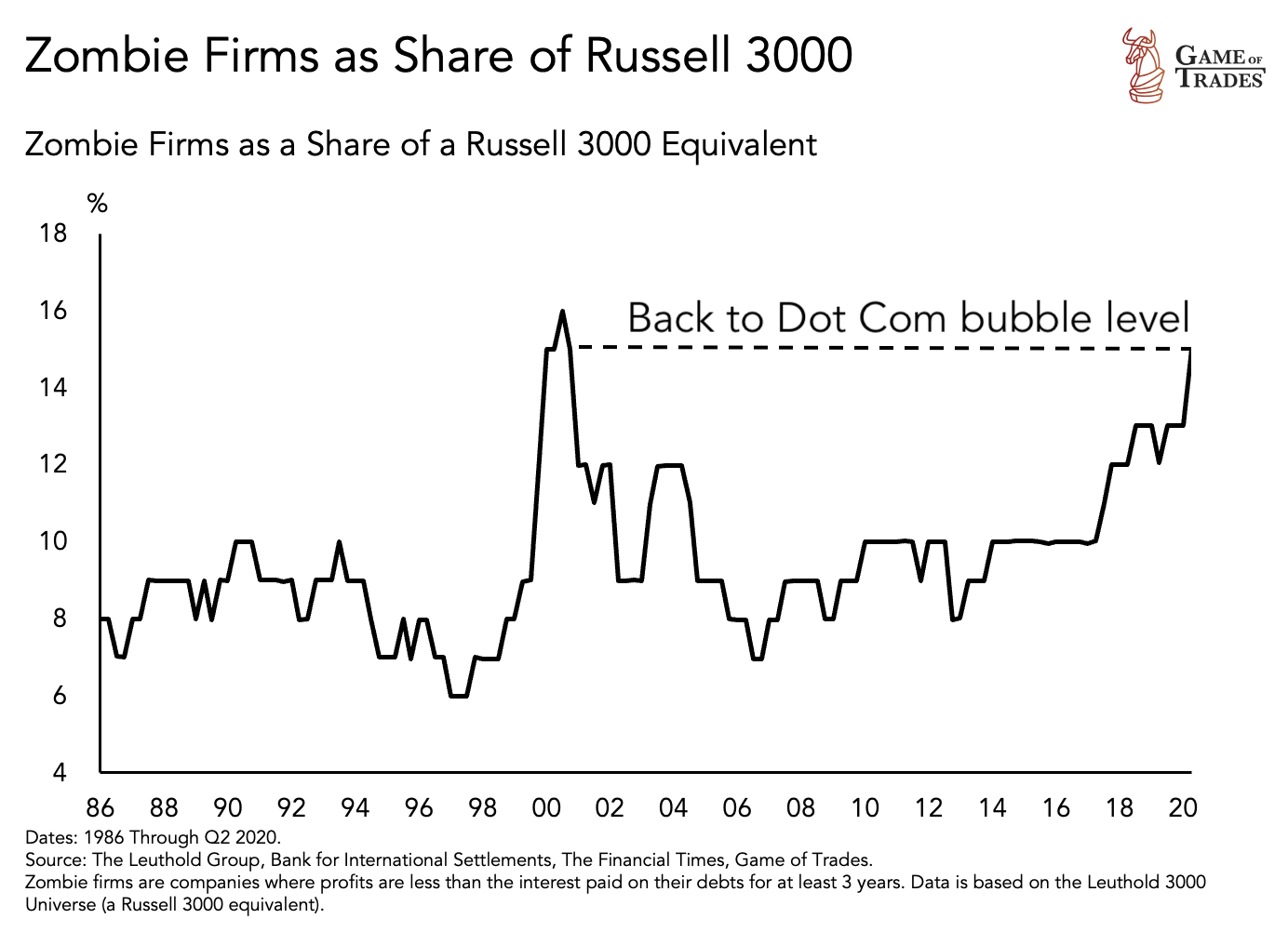

Deregulation and its Effect on Financial Stability

The Trump administration pursued a significant deregulation agenda, easing regulations across various sectors, including finance and the environment. While proponents argued this stimulated economic growth by reducing bureaucratic burdens, critics raised concerns about potential risks to financial stability and environmental protection.

Risks and Rewards

Deregulation can lead to increased economic efficiency and reduced costs, but it also carries risks. Reducing oversight can increase systemic risk and make the economy more vulnerable to shocks.

- Specific Examples: Deregulation efforts included easing banking regulations and environmental protection rules.

- Benefits and Drawbacks: Deregulation can promote innovation and competition but may also lead to increased risk-taking and market instability.

- Federal Reserve's Role: The Federal Reserve plays a crucial role in mitigating the risks associated with deregulation by monitoring financial markets and implementing appropriate monetary policy.

- Long-Term Effects: The long-term effects of deregulation on financial markets and economic stability are yet to be fully understood and will be a key consideration for the next Fed Chair.

The Inheritance: Challenges Facing the Next Fed Chair

The next Federal Reserve Chair inherits a complex economic landscape shaped by Trump's economic policies. Navigating this environment will require a sophisticated understanding of monetary policy and the ability to respond effectively to evolving economic conditions.

Navigating Uncertainty

The increased national debt, trade tensions, and potential for both inflation and recession present significant challenges. The next Fed Chair must make crucial decisions regarding interest rates and other monetary policy tools to maintain economic stability.

- Potential for Inflation/Recession: The combination of increased government spending and potential supply chain disruptions creates the potential for both inflation and recession.

- Tools Available to the Fed: The Fed has several tools at its disposal, including interest rate adjustments, quantitative easing, and forward guidance.

- Political Pressures: The Fed Chair is subject to political pressures, requiring skillful navigation of the political landscape while maintaining the Fed's independence.

- Implications for Global Stability: The US economy's performance significantly impacts global economic stability, adding another layer of complexity for the Fed Chair.

Conclusion: Trump's Economic Policies and the Path Forward for the Next Fed Chair

The economic legacy of Trump's policies presents a formidable challenge for the next Federal Reserve Chair. Understanding the complex interplay of increased national debt, trade wars, and deregulation is crucial for navigating the economic uncertainties ahead. The next Fed Chair must possess a deep understanding of monetary policy and the ability to make timely and effective decisions to maintain economic stability and foster sustainable growth. Further research into Trump's economic legacy and the challenges facing the Federal Reserve is crucial for understanding the future of the US and global economies. Explore resources such as the Federal Reserve website and the Congressional Budget Office reports to gain a deeper understanding of these critical issues.

Featured Posts

-

Espn Analyst Weighs In On Deion Sanders Shedeur Sanders Draft Assessment

Apr 26, 2025

Espn Analyst Weighs In On Deion Sanders Shedeur Sanders Draft Assessment

Apr 26, 2025 -

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 26, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 26, 2025 -

5 Key Actions To Secure A Private Credit Job During The Boom

Apr 26, 2025

5 Key Actions To Secure A Private Credit Job During The Boom

Apr 26, 2025 -

Nepo Babies Inherited Fame And The Oscars After Party Debate

Apr 26, 2025

Nepo Babies Inherited Fame And The Oscars After Party Debate

Apr 26, 2025 -

Floridas Charm A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025

Floridas Charm A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025

Latest Posts

-

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025 -

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Connection

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Connection

Apr 27, 2025 -

Public Health Concerns Evaluating The Credentials Of The Cdcs New Vaccine Study Hire

Apr 27, 2025

Public Health Concerns Evaluating The Credentials Of The Cdcs New Vaccine Study Hire

Apr 27, 2025